Source: https://www.advan.us/blog.php

Recovery in Foot Traffic Levels at Car Dealerships Most Pronounced in Red States

Like many other sectors, the US car industry saw a sharp downturn in business when lock-down orders and business closures were at their peak in late March and April. Combined sales in April 2020 for the Big 3 US carmakers - GM, Ford and Fiat-Chrysler - were down 63% compared to the previous year according to GoodCarBadCar.net.

To understand the correlation between foot traffic to car dealerships and auto sales, as well as the impact of COVID on the sector, we analyzed foot traffic for the Big 3 US carmakers alongside the Big 3 Japanese brands - Toyota, Honda and Nissan.

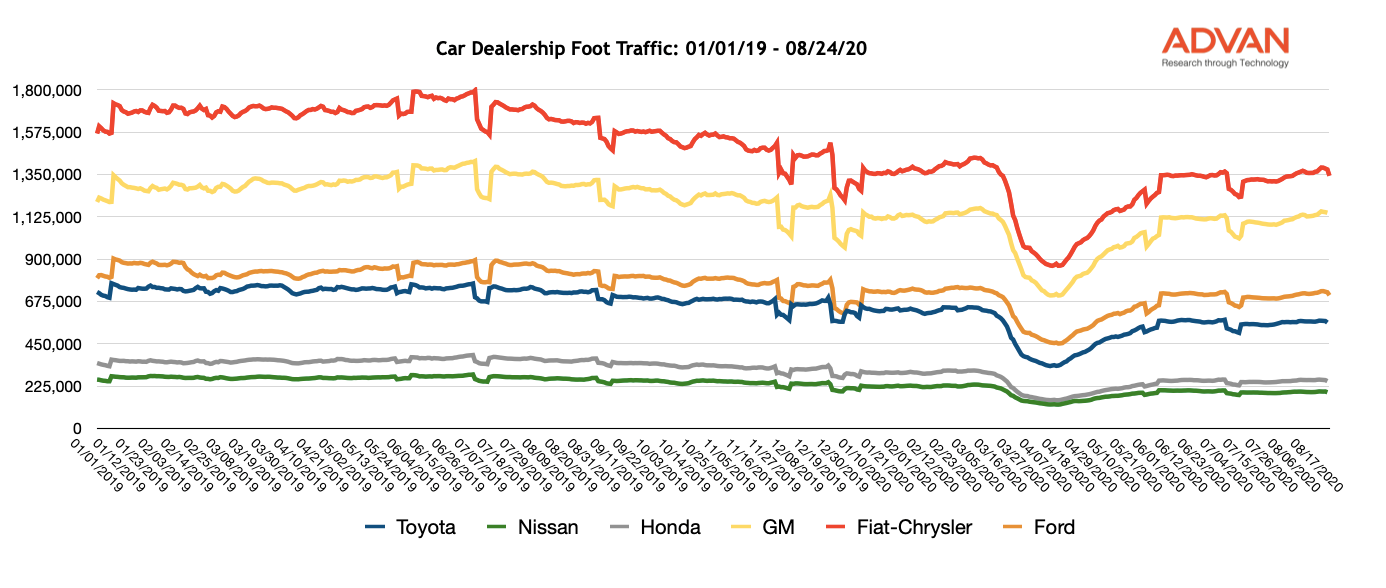

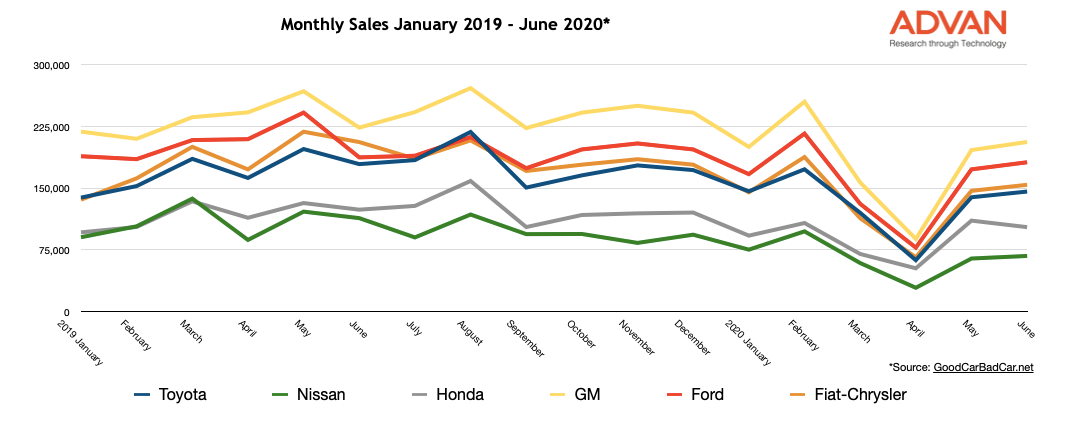

Since most car purchases have historically been done in person, foot traffic trends have tended to correlate fairly well with sales. The chart below shows normalized weekly foot traffic to the six dealers since January 2019. Compare this to the monthly sales data in the chart underneath. The carmakers with the lowest foot traffic - Nissan and Honda - also have the lowest sales figures

Interestingly, GM consistently has the highest sales figures while its foot traffic figures are below those of Fiat-Chrysler. Fiat-Chrysler, with the highest foot traffic, comes in third out of the six on sales.

This may be because Fiat-Chrysler dealerships more regularly carry other makes of car, compared to Ford and GM, which typically carry just their own vehicles. Overall, there we see a gradual downward trend in foot traffic to all of the dealerships since the middle of last year, even prior to COVID, which is also reflected in the sales figures.

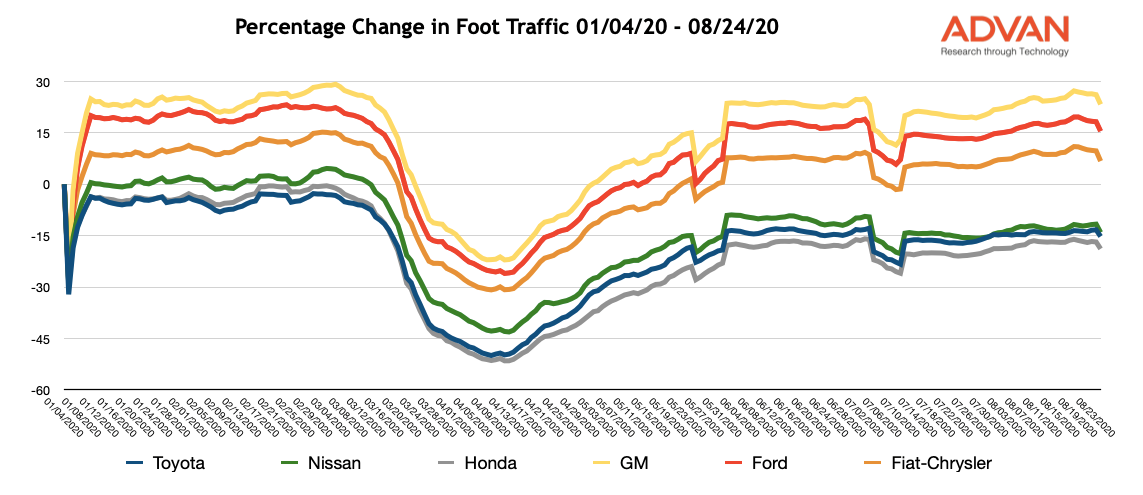

To understand the impact of the pandemic more closely, in the chart below we looked at the percentage change in the number of people visiting each dealership since January 4, 2020 - the first Saturday of the year.

Here we notice a much clearer bifurcation in visitor numbers to the Detroit 3, compared to their Japanese counterparts. Since the nadir in April, the relative number of visitors to the US car dealers has grown at a much faster rate, with all three now at least 10% above the first weekend of the year. In contrast, Toyota, Honda and Nissan all have around 15% fewer visitors than in January.

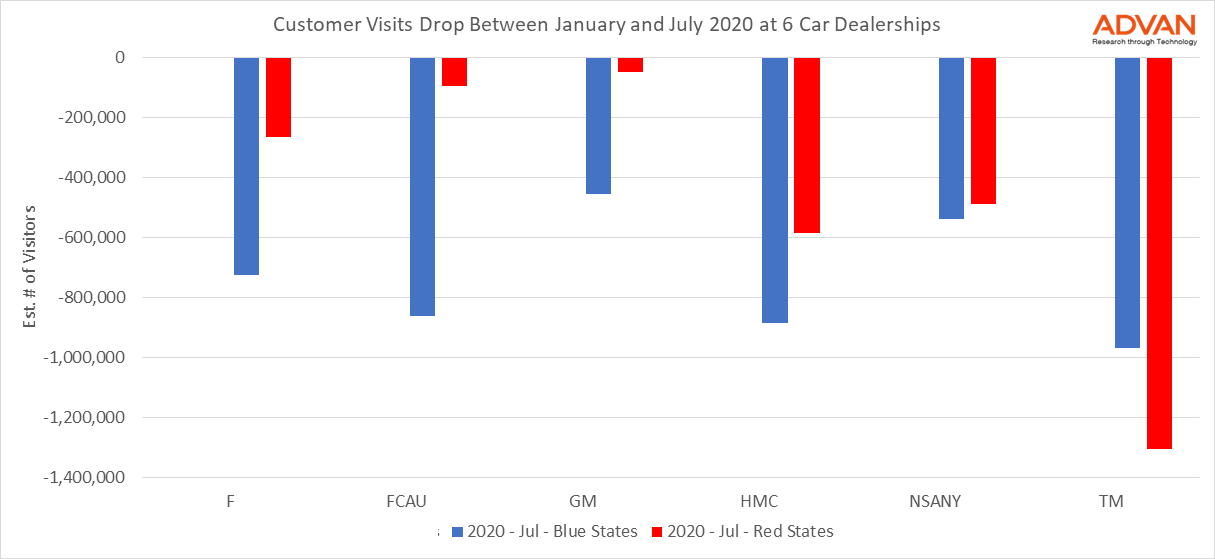

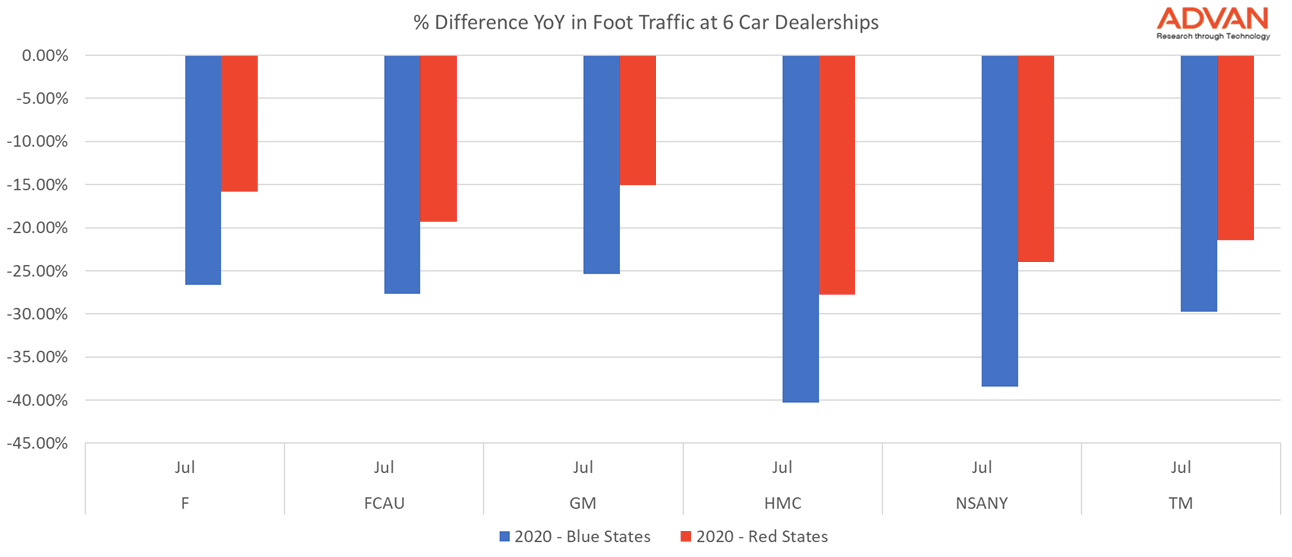

We then dug further into the data between states. This time we looked at the change in foot traffic to each of the dealerships since January by red and blue state (based on the results of the last election).

The trend here was much more pronounced. In red states, visits to Ford, GM and Fiat-Chrysler are barely down since the start of the year.The fall in foot traffic has been predominantly in blue states, and most significant for Toyota and Honda.

Looking at the year-over-year change we can see that there are fewer visitors to all car dealerships in July 2020 than in the previous July. But whether the state is blue or red, the Detroit 3 are clearly having greater success at tempting back their customers.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.