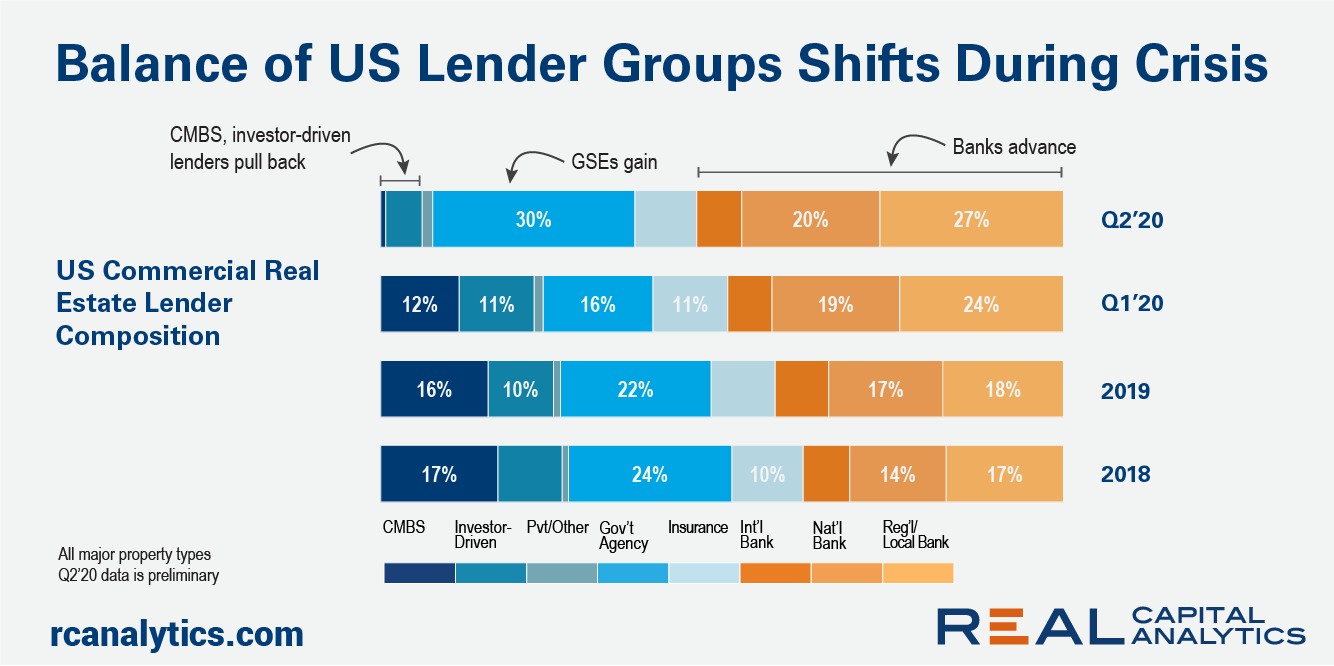

The debt portion of the U.S. capital stack has seen a tumultuous 2020. Key industry participants have pulled back on mortgage originations in response to the uncertainty around the Covid-19 recession. Commercial mortgage originations in the second quarter of 2020 were supported by banks and the GSEs.

The debt portion of the capital stack is more stable today than it was in the last downturn. The Global Financial Crisis was, as the name suggests, a financial shock and the majority of the legs of the debt stool were kicked out. Take away the debt portion of the capital stack and you are going to have a bad time with respect to asset pricing.

Into Q2 2020, the pullback by CMBS and investor-driven originators is not as destructive to asset pricing today as the shocks to the debt market were in the GFC. There is still debt available to commercial property investors in this downturn. Bank lenders in particular are still in the game and, with the pace of acquisitions falling, refinancing activity dominates originations. The GSEs were the largest source of debt capital in Q2 2020, behind 30% of all lending according to preliminary data.

Investor-driven lenders had been the most aggressive originators in the recent economic expansion. These lenders have not pulled back as sharply as the CMBS originators, but their shrinking market share reduces the availability of the high octane debt that these groups put out in the marketplace.

A reduction in debt availability led to a vicious downward spiral in the GFC, with falling prices making lenders hesitant to originate new mortgages. That lack of debt forced owners of even cash-flowing properties to sell at a lower prices, which in turn made lenders more fearful of falling prices.

The fact that the current market still has a number of legs on the debt stool has provided support to asset pricing, with the RCA All-Property Index CPPI down only 1.5% year-over-year in July. Declines are likely to be coming in the months ahead, but the debt markets so far do not seem to be an accelerant to that decline.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.