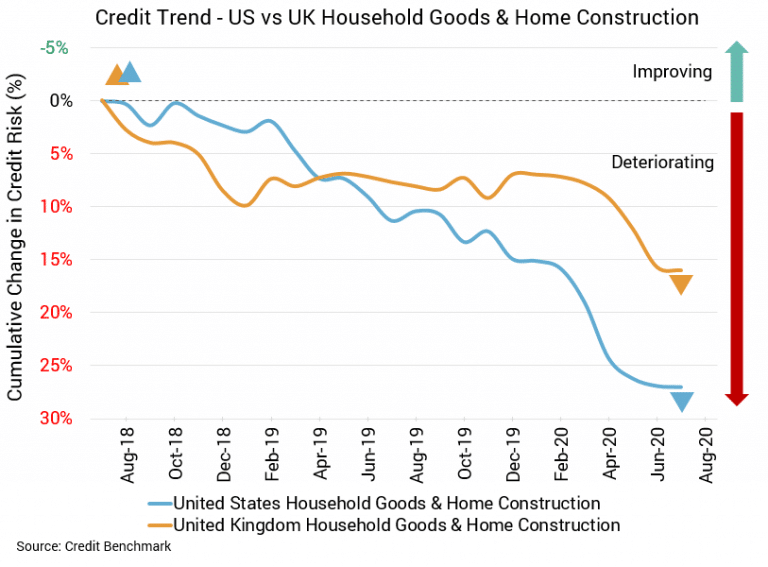

With the economic picture still murky, no news may be good news for the US and UK housing sectors. Credit quality has seen little change in each region with the most recent update. Recent positive signs in the US and UK markets may suggest continued stabilization. But as noted last month, the UK is experiencing its worst recession on record and the sector’s credit prospects may limited for some time. There’s more reason for optimism for the US, according to some reports.

Overall Credit Picture Remains Worse for UK Housing Sector

US Household Goods and Home Construction Firms

The latest update indicates stabilization in credit quality for the US housing sector. There was no change in credit quality from the month prior, and deterioration of about 1% from two months prior. Still, there was a decline of 10.3% from six months prior and 14.1% from the same point last year. Average probability of default for this sector is 49.6 basis points, unchanged from the prior month and compared to 49.3 basis points two months prior. It was 45 basis points six months prior and 43.5 basis points at the same point last year. The declines in credit quality may have levelled off, but the sector does have a large percentage of companies with weak credit quality. About 76% of firms with a CBC rating are at bbb or lower. The aggregate’s average CBC rating is bb+.

UK Household Goods and Home Construction Firms

Last month, it looked like the holding pattern for the UK housing sector may have ended. But this month’s updates shows little change. Credit quality is essentially unchanged, down just 0.3% from one month compared to a decline of 4% from two months prior. It’s down 8% from six months prior, and from the same point last year. Average probability of default is now 56.1 basis points, compared to 55.9 basis points the prior month and 54.2 basis points two months prior. It was 51.7 basis point six months prior and 52.1 basis points at the same point last year. As with the US housing aggregate, there is a large percentage of companies with weak credit quality. About 83% of firms with a CBC rating are at bbb or lower. The aggregate’s average CBC rating is bb+.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.