With emergency government funding set to expire at the end of September, US Airlines are planning mass layoffs after a more than 80% collapse in revenues. The more cash rich carriers – such as SouthWest and Delta – have avoided Federal loans so far, hoping to tough it out until a vaccine arrives, with the prospect of a large increase in market shares for the survivors. UK Airlines face a battle for their very survival, with the lack of Government support leading industry leaders to the conclusion that this is the “last chance” to save the industry. Continental European and Asian airlines have seen more Government support, but the immediate global outlook is very bleak.

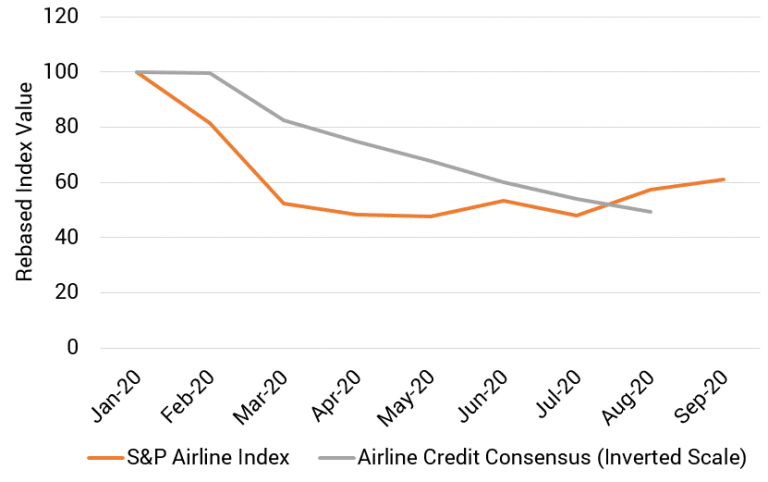

As Figure 1 shows, equity markets were quick to react in early 2020, with US airlines losing more than half of their value by April.

Figure 1 S&P Airline Index v Airline Credit Consensus

The Credit Consensus also shows a dramatic deterioration, although it lagged behind the equity market until August this year. While the US airline equity index has recovered (giving a 70% gain to those brave enough to buy at the lowest point in May), the Credit Consensus has continued its relentless decline, with – so far – a 100% increase in credit risk – equivalent to a 50% drop in credit quality so far.

With a second wave and selective lockdown measures now being announced across the globe, the recent rally in Airline stocks looks increasingly anomalous against the continued deterioration in credit.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.