In the face of COVID‐19, the commercial automotive market experienced a nosedive.

However, the push for new energy-efficient vehicles provides optimism for market recovery.

This pivot comes at a time when few people are leaving their homes and many are relying on businesses to bring the outside world to them in the form of packages and food deliveries, making reliable fleet vehicles even more important.

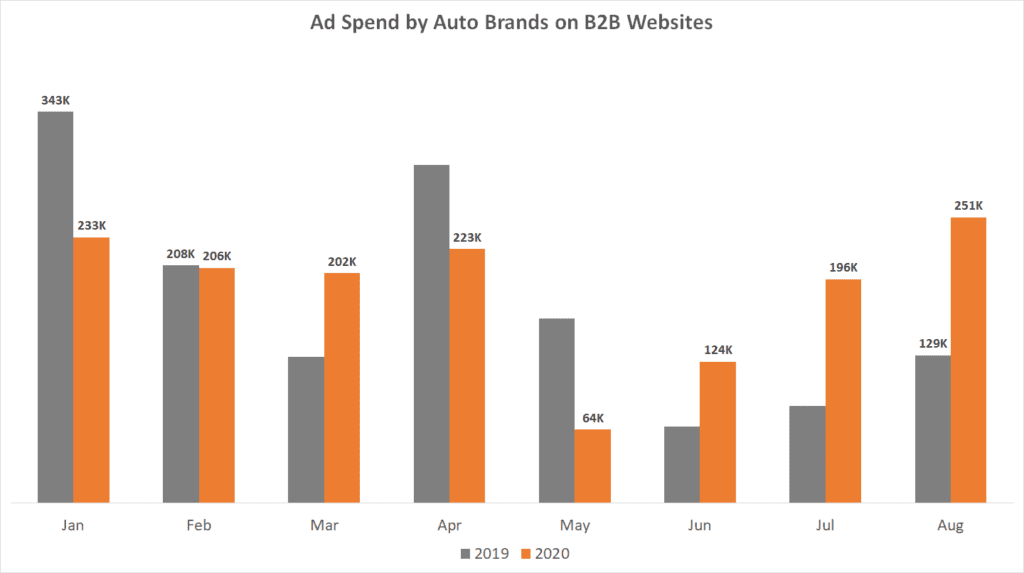

We see this optimism shining through in the ad spend: spending in the B2B automotive market bounced back quickly and is up significantly from last year.

Changes in Commercial Fleets As Businesses Search for Eco‐Friendly Options

One big drive behind spending on commercial fleets is the industry’s move towards more energy‐efficient vehicles.

Some companies have used all‐electric vehicles for over a decade. FedEx, for example, began using them in 2009. As recently as 2018, though, these vehicles were only used in California.

Other companies announced deadlines by which they aim to be gas and diesel‐free.

“All of our scooters and e-bikes are already electric, already powered by renewables,” says Andrew Savage, the head of sustainability at Lime. “We’re going to take the vans and the vehicles used to manage those programs and transition those to zero emissions as well.”

Other companies, like Ikea and Unilever, have the same goal in mind.

Announcements of new, energy‐efficient and sustainable car models coincide with Governor Gavin Newsom of California signing an executive order banning the sale of new gasoline cars by 2035.

“To get to a carbon-free economy by 2045 we can’t get there without transportation,” Newsom said in a webcast. With this new legislation, EVs will most likely play a large part in fleet management over the next few years.

In January, UPS committed to purchasing 10,000 Electric Vehicles (EVs) for their fleet. Amazon expects to add 100,000 EVs to their fleet by 2030, and FedEx has integrated electric vehicles into their fleet for over a decade.

eCommerce in B2B automotive on the rise

At the same time, many automotive companies are turning to eCommerce to boost sales.

This allows them to keep more accurate inventory and expand their customer base. TruPar, for example, increased online revenue by 25% and average order value by 70% since switching to an eCommerce platform.

eCommerce in the B2B automotive parts industry is expected to see revenues increase to $8,921 billion by 2030, primarily because:

MediaRadar Insights

With much of the country shut down, ad spend initially fell dramatically in May—down 71% YoY. However, the drop didn’t last long. Since June, there has been consistent growth in spending. By August spending increased 47% YoY.

Despite new environmental pushes, companies aren’t buying too many new vehicles yet. Commercial fleet sales from nine manufacturers saw a 16.8% overall decrease in August compared to the same time last year, following a 6.3% drop from the previous month.

However, digital ad spend in the B2B automotive market is consistent with levels seen in January, before experiencing the effects of COVID‐19. While the pandemic impacted the commercial automotive advertising industry, its effects on advertising were short lived.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.