In the week that some 32,000 aviation professionals’ careers were placed at risk in the United States as the CARES Act expires, it feels like a really flat week for what is a great industry. It seems that this week’s capacity data reflects what is probably one of the most depressing weeks of the Covid-19 crisis; we knew those furloughs were coming but just hoped that they could be avoided, perhaps they still can.

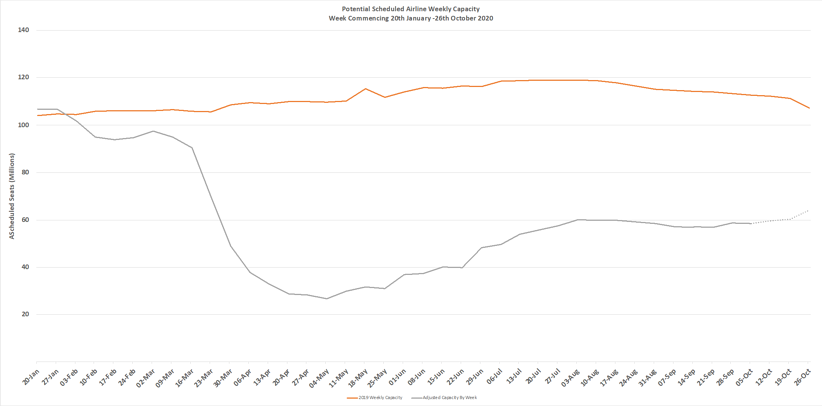

With some 58.3 million scheduled seats this week, global capacity has only fallen by some 200,000 which may perhaps suggest we are beginning to see capacity bottoming out; at least for the next few weeks ahead of the IATA Winter Season. Capacity is now at some 51% of the same week last year and IATA’s latest forecast suggest a slower growth rate for the rest of the year resulting in an industry loss of some US$84.3 Billion, it could of course be more; it certainly will not improve.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

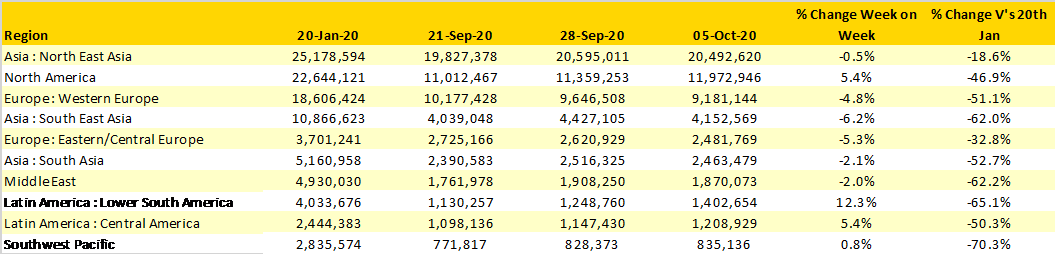

In an ironic twist to the forthcoming furloughs in the United States the North American market actually reported capacity growth of some 5.4% week on week making the region one of the fastest growing areas. Only Lower South America reported a higher rate of growth although of course from a much lower base, nevertheless an additional 50,000 seats a week in the region maintains the growth we have been witnessing in recent weeks.

The growth in North American capacity actually disguises reductions in weekly capacity across a number of markets. South East Asia, Western Europe and Eastern/Central Europe all reported capacity cuts; in the case of Western Europe over 465,000 seats were removed week on week and since the first week of September some 1.8 million seats have dropped out of the market. Seven of the ten largest regional markets remain at less than half of the capacity operated in January and all are of course significantly down against the same week last year.

As if expecting to be heavily covered in this week’s OAG webinars, Southern Africa takes the award as the fastest growing region in the world this week, however, the 13.5% increase in capacity amounts to only 29,000 extra seats and the market remains some 69% below January’s level.

Table 1 – Scheduled Airline Capacity by Weakest Performing Regions, 20th Jan – 5th October 2020 by Region

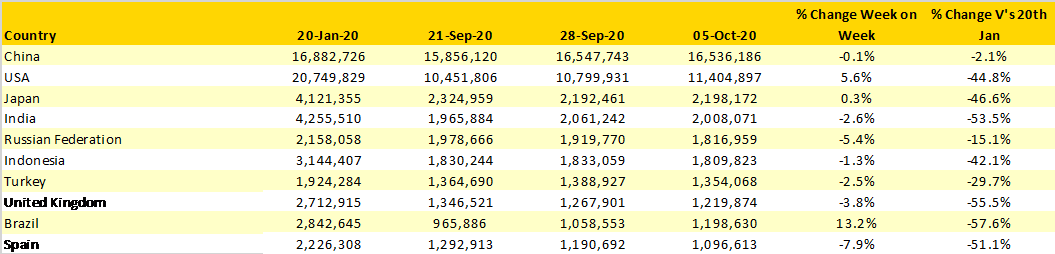

As we are in the middle of Golden Week in China it is perhaps no surprise that capacity has fallen slightly as everyone should have travelled by now. Even allowing for that small reduction, for one of the largest markets in the world to be operating with capacity close to January’s levels reflects a major structural change of focus towards domestic services. It begs the question will international ever recover to previous levels?

Ten country markets actually report capacity above their January levels and of those only Greece (+31.5%) could be considered a major market with more than 420,000 seats a week. Just to place that “impressive” result into context, the Greek market is highly seasonal, and January is not the best month in Greece for a holiday (trust me!) and last year there were some 793,000 seats a week. It just shows how easy it is both to be impressed and fooled by data on occasions!

The reappearance of Brazil in the global top 10 countries reflects the recent capacity growth and an additional 140,000 seats this week places them in ninth position with South Korea and Germany dropping just outside of the chart.

Table 2 - Scheduled Capacity, Top 10 Countries Markets

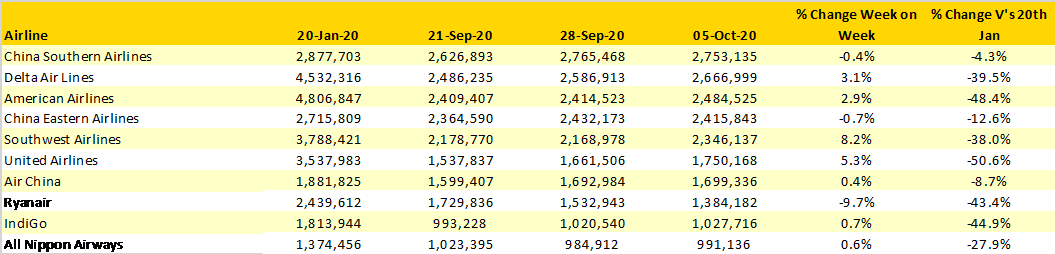

The capacity increases from Delta Air Lines (+80,000 seats) and American Airlines (+70,000) seats week on week seem slightly at odds with the announced furloughs but as we have seen throughout the Summer Season airlines are adjusting capacity on a regular basis and the furloughs are in preparation for the Winter Season which is only three weeks away now.

Two of Europe’s largest LCC’s, Ryanair and easyJet have this again cut capacity by some 300,00 as they continue to steadily ease back the throttle on production ahead of what is expected to be a very tough winter. Traditionally the next eight weeks demand is built around a mix of half-term holiday travel and conference business; neither of those will be happening this year for sure. Amongst those airlines based in Western Europe only four carriers added capacity in the last seven days with British Airways increasing capacity by a bold 27% against a Western European market average decline of 5%.

Table 3 - Scheduled Capacity Top 10 Airlines

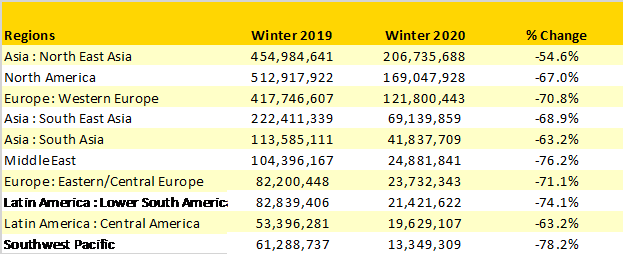

Taking a brave step forward we’ve had a quick look at how current scheduled Winter 2020/21 capacity compares to that operated in the last winter season. Accepting that there is much still to change and that traditionally the Chinese airlines file capacity quite late in some markets there are considerable reductions in capacity over and above the levels that we are currently reporting.

All of the top ten regional markets are currently standing with less than 40% of their normal capacity levels and with markets such as North America currently showing a “gap” of 343 million seats alone over the five-month period. The data suggests that we are heading into toughest ever winter for the aviation industry.

Table 4 - Winter 2020/21 Regional Capacity v Previous Winter Season

And finally, we mentioned in the September OAG webinars that the aviation industry was looking at the most crucial six-week period in any recovery process. We noted that many steps needed to be taken; a co-ordinated approach from Government Agencies, testing, funding, easing of slot restrictions and of course fewer quarantine restrictions. In the last six weeks, little has been done to change the situation and although the news has snippets of possible testing before flying and yet more corridors of travel as an industry, we have probably moved further backwards than forwards.

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.