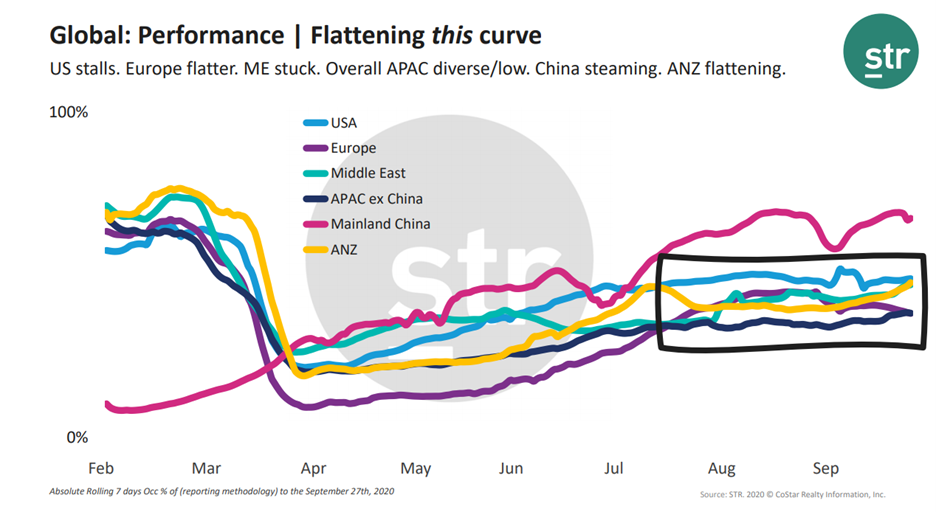

“Flattening the curve”

Mainland China hotel performance is steaming, while occupancy in the Asia Pacific region (excluding Mainland China) presents low occupancy levels overall. U.S. occupancy has remained mostly flat in recent weeks even with a lift from post-natural disaster demand. Recovery in Europe, Australia and New Zealand is also flattening.

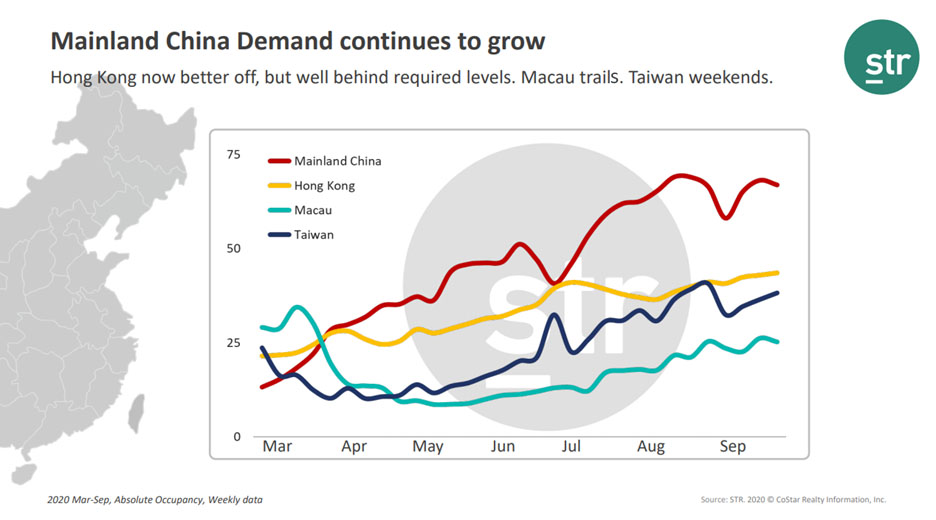

Mainland China demand continues to grow

Demand has been growing consistently over the months in Mainland China due to strong domestic demand and the new duty-free policy implemented.

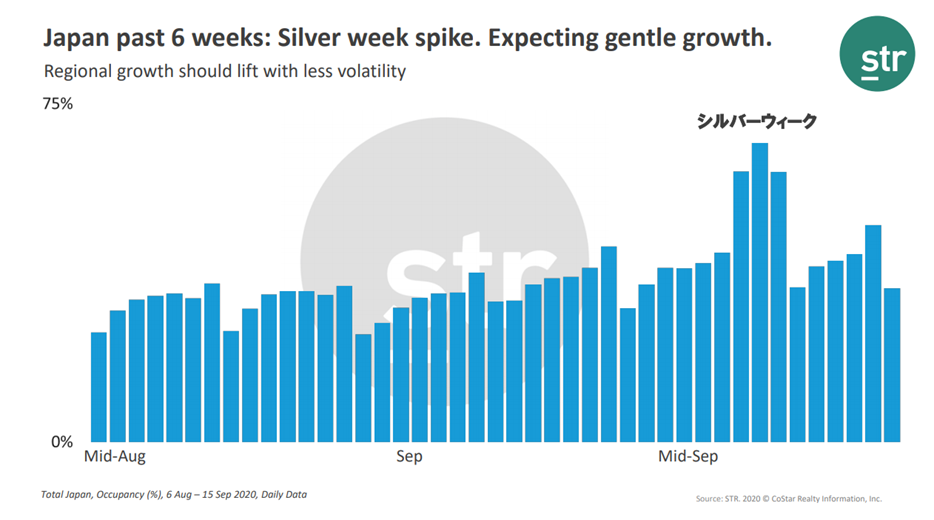

Japan: Silver Week spike

Although hotel occupancy has been improving since the Japanese government “Go to Travel” campaign to promote domestic travel and help boost local businesses, levels have remained well below pre-pandemic levels with full recovery not expected for years. However, following the Silver Week (19-22 through September 2020), Japan saw an occupancy spike.

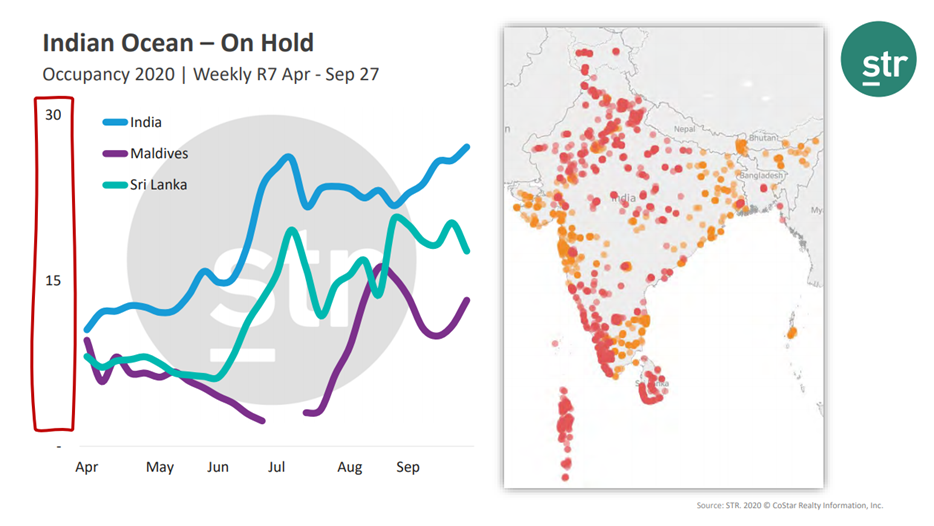

Domestic leisure demand picks up in India

While occupancy across India is taking time to recover, many leisure destinations began seeing weekend occupancy spikes in August. Hotels in some of these leisure destinations have even started seeing MICE business with weddings/groups of less than 50 people permitted. This too is aiding the recovery for leisure destinations to a certain extent.

What can we expect next?

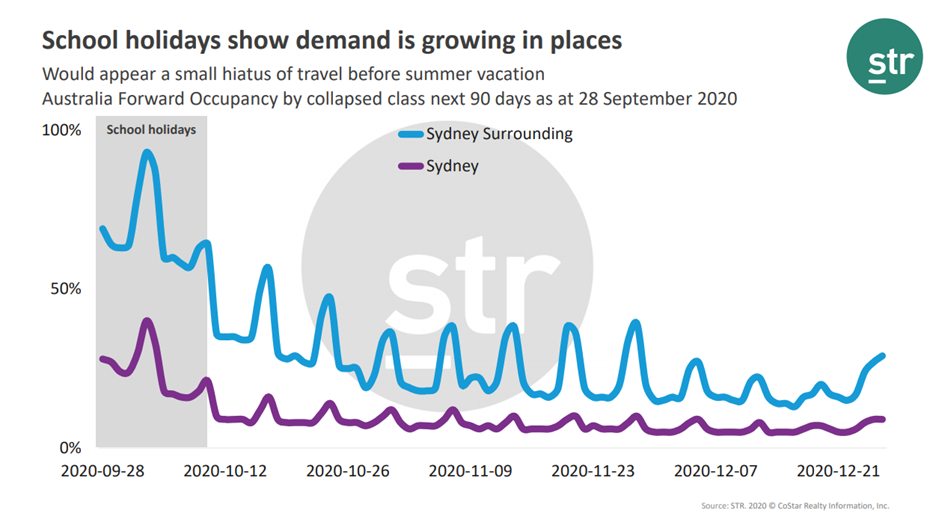

Powered by Forward STAR data, the below image includes occupancy on the books for the next 90 days (as of 28 September) in Sydney and Sydney Surrounding, and further insights are provided in the full webinar recording. Occupancy-on-the-books intelligence will help us all understand recovery and provide much-needed context.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.