With the overall economy slowly recovering and the country returning to ‘normalcy’, some sectors have been hit far harder than others. None more so than travel. So with a return en route, we dove back into this space to see how leading players are responding.

Hotels Hit Hard, but Bouncing Back

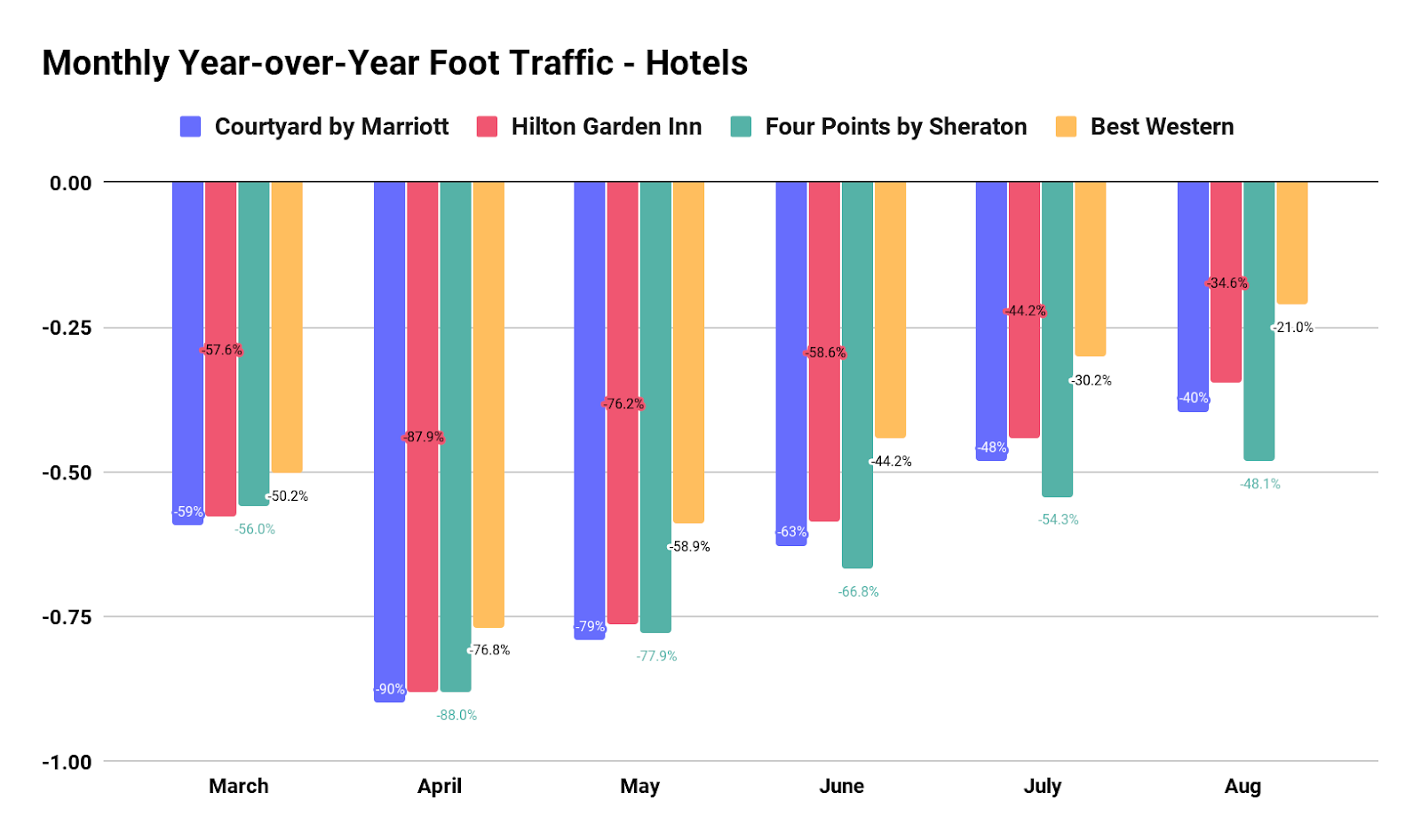

The hotel industry was unsurprisingly hit extremely hard at the onset of the pandemic. But, when looking at monthly year-over-year data we see a glimmer of hope for the sector. While traffic bottomed out for each chain in April, we see every month generating traffic that inched closer to 2019 levels – including an August period that saw average visits for four key chains down just 35.8% on average compared to an average decline of over 42% just one month prior.

Nationwide visits for the Best Western and Hilton Garden Inn were just 21.0% and 34.6% down year over year, respectively in August. Impressively, these numbers are significantly closer to 2019 levels than they were just a month before where visits to the chains were 30.2% and 44.2% down – speaking volumes for the pent-up consumer demand for travel.

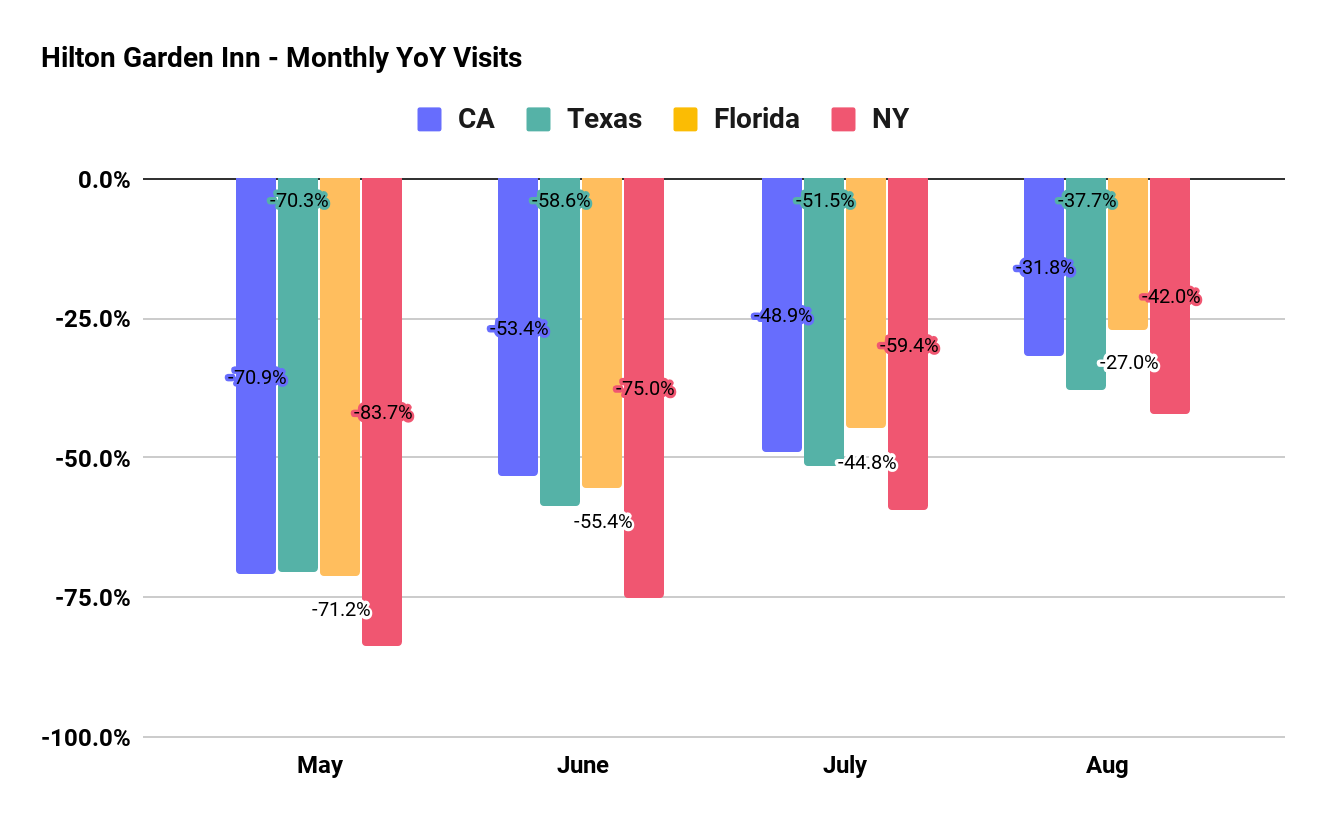

Even in hard-hit states where cases have recently resurfaced, traffic to these chains shows a positive trend. When looking at nationwide visits to the Hilton Garden Inn in Florida and Texas, we see traffic bouncing back since April. August visits to the Texas chains were just 37.7% down while traffic in Florida was an impressive 27.0% down year over year. And this trend also holds true for each of the other chains measured.

Promising Signs for Airports

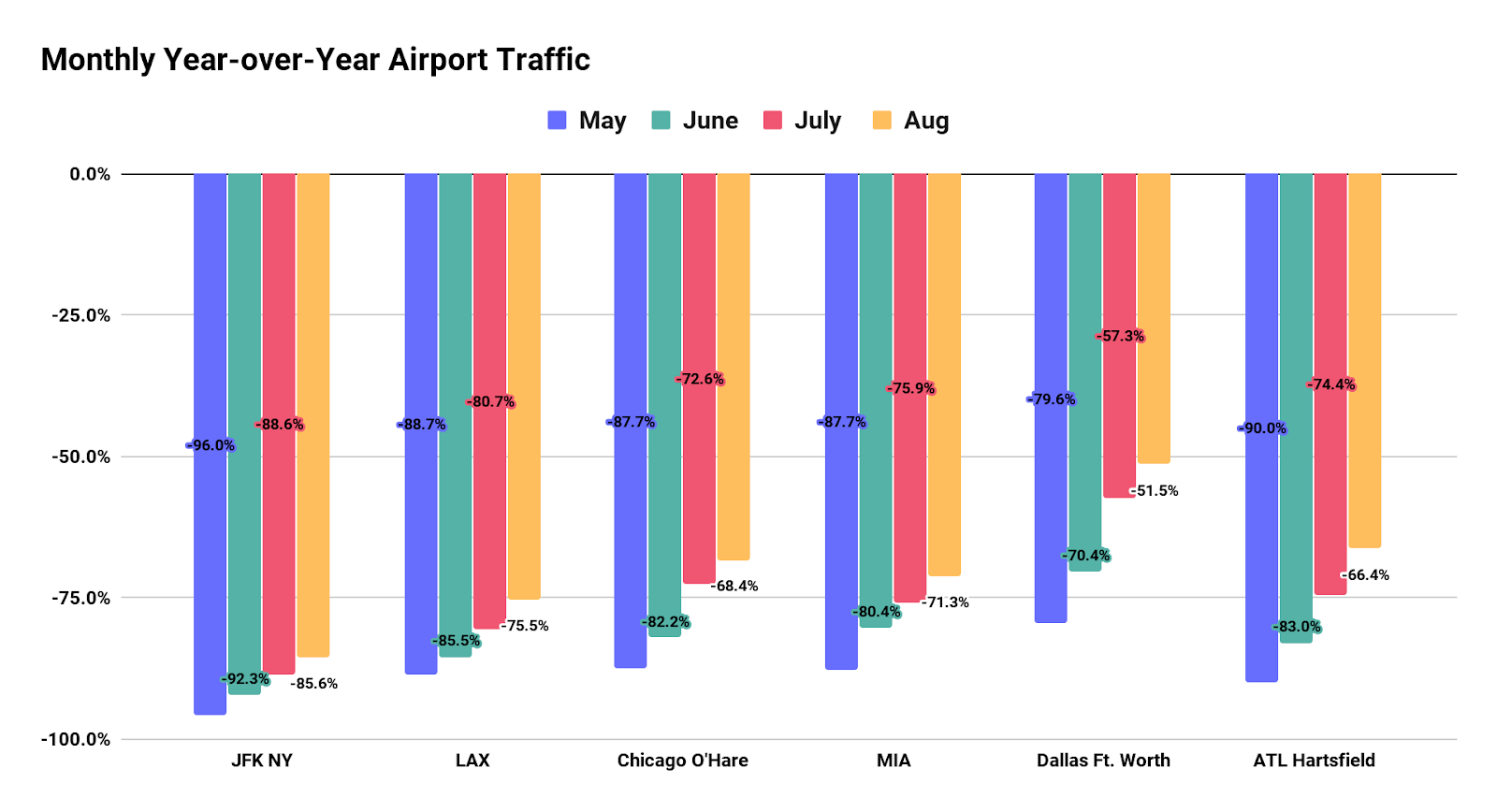

We see a similarly positive trend when looking at six of the largest, and busiest airports in the country, though the pace of recovery can differ greatly. Taking JFK in NY as an example, visits have inched slowly back to 2019 levels every month since May, but traffic is still 85.6% down year over year for August. This is only a slightly better result than the month prior, when visits to the airport were still 88.6% down – marking it the slowest recovery out of any of the airports measured. When combining this information with hotel recoveries it is clear that airports remain a particular area of concern for many travelers, with the preference being to identify other means of transportation to get away.

Conversely, even with a massive resurgence in cases in Texas, Dallas / Ft. Worth International airport is seeing numbers that are closest to pre-COVID levels. August visits were down just 51.5% year over year. While this is still a far away from 2019 numbers, this is a significant leap toward normalcy when compared to June, when visits were 70.4% down.

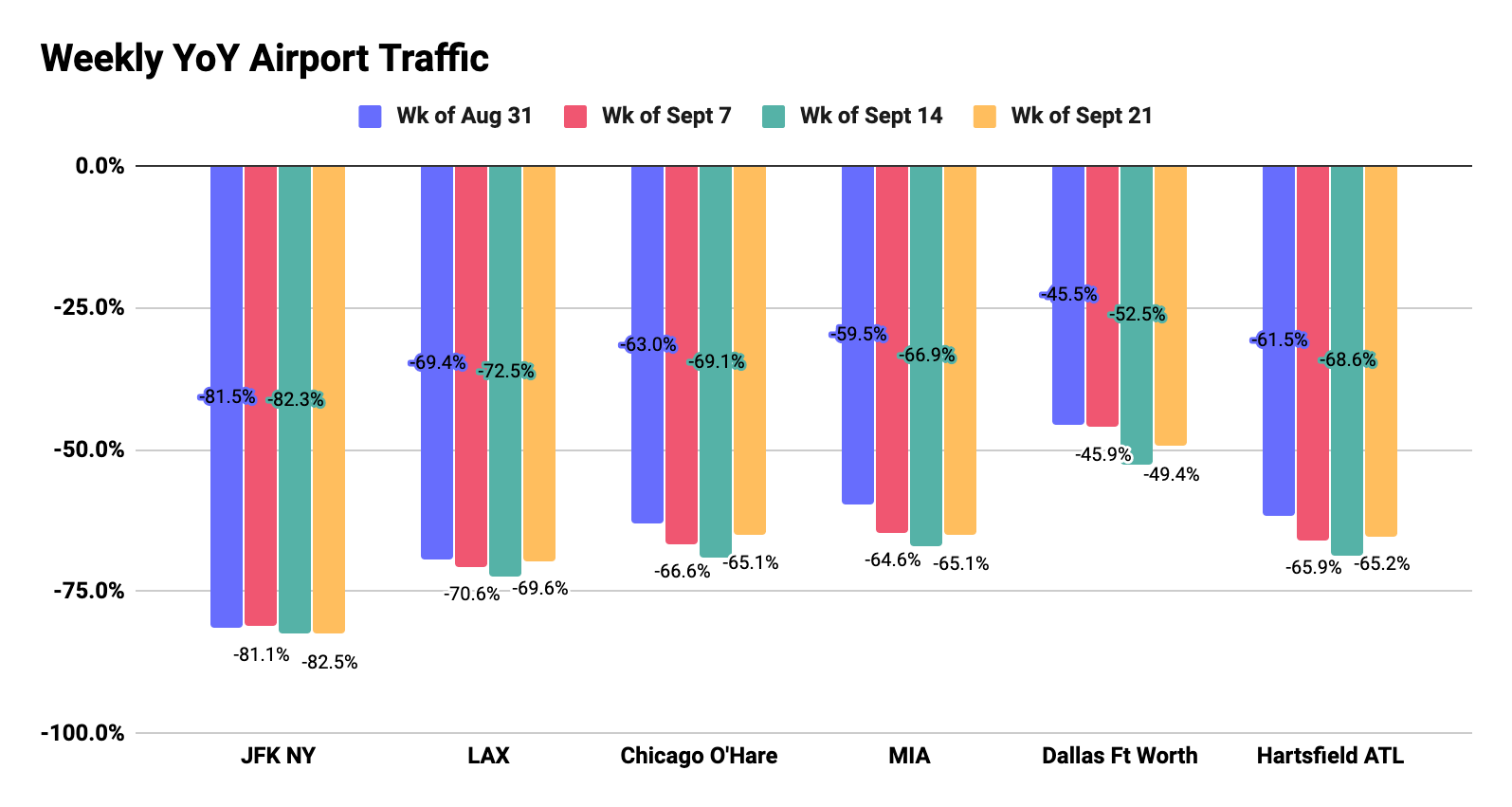

And, looking into weekly year-over-year traffic for the beginning of September also gives us reason to believe that the industry is in the midst of a bounce back. More importantly, these six airports are some of the biggest hubs for both domestic and international connection – giving hope that cross-country and intercontinental air traffic is on a path back to normalcy. In spite of there still being an abundant amount of restrictions when it comes to travel, it seems as though the pent up consumer demand for travel is significant giving a positive outlook to an industry in desperate need of a recovery.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.