The holidays often seem to sneak up on consumers. In fact, a 2017 survey found that over half of shoppers planned to buy gifts within two days of Christmas. Retailers, on the other hand, think about the holiday season year-round. Employers usually start their holiday hiring as early as September to deal with surges, as 21% of retail sales come during this time.

However, low sales leading up to the holidays can mean a significant blow to a company’s annual revenue. With the global pandemic still spreading and the U.S. unemployment rate the highest it’s been in nearly a decade, this year’s holiday season will almost certainly be different. Consumer spending was down 10% in the second quarter, while air travel in September was about one-third of what it was in 2019, in terms of traveler throughput.

To sum it up: We are heading into a holiday season that will likely involve a lot less spending than usual. In turn, this may significantly impact retail businesses as well as their current and potential employees. So what can we expect as employers begin holiday hiring? We spoke with Indeed economist AnnElizabeth Konkel about her research on seasonal job postings and what it can tell us about the current economic situation.

What are the key findings?

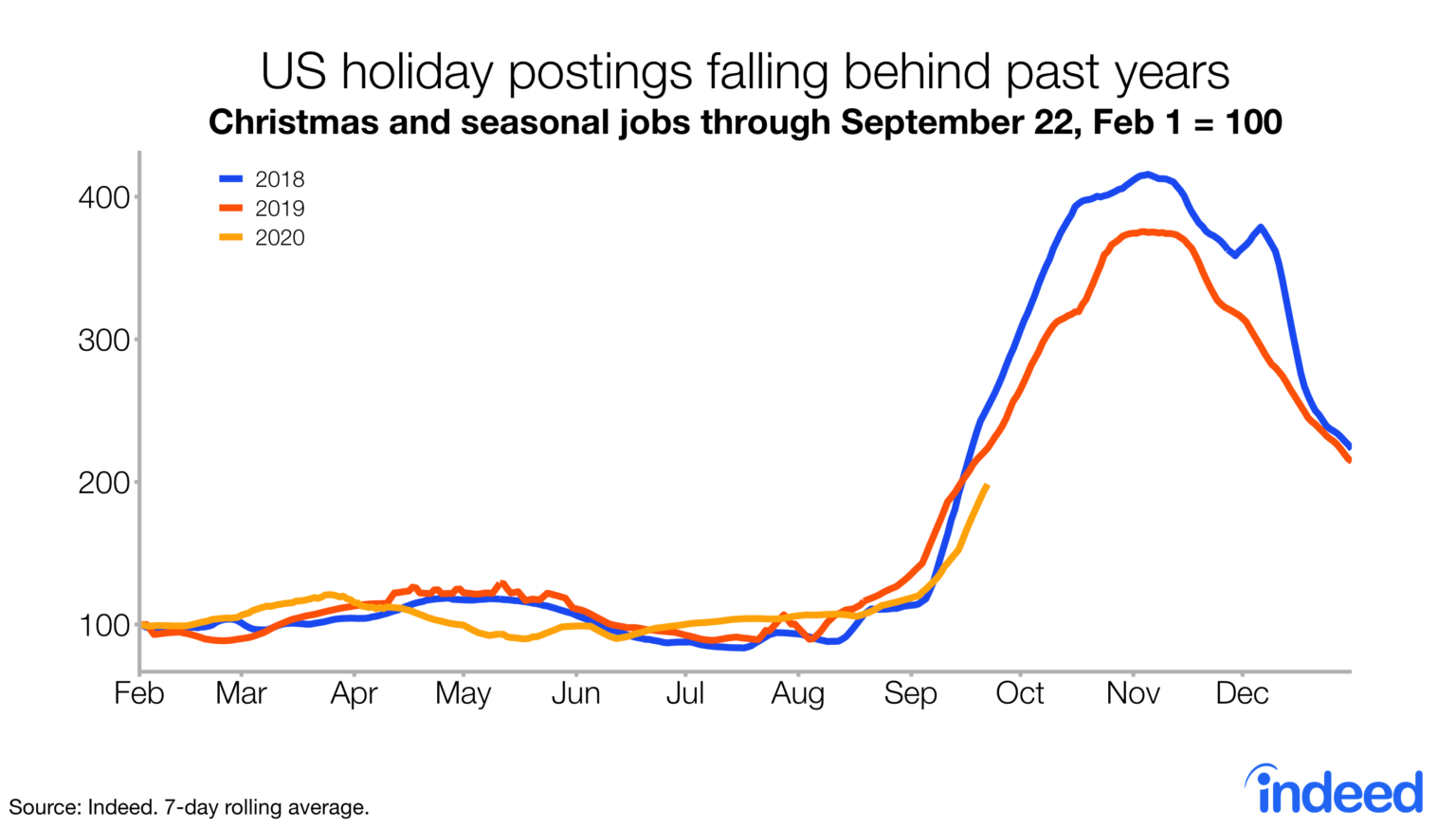

Typically, we see retailers amp up holiday hiring in September, with a rise in job titles that include “holiday,” “seasonal” and “Christmas.” This year we see a similar trend, but progressing at a slower pace. As of Sep. 22, seasonal job postings lagged 11% behind last year’s trend.

In AnnElizabeth’s words, “There’s no mystery as to why: It’s the coronavirus and the uncertainty of the economy.”

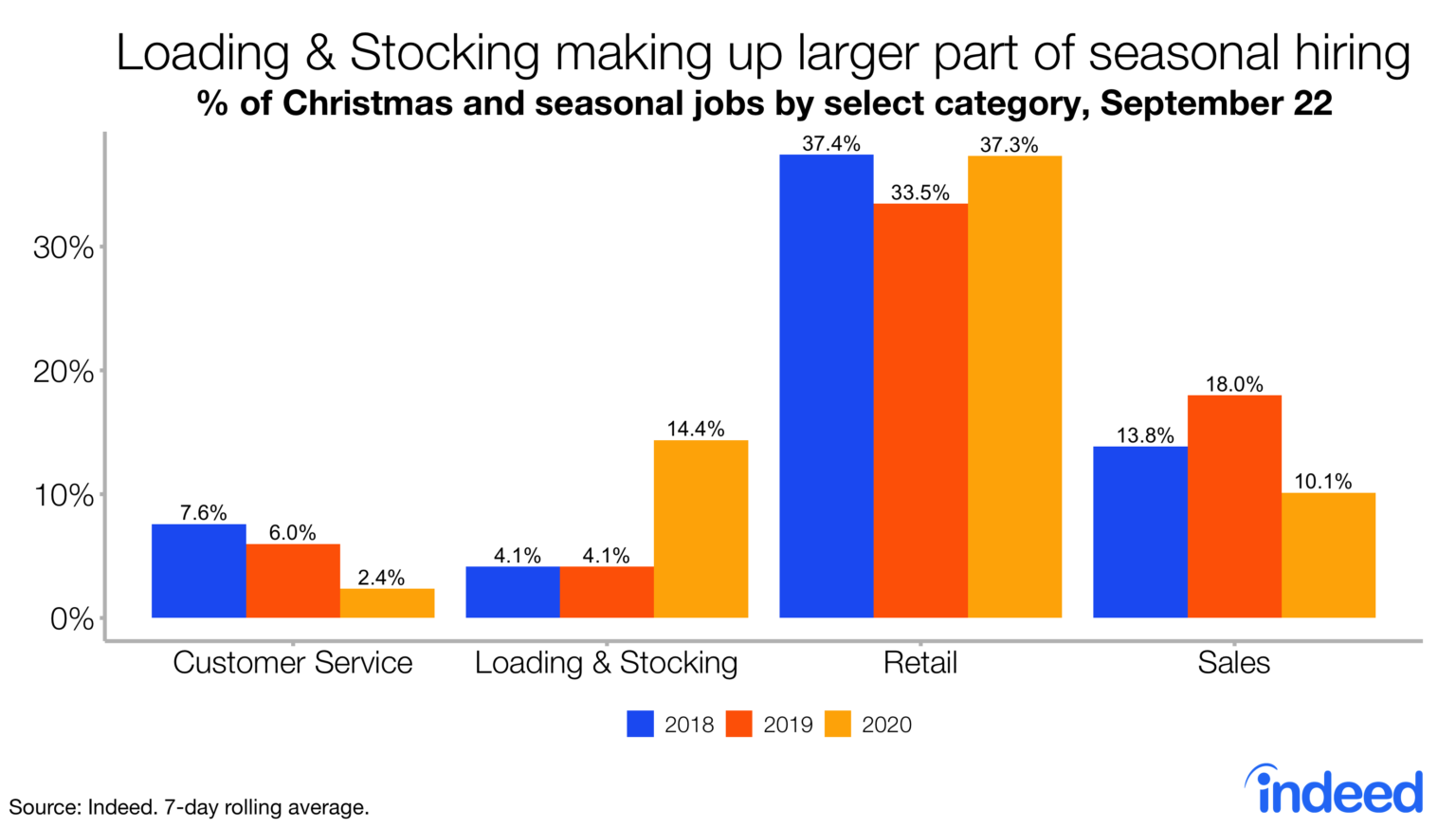

According to AnnElizabeth, COVID-19 is impacting holiday hiring in a few major ways. First, there has been a general economic slowdown — you don’t need as many seasonal workers if people are shopping less. Second, people are now buying different things. For example, spending on home goods, such as food, furnishings and exercise equipment, is up, while spending on services that involve face-to-face interaction, such as transportation and restaurants, is down.

Lastly, online shopping increased 31% between the first and second quarter of 2020, as people began limiting in-person contact. This trend also explains why one area traditionally associated with season hiring is booming: loading and stocking.

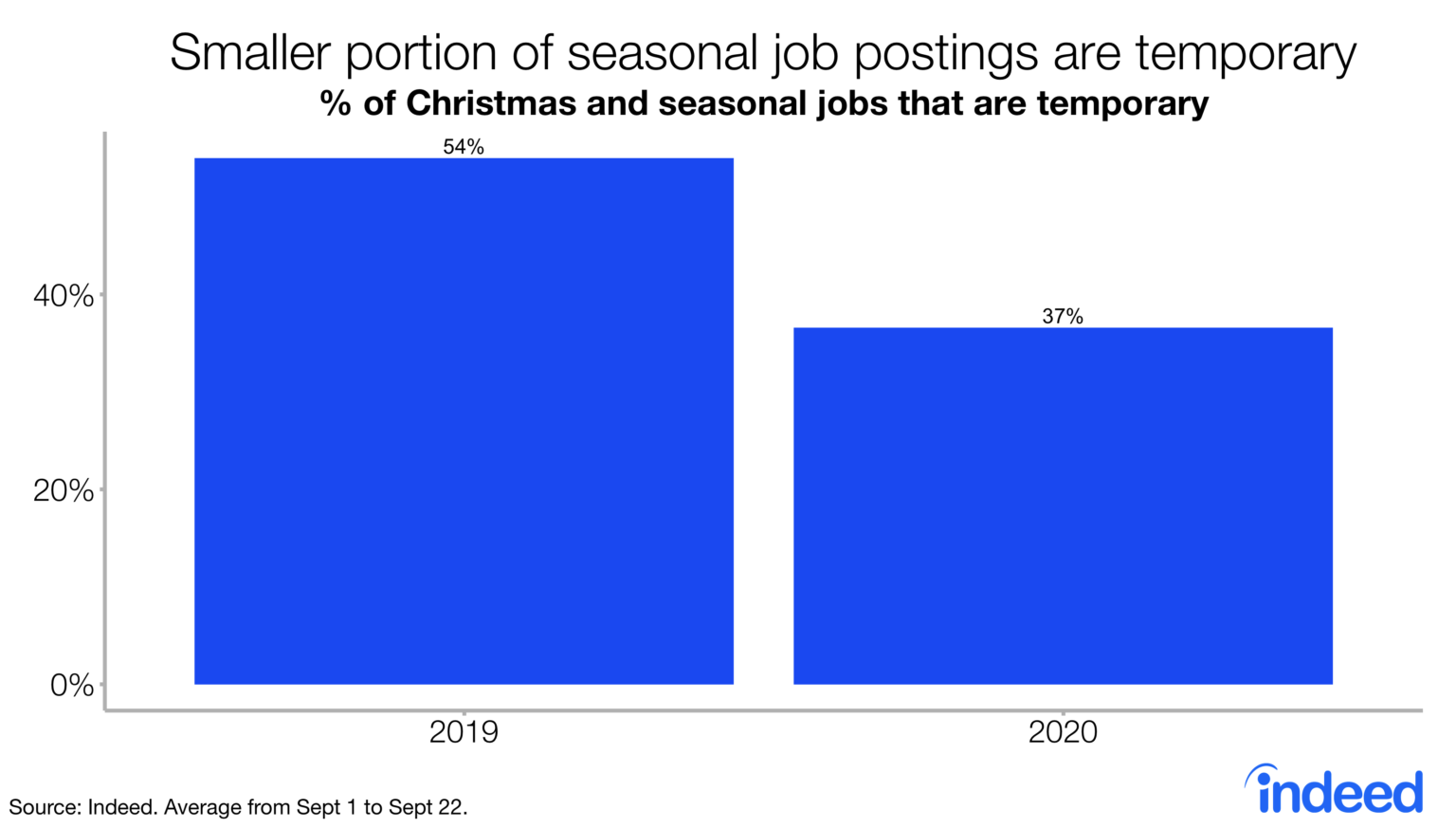

AnnElizabeth also discovered that many of the seasonal jobs that would typically be temporary are being offered as permanent positions this year. In 2019, 54% of seasonal jobs were temporary, but this year, only 37% of them are. This trend indicates that the job market is seeing a mild bounce-back from the huge job losses of the spring, rather than a true reflection of holiday hiring needs.

What does this mean for employers?

Just because things have slowed down doesn’t mean the holidays are canceled. Many employers will still need additional workers to bolster their seasonal operations.

However, the types of employers that need extra help may be different than in years past. Due to restrictions such as store capacity limits and concerns about the spread of the virus, shoppers may be less likely to purchase gifts that involve human interaction, such as spa gift cards, and more likely to buy items that can be used at home.

What’s more, “winter impacts the entire economy,” as AnnElizabeth says, and this is truer than ever this year. It will soon become difficult for restaurants to offer outdoor seating in cold climates, and activities such as outdoor fitness will be much more challenging when temperatures become frigid. This will likely lead to fewer job postings in fields that have become weather-dependent due to the coronavirus.

What does this mean for job seekers?

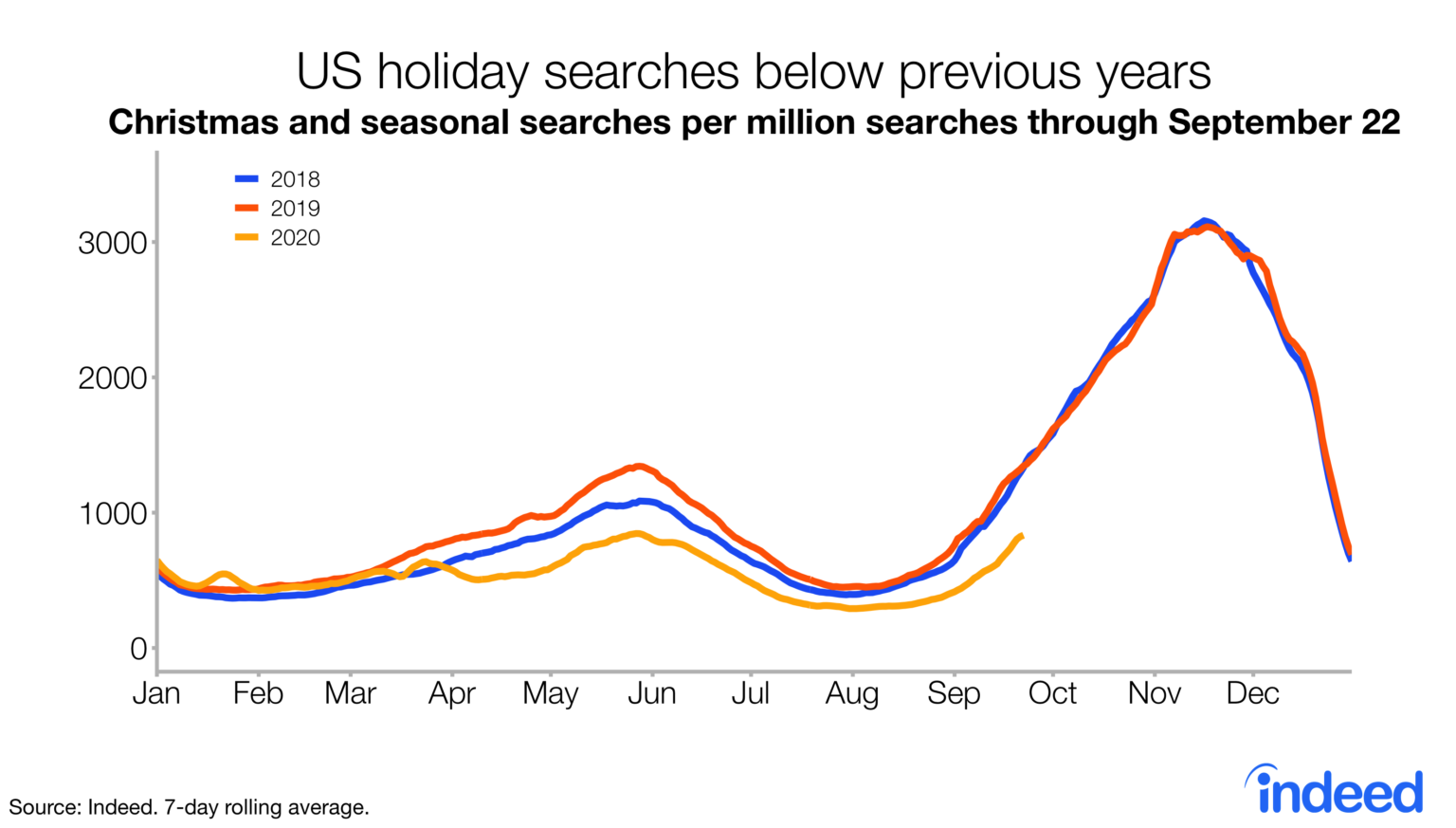

While more workers are enjoying permanent employment in sectors previously dominated by temporary jobs, they’re also showing less interest in seasonal jobs when compared to previous years. As of Sep. 22, searches for seasonal jobs were down 38% from the trends in 2019 and 2018.

But if unemployment in the U.S. is so high, why would there be fewer searches for seasonal jobs? Yet again, all signs point to coronavirus. Many seasonal jobs, such as retail and customer service, involve in-person interactions, triggering concerns about job seeker safety. Lack of childcare is another common factor keeping workers close to home.

But if unemployment in the U.S. is so high, why would there be fewer searches for seasonal jobs? Yet again, all signs point to coronavirus. Many seasonal jobs, such as retail and customer service, involve in-person interactions, triggering concerns about job seeker safety. Lack of childcare is another common factor keeping workers close to home.

As a result, AnnElizabeth explains that “job seekers are interested in remote work. Six months into the pandemic, ‘work from home’ is still one of the most common job search terms.”

This year’s holidays will involve fewer meals out, less travel and more gifts to use at home. But they will still be celebrated, even if traditions are forced to change. Only time will tell if retailers and job seekers increase their postings and searches, respectively, as the season gets closer, or if this year’s holidays will just involve smaller swells in economic activity.

Methodology:

We define “seasonal job postings” as those with one or more holiday-related terms in the job title, including, but not limited to, “holiday,” “seasonal” and “Christmas.” “Seasonal job searches” are defined as those containing one or more of the same list of holiday-related terms.

To learn more about the data behind this article and what Indeed has to offer, visit https://www.indeed.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.