In this Placer Bytes, we dive into the pharmacy sector with a focus on Walgreens before taking a look at H&M following its announcement it’ll be closing 250 stores.

Walgreens Recovery Update

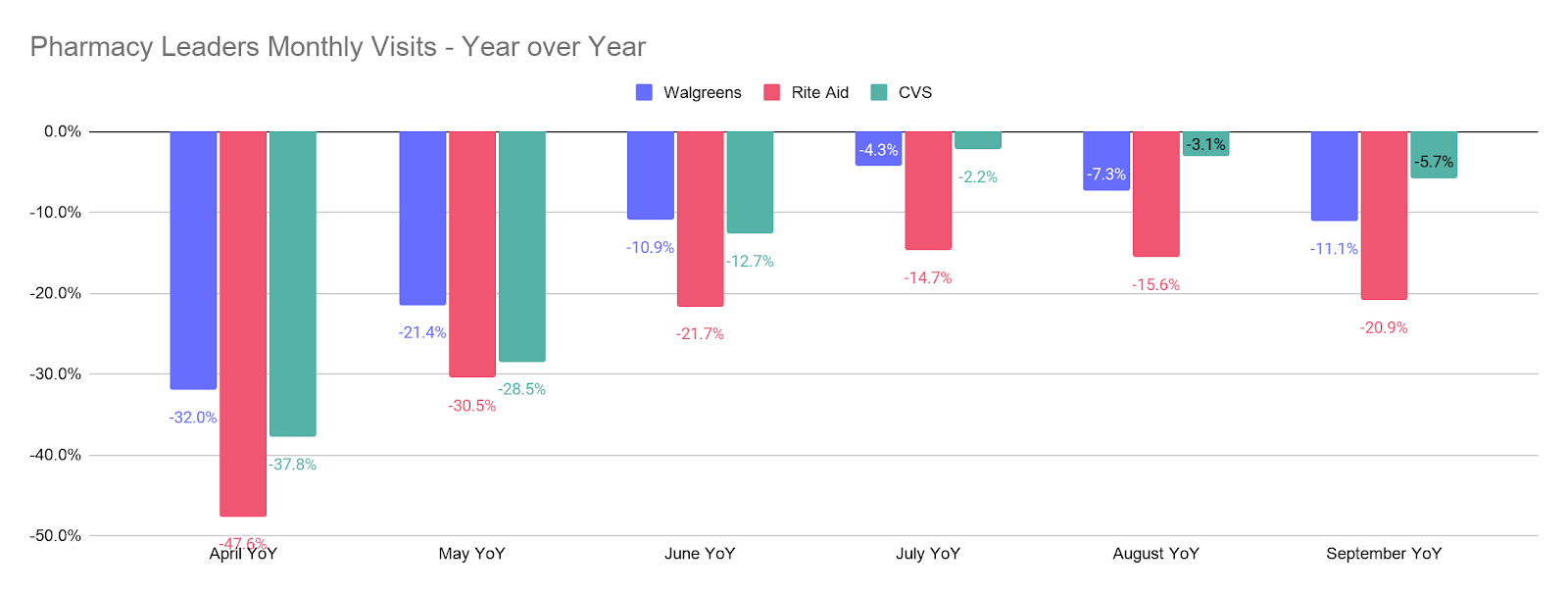

Overall, the pharmacy sector has been experiencing a very strong recovery in offline visits with each of the three brands analyzed seeing dramatic improvements from a COVID defined spring to the summer months.

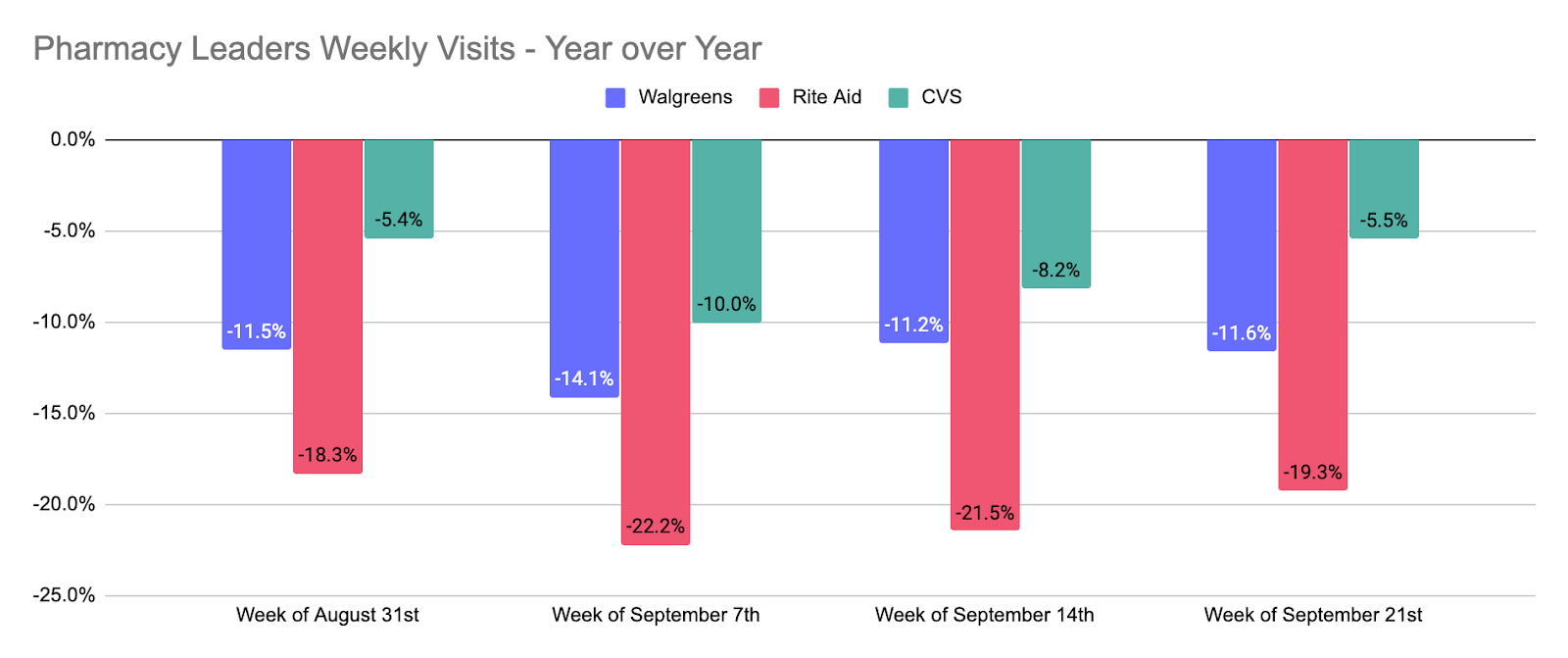

Yet, two factors are important when analyzing Walgreens. The first is that both Walgreens and Rite Aid brands while recovering, are still not matching the pace that CVS is setting in the sector. The second is that while Walgreens brand stores were within striking distance of the numbers being put up by CVS, those of Rite Aid are significantly behind. Much of this gap is related to store distribution. Rite Aid counts a hard hit California as one of its most significant states and is seeing its city orientation drive lower visits following residents leaving city locations and declines in office works returning to these business centers.

And the latest weekly data from September makes these gaps all the more significant as year-over-year visit gaps appear to be increasing following fairly consistent improvements since the spring. After seeing visits down just 4.6% and 7.4% year over year in July and August respectively, Walgreens visits have been down an average of 12.1% in the last four weeks. For Rite Aid that average was down 20.3% after two months where visits were within 14.0% and 14.7% respectively. Yet, CVS was also further away than recent months with visits down 7.3% on average those weeks indicating that this could indicate a wider sector-wide shift.

H&M – Rising Visits & Closure Beneficiaries

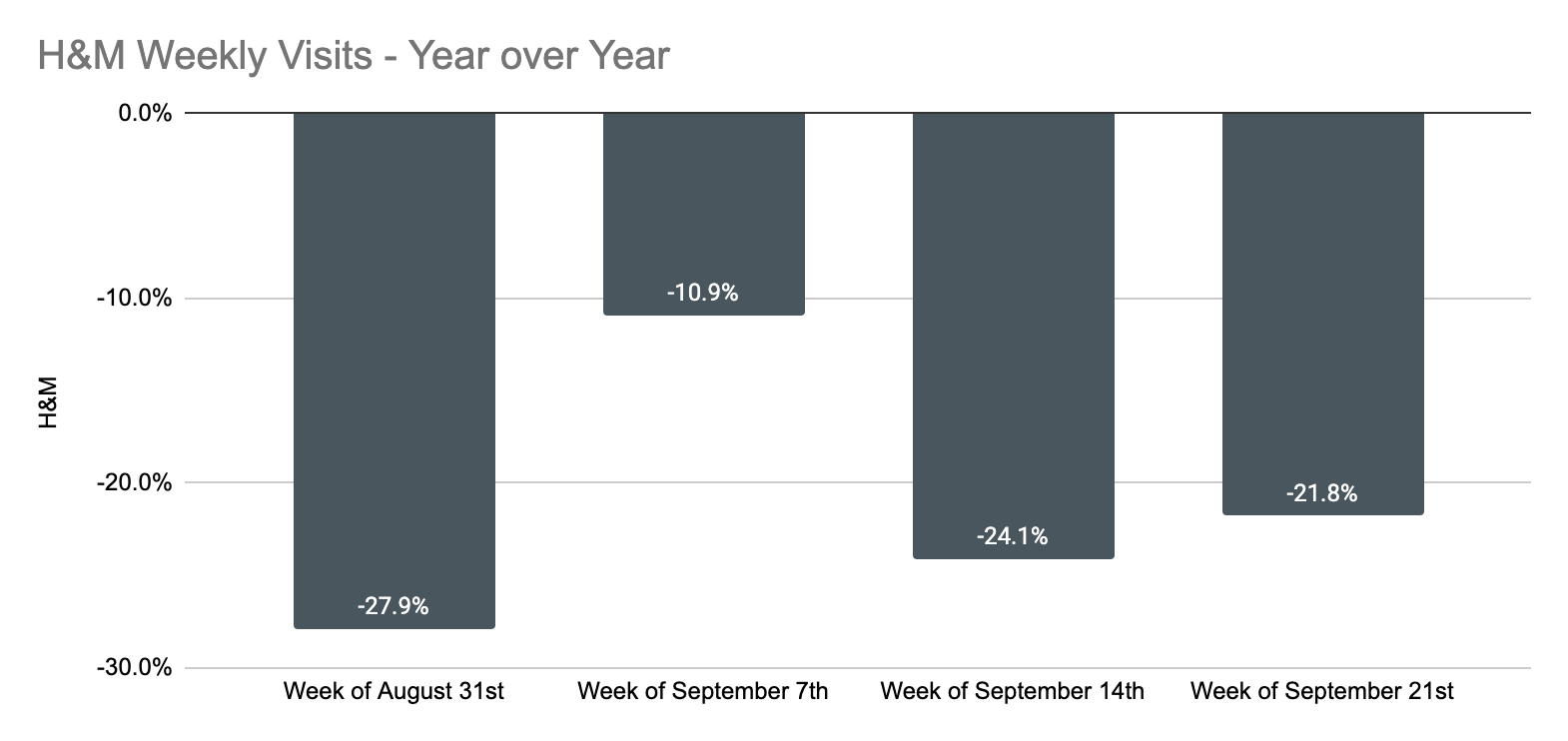

H&M recently announced that they’d be closing 250 stores in the coming year, so we dug into the data to try and understand why and who might benefit. Interestingly, following a July and August where visits to H&M locations were down 42.8% and 37.1% respectively, September numbers were looking strong. Average weekly visits for the weeks of August 31st, September 7th, 14th, and 21st were down just 21.2% year over year, the strongest visit numbers since the start of the pandemic by far. This was highlighted by visits down just 10.9% the week of September 7th, though that was clearly boosted by a later Labor Day.

And with visits returning at a healthy rate the vacuum that the brand leaves could be significant. So, who might fill it? Interestingly, two of the top three spots, Macy’s and JC Penney with 47.0% and 37.7% visitor overlap, are in the midst of determining closures of their own. This could position T.J. Maxx, Marshalls, and Kohl’s incredibly well as the three brands saw 41.3%, 37.2%, and 36.7% of H&M visitors also visit one of its locations since the start of 2019.

Yet, this does beg the question – why close so many stores? It does feel as though H&M is actually well-positioned amid the wider apparel sector with key competitors closing and visits rising back a healthy rate.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.