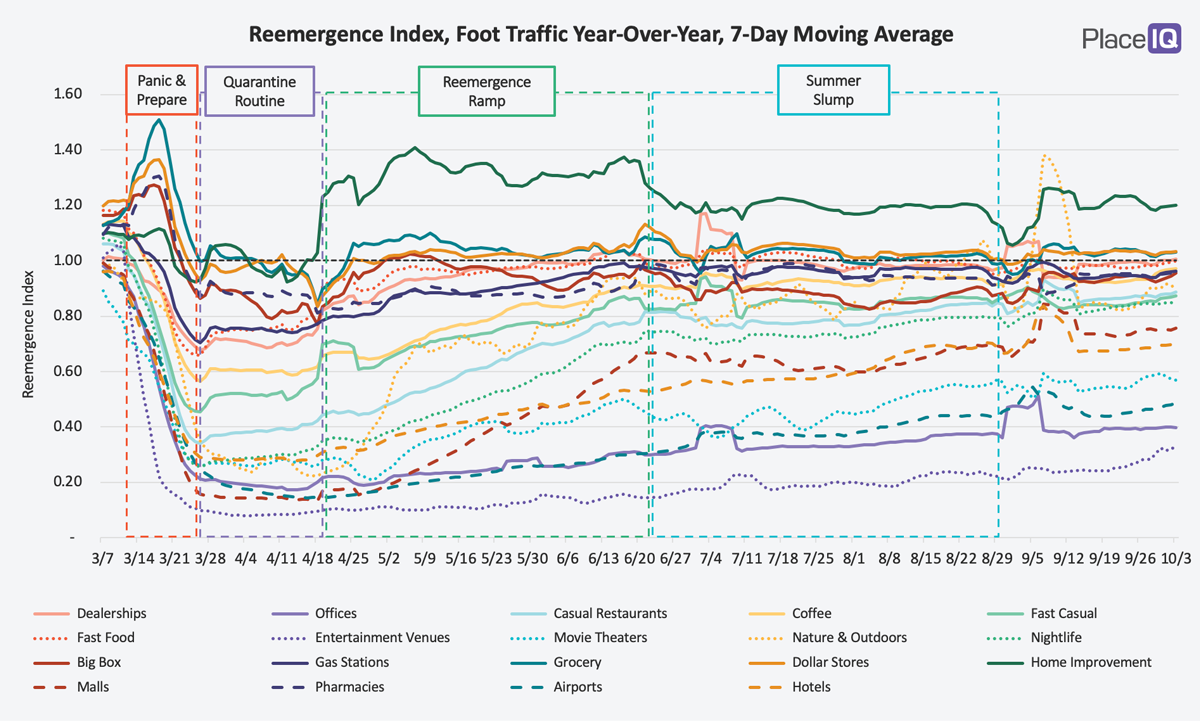

We are now into Fall, but the phase after the Summer Slump defies definition. It is a slowww crawl upwards for most categories – barely above a flatline.

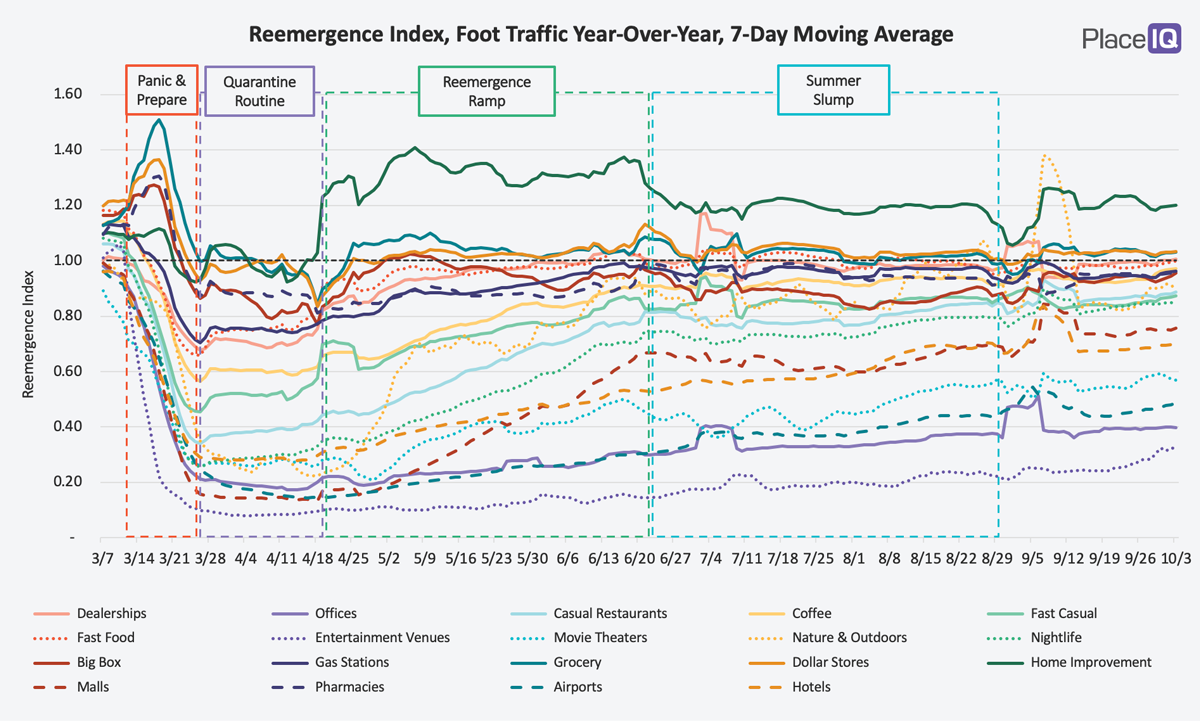

If we consolidate these categories into our Still Empty, Vacillating, and Resilient clusters we can see the gains more clearly. Of course, the Resilient venues like grocery, big box, and gas stations remain at or near their 2019 levels; we don’t expect them to outperform, just stay even. But the Vacillating categories, those whose fortunes are governed by people’s desire to stay home, are creeping steadily upward.

On the chart the Vacillating gains look more significant than they are (thanks in part to that Labor Day spike masking the dominant trend). It’s only a gain of 5 points over a single month. There’s no breakout to cap off Summer, but we’re making progress.

That upward trend is occurring right when we need it as we head towards the holidays. Much of our conversations with clients these days are focused on holiday planning. Consumer behavior is different this year, to say the least, and businesses are changing to address this challenge. Just last week we shared several holiday season strategies on a call with Criteo, which you can check out here.

In this issue of the Social Distance Tracker we’ll be sharing some tactics to address the big change in consumer behavior we expect to see this holiday season. First, we’ll take a look at how outdoor and indoor malls have been recovering differently.

We are gratified to see our analyses being included in various reports, since it is our goal to contribute to the #dataforgood effort. If you choose to re-use one of our analysis, all we ask is that you attribute the analysis or content to PlaceIQ. Thank you!

The Case for Momentum in Malls

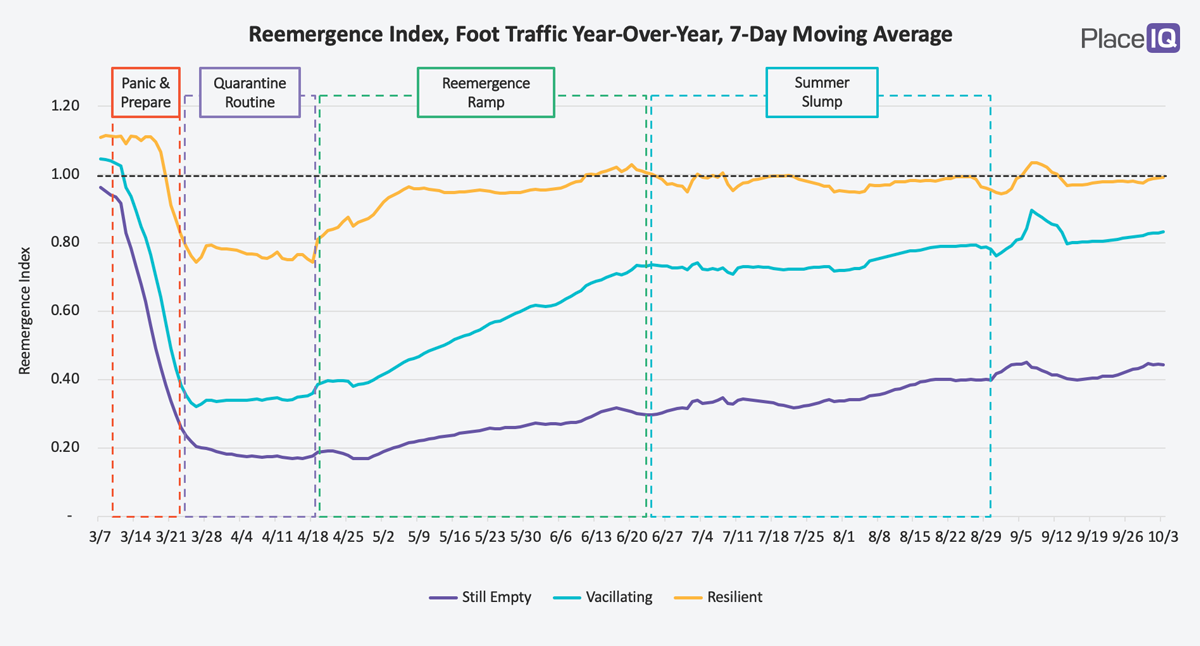

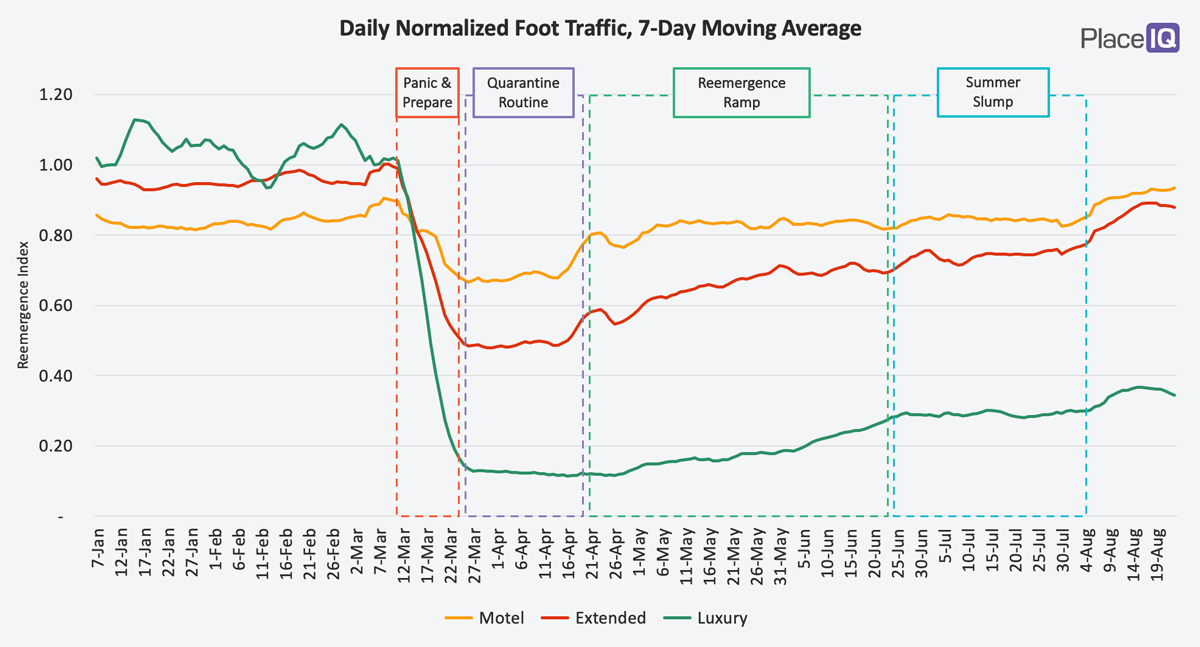

We’re always excited to find trends that hide behind the average. Despite relatively clear trend lines at the category or national level, there’s often disparate subplots lurking down in the subcategories or individual brands. For example, a few issues ago we broke down the hotel category and found an incredible breadth of performance. Motels are doing rather well (all things considered) while luxury resorts are veritable ghost towns:

Another category we’ve been wanting to break down is shopping malls. Coming out of the Summer Slump, malls have been staging a comeback that outperforms their Vacillating cluster. Traffic is up nearly 15 points since the Slump closed. To understand what’s driving this recovery, we need to break down the mall category, though this is more easily said than done.

There are a dizzying array of shopping mall types and they vary significantly by region. In California outdoor malls are the norm; while in the midwest indoor multiplexes reign; and in New Jersey the strip mall dominates the landscape. At PlaceIQ we know this diversity too well: our cartographers and map managers have been working to define these shades of grey for over half a decade in order to better reflect their influence in our data.

For this analysis, we set out in search of a regional, controlled experiment where we could compare multiple similar malls with minimal variables. This would allow us to understand how these differences determine a mall’s fate during COVID. After a bit of hunting, we identified Orange County, California as an ideal laboratory.

In Orange County, we found malls with similar shopper demographics and visitation volumes. The first variable we wanted to understand is how being an indoor mall vs. an outdoor mall affected traffic:

Orange County Malls: Indoor vs. Outdoor Trends

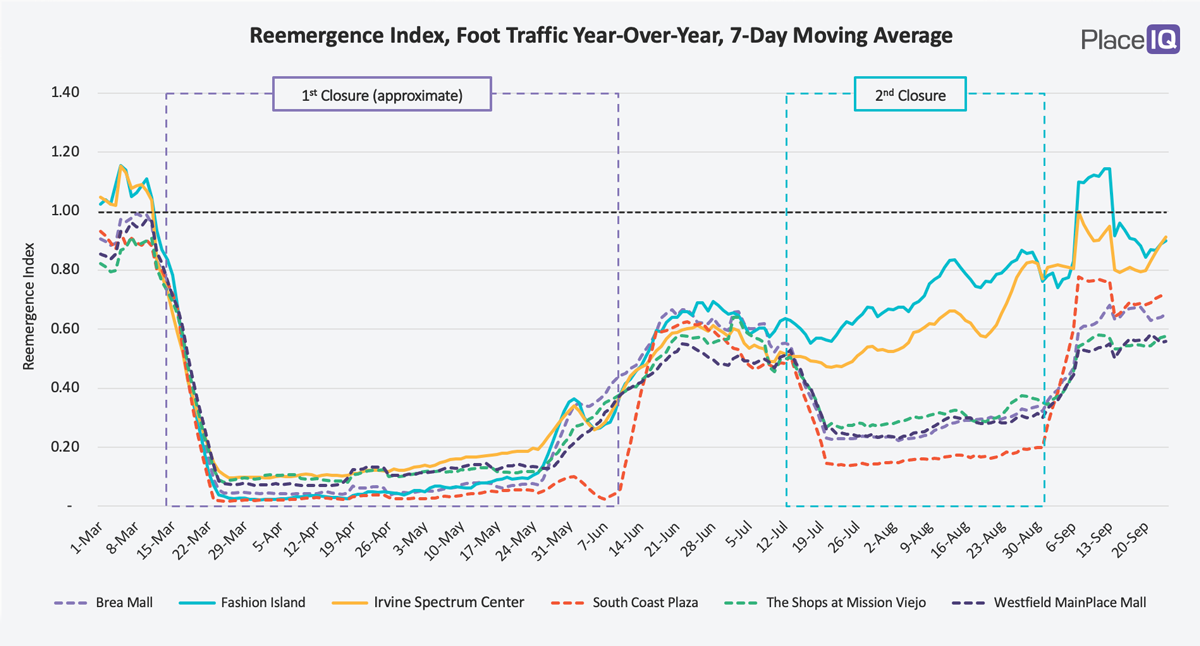

The malls with dotted lines are indoor venues. Solid lines are outdoor venues.

The first thing to notice is that there are two different closure events.

The first event started in March, driven by employees testing positive at various outlets. An anticipated two-week quarantine turned into more than two months as state and county rules kept non-essential retailers shuttered. As cases lessened, all malls reopened and traffic shot up during the Reemergence Ramp.

The second event arrived in mid-July, right as our Summer Slump arrived. Surging cases in California led to state-level restrictions requiring indoor malls to close. Outdoor venues, on the other hand, could remain open for take-out dining and click-and-collect shopping. As cases calmed down in Orange County, indoor malls reopened (with precautions) in September.

Given all this, this cluster of Orange County malls allows us to address two key questions:

To answer the first question, we need to look at each malls’ recovery after the first closure. Nearly all malls, both indoor and outdoor, recovered at almost the same rate following reopening. Even South Coast Plaza, which reopened later as they took steps to prepare for business during COVID, shot up to join the group once it reopened. Given this cluster, it appears indoor and outdoor malls recover at the same rate once reopened.

The second question is trickier, but one we’ve taken great interest in at PlaceIQ. We’ve seen hints in our data that venues which are able to remain open are recovering closer to pre-COVID norms compared to businesses which had to close and then reopen. This was a hard question to clearly answer though, as the businesses which closed were generally more risky and/or less essential than those which remained open. It is natural to assume that a grocery store would normalize traffic quicker than an indoor, sit-down restaurant — with or without closures.

But here in Orange County we find pretty good experimental conditions. We can compare the reopening trends following the first closure (when both indoor and outdoor malls closed) to the trends following the second closure (when only indoor venues closed). Here we can clearly see: malls which remained open were able to build and sustain higher levels of foot traffic than malls which had to close and reopen. After indoor malls reopened following the second closure, they are recovering but remain consistently ~20 points below their outdoor counterparts.

This learning complicates the calculus businesses must consider when forced to operate at a reduced capacity. Even though the businesses in outdoor malls could only provide some services (indoor shopping was limited or restricted, for example), remaining open allowed them to build and maintain an audience while their indoor competition was closed — and that advantage was sustained following their competitions’ reopening.

Even with less active customers or restrictions on services, businesses can accrue benefits by remaining open and engaged with their market.

Meeting Audiences Where They Are

Visits are coming back, but they’re different. Social distancing has shocked our shopping habits into a new order, one more dependent on digital services. Ecommerce is rising, but so is the hybrid click-and-collect model. Order online, drive to the store, pop your trunk.

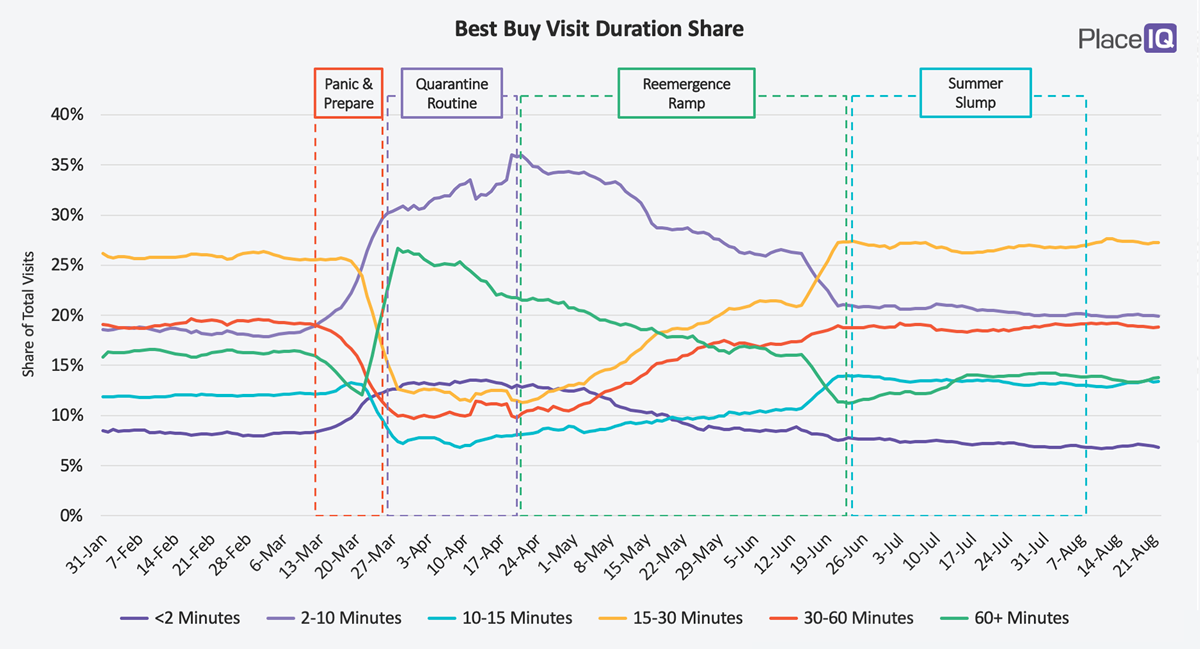

We covered this shift in an earlier issue by analyzing visit durations before, during, and after quarantine. Best Buy provided an excellent example:

Visits less than 10 minutes rose dramatically when click-and-collect was the only game in town, but even when stores opened the make up of visit durations remains different. Take note of the blue and green lines, especially. 10 to 15 minute trips are as likely to occur as 60 minute visits, which was nowhere near the case pre-COVID.

This shift by consumers to spread out trips more equitably among ecommerce, click-and-collect, and in-store shopping is a major change which will significantly affect this holiday season. Marketers will need data to better match customers with their preferred risk profile and shopping preference.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.