In April, we made the argument that fitness could be one of the sectors to bounce back fastest – a bold claim at the time. The idea was that an extended period of being “stuck at home” could actually increase our longing for the gym. But, after months of watching the sector struggle as a whole, we backtracked and left even the strongest players off of our updated expected 2020 winners list.

And it looks like our inability to stand behind our bolder, earlier prediction has caught up to us. Because, indeed, the fitness sector is showing exceptional signs of strength.

Warning: many gym-related puns to come.

Visits Get a Lift

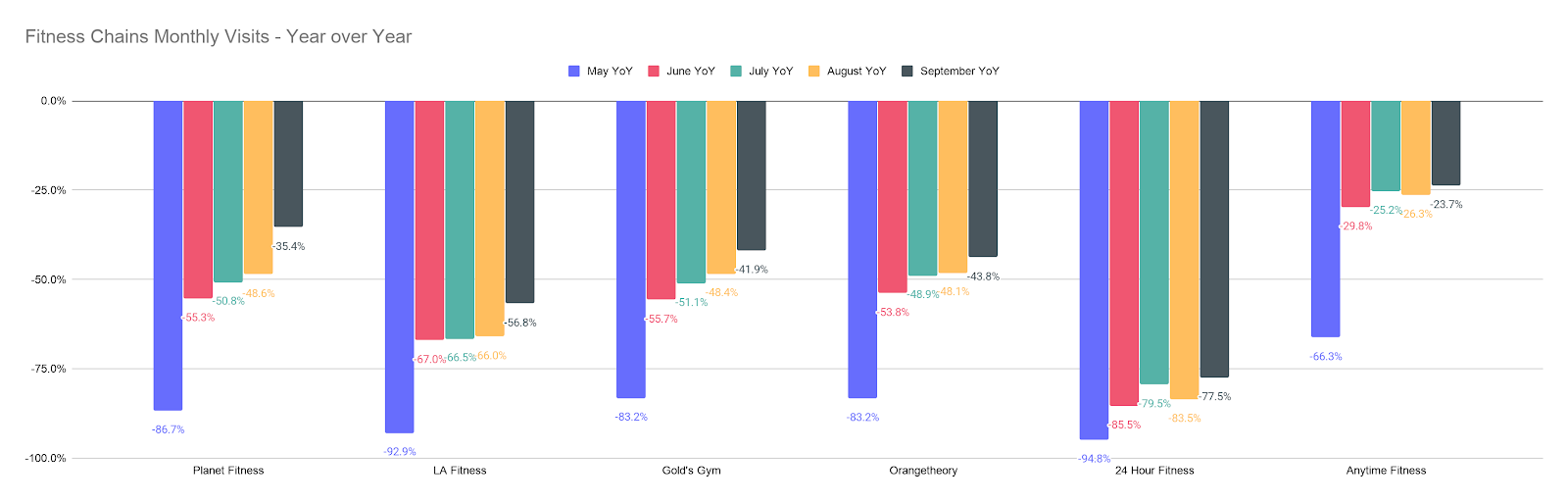

In the early stages of the pandemic and recovery, the weight of COVID was heavy on the fitness space. Five of the strongest national brands saw visits down an average of 84.5% year over year in May. Yet, all of the analyzed brands have been recovering with that same average gap down to just 46.5% in September. Anytime Fitness and Planet Fitness have been leading the way, seeing visits that were down just 23.7% and 35.4% year over year, respectively in September. And, while Anytime Fitness was among the stronger performers throughout the pandemic due to its regional distribution and focus, Planet Fitness saw visits lunge forward from down 48.6% just a month prior in August.

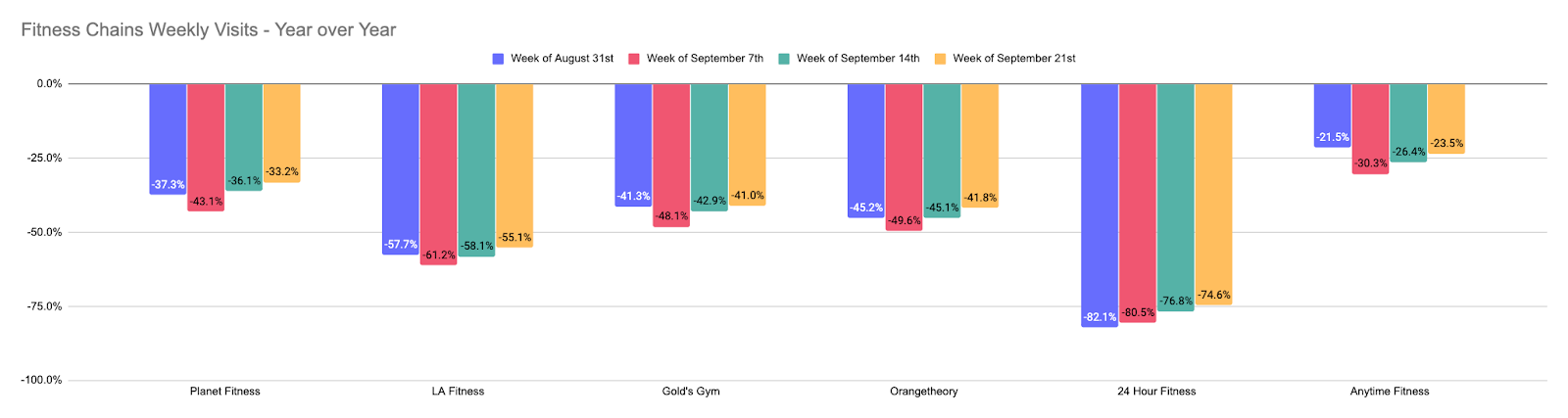

And weekly visits tell a similar story of a sector that is pulling back up to ‘normalcy’. Looking at the weeks beginning August 31st, September 7th, September 14th, and September 21st show visit declines dropping significantly. Planet Fitness saw its average visit decline over those four weeks at just 37.4%, a 10.9% improvement on the visit decline from the four weeks prior. LA Fitness and Gold’s Gym saw impressive improvements of 7.9% and 4.9% on this average decline, respectively, looking at those same periods.

Pressing Regional Perspectives

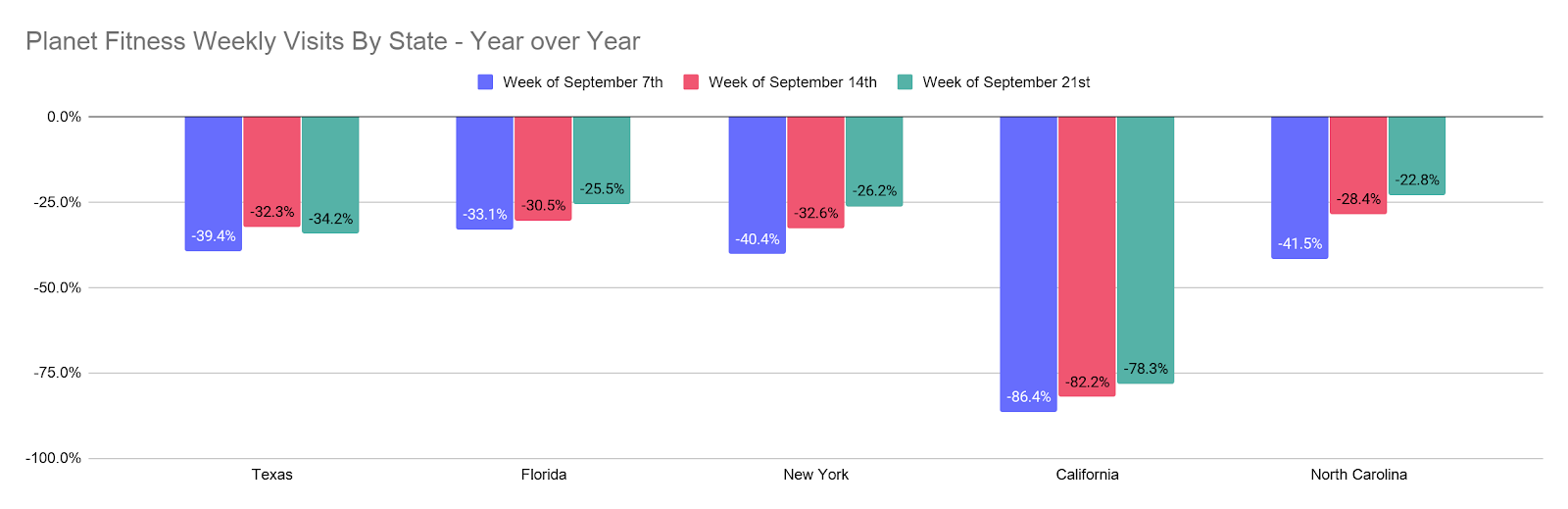

And it does appear that there is still more room for improvement. Planet Fitness, while seeing its strongest performance since the start of the pandemic in September, is still coping with a huge decline in California as a result of case resurgences and state-level regulations. This is something that is having a heavy effect on Planet Fitness and other brands with a large number of locations in the state, but also points to a potentially acute rebound once California comes back online.

Additionally, with brands like 24 Hour Fitness and Gold’s Gym announcing that they’ll be closing over 150 locations combined, there are vacuums that other brands can fill to boost performance in the coming months and years.

Visit Crunch?

Perhaps even more importantly, it does not appear that the caliber of gym visits are changing dramatically. Those willing to go to the gym are going, and in some cases are spending more time on average. Planet Fitness saw a 2.9% increase in visit duration in September 2020 compared to the same month in 2019, while LA Fitness saw just a 1.3% decline and Anytime Fitness saw a huge 8.7% increase. Yet, this is happening as visits per visitor numbers declined 3.0% for Planet Fitness and 9.8% for LA Fitness while rising 4.0% for Anytime Fitness.

What this likely tells us is that the most avid and committed of gym-goers have been those to continue going. However, the return behavior of this core is critical as it suggests that once visitors do return, they return regularly.

Classes on the Comeback

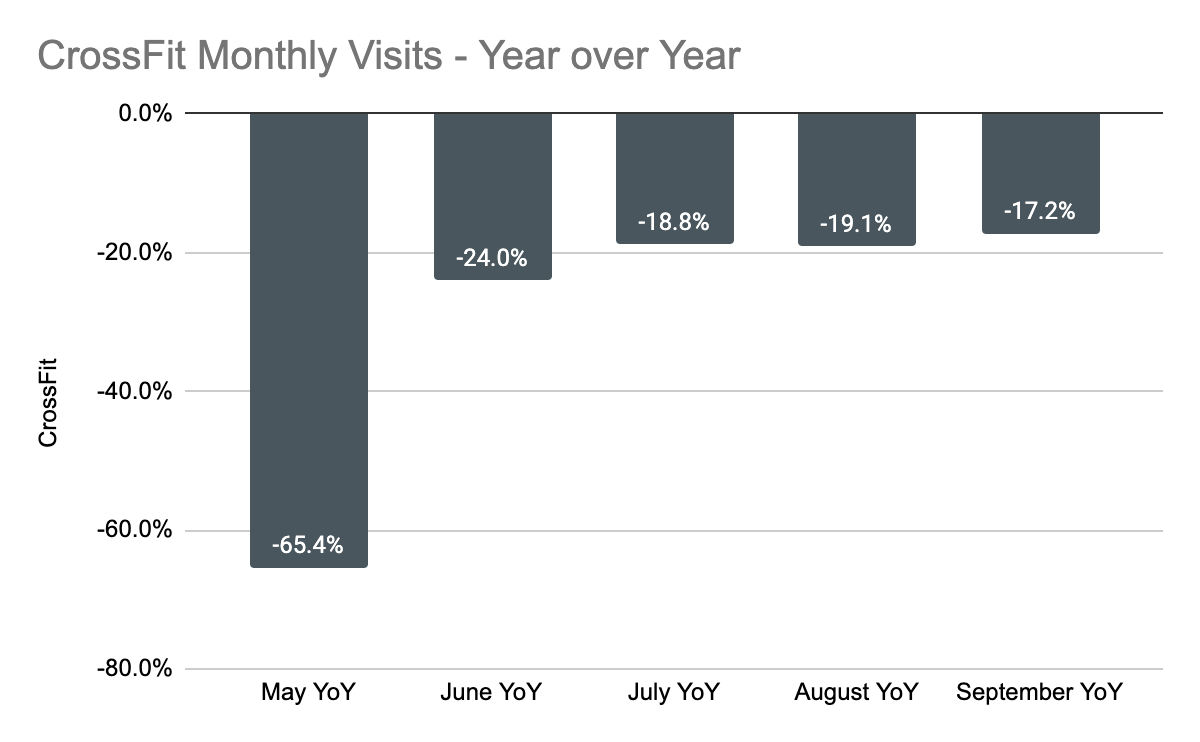

While CrossFit data can be especially difficult to aggregate because of the large number of smaller locations, the numbers we have seen have shown a unique promise for this form of group-oriented classes. The sector has seen a sharp rebound showing the unique commitment of its members and the draw of its locations.

This could be a sign of promise for more group style and personal-relationship oriented formats, something that may be especially true for fitness styles that can utilize outdoor spaces like parking lots.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.