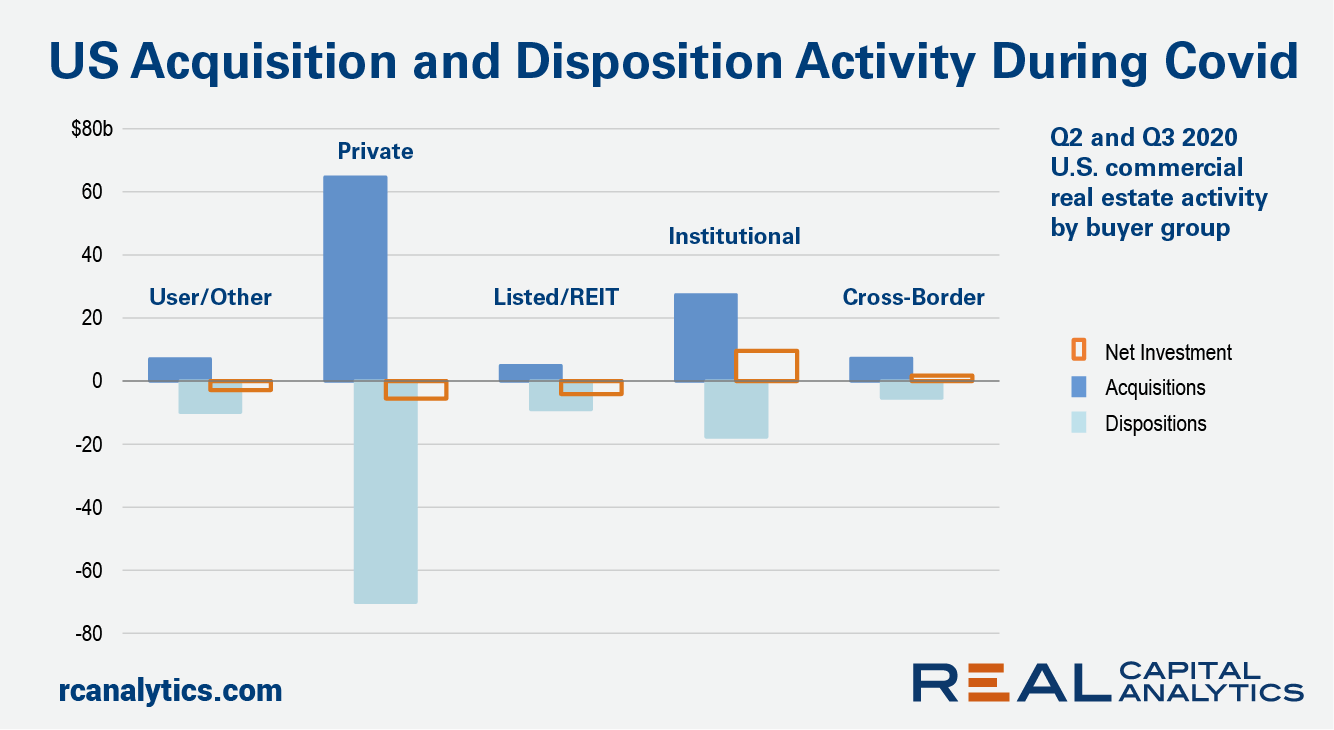

U.S. deal activity has corrected in 2020 following the onset of the Covid-19 crisis. Looking at total acquisitions by all investor types, deal volume for the past two quarters has retreated to levels last seen in 2012.

Institutional investors, however, stand as net buyers of U.S. commercial real estate in the face of the pandemic. Despite uncertainty over the economy and ongoing health crisis, this class of investor has been growing their portfolio exposures to the U.S. market.

In the second and third quarters of 2020, institutional capital sources acquired $9.6 billion more in U.S. commercial property assets than they sold. Even though Covid-19 came onto the scene earlier in March, these are the two quarters when the sting on deal activity was the most intense.

Cross-border investors also expanded their net position in these two, troubling quarters by acquiring $1.8 billion more than they sold. Many of these cross-border investors are also institutional capital sources and are typically composed of pension and sovereign wealth funds and insurance companies. What these cross-border players have in common with U.S. sources is a deep pool of capital that can pause for a while amid the crisis.

Why sell now in the face of uncertainty when the only active buyers will want significant discounts? REITs can be more constrained in their ability to hold assets as NAVs fall with the turbulence in the stock market. Private capital sources and the users of space may encounter more limited access to capital than the institutional investors.

The fact that the institutional investors bought more than they sold over the last two quarters is therefore, in part, a story of not being forced to sell assets yet in a time of uncertainty. Still, there are distressed deals that are starting to impact volume. A Starwood Capital-owned portfolio of malls is slated to be purchased by a joint venture between Pacific Retail Capital Partners and Golden East Investors, at a price likely to be a severe discount from the $1.6 billion paid for the properties in 2013.

Time will tell if the buyers of distressed assets in the current downturn will become major industry names in the next cycle.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.