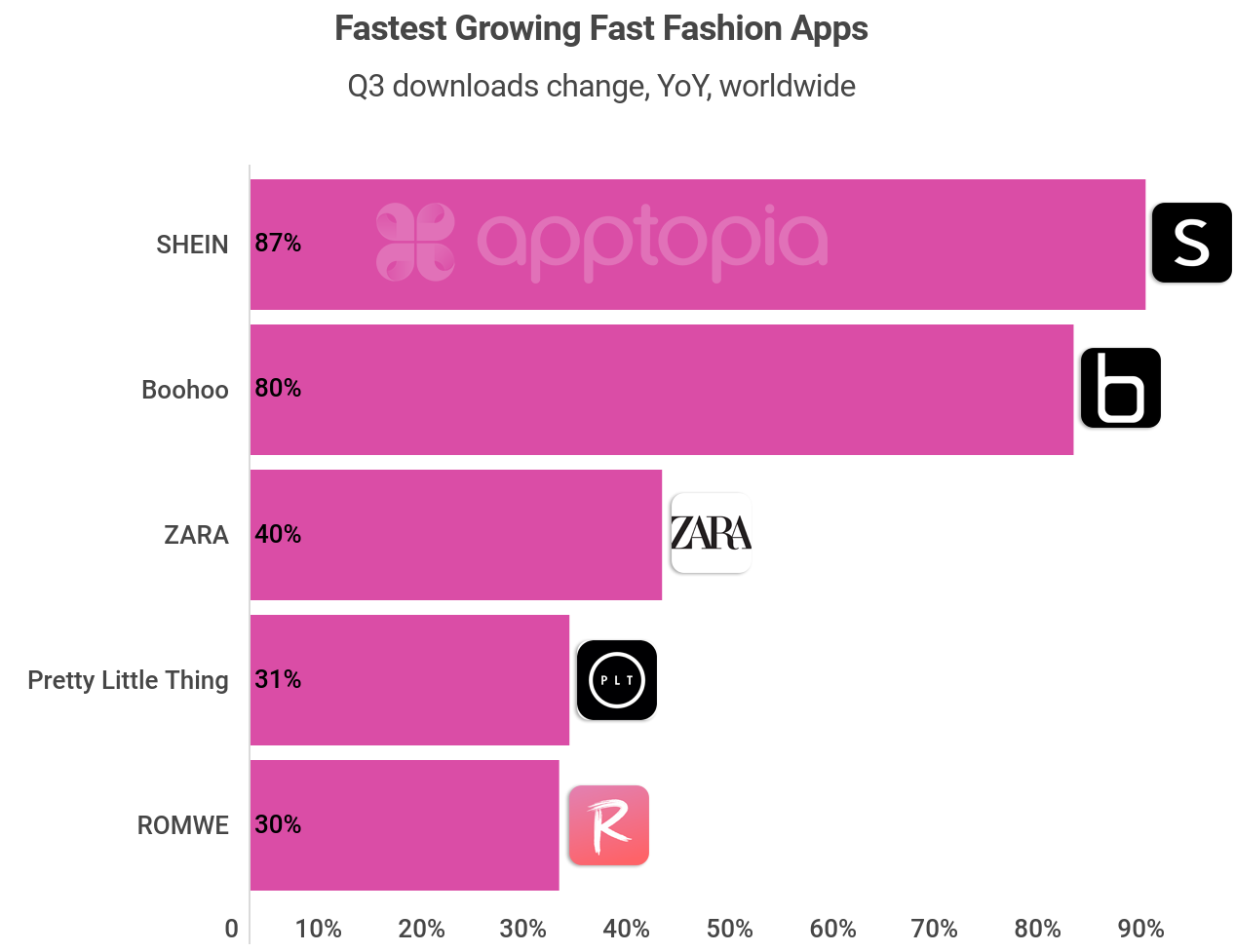

Globally, the top 10 Fast Fashion apps grew Q3 downloads 40% YoY. But what is Fast Fashion? Investopedia defines it as a term used by fashion retailers to describe inexpensive designs that move quickly from the catwalk to stores to meet new trends… it is not uncommon for fast-fashion retailers to introduce new products multiple times in a single week to stay on-trend. I will note that many people are against this industry as a whole for environmental concerns.

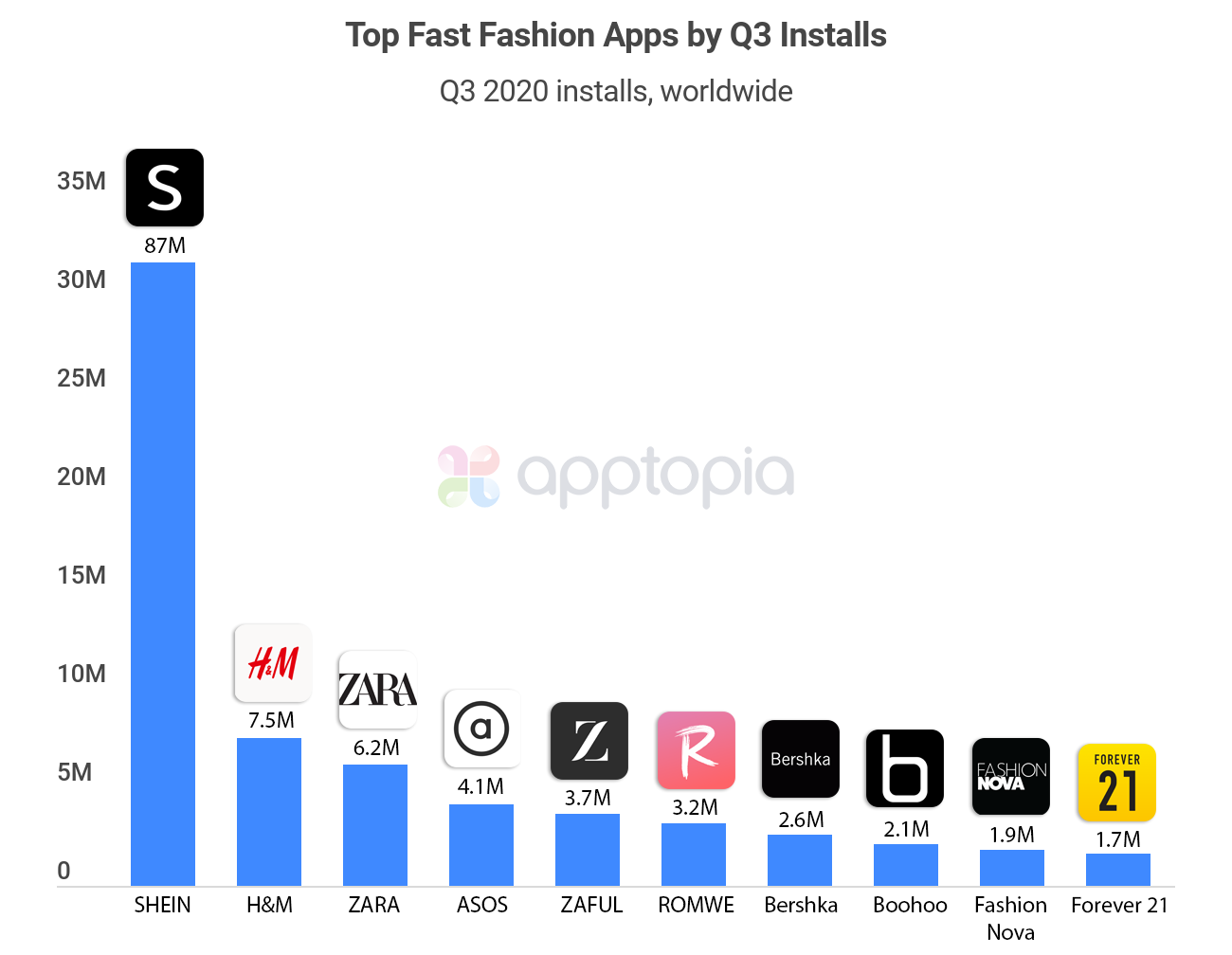

SHEIN was the top downloaded Fast Fashion app of Q3 both globally and in the United States. It was also the fastest growing app in this space year-over-year in the third quarter. The app had 1060% more downloads than the #2 app, H&M.

The top 5 markets for Q3 downloads of the top 10 Fast Fashion apps are the United States, Mexico, the United Kingdom, Russia and France, in that order. Interest in these retailers is truly global as its largest market, the US, only makes up 17% of the quarter’s downloads, while the grouping as a whole makes up 45%.

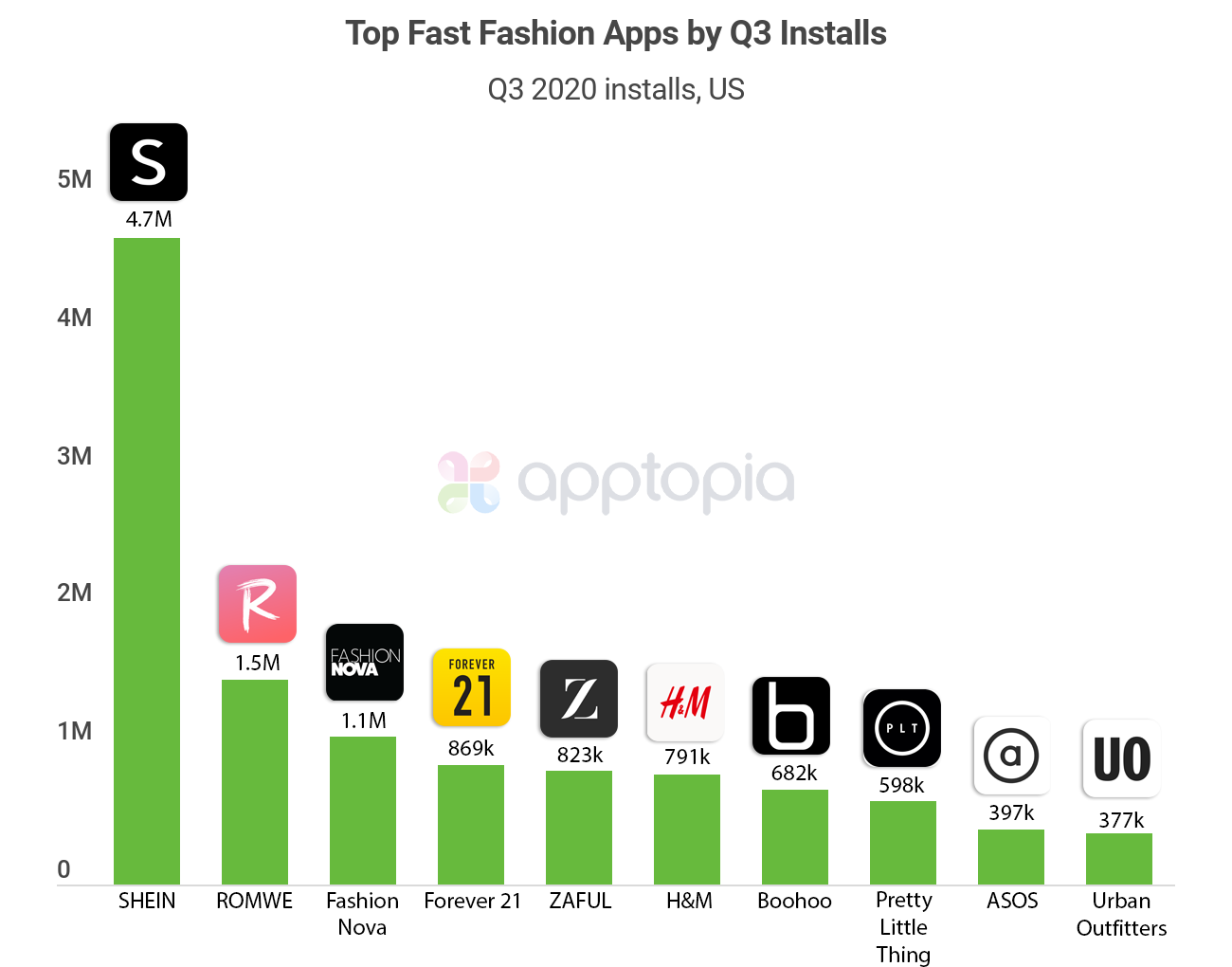

While SHEIN is still the top app in the US, there are some major differences. Pretty Little Thing and Urban Outfitters move onto the list while pushing Zara and Bershka out. ROMWE, Fashion Nova and Forever 21 show up much higher up the US list than the global list.

Unlike some of its competitors, SHEIN does not have any physical storefronts. This gives it lower overhead costs and a more focused marketing effort. It is specifically prominent in social media marketing where the company employs influencers and brand ambassadors on TikTok and Instagram to promote discount codes to Gen Z users. The app launched in May 2014 and has amassed more than 260 million lifetime downloads.

Scratching the surface of a deeper competitor analysis, we can look at an overview chart of user review sentiment vs. volume. Naturally, the SHEIN app has received the most user reviews but ROMWE’s reviews are the most positive, with SHEIN and ASOS not far behind. Of the top eight global Fast Fashion apps, only Boohoo sits behind the 50% mark for review sentiment but Zara and Bershka are close. The dotted outline you see in the above chart is the group’s average or benchmark.

To learn more about the data behind this article and what Apptopia has to offer, please reach out to Connor Emmel at cemmel@apptopia.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.