Prime Day is a pinnacle for online shopping, yet in recent years the offline impact has been significant and growing. Brands like Walmart, Target, and Best Buy have aligned deals to take advantage of the excitement surrounding Prime Day to drive offline and online visits. Even Amazon entities like Whole Foods have gotten into the mix, utilizing the buzz and cross-channel deals to drive interest in stores.

Did the pandemic put a halt to Prime Day’s offline impact? We dove into the data to find out.

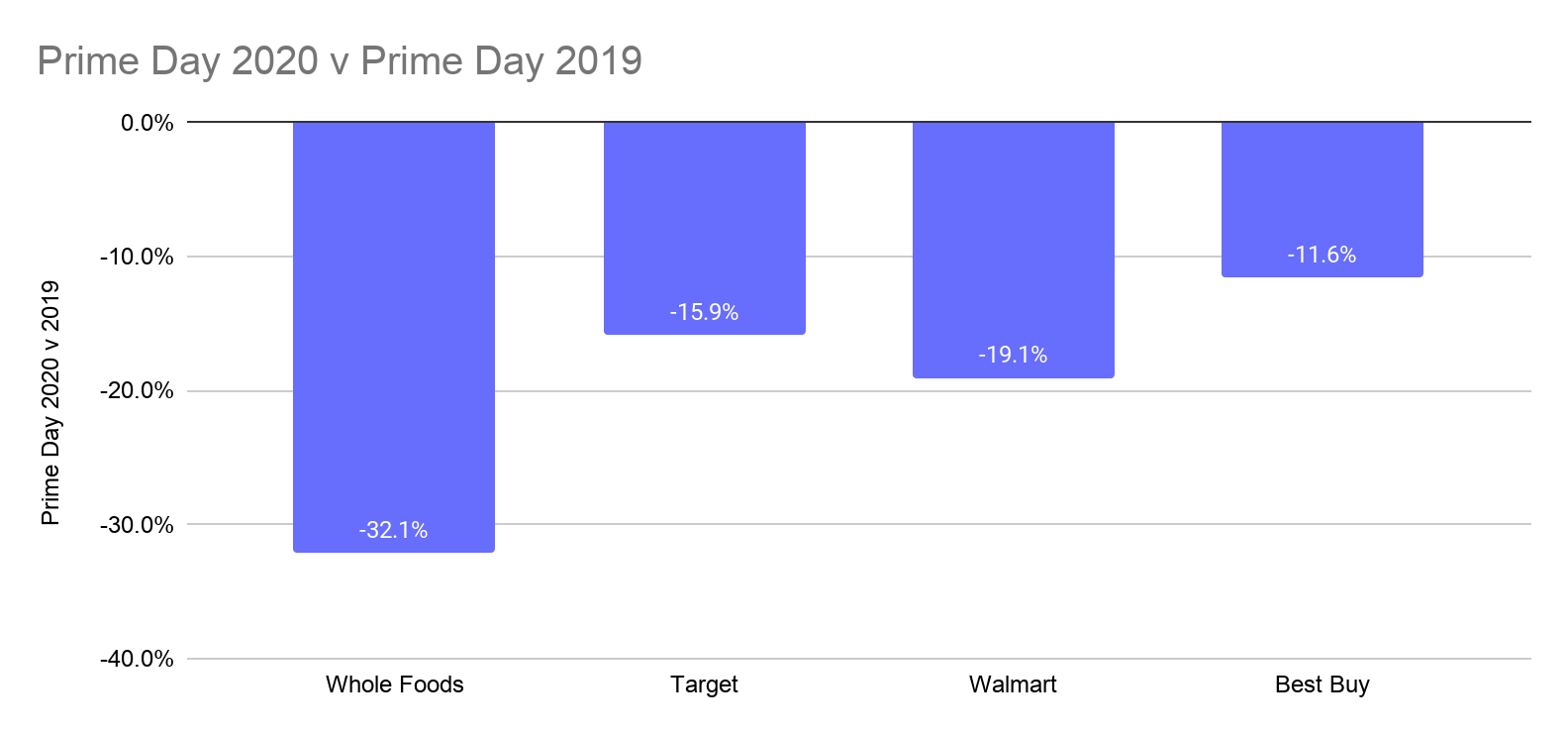

Offline Visits on Prime Day Fall Off From Prime Day 2019

Looking at the days of Prime Day 2020, October 13th and 14th, there was a significant drop when compared to Prime Day 2019, the 15th and 16th of July, 2019. Whole Foods saw visits 32.1% lower, while wider big-box retailers like Target, Walmart, and Best Buy were down 15.9%, 19.1%, and 11.6% respectively compared to those same days in July 2019.

Yet, this was widely expected as brands didn’t have the same time to prepare for an offline Prime Day and had been careful to try to limit their pushes for single-day jumps. The summer of 2019 was a uniquely successful period for brands like Target and Walmart, making the comparison especially challenging – not to mention losing the value of holding this event during a higher-trafficked summer holiday period instead of early October.

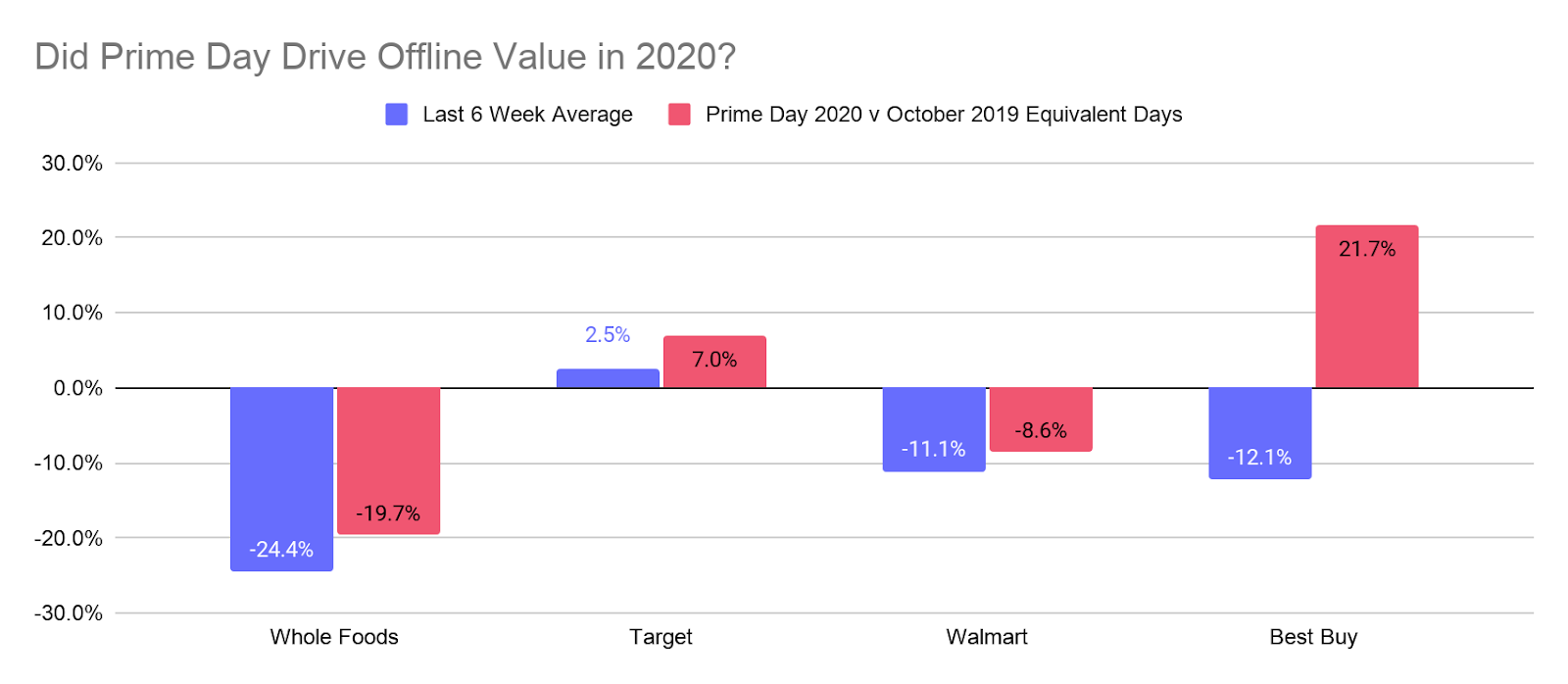

Still Seeing Significant Value

These obstacles made the offline successes all the more impressive, with all four brands seeing the two days of Prime Day drive visits at better rates than the average of the six weeks that preceded Prime Day. Target saw visits those days that were up 7.0% year over year for the equivalent days in October and far above the average visit rates of the last six weeks when visits were up an average of 2.5%. Best Buy saw an even more massive surge with visits up 21.7% on the equivalent days in October 2019. This was a massive jump on average visits numbers that were down 12.1% compared to the same periods in 2019. Even Whole Foods saw a stronger performance during those days than it had seen over the last six weeks – a strong indication that Prime Day’s offline power is alive and well.

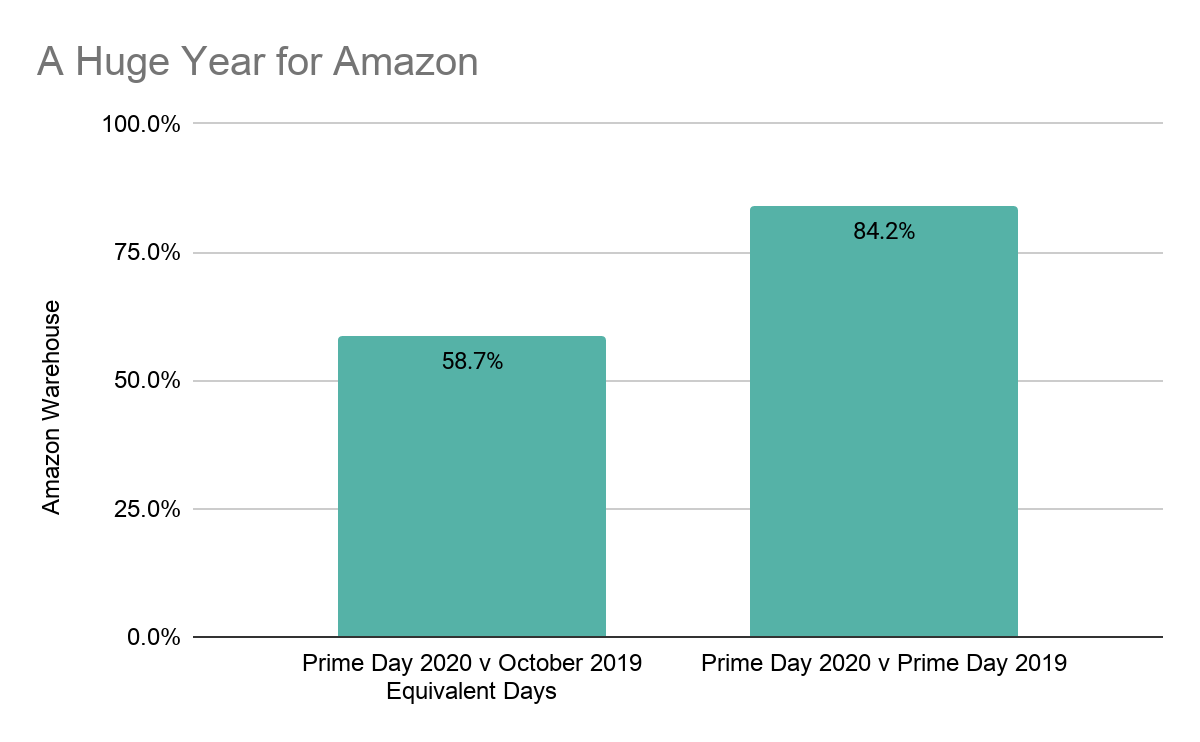

Amazon’s Giant Season

But the biggest Prime Day winner in 2020 was Amazon. Looking at visits to Amazon warehouses – a powerful indication of their online demand – shows huge growth even when compared to Prime Day 2019. Visits saw increases when compared to both Prime Day 2019 and the equivalent days in 2020, a sign that Amazon was very prepared to handle the increased demand and focused on maximizing the surges in interest.

Is Amazon still the king of Prime Day? Of course. But offline retailers showed that even when online pushes are providing the boost in urgency and excitement, physical retail can still benefit. Ahead of a critical holiday season, this is a huge testament to the ongoing power of offline retail as a critical component of the overall retail picture.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.