As the holidays approach, consumers and brands alike are filled with uncertainty. What does a Halloween celebration look like in a world of masks and social distancing?

With the holiday just a week away, we take a look at how consumers are approaching Halloween and how ad spend has changed this year.

Halloween Spending Adjusts for Safety in 2020

This year, safety recommendations will impact—but not get rid of—Halloween activities. The Halloween & Costume Association and Harvard Global Health Institute put together a map of national COVID risk levels and halloween activity ideas—from trick or treating guidelines in green zones to ‘Halloween Piñatas’ for families living in red zones.

Though many people will dress up at home, dress up their pet, and decorate their house, research from the National Retail Federation (NRF) found that less people will go to a party, hand out candy, and visit haunted houses.

Overall halloween spending is down, but participating individuals are making this year more special by layering on the home decorations, buying more candy, and sending out greeting cards. Despite safety guidelines and untraditional activities, participating individuals will spend about $6 more on average than last year.

Consumers won’t ghost Halloween—they’ll celebrate bigger at home

Halloween retailers confirm the NRF’s study and add context.

“In some ways, the holidays are even more important to people during the coronavirus,” says Evan Mendelsohn, CEO of Tipsy Elves. The holiday-apparel brand has seen a 30% increase since September. People are “making sure that the holidays remain special and that means continuing to purchase products that allow them to make those events extra memorable.”

Large retailer Party City also predicted that sales will be higher this year, with higher sales of home decorations.

Since many retailers use Halloween sales as an early indicator of other sales during the holiday season, these continued celebrations may serve as reassurance that Thanksgiving and Christmas celebrations will continue, regardless of the state of the pandemic.

MediaRadar Insights

While the outlook is still fairly positive for retailers, consumer spending is not reflective in the advertising numbers.

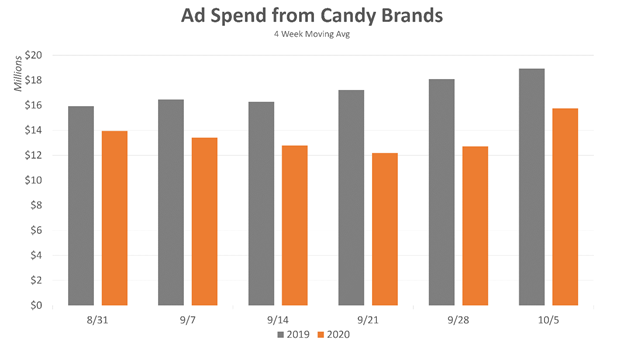

For example, candy ad spending decreased by about 14% overall compared to 2019, but recently the category began to show improvement. Since September, they’re only down by 8%.

However, spending cuts aren’t even across halloween sub-categories. Costume and arts and crafts retailers cut their spending more drastically, for example. Spending decreased $5 million during the same six week period— a 51% drop overall.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.