In this Placer Bytes we dive into the Yum! Brands’s portfolio and fast-food giant, Wendys.

Yum! Brands Portfolio

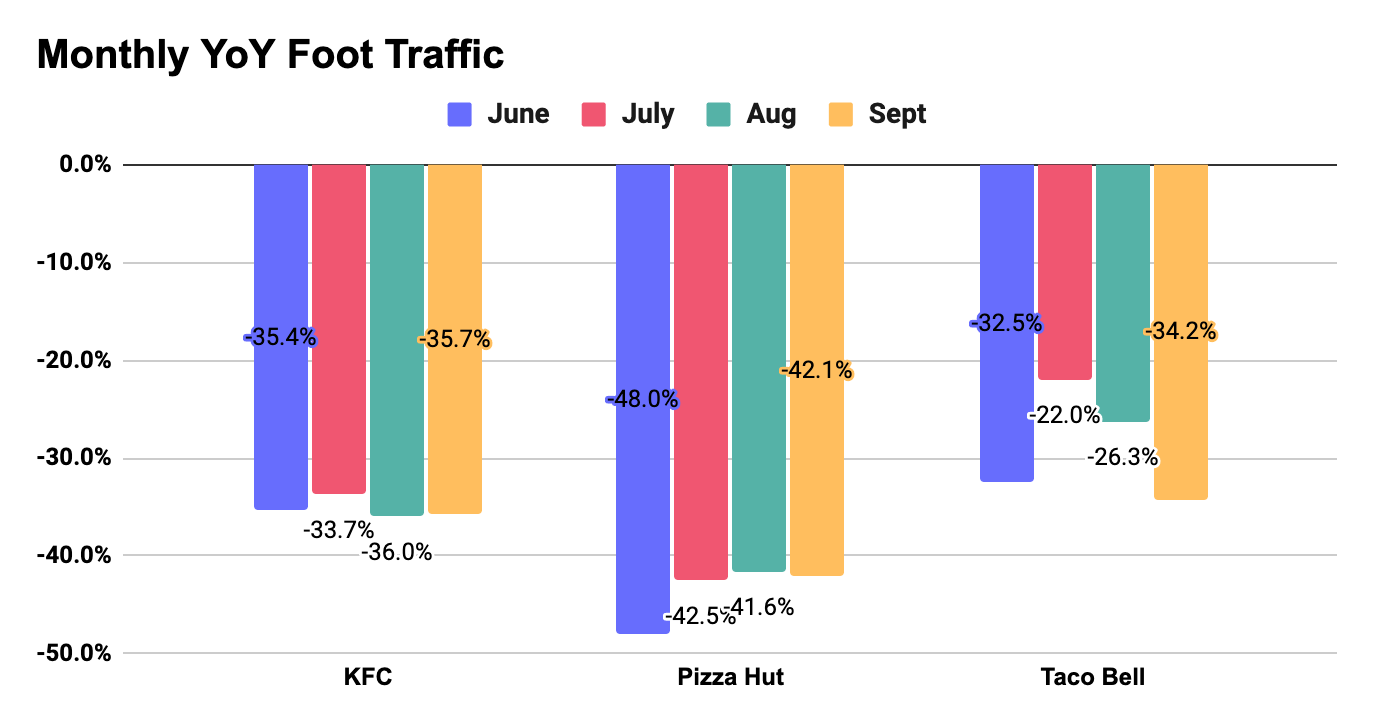

Yum! Brands’s portfolio consists of fast-food players such as KFC, Pizza Hut, Taco Bell and the recently acquired Habit Grill. And, when looking at the first three, there were reasons to be optimistic at the beginning of 2020. Traffic for both KFC and Taco Bell was above 2019 levels for January and February. And, while visits to Pizza Hut locations were down 1.3% in January, they peaked right above 2019 numbers the following month.

But, year-over-year monthly visits for each brand have been relatively stagnant since June. After a slight bump in traffic back to pre-COVID levels from June to July for all three brands, visits have remained consistently down from July to August. Most significantly with Pizza Hut showing a year-over-year decrease of 42.1% for September. This places an added emphasis on their digital efforts, which drove significant year over year gains in Q2.

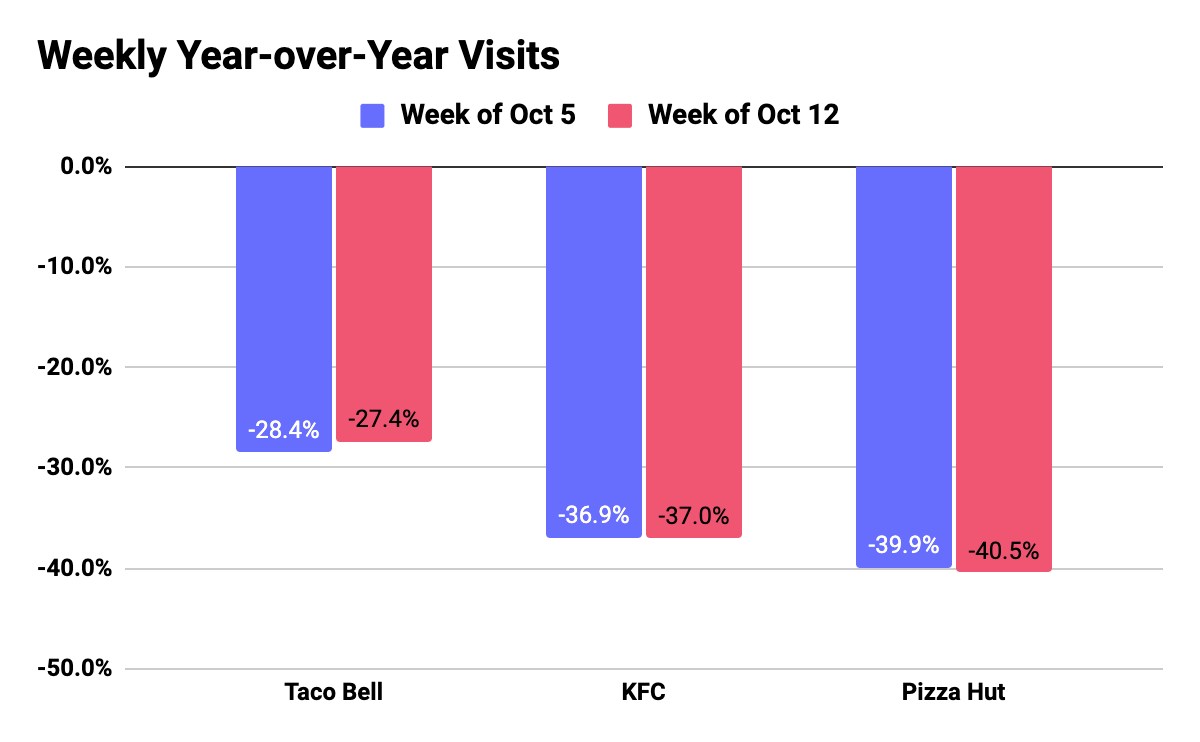

But driving in-store visits is as important as even with online surges, key profit metrics were still down. And, unfortunately weekly data for the first two weeks of October isn’t showing any signs of a sudden turnaround. Only Taco Bell has managed to inch a bit closer to pre-COVID levels for the week of October 12th with visits 27.4% below, while KFC and Pizza Hut continue to hover in a similar situation with visits down 37.0% and 40.5% year over year – with the impact slightly less critical for the latter as delivery is the key to that business.

Wendy’s Woes

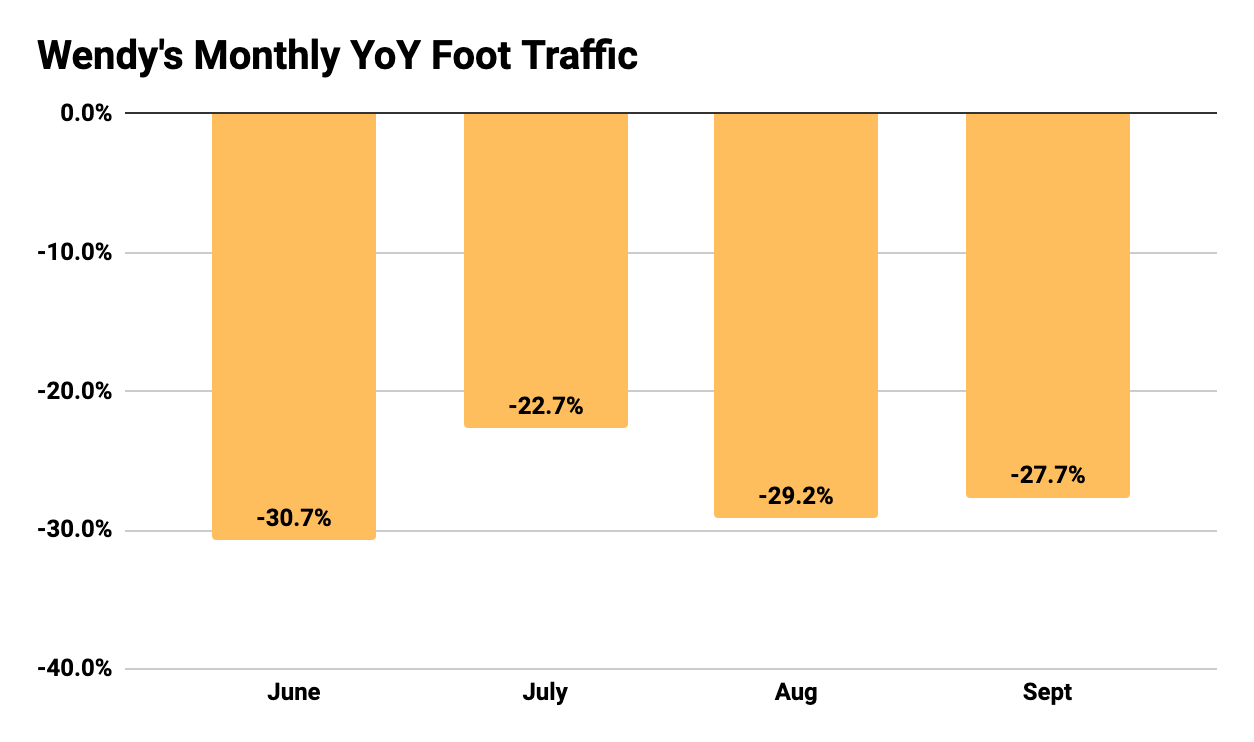

Similar to the above brands, Wendy’s has also seen a recent stall in its recovery. After nearing pre-COVID levels in July with visits down just 22.7%, traffic, the recovery pace flattened. Traffic for both August and September fell farther away from 2019 levels with visits down 29.2% and 27.7% year over year, respectively. But things were seeing a slight uptick with visits the weeks of October 5th and 12th down 26.2% and 26.8% year over year. And Wendy’s offline circumstances are still significantly better than many others in the sector with a gap of under 30% marking a high point many brands wish they could reach.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.