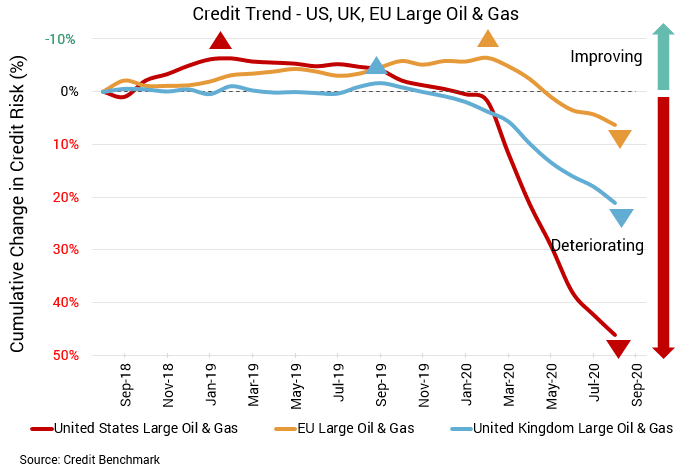

Challenges in the energy sector are numerous and persistent. These challenges are perhaps most evident in the US energy sector, where strained prices and weakened demand have accompanied months of reduced travelling for professional and personal reasons. Bankruptcies are increasing. Some firms are doing better than others, yet few are in great shape. The near-term outlook remains weak as a resurgence of COVID cases threatens the recovery. A similar scenario is playing out in the UK and EU sectors.

Default Risk Remains Far Higher for US Energy Sector

US Oil & Gas

The US energy sector continues to see large deterioration in credit quality and increases in credit risk. Credit quality for large US oil & gas firms is down roughly 3% from one month prior, about 42% from six months prior, and about 49% from the same point last year. Average probability of default is now about 59 bps, significantly higher than that of the UK or EU. That compares to about 58 bps from one month prior, about 41 bps six months prior, and about 39 bps at the same point last year. Approximately 83% of firms have CBC rating of bbb or lower. The aggregate’s average CBC rating is bb+.

UK Oil & Gas

The UK energy sector is also seeing its credit quality weaken, but with less severe changes. For large UK oil & gas firms, credit quality has deteriorated roughly 3% from one month prior, about 17% from six months prior, and about 22% from the same point last year. Average probability of default is now about 40 bps, compared to about 39 bps one month prior, about 35 bps six months prior, and about 33 bps at the same point last year. Approximately 70% of firms have CBC rating of bbb or lower. The aggregate’s average CBC rating is bbb-.

EU Oil & Gas

Like the US and UK energy sectors, the EU energy sector is experiencing credit deterioration, but with less dramatic changes. Credit quality is down roughly 2% from one month prior, about 13% from six months prior, and about 10% from the same point last year, as credit quality improved in the first part of the 12-month period before declining again. At about 28 bps this month and last month, this aggregate’s credit risk remains far lower than that of the US or UK. It was about 25 bps six months prior and about 26 bps at the same point last year. Approximately 66% of firms have CBC rating of bbb or lower. The aggregate’s average CBC rating is bbb.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.