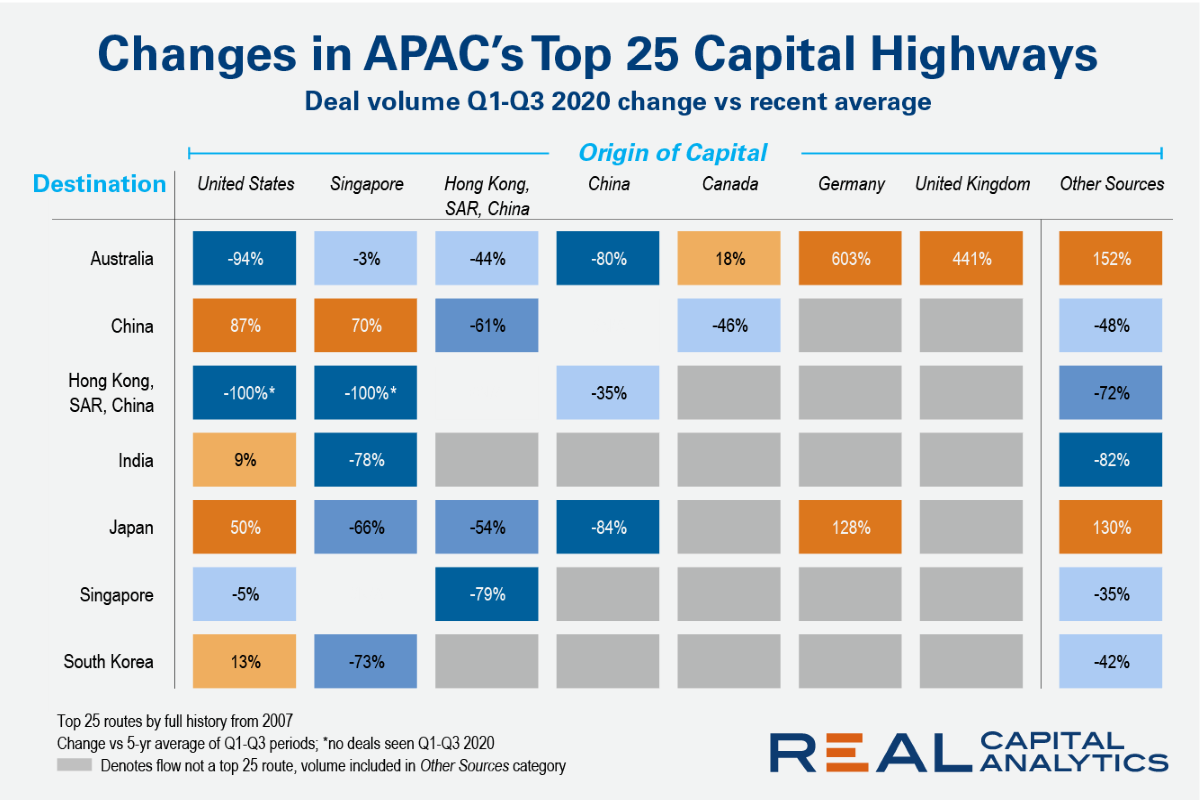

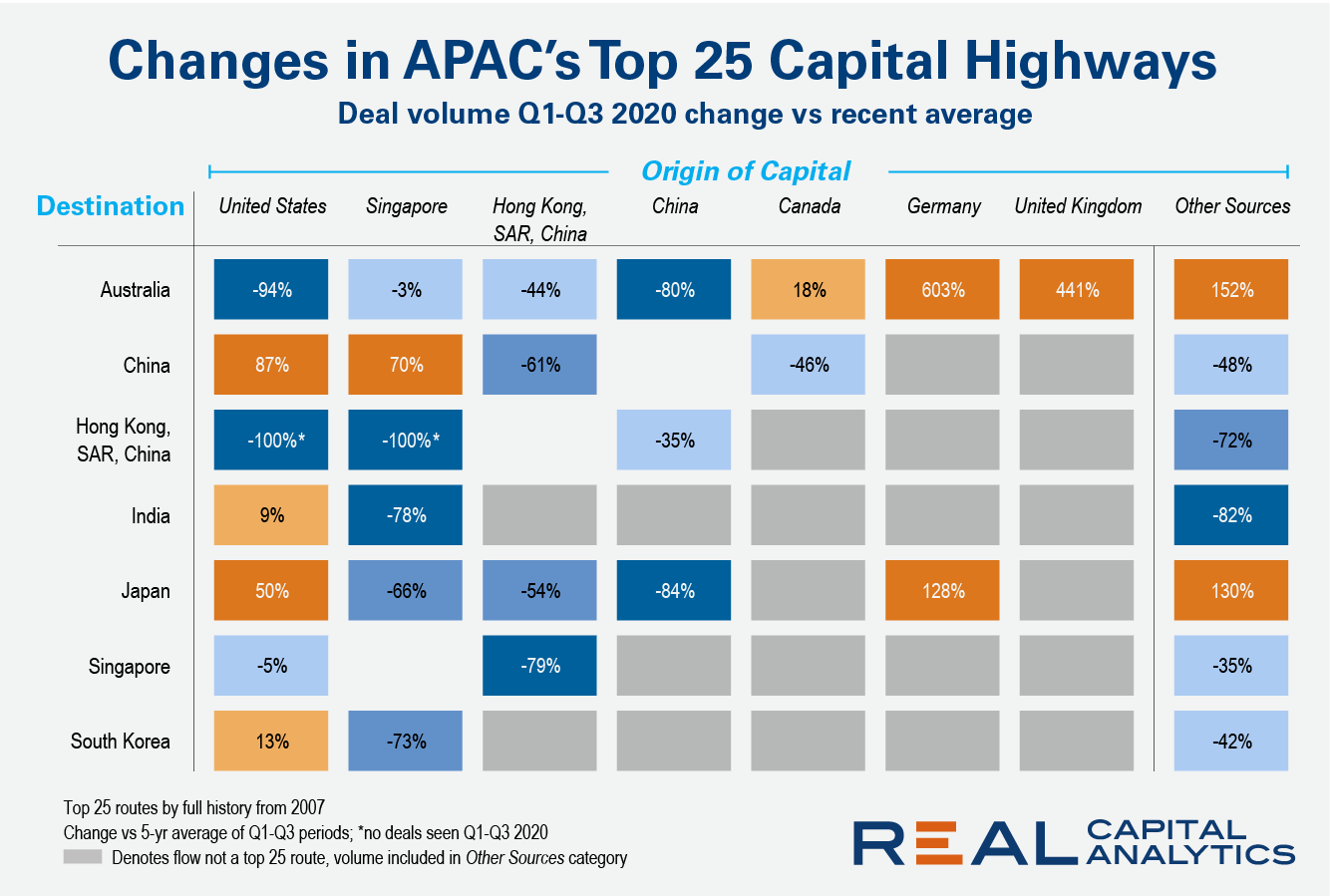

In the below chart we present the 25 biggest trade routes in Asia Pacific and illustrate how cross-border investment has behaved during this pandemic year. Novel capital flows, such as Austrian investors spending in China and Saudi players investing in Singapore, may be interesting from an anecdotal perspective, but market liquidity is ultimately driven by the most well traveled capital highways.

The Singapore-to-China capital flow, for instance, is third biggest in the region over time. The likes of GIC, Mapletree, and CapitaLand have all built up extensive teams on the ground, and this has kept deals flowing despite the breakdown in global business travel.

Hong Kong’s recent pickup in inflows was primarily due to a moderate increase from mainland China, but overall volume remains below average. Flows from Singapore and the U.S., both significant capital sources for Hong Kong in the past, evaporated in 2020 so far.

A big surprise in 2020 has been the absence of U.S. capital into Australia. This flow, which was the fifth largest trade route historically, showed a 94% year-over-year decline. European investors stepped up in Australia this year. While the U.K.’s triple-digit growth comes from a single large deal, German investment derives from a wider, more diversified investment base.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.