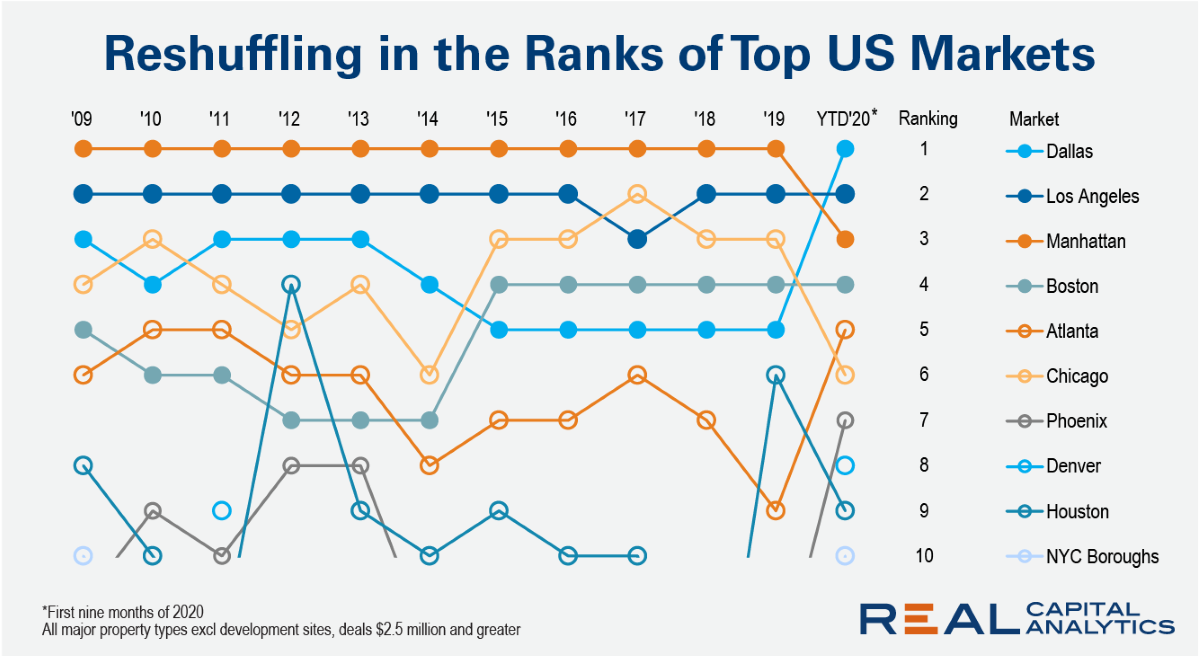

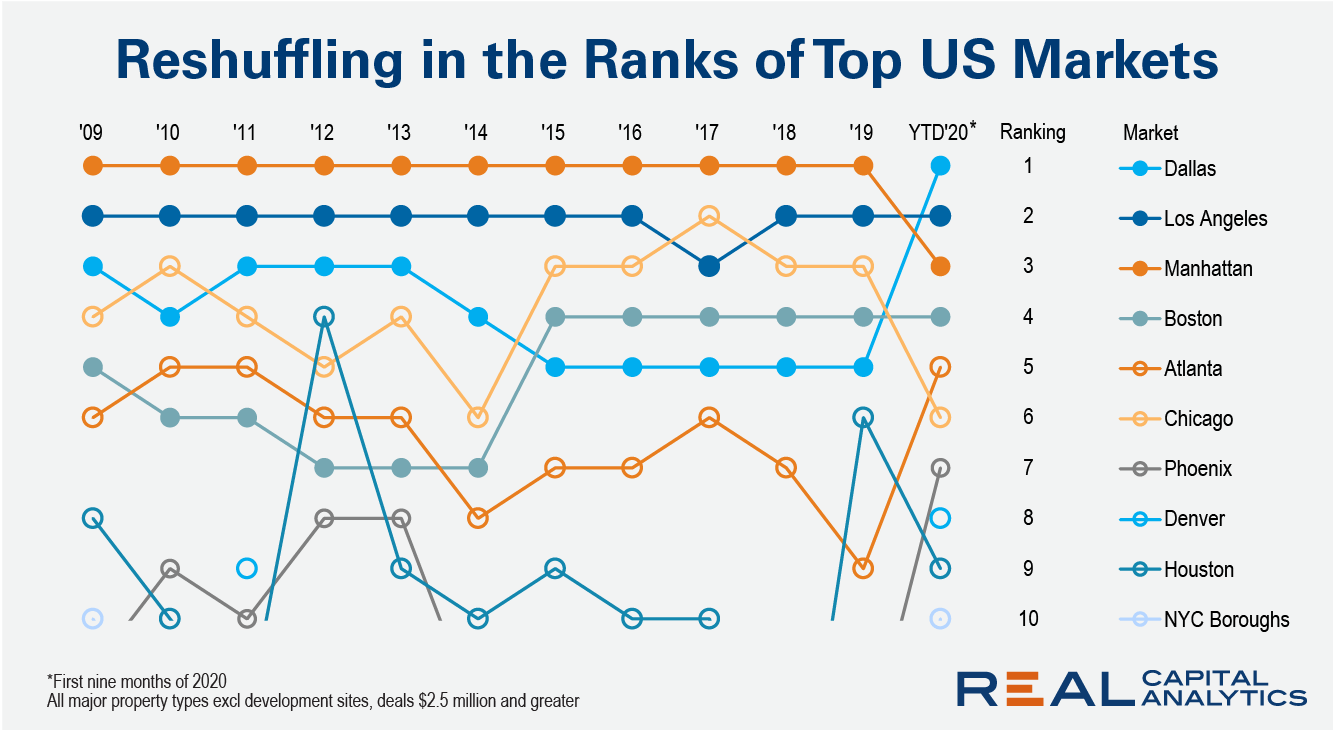

Dallas sits atop U.S. leader board for commercial property deal volume in the first nine months of 2020. Normally Manhattan would occupy the #1 position. Los Angeles has sometimes taken the top spot for shorter periods during times of market disruption in Manhattan, but Dallas has never topped the rankings for an extended period until 2020.

Granted, deal activity for the year to date across all the top U.S. markets has fallen amidst the Covid-19 tumult. Dallas simply fell less than the other heavyweight markets.

Manhattan’s drop in the rankings is the story of a one-two punch of apartment market turmoil, then the freezing of the hotel market. Manhattan had slipped to the #8 position for apartment sales in 2019 after new rent control regulations took away a portion of investor interest. Then, in 2020, came the collapse of the hotel market which was already under pressure because of disruptive new competition and oversupply.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.