COVID-19 forced people around the world to pack up offices, schools, and stores this year, sending people to stay home. At home, people were glued to their digital devices for work, studies, and entertainment. This led to a rise in content streaming—on over-the-top (OTT) platforms and websites.

Even though attention went to both OTT and digital publishers, advertisers largely targeted audiences using one medium over the other, with little overlap in between.

Connected TV (CTV) is Winning Through the Pandemic

Though advertisers are dedicating large sums of money to upfront ad space, CTV is pulling ad dollars from linear TV and traditional digital partners.

Ad executives report that ad buyers dedicated anywhere from 25% to 30% of their upfront ad budgets on streaming. However, this doesn’t mean that this ad money is going to untraditional publishers. For example, many advertisers who previously advertised on Disney or NBCUniversal moved their dollars from traditional TV to the networks’ streaming equivalent.

Streaming-only companies like Amazon, Roku, and YouTube are doing well too. “CTV is all growing. So it’s not one at the expense of another,” explained one agency executive to Digiday.

Video is effective for brands this year, not just because some industry leaders are calling 2020 “The Year of Streaming.” Consumers pay more attention to video than written and audio content.

“There is a clear indication that people tend to skim most written and audio content. If you want someone’s full attention, video is a great bet,” explains Mimi An at Hubspot. This was true before COVID-19, and it rings even more true today.

As a result, dollars are shifting away from other mediums, like online display and print to video. The question is: how much is dedicated to ad space on OTT platforms vs digital (i.e. the networks’ website). And is there any overlap between the two?

MediaRadar Insights

Looking at OTT advertisers from February through August 2020, we analyzed trends month-over-month (MoM), examining ad buying habits of advertisers who purchased OTT ads from major networks and their digital equivalents (i.e. ESPN+ and espn.com).

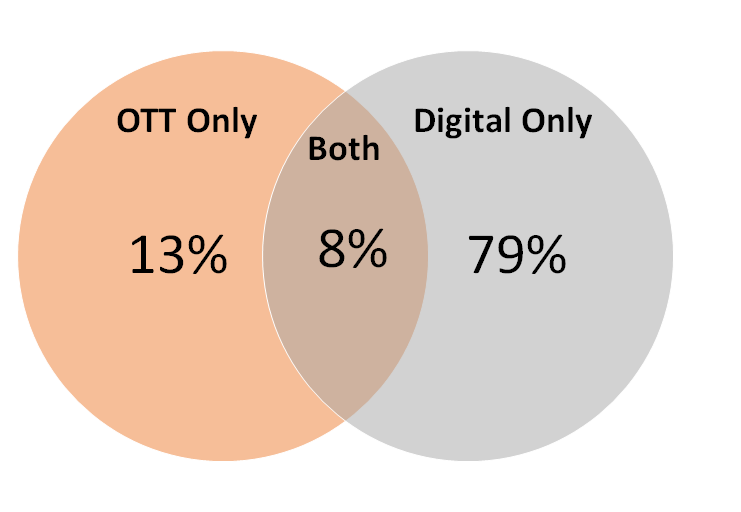

Overall, advertisers still invest heavily using network online publications—like Bravo, ESPN, FOX, and TBS TV. There is a slight overlap between advertisers who use the networks’ digital version and OTT version. Only 8% of digital advertisers use the same content between OTT and the digital space.

However, most stick with one or the other. It seems the industry sees OTT as more of an extension of TV, rather than a completely new digital offering.

Note: Typically, these publishers have the same content on their websites as they do on their OTT platform. ESPN differs in this regard: content on ESPN+ varies from espn.com.

In the overlap between advertisers in the digital and OTT spaces, 38% of these advertisers also advertise using other digital formats. And when they do, OTT is less than a quarter of the total spend (22%). Though OTT is hugely popular among consumers, it’s still a very nascent opportunity for advertisers.

Up to this point in this year, we have seen nearly 1,900 advertisers on OTT and who were not advertising on digital.

Media brands spend the most on OTT—making up 22% of the spend from companies that spend on OTT but not digital. Brands that fall within ‘media’ include video games, TV programming, streaming services, and books.

Food and Beauty brands also make up a significant chunk of OTT advertising dollars.

Key Takeaways

OTT is a very new market and not saturated with advertisers—even though consumers have been streaming excessively this year. As publishers navegate how to monetize this new format, there is abundant room for growth.

Companies who have chosen to advertise using OTT do so in a very specific way and are increasing their presence monthly. Likewise, we see new companies buying ad space every month. This is very much the beginning of what OTT is evolving into.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.