When we last checked in on the hotel industry in August, things seemed to be going smoothly. But, with a resurgence of cases across the entire world, we decided to dive back into three of the largest chains to see if and how they’ve been affected.

Monthly Recovery

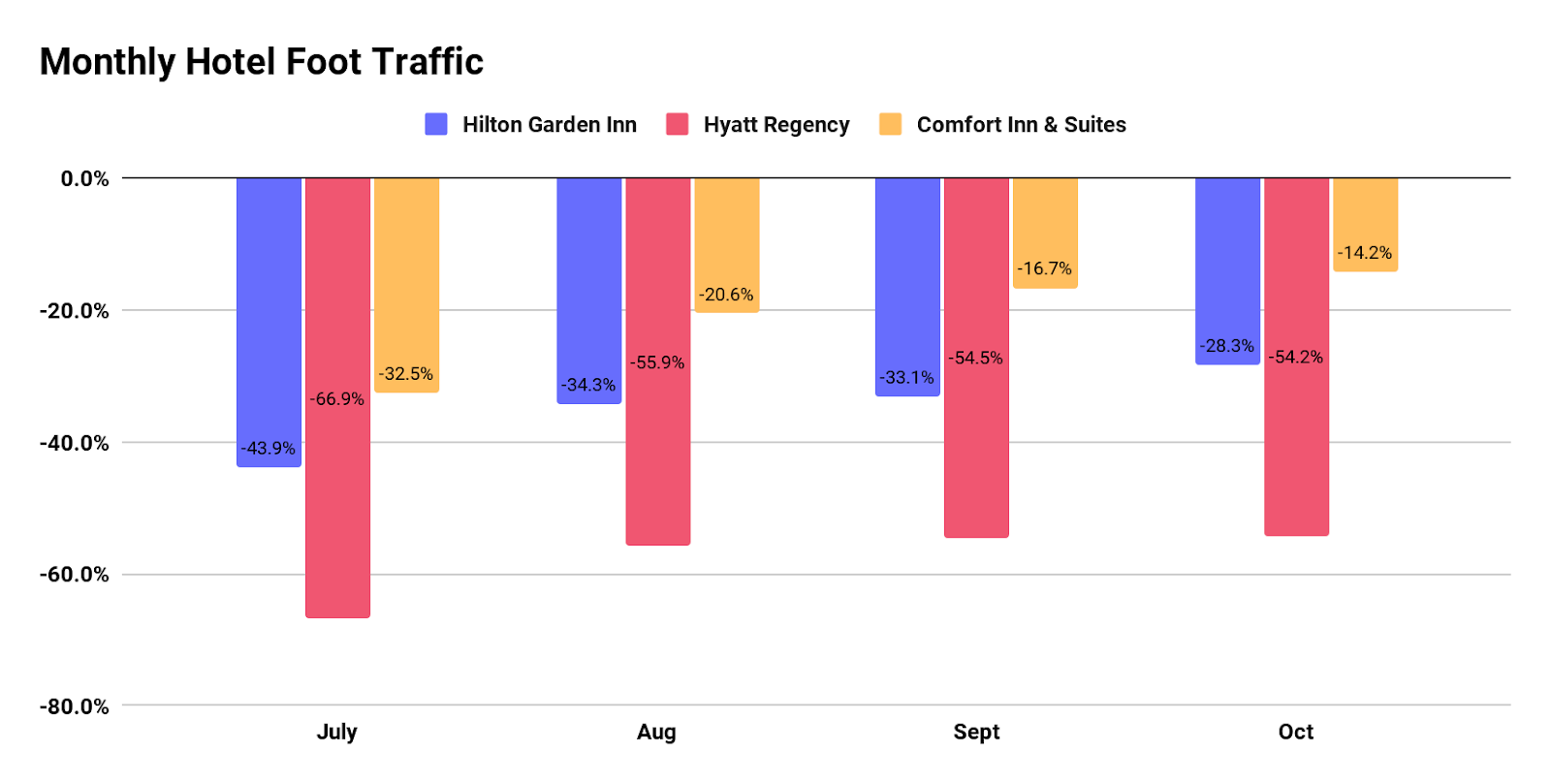

When looking at monthly foot traffic, we see each hotel chain moving closer to 2019 levels. In July, nationwide visits for Hyatt Regency locations were 66.9% down, but jumped 10.0% closer to pre-COVID levels with traffic down 55.9% in August. And, the positive trend only continued into the fall. Although not a significant increase from the previous month, September garnered visits that were slightly closer to ‘normalcy’ at 54.5% down and October visits were a slight step closer at 54.2% down.

While traffic is bouncing back to normal, the Hyatt Regency is lagging behind the other chains, and it’s likely due to the more expensive rate and geographic locations. A lot of these hotels are situated in larger cities, where coronavirus has had a greater effect. Additionally in the current economic climate, many Americans unfortunately can no longer afford the luxury and are opting for cheaper, more cost-effective options when searching for a place to stay.

And, while we see similar traffic patterns for the Hilton Garden Inn, the declines are not nearly as severe. In fact, traffic was down just 28.3% in October, the closest it’s been to pre-COVID levels since before the virus took hold in the states. Also, unlike the Hyatt Regency, the Hilton Garden Inn isn’t known for its high-price, likely giving it an upper-hand in the short term recovery.

Weekly Pace Falls Off

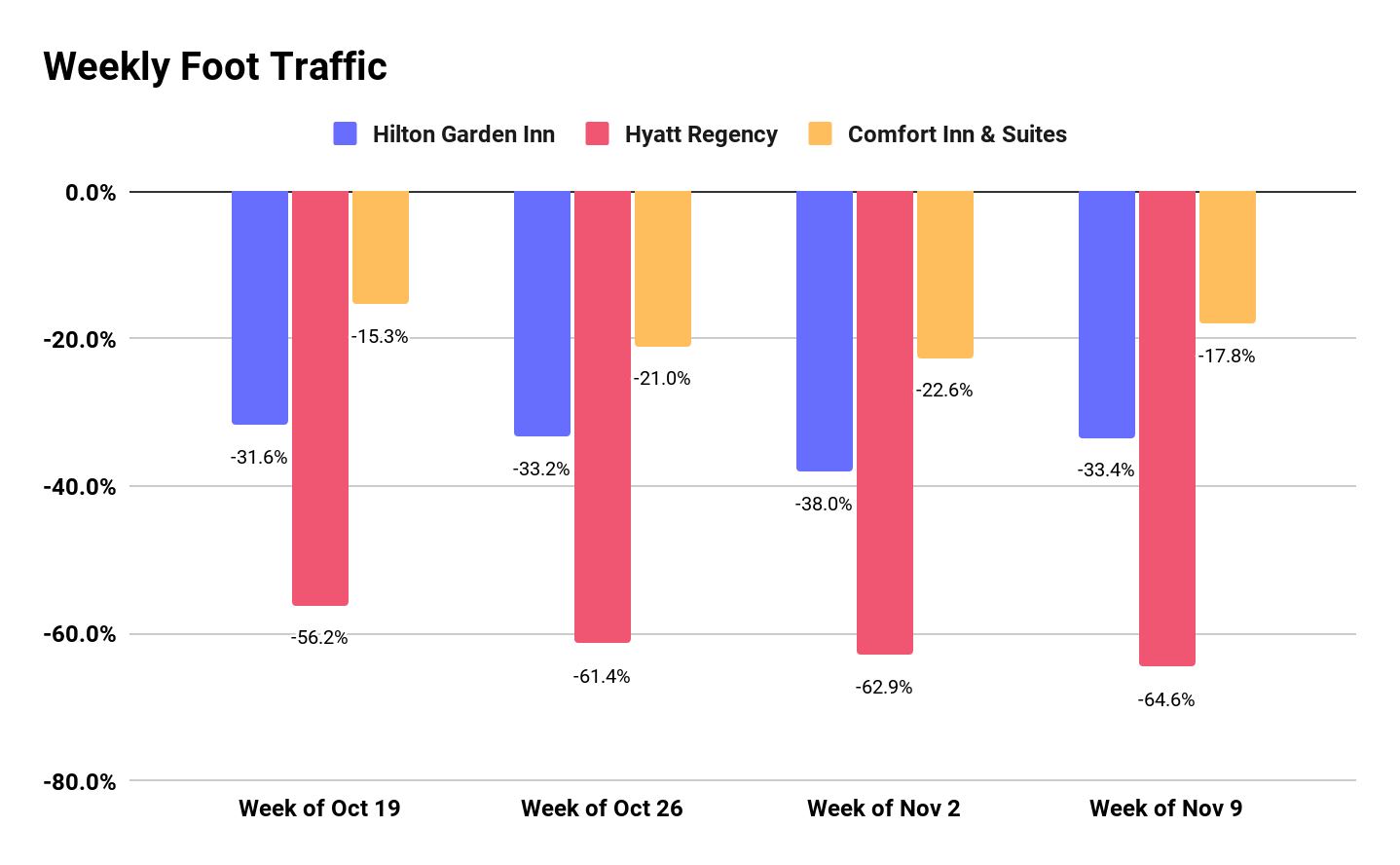

While monthly data shows year-over-year traffic increases for each chain, we do see the Hyatt Regency falling off pace, farther away from ‘normalcy,’ while Hilton Garden and Comfort Inn locations are maintaining positive traffic patterns. The week of October 19th generated visits that were 56.2% down for Hyatt Regency, a far cry from 2019 numbers. But, more concerning is that the pace has continued to fall off each week following. Most recently, visits were down 64.6% down for the week of November 9th.

Comfort Inn and Hilton Garden Inn locations also saw slight drops in traffic toward the end of October, but both rebounded back the week of November 9th.

Quicker Recovery for Comfort Inn

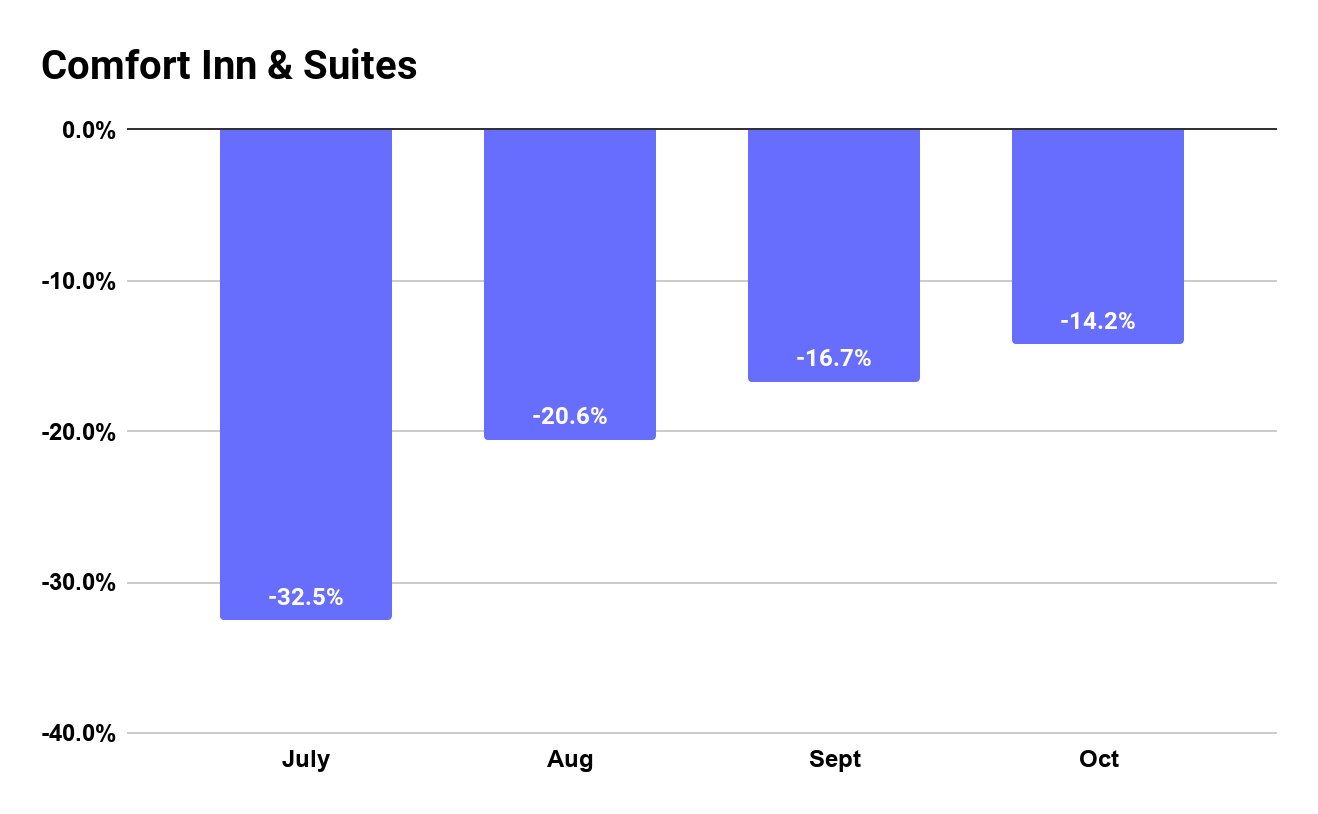

Comfort Inn & Suites is the only chain measured that has seen significant year-over-year improvement in their monthly & weekly traffic gaps. The drops in traffic are also much less severe than the other chains measured. July traffic was just 32.5% down and jumped closer to 2019 levels in June, with visits down 20.6%. More impressively, October visits moved closest to pre-COVID numbers with traffic down just 14.2% year over year.

The low-cost model associated with this chain, along with its geographic locations is likely aiding in its recovery. Unlike the Hyatt Regency, where most are located within larger, metropolitan areas, a majority of Comfort Inn locations are situated within rural areas.

While traffic is seemingly improving month to month for these chains, the looming resurgence in cases and stay-at-home orders is likely to stop movement across the country, in turn affecting the overall economy and hotel industry and leading to a traffic halt.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.