In this Placer Bytes, we dive into Simon’s new return policy, GameStop’s turnaround potential, Walmart’s signs ahead of the holidays, and Ollie’s strong position.

Simon Talks Returns

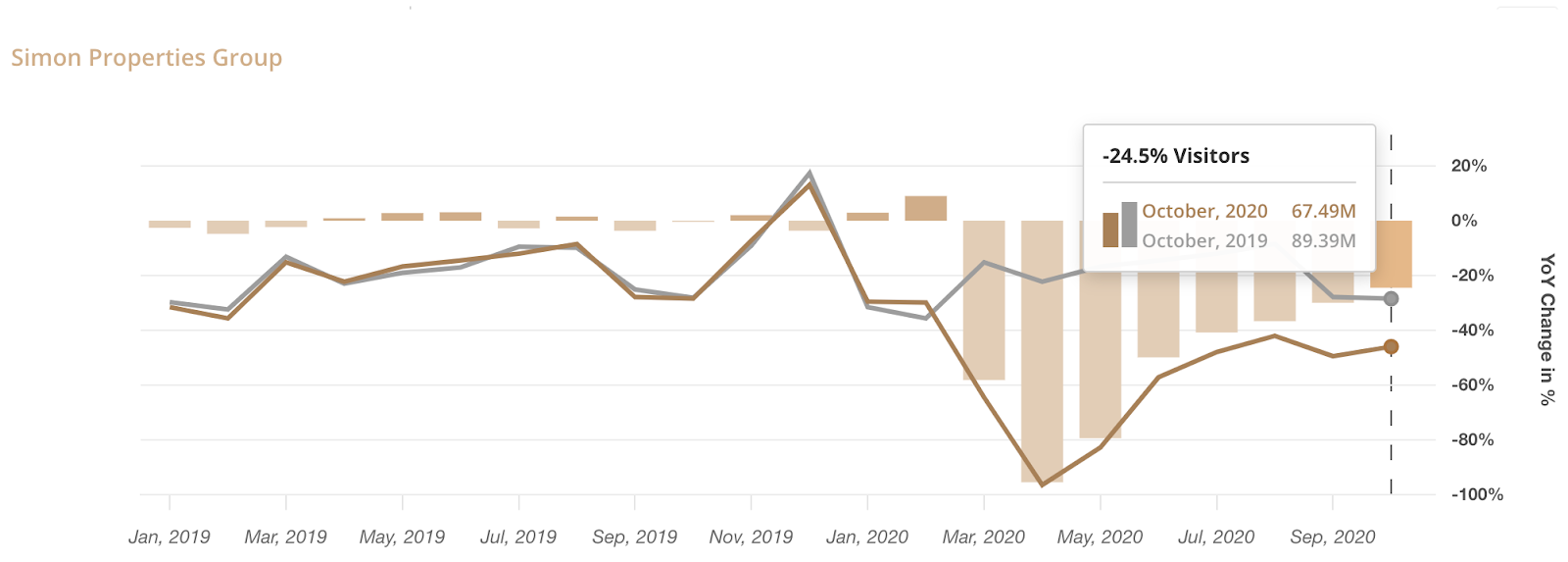

Simon recently announced a new return concept that could help provide even more reasons to visit their centers. And the timing is very interesting. October visits were down just 24.5% for Simon centers nationwide, following a steady improvement from July, August, and September when visits were down 40.8%, 36.7% and 30.0% year over year, respectively.

Should this idea prove capable of moving the needle it could combine with the coming winter weather to give Simon’s indoor centers a needed holiday boost. Even more, this is a concept that could be seen with increasing frequency across shopping centers as they look to tap into new channels for driving visits and engagement.

GameStop Showing Upside?

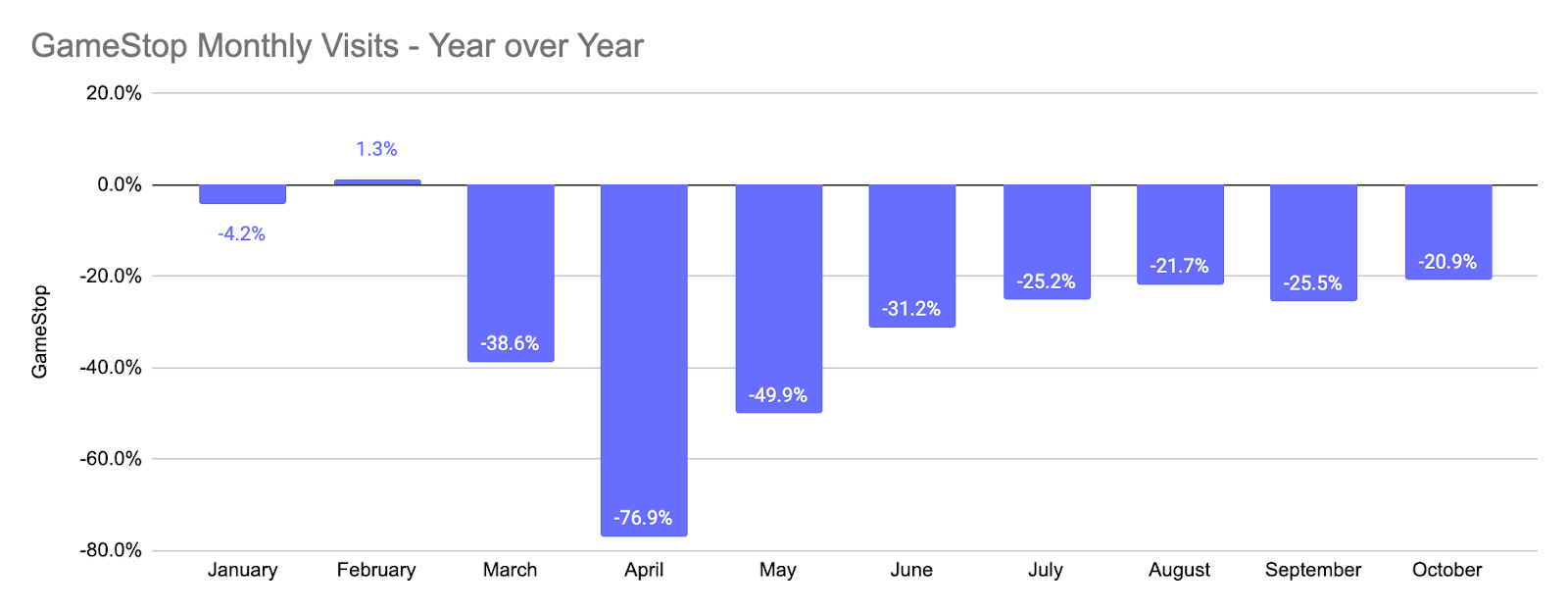

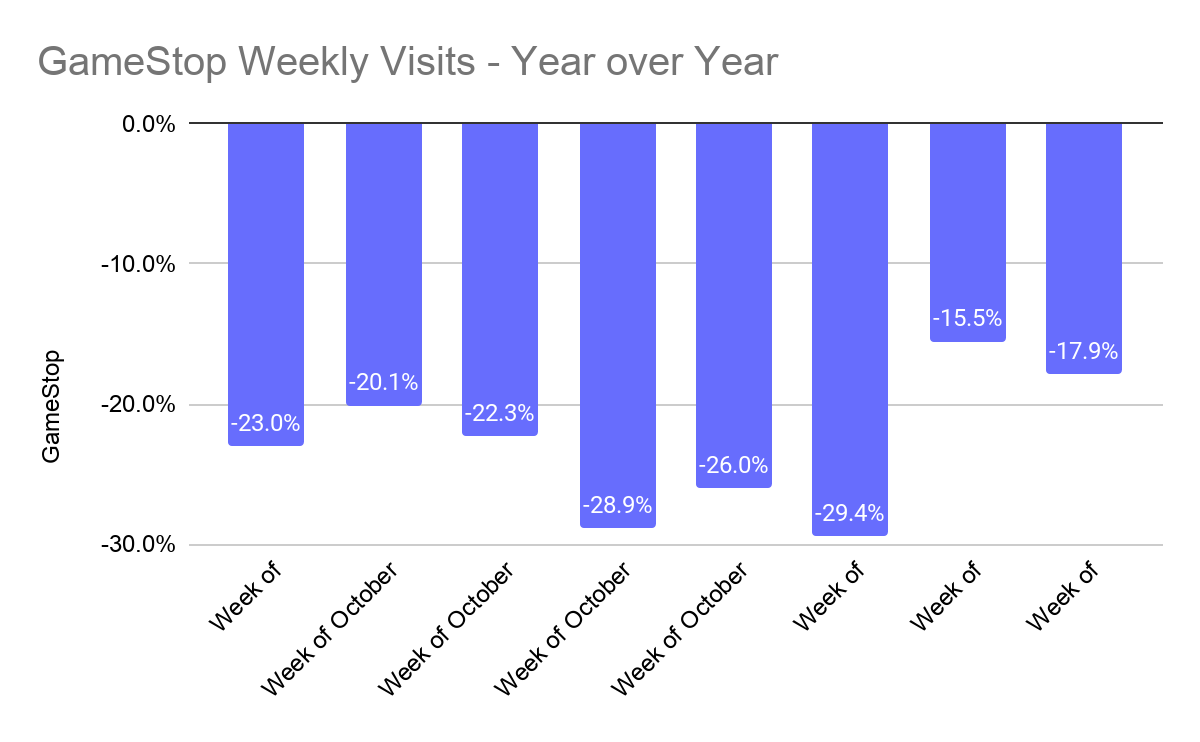

Offline visits for GameStop took an expected hit in 2020 with visits down 21.7%, 25.5% and 20.9% respectively in August, September, and October year over year. And while these numbers are still strong relative to the wider sector, there are signs that the brand could see a strong end-of-year performance.

GameStop visits saw a sharp rise the weeks of November 9th and 16th with visits down just 15.5% and 17.9% year over year. Should the pattern hold, the brand could be well positioned for the holiday season.

Walmart’s Next Gear

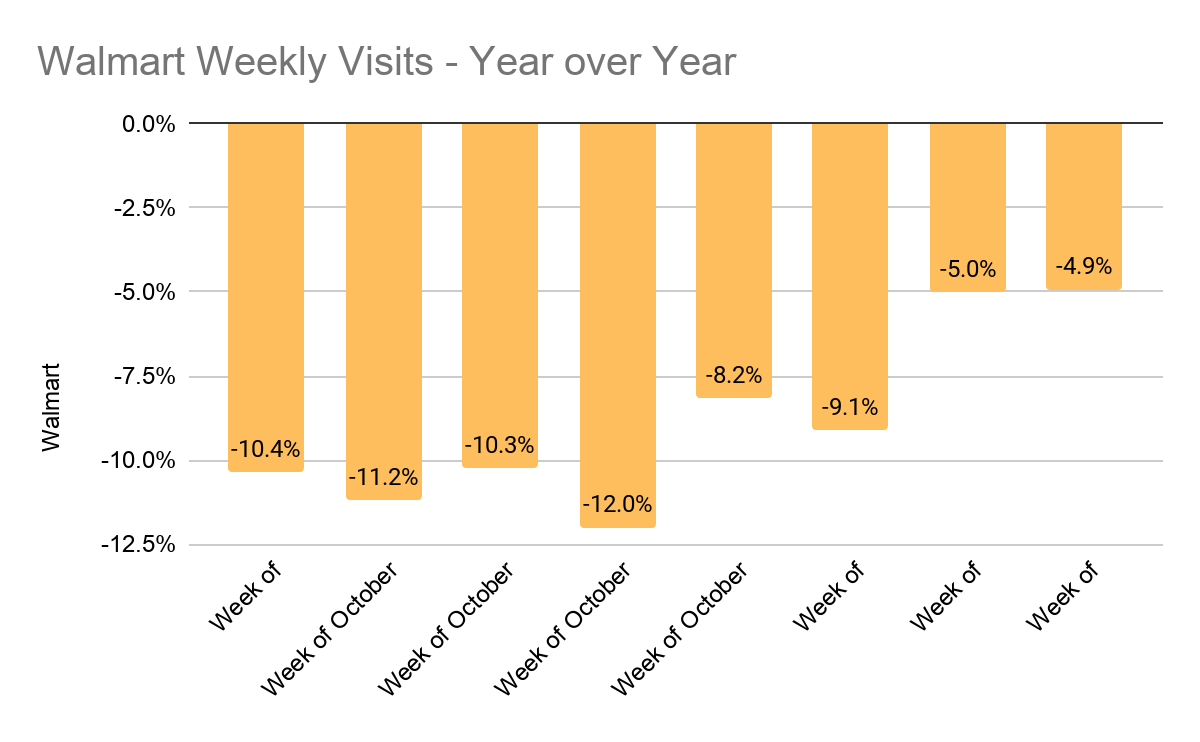

On Tuesday November 17th, visits to Walmart Supercenters were up 1% year over year. And while the number may seem like a fairly minor jump, it could portend a massive holiday season for the retailer. From June through September, visits were down year over year between 11% and 13%. Yet, by the weeks beginning October 26th and November 2nd, visits were down just 8.0% and 8.8%, and the weeks of November 9th and 16th saw visits down just 5.0% and 4.9% respectively. If the mission-driven shopping trends that drive larger basket sizes for Walmart visitors hold while visit levels increase, Walmart could be in store for a massive end to 2020.

Ollie’s

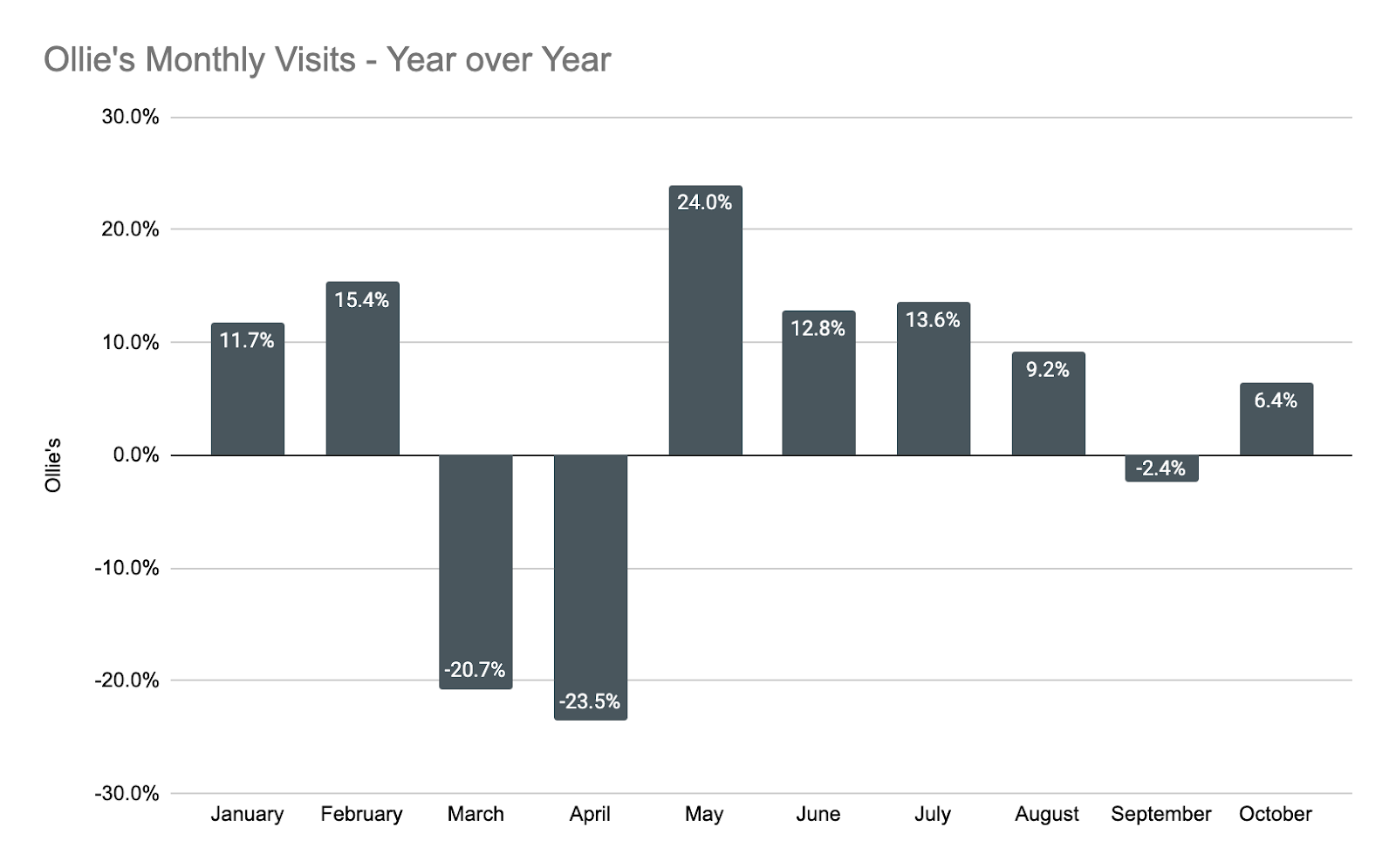

Ollie’s is yet another bargain chain that could be well positioned for the coming months. Apart from a visit decline in September, the brand has seen year-over-year visit growth since the offline retail economy had a reboot in May. But it does appear that visits are beginning to stabilize and move closer to 2019 levels. While October saw a 6.4% jump in year over year visits, the weeks of October 26th, November 2nd and November 9th saw an average year-over-year increase of just 0.3%. The coming weeks will be telling in just how long the brand’s recent visit growth can last.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.