The key takeaways from ATTOM Data Solutions’ newly released November 2020 U.S. Foreclosure Market Report revealed that foreclosure filings were down 14 percent from October 2020, Florida posted the highest foreclosure rate and greatest number of REOs, and while foreclosure starts were down across the nation, a few states did see monthly increases in November 2020.

According to ATTOM’s latest foreclosure market analysis, there were 10,042 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in November 2020. While reported just a dip from the previous month, that figure is still down 80 percent from November 2019.

ATTOM’s November 2020 foreclosure report also noted that nationwide one in every 13,581 housing units had a foreclosure filing during the month. The report mentioned the states with the highest foreclosure rates were Florida (one in every 7,109 housing units with a foreclosure filing); Illinois (one in every 7,285 housing units); Oklahoma (one in every 8,128 housing units); New Mexico (one in every 9,236 housing units); and Delaware (one in every 9,310 housing units).

The analysis also reported that lenders foreclosed (REO) on a total of 2,010 U.S. properties in November 2020, down 22 percent from October 2020 and down 86 percent from November 2019. The report noted that the states with the greatest number of completed foreclosures (REOs) in November 2020, included Florida (273 REOs filed); Illinois (167 REOs filed); California (164 REOs filed); Arizona (141 REOs filed); and Georgia (117 REOs filed).

Also, according to the November 2020 report, among the metro areas with a population greater than 1 million, those with the greatest number of REOs filed in November 2020, included Chicago, IL (114 REOs filed); Phoenix, AZ (93 REOs filed); Atlanta, GA (88 REOs filed); Birmingham, AL (60 REOs filed); and Miami, FL (58 REOs filed).

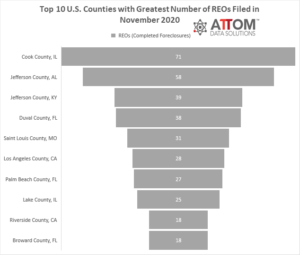

In this post, we take a deep data dive to isolate the top 10 county-level housing markets, among those with a population greater than 500,000, that posted the greatest number of REOs filed in November 2020. Those counties include: Cook County, IL (71 REOs filed); Jefferson County, AL (58 REOs filed); Jefferson County, KY (39 REOs filed); Duval County, FL (38 REOs filed); Saint Louis County, MO (31 REOs filed); Los Angeles County, CA (28 REOs filed); Palm Beach County, FL (27 REOs filed); Lake County, IL (25 REOs filed); Riverside County, CA (18 REOs filed); and Broward County, FL (18 REOs filed).

ATTOM’s November 2020 foreclosure market analysis also reported that a total of 5,256 U.S. properties started the foreclosure process in November 2020. That number was down 13 percent from October 2020 and down 79 percent November 2019.

The states that saw monthly increases in foreclosure starts in November 2020, included Missouri (up 18 percent), Indiana (up 14 percent), Georgia (up 4 percent), Arizona (up 1 percent), and Texas (up 1 percent).

Among those metros with a population greater than 1 million, those with the greatest number of foreclosure starts in November 2020 were New York, NY (454 foreclosure starts); St. Louis, MO (208 foreclosure starts), Chicago, IL (207 foreclosure starts); Miami, FL (151 foreclosure starts); and Los Angeles, CA (147 foreclosure starts).

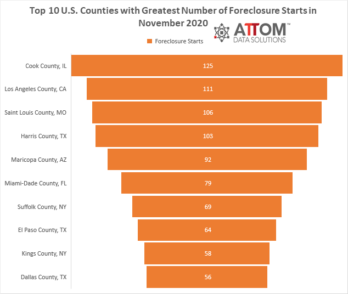

In drilling down to the county-level, among those counties with a population greater than 500,000, the top 10 with the greatest number of foreclosure starts in November 2020 were Cook County, IL (125 foreclosure starts); Los Angeles County, CA (111 foreclosure starts); Saint Louis County, MO (106 foreclosure starts); Harris County, TX (103 foreclosure starts); Maricopa County, AZ (92 foreclosure starts); Miami-Dade County, FL (79 foreclosure starts); Suffolk County, NY (69 foreclosure starts); El Paso County, TX (64 foreclosure starts); Kings County, NY (58 foreclosure starts); and Dallas County, TX (56 foreclosure starts).

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.