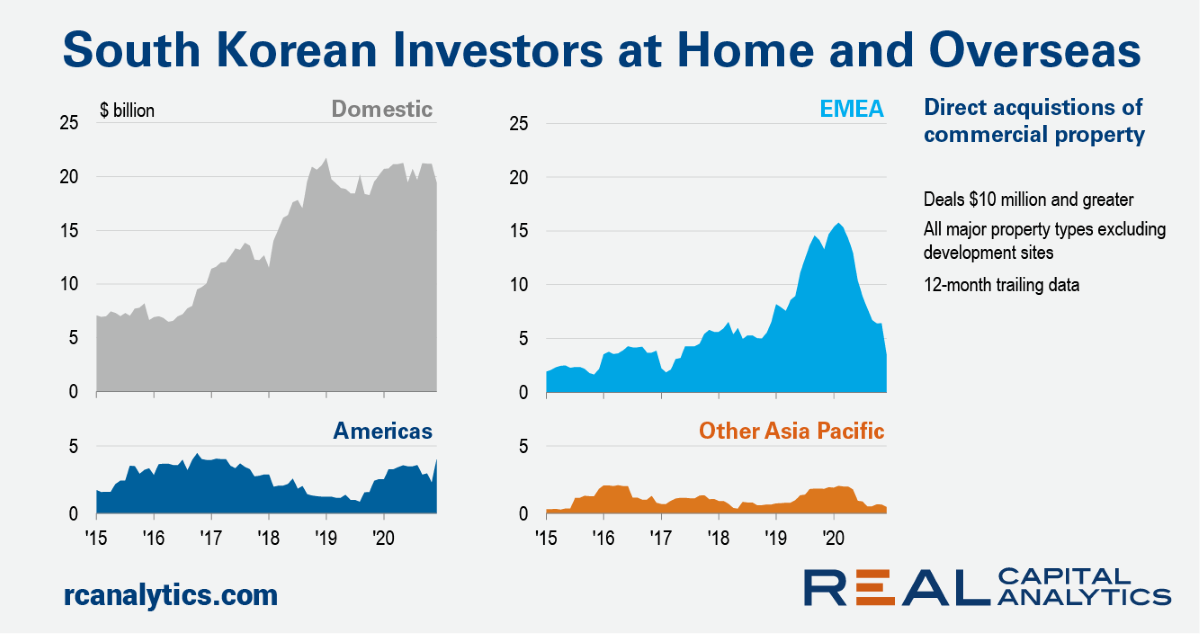

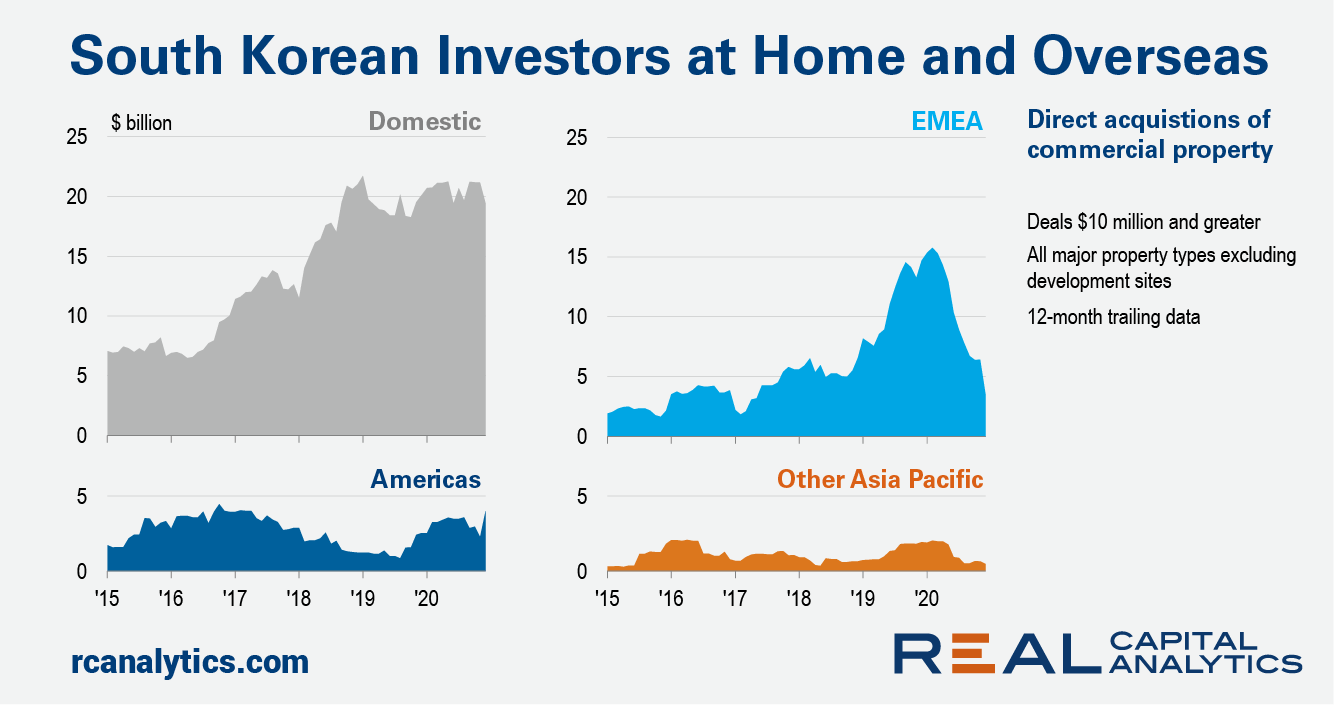

One of the biggest cross-border stories of 2019 was the outpouring of South Korean capital into Europe and the U.S. Towards the end of last year, there were signs that this trend was reaching its satiation point – asset managers had needed time to digest and syndicate the stakes in their newly acquired real estate assets back home.

Then of course, Covid-19 hit, along with a near-moratorium on global travel. Alongside a rapidly strengthening euro, Seoul’s 4% yields on prime offices and shopping malls back home began to look attractive once again. A dramatic collapse in capital outflows ensued, with Europe, 2019’s biggest beneficiary, bearing most of the brunt.

While most Korean investors began redirecting capital home, one was heading in the other direction. The National Pension Service of Korea (NPS) has been busy downsizing its domestic footprint, having sold over $1 billion of office and retail assets already in 2020, with another $1 billion of pending deals in the pipeline. Recently, the pension fund has plowed capital most notably into the U.S., where it was involved in the $2 billion purchase of a logistics portfolio in December. That has brought Korean inflows to the U.S. to a record level of $4 billion, more than 50% higher than last year’s tally.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.