In a year where grocery dominated headlines for all the right reasons, the sector also saw the addition of a new Amazon foray into grocery, Amazon Fresh stores. The focus on a strong, technologically backed shopping experience and value pricing seemed like a winning mix. This new concept was especially interesting in the wake of the struggles of Whole Foods, who faced a uniquely challenging mix considering their regional and price focus.

So, how did this first location perform in its first few months and what might this mean for the wider sector?

The Early Surge

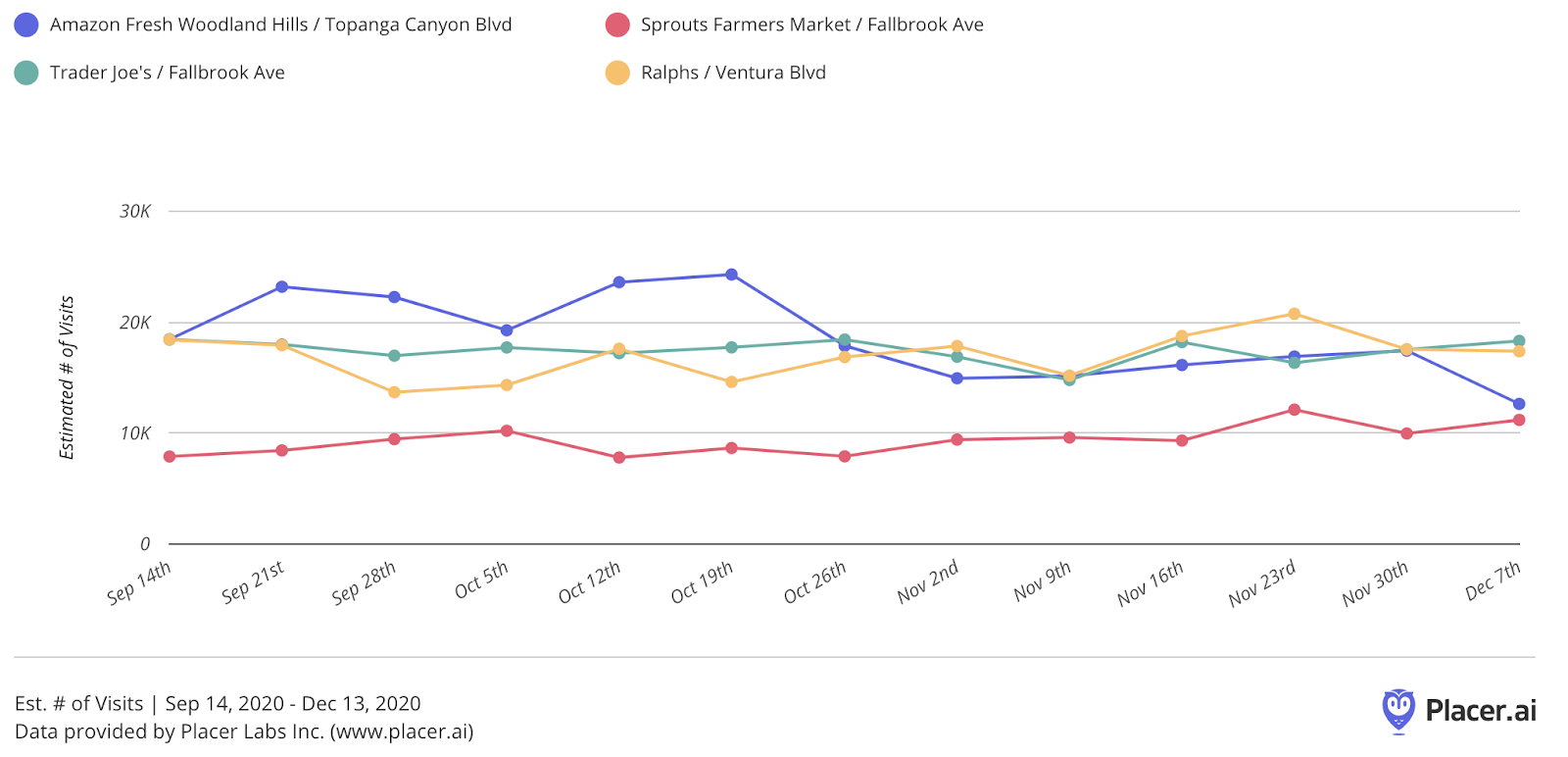

The initial data from the Amazon Fresh launch was very impressive. The first week saw visits on par with two local players with very strong visits rates, Trader Joe’s and Ralphs. But, Amazon Fresh quickly burst ahead with four of the next five weeks seeing the location drive over 5,000 more visits per week than either of those two competitors.

And the location was actually proving to be more than a one-time draw. While Trader Joe’s and Ralphs saw an average of 2.2 and 2.4 visits per visitor, respectively during this period, Amazon saw a 2.0 visit per visitor number. This indicates that not only was the location driving a large number of visits, but an experience positive enough that it was creating repeat customers.

COVID Resurgence

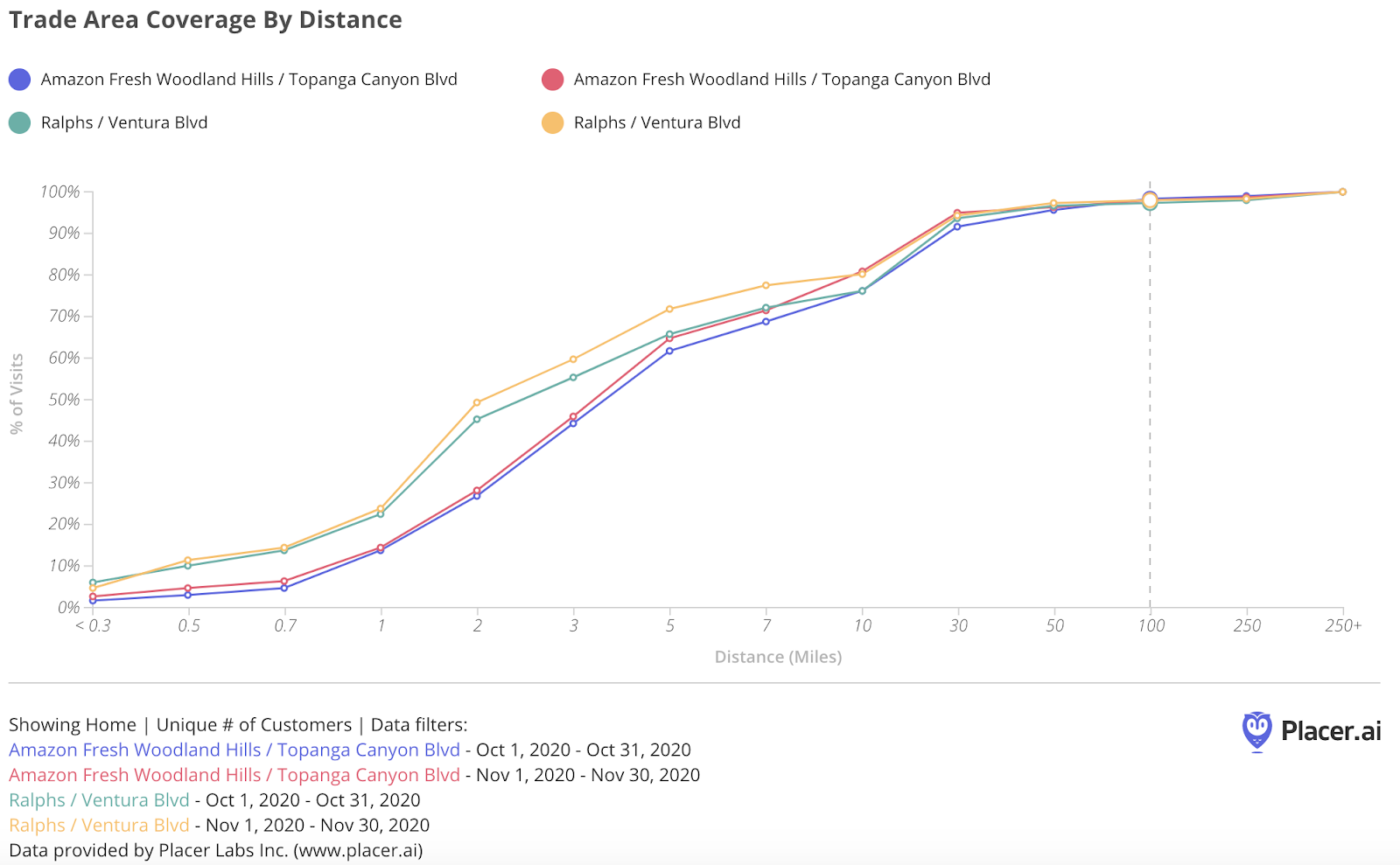

But, then came the resurgence of COVID cases that left an impact across the retail landscape. Both the Amazon Fresh and Ralphs locations saw their reach decline between October and November with more visitors coming from a shorter distance. And this push to proximity did not benefit both in the same way.

By the end of October, weekly visits to Amazon Fresh fell behind those to Ralphs and Trader Joes, reversing the trend seen in the weeks following the launch. And much of this seems to center around a significant decline in the size of the Amazon Fresh True Trade Area. Between October and November, the Amazon Fresh True Trade Area decreased by 27.1%, just as monthly visits declined 27.6%. On the other hand, Ralphs saw visits rise 13.7% as its own True Trade Area declined by 7.1%.

Insight into Amazon’s Core Audience?

These changes could provide some very tangible insights into the audience of this Amazon Fresh. One possibility is that Amazon Fresh had a strong launch because of the excitement surrounding the new location, and that in the longer term people returned to their normal grocery of choice. Yet, the close relationship between visits per visitor metrics between the top local grocers indicates that this location was actually succeeding in driving repeat visits even among the launch buzz.

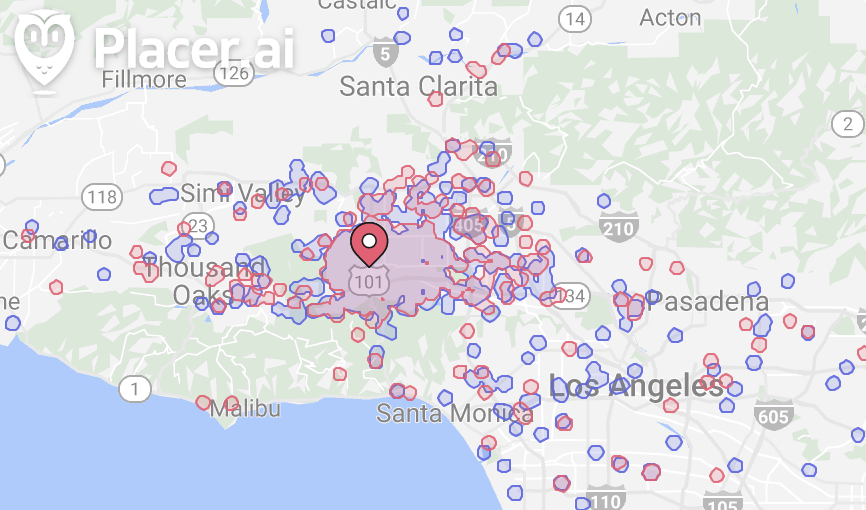

Instead, another possibility is that the rise of COVID cases also limited travel to work and retail in this region. This would suggest that this particular location benefits heavily from cross shopping and/or grocery visits before and after visits to work or school. Should the latter be the case, Amazon Fresh should see a strong rebound when its True Trade Area increases.

And this could also produce key takeaways for Amazon as it looks to expand the concept nationwide. While some brands, like Ralphs or Krogers, see a huge benefit to being close to core audiences, others are less dependent on proximity. Instead, these brands see value from their alignment with the work/school routines that many people orient their shopping around.

If the latter is the case, expect Amazon to put more locations alongside key cross shopping partners and in the direction of key commutes. The other process would be to attempt to better identify where core audiences reside in order to more effectively leverage proximity. It also might not be a one size fits all approach with the brand attempting to align strategy by region.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.