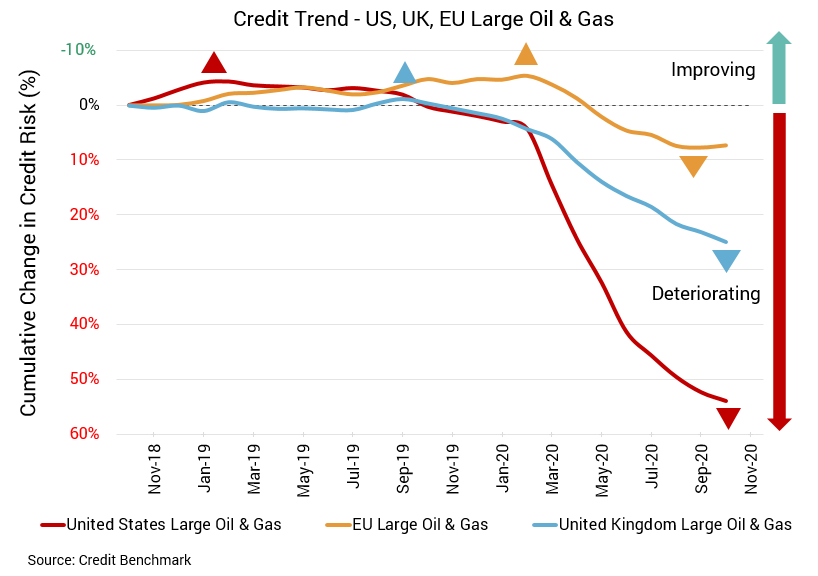

Problems in the energy sector are far from new, and are continuing to worsen slightly each month. This is particularly true for the US and UK energy sectors which have seen a great deal of volatility and distress in the last year or so. The picture isn’t so dire for the EU energy sector however. While far from immune from the problems facing US and UK companies, EU Oil & Gas firms are nevertheless something of a bright star amongst the industry. But the impact of COVID lingers for all three sectors and only time will tell if any of the positive signs emerging at the end of 2020 will have a lasting effect.

EU Energy Sector Remains Bright Star

US Oil & Gas

Persistent deterioration in credit for the US energy sector continues to add up. The decline in credit quality for large US Oil & Gas firms from the prior update is only around 1%, yet the drop from six months prior is about 24% and the year-over-year drop is even larger at about 54%. Average probability is now 57 bps. While that is a small increase from the prior month’s 56 bps, it’s much higher than the average probability of default six months prior at 46 bps, or 37 bps at the same point last year. Approximately 82% of firms have CBC rating of bbb or lower, and the aggregate’s average CBC rating is bb+.

UK Oil & Gas

Credit quality continues to get worse for the UK energy sector. Large UK Oil & Gas firms saw a drop in credit quality of about 1% from the prior month, while the six-month decline was about 12% and the year-over-year decline about 25%. Average probability of default is lower than it is for the US, but still rising. It’s still 40 bps, compared to 36 bps six months ago and 32 bps at the same point last year. Approximately 69% of firms have CBC rating of bbb or lower, and the aggregate’s average CBC rating is bbb-.

EU Oil & Gas

The EU energy sector continues to be in better shape than its US or UK counterparts. Credit quality for large EU Oil & Gas firms remains largely unchanged in recent months, and it’s down by about 9% from six months prior and about 13% year-over-year. Default risk is lower at 25 bps, compared to 23 bps six months ago and 22 bps at the same point last year. A smaller percentage of firms – currently about 65% – have a CBC rating of bbb or lower. The aggregate’s average CBC rating is bbb.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.