The restaurant industry has been completely upended by COVID, though with dramatically different effects on sub-sectors. QSR restaurants benefitted from their strength in drive-thru, delivery, and takeaway allowing them to offset losses and even drive strength during the pandemic. And the year to come could be especially well suited for their offerings as economic uncertainty could further boost the appeal of their high-value offering.

But what about sitdown chains? There is a real concern that the current environment could cause further damage to an industry that had already been facing challenges prior to the pandemic.

Top Chains – Where Are They Now?

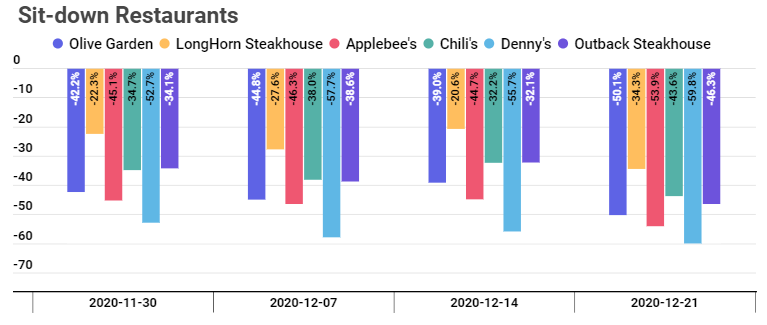

Unsurprisingly, the current resurgence of COVID cases has been especially unkind to the sitdown restaurant sector. Looking at six top national chains shows the group averaged a year-over-year visit gap of 38.5%, 42.1%, 37.4%, and 48.0% for the weeks beginning November 30th, December 7th, December 14th, and December 21st respectively. Denny’s specifically has seen declines of more than 50% for all of those weeks while LongHorn Steakhouse saw the most limited losses with the week of December 14th seeing a relatively minor 20.6% year-over year-decline.

Regional distribution clearly has a lot to do with this mix, but when analyzing the sector it is also critical to bring full context into the mix.

The Sector was Recovering

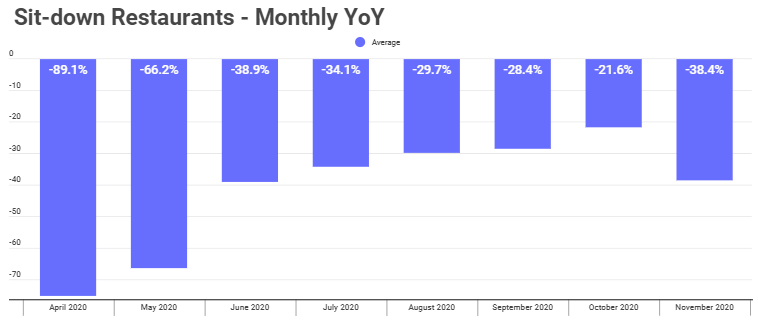

Looking at the average monthly year over year visit change for this same group shows that the sector was in the midst of a significant and marked recovery. Visits for the group were down just 21.6% year over year in October, but the gap ballooned back to 38.4% in November as case numbers surged.

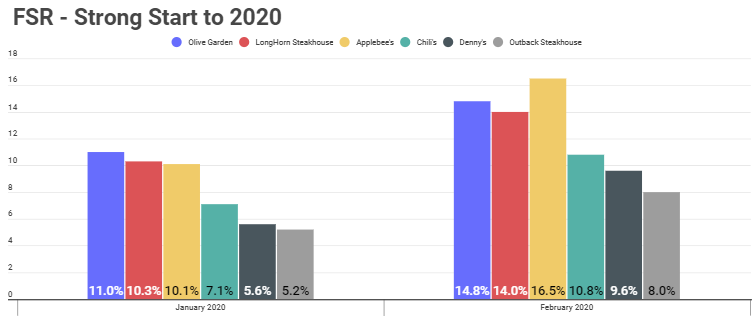

It is equally imperative to remember that not only was the sector recovering, but had performed exceptionally well in their last moments of ‘normalcy’. All six brands analyzed saw significant year over year growth in both January and February of 2020, though the latter month was boosted by an extra day.

Future Outlook

There are reasons to be less than optimistic for the sector in 2021. Visits have been way down because of COVID and COVID is going to continue into the new year. Additionally, periods of economic uncertainty tend to privilege QSR brands as opposed to sit-down restaurants.

Yet, there are also very real reasons to be bullish about the segment’s recovery potential. The pandemic presented a perfect storm of challenges that severely limited their ability to perform. And yet, even amid this situation, top brands were showing very strong signs of a recovery. In addition, many of these players have significantly strengthened their takeaway and delivery capabilities, giving them more diverse ways of reaching customers. And these new strengths could have serious long term benefits. Finally, there is a very high likelihood that the end of COVID will bring back customers who missed having these ‘out-of-home’ experiences. If the brands can align themselves with key trends like lingering economic uncertainty by focusing on more value-oriented offerings, there may be a possibility of a strong and sustained resurgence for sit-down chains in the years to come.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.