Source: https://insights.consumer-edge.com/2021/01/caber-yay-deep-dive-on-wine-spirits-delivery-growth/

Among the list of COVID-19 winners and losers, Wine & Liquor stores stand out as clear winners. Brick-and-mortar locations were considered essential businesses in many states and were allowed to stay open while other retailers shuttered, and both online and offline outlets benefitted from the closure of restaurants for seated dining. Wine and spirits delivery services, which were proliferating and growing even before the pandemic, rode an especially strong tailwind during this period. However, not all may be long-term winners – among the top delivery services, there are clear standouts when it comes to encouraging repeat purchases over time and avoiding harmful cross-shop. Yet, even the fastest growing business eventually reach saturation. We further explore opportunities for cross-promotion and business expansion based on complementary share of wallet shopping.

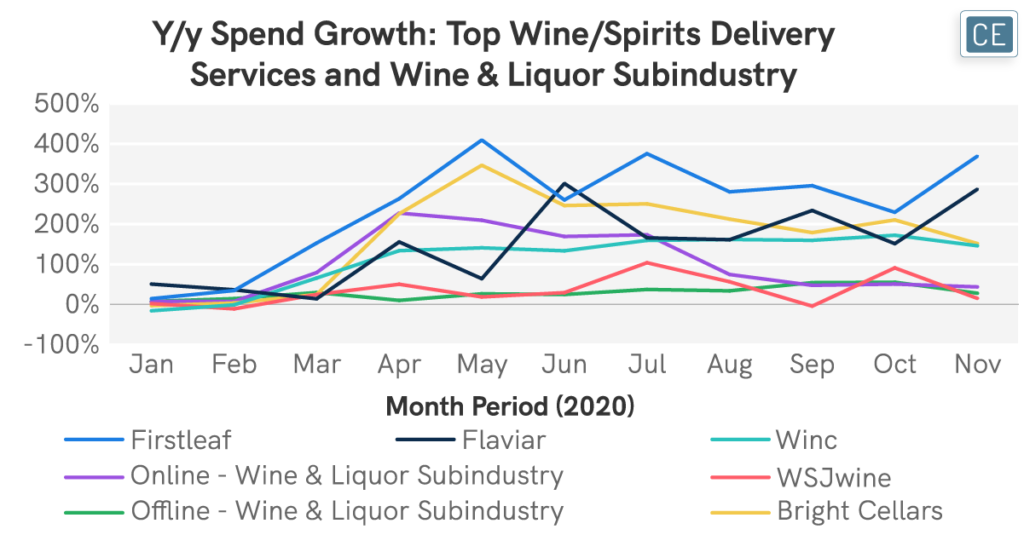

Overall, the Wine & Liquor subindustry was showing strong growth pre-pandemic, with offline sales up 7% y/y in January and 8% in February and online sales up 8% y/y in January and 15% in February. Restaurant closures and stay-at-home orders dramatically improved this growth, with offline growth steadily accelerating to a peak of 56% y/y in October and online growth more than tripling in April and May before settling down to rates inline with offline growth in September and October. The top five wine/spirits subscription services showed a bumpier trajectory. Bright Cellars, Winc, and WSJwine all saw negative spend growth in either January or February of 2020, which got bumped up to double and even triple-digit growth over the spring and summer. Growth for Bright Cellars and Winc slowed slightly in the fall but remained strong, both at ~150% y/y spend growth in November. Sales for WSJwine moderated dramatically, however, returning to negative territory in September and up only 15% in November. In contrast, Firstleaf and Flaviar started the year with strong growth, and spend was up by over a third for both brands in February. Firstleaf spend growth rocketed to over 400% in May and Flaviar grew over 300% in June before both brands “moderated” growth somewhat in the fall and then reaccelerated to 369% growth for Firstleaf and 287% growth for Flaviar in November.

Wine & Liquor Subindustry

Although new customer acquisition was a key driver for the wine/spirits subscription services, long-term success is likely to be based more on customer retention. All of the top five subscription brands lost at least half of the new customers they had acquired in April by May, possibly as the sheen of initial promotions wore off. Bright Cellars and Winc managed to get 50% of shoppers to repeat their purchases, followed closely by 44% for Firstleaf. Flaviar only kept 26% of customers the second month and WSJwine had the worst repeat purchase rate at only 13% of customers returning in the second month. Seven months later, however, the differences between the providers were much smaller. In November, ~20% of those who had first subscribed to Firstleaf, Winc, and WSJwine in April returned for further purchases. Just over 10% of Bright Cellars and Flaviar customers returned. Interestingly, although Flaviar and WSJwine both have quarterly subscriptions, their repeat customer curves don’t appear to follow a quarterly pattern for the shoppers who started in April, implying that interim incremental purchases are frequent.

Customer Loyalty

Note: “First shopped” defined as those who shopped each brand in April 2020 for the first time in 1120-day data history

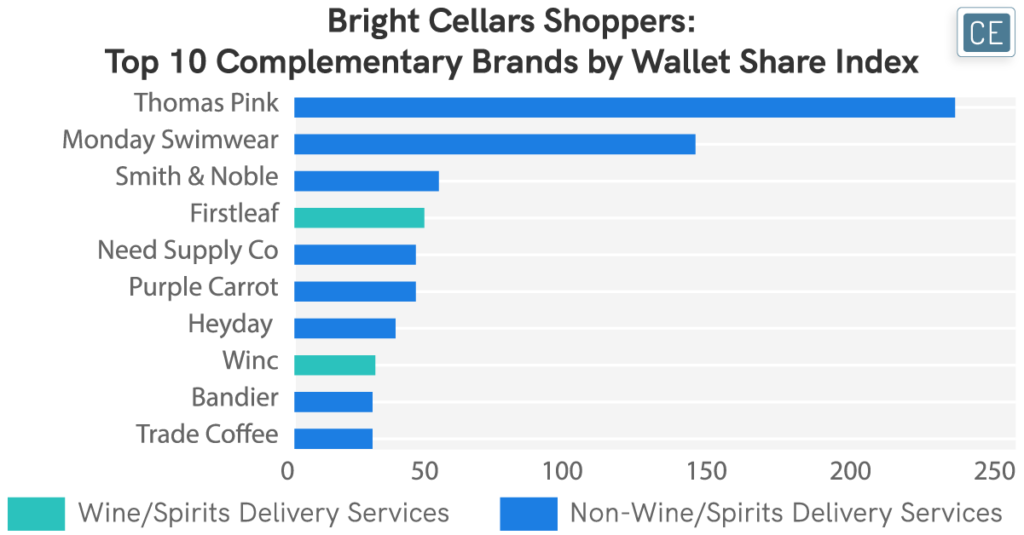

A share of wallet analysis looking at where else wine/spirits subscription customers shop can provide two other interesting lenses through which to view the data. One is simply looking at cross-shop within the category. Firstleaf shoppers are the most likely to try other wine brands, including subscription services. Five of the top ten brands where Firstleaf shoppers overindex spend across all categories are other wine outlets: Bright Cellars, Splash Wines, Wine Insiders, WSJwine, and Laithwaites Wine. In fact, all of the wine subscription services have at least one other wine brand among those where their customers overindex. Flaviar, on the other hand, doesn’t have any direct competitors among brands where its customers overindex.

In addition to assessing competitors’ hold on their shoppers’ wallet share, brands can also use the share of wallet analysis to search for potential partnership opportunities. For instance, the inclusion of Purple Carrot as one of the top ten share of wallet brands for two different wine delivery services may suggest that these brands can partner with the company for paired wine deliveries that match selected meals or bundled subscriptions. Top restaurants these services’ customers eat at may cross-market with sommelier recommendations or waived corkage fees.

Share of Wallet

Note: 1/1/2020 – 11/30/2020; wallet share index defined as percent of wallet stated wine/spirits delivery brand customers spend at other brand divided by percent of wallet spent at other brand among total panel

COVID-19 has created winners and losers in certain sectors of the economy, but there are also companies that are performing better and worse within those sectors.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.