There is a line of thinking around the Covid-19 pandemic that developers can solve some of the problems caused by rising office vacancies in Midtown Manhattan. Developers are capable of amazing feats, but a stabilization of the office market will ultimately depend on a curtailment of the pandemic.

New York Gov. Andrew Cuomo in his State of the State address called for a change in regulations to permit commercial property owners to convert their buildings to residential uses in the next five years. On the face of it, I am always in favor of less burdensome regulations around what property owners can do with what they own. Additional housing units in an area that had limited supply pre-pandemic would have been helpful as well, particularly if the units were affordable.

The thing is though, regulation around what one can do with a property is not the only limiting factor on conversions. Repurposing a building to another use is a costly and cumbersome exercise that will often exceed budgeted expenses due to so many uncertain elements beyond one’s control.

The only way to redevelop an office building to some other use profitably is to buy the asset at a significant discount. A redevelopment that prices an office building at the discounted value of future rental income for the building just cannot get off the ground. The times when it has made sense in the past to remove office buildings from market inventory for redevelopment are generally when the price cycle moves against the office sector.

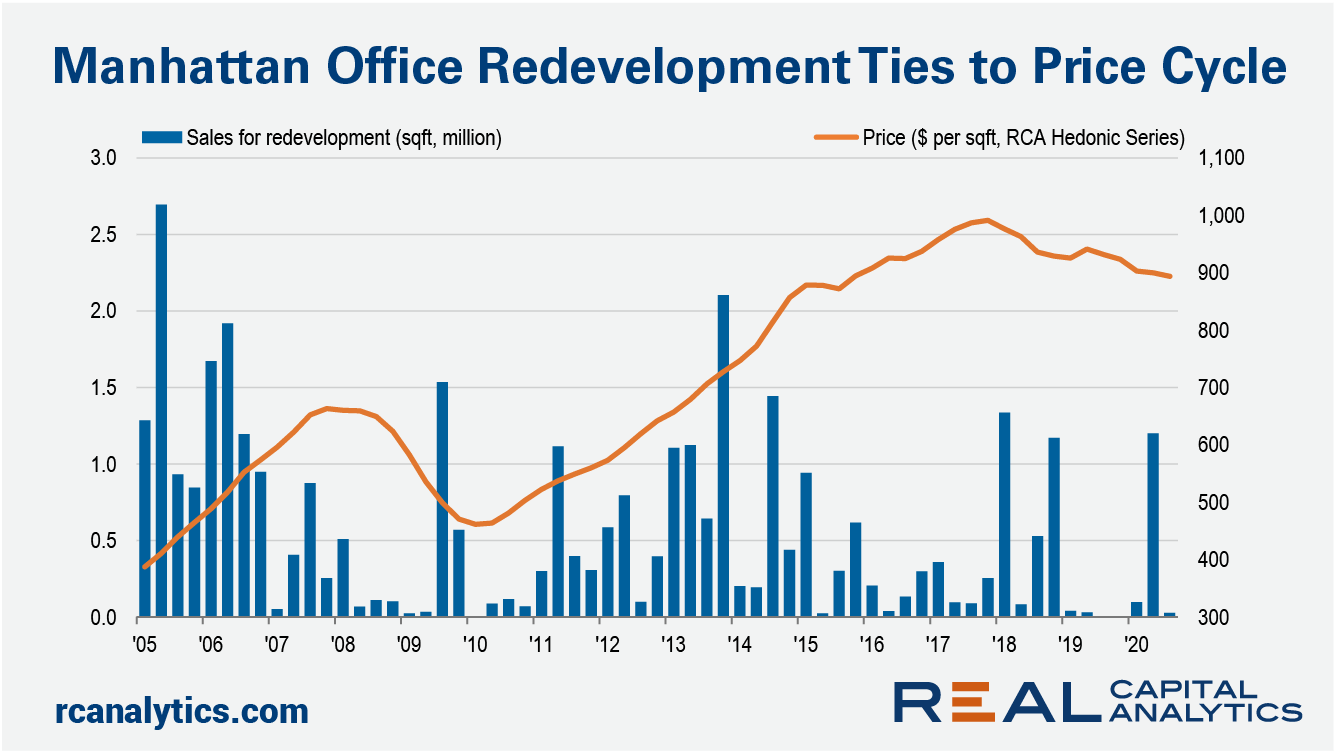

Plotting sales of office buildings in Manhattan sold for purposes of redevelopment versus Manhattan office sale prices as measured by the RCA Hedonic Series, there is a clear lag relationship where redevelopment becomes popular after prices fall. There had been a redevelopment wave underway that cooled into 2007 given steady increases in office prices as the housing boom was underway. The trend towards redevelopment was already easing off before prices peaked in 2008. After the peak, prices declined 30% in Manhattan and from 2009 to 2015, some 15.6 million square feet of office space was sold for purposes of redevelopment.

Office prices peaked in Manhattan in 2017 just as Chinese investors were pulling out of the bidding pool for investments in the market. A slow correction was underway in prices even ahead of the Covid-19 pandemic as some of that froth in pricing was removed. By Q3 2020, office prices were down 10% from the high set in 2017, RCA data shows.

The impact of the health crisis on office asset pricing in Manhattan is yet to be realized. Working from home has been more successful for firms than many anticipated, so there is likely to be some sort of change in the use of office space moving forward. It is uncertain, however, whether that change is a simple move to more flexibility or a permanent reduction in space usage that changes the income potential for buildings and thus what investors are willing to pay.

In the face of that income uncertainty, potential buyers and current owners are still far apart on asset pricing. For developers, that uncertainty in pricing is just one more obstacle in converting office buildings to apartments. If current owners give up and 30%+ price declines are seen, perhaps like after the last downturn some creative redevelopment could occur. At the same time though, if office prices plummet because nobody wants to work in Manhattan, why would people want to live there?

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.