As COVID-19 has forced movie theatres to close and spurred increased subscriptions to streaming services nationwide, Disney has doubled down on streaming by releasing new movies straight to Disney+. The company, which originally included new releases in base subscription plans, launched its Premier Access feature with the release of Mulan, requiring a $29.99 one-time fee for customers to gain early streaming access to a movie. Our analysis explores customer acquisition and retention in the days before and after the release of Mulan (when this surcharge went into effect) as well as consumer behavior around other noteworthy Disney+ launches.

The hype is real

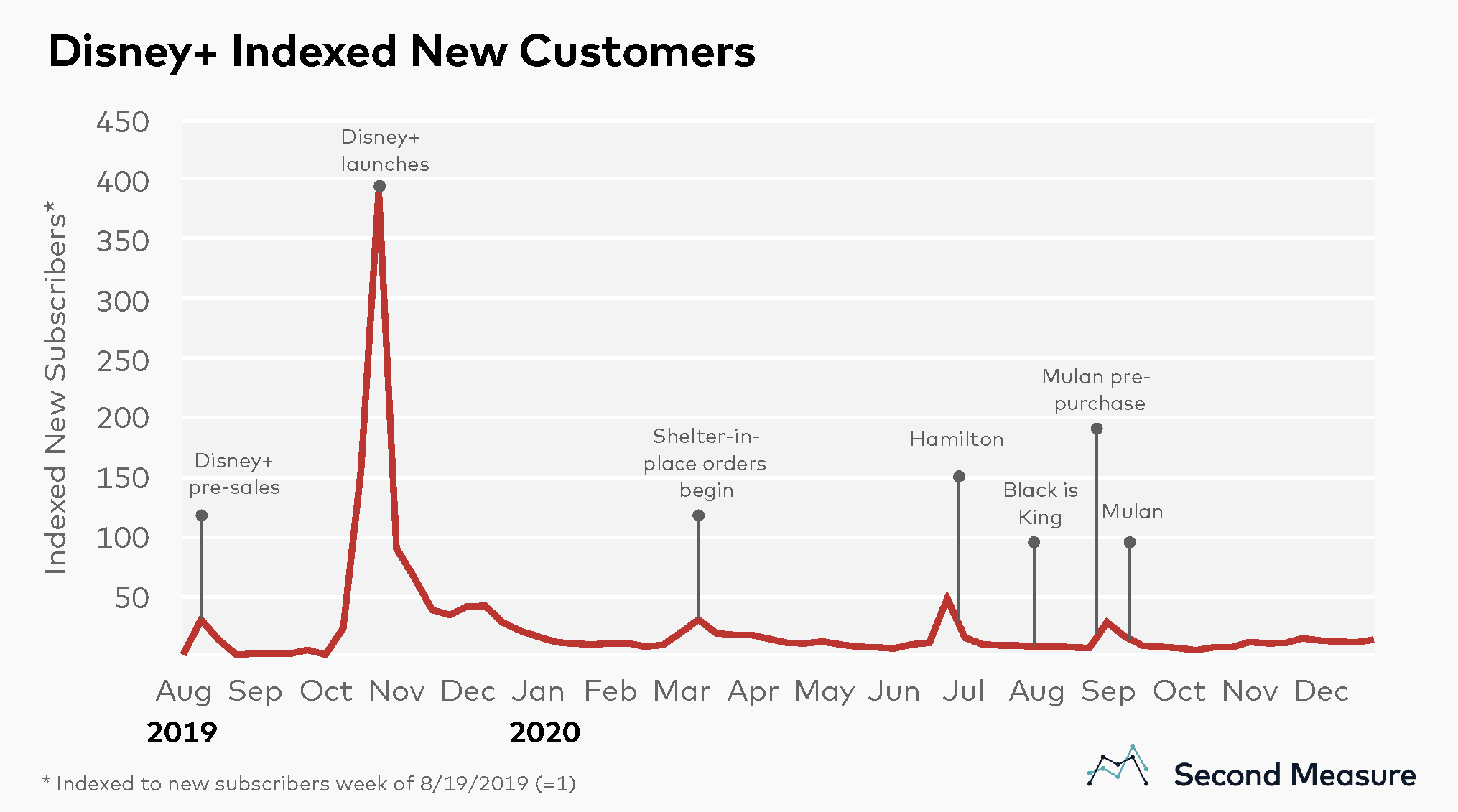

Following a pre-sale in August 2019 and a solid launch in December 2019, the launch of big name titles has certainly helped propel new subscriber sales. New customers in September 2020 doubled that of January with the launch of Mulan, and also tripled that of January with Hamilton’s mid-summer release.

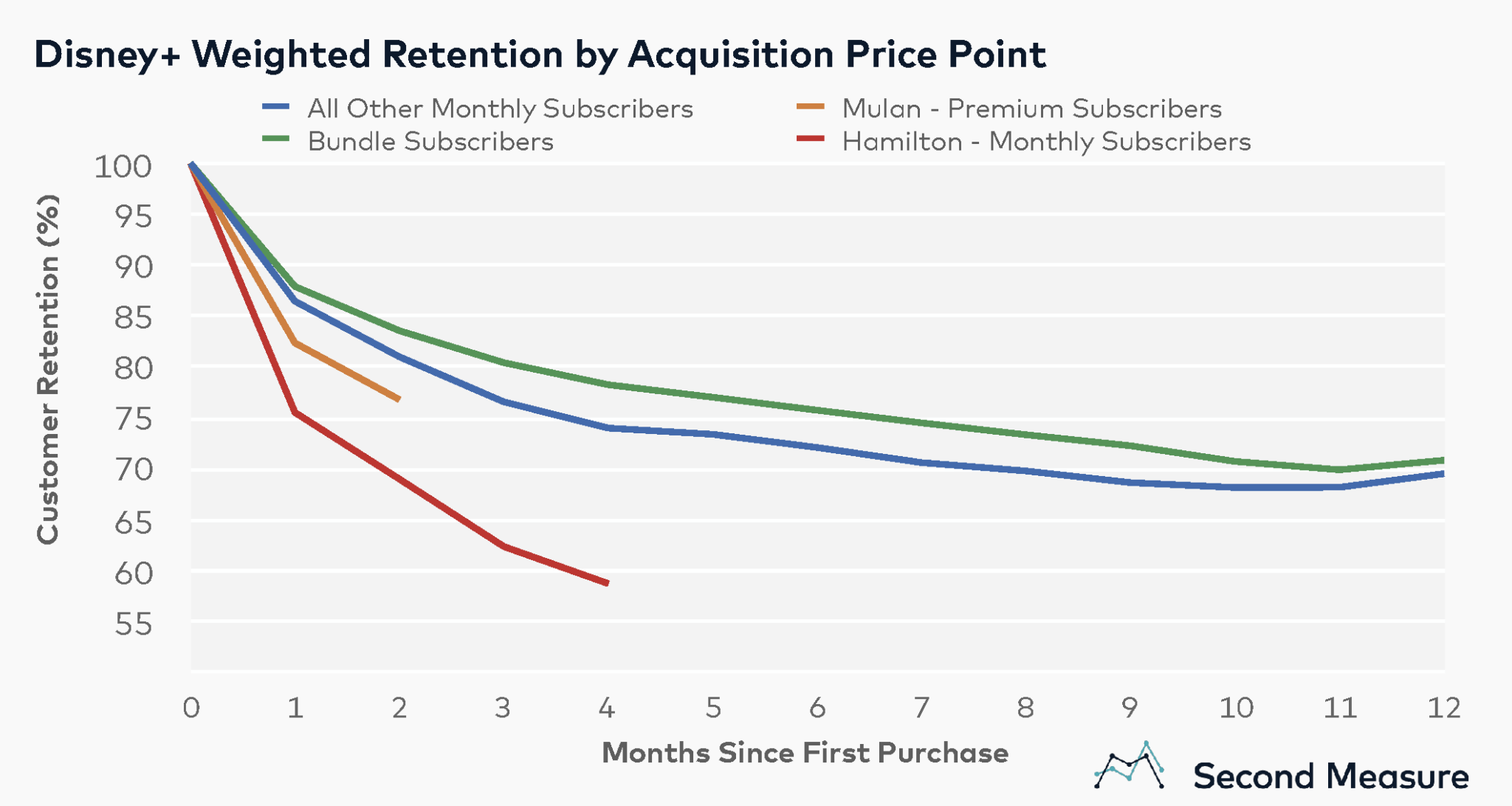

Eighty-two percent of customers who subscribed during Mulan’s launch period remained subscribers after a month, while 75 percent of Hamilton subscribers were retained after the same time period. These retention numbers remain lower than the weight average retention of monthly subscribers after 1 month, which currently stand at 86 percent. Conversely, 88 percent of subscribers who subscribed to the bundle with Hulu and ESPN are retained after their first month.

Disney+ is the leader when it comes to subscriber retention

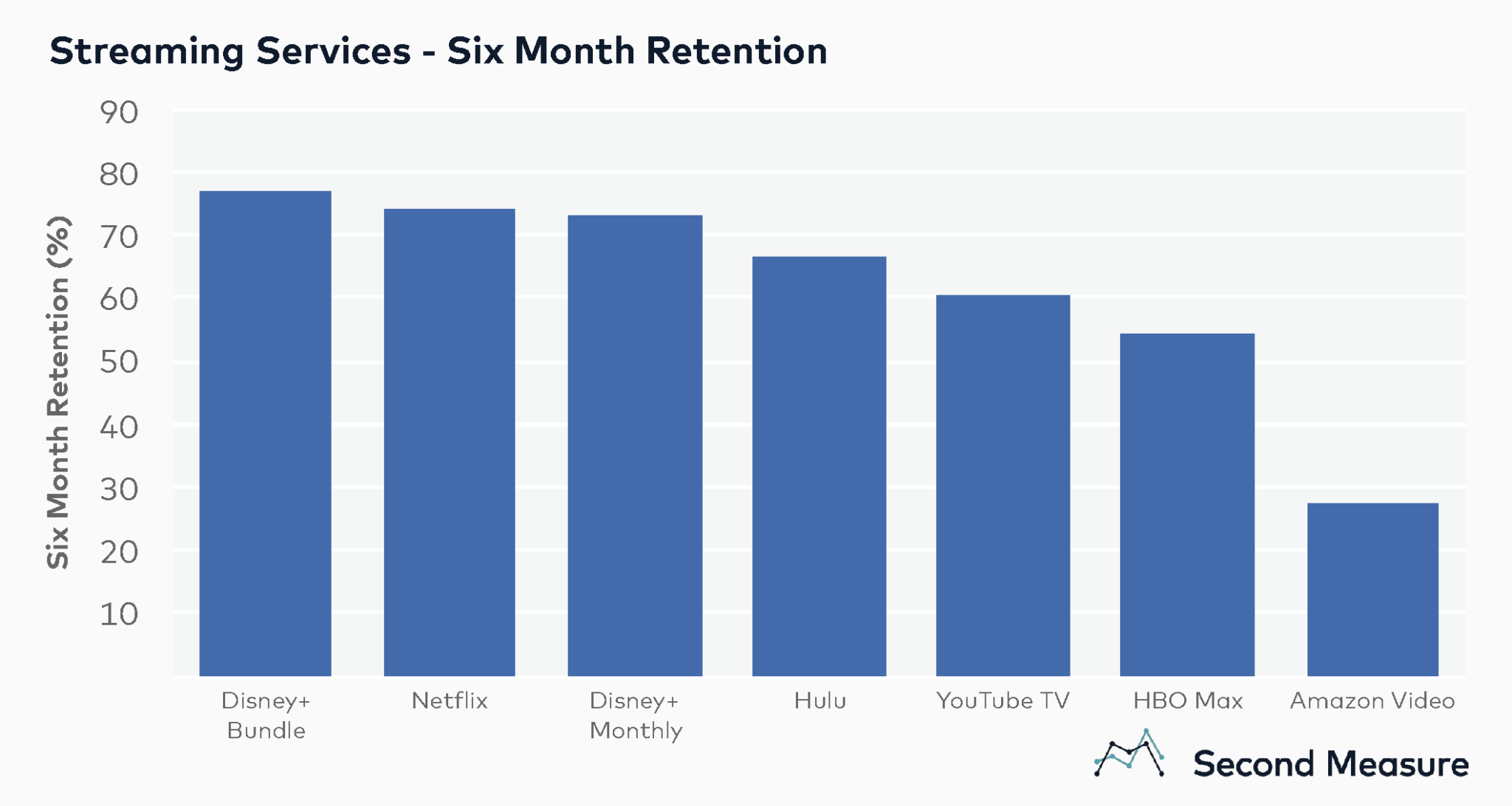

Disney+ leads the pack in terms of customer retention, with its bundle plan edging out Netflix in an increasingly saturated streaming services industry.

A deeper look at six-month retention rates showed Disney+ bundle and monthly subscriptions maintaining their stronghold on customer retention. As of November 2020, 78 percent of the company’s bundle subscribers, and 74 percent of monthly subscribers, remain subscribers after six months. Its closest rival, Netflix, maintained a retention rate of 74 percent, while Hulu subscribers (not including those through the Disney+ bundle) observed a retention rate of 67 percent.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.