Grocery’s Q4 – Visits Continue to Approach 2019 Numbers

One of the sectors less affected by the pandemic was the wider grocery space; yet even here, there were dramatic changes in shopping behavior. How did this affect the sector from a larger perspective? Which brands were impacted most by these changes?

We dove into an index of dozens of grocery chains to find out.

The Overall Picture

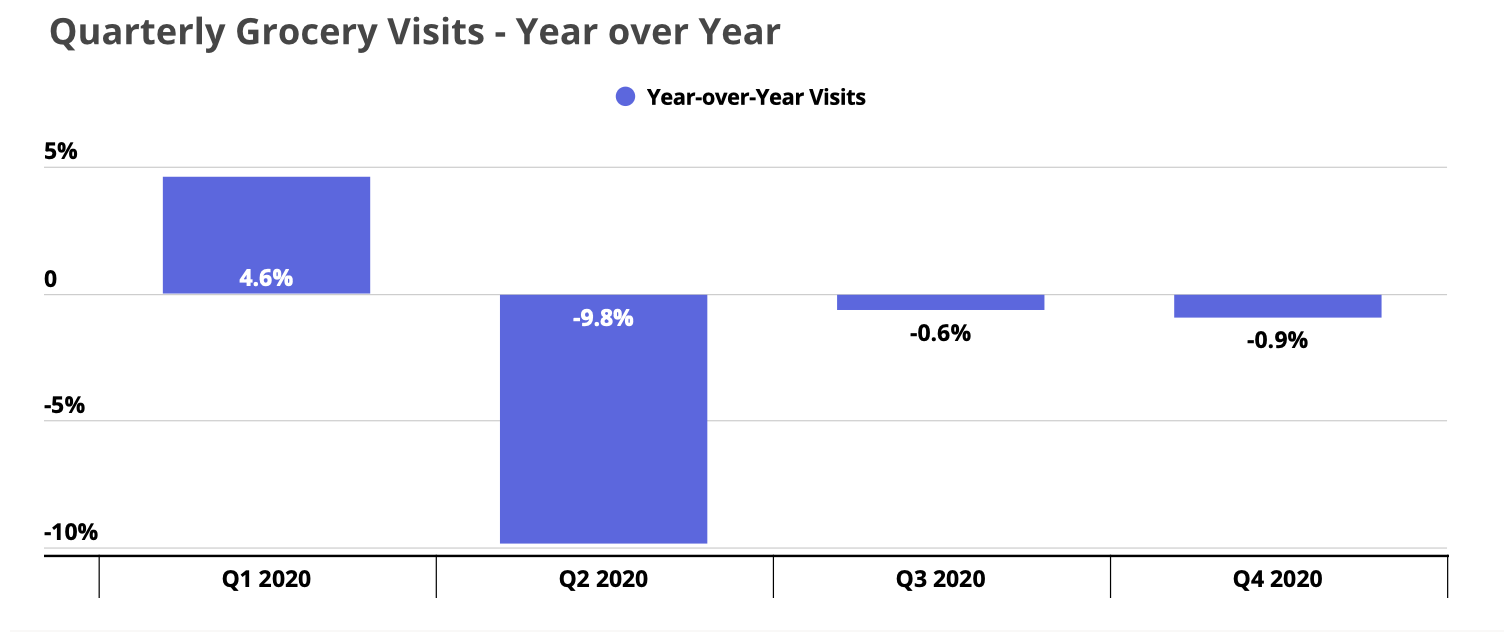

The grocery sector surged in Q1 with a big boost coming from the pre-pandemic supermarket rush. Visits were up 4.6% in the first quarter of 2020, before seeing a 9.8% decline year over year in Q2. Yet, Q3 and Q4 saw essentially flat numbers year over year with visits down 0.6% and 0.9% for the group analyzed.

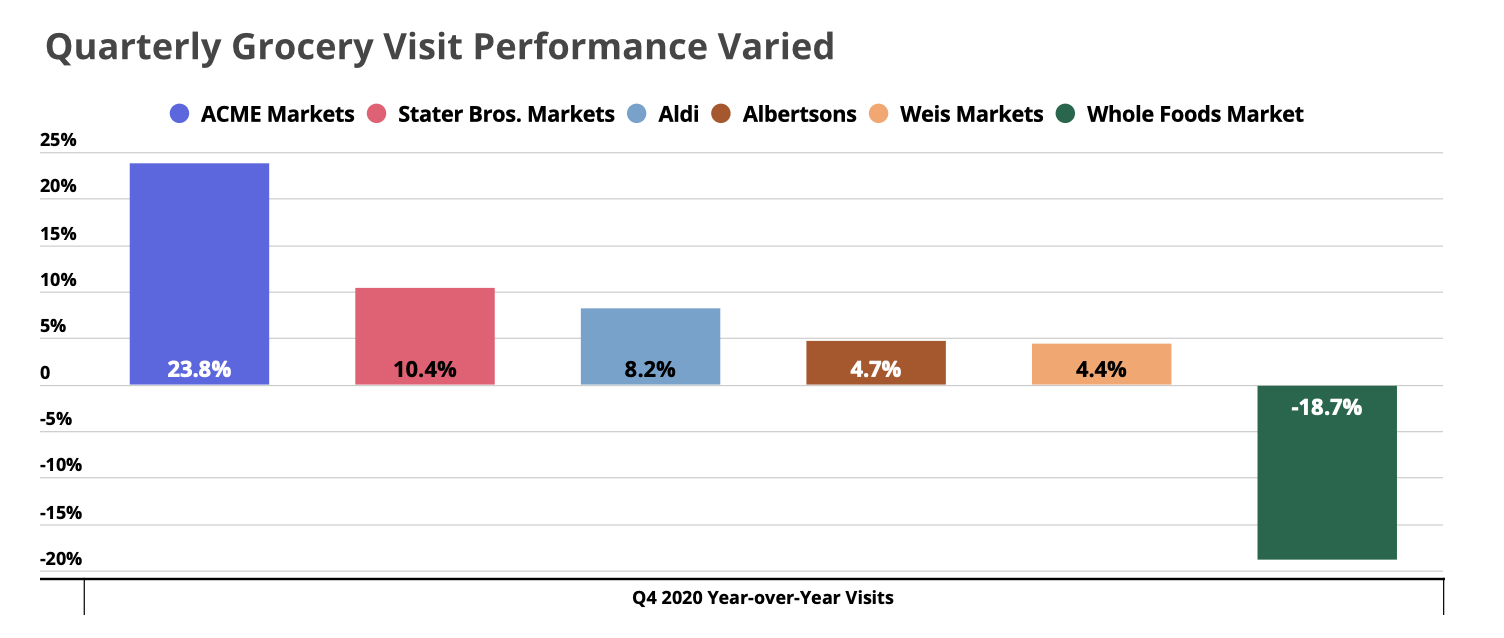

And much of this decline is related to the wide range of Q4 results seen by grocery brands. While ACME and Stater Bros. saw huge increases of 23.8% and 10.4% respectively, Whole Foods saw an 18.7% decline. The latter’s weaker performance was due heavily to a uniquely challenging confluence of factors, including the geographic distribution of stores and a higher-end approach.

Visit Duration Tells a Fuller Story

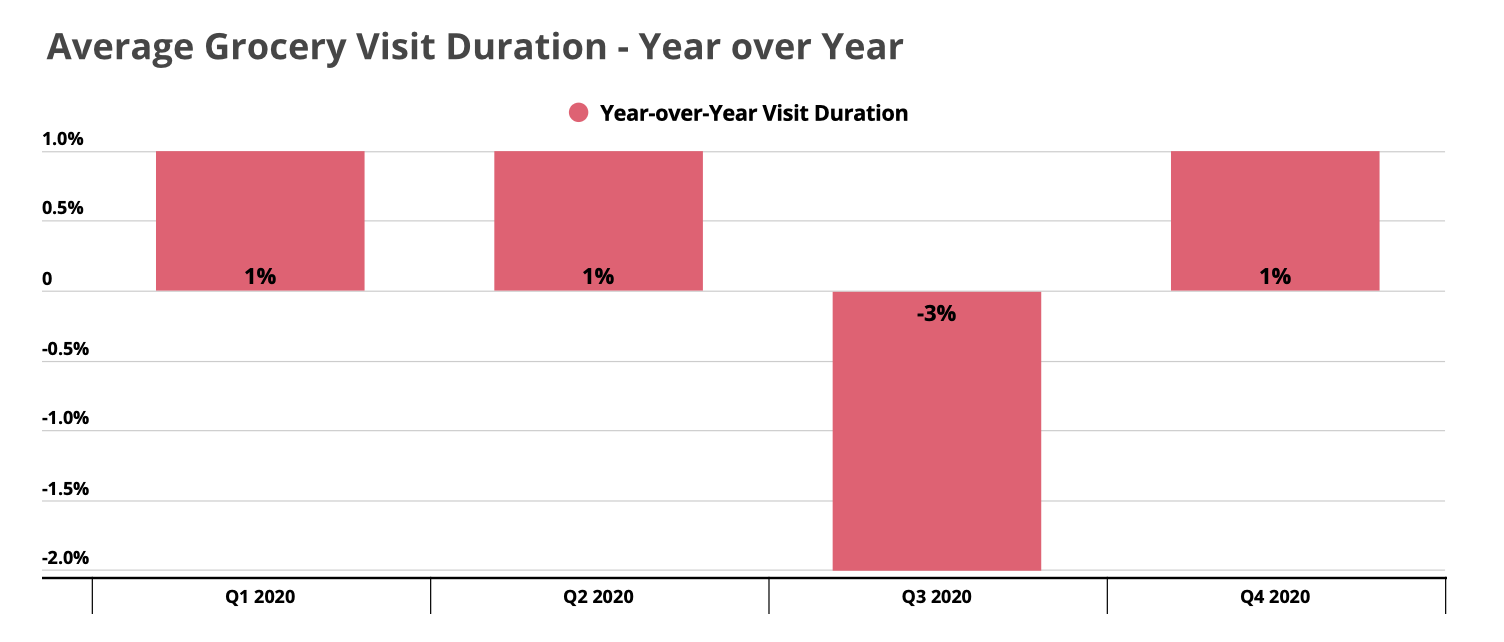

These overall declines for the sector, however minor, also require context. While visits may have been down overall, visit duration still showed growth in Q4. Average visit duration for these brands rose 1% in Q2, dropped 3% in Q3 as visits began to normalize, and rose 1% again in Q4. This indicates the continuation of a mission-driven shopping trend that supported one-stop-shop grocers and led to increases in basket size. So while visits may have dropped slightly for the overall group, the caliber of these visits was more significant.

Equally important is that the increase picked back up in Q4. While the resurgence of COVID cases likely had a major impact here, the jump was significant and shows that this trend could have more staying power than expected.

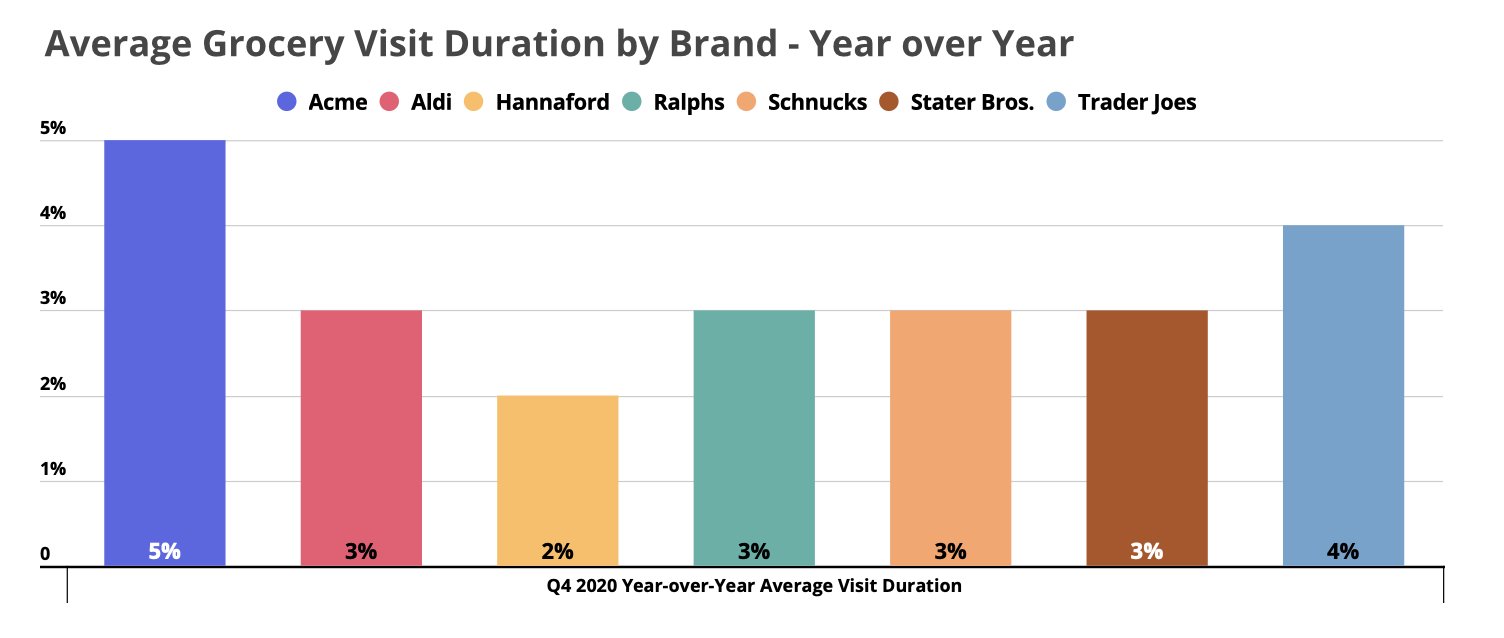

Though there was a wide range of results here too – from 5% year-over-year growth for Acme Markets and 4.0% for Trader Joe’s to flat year over year numbers for H-E-B – most of the brands measured saw a positive mark in this respect. And these jumps are potentially game-changing as they give top grocers like Publix, Kroger, and Albertsons another advantage heading into a year that could put these brands on a pedestal yet again.

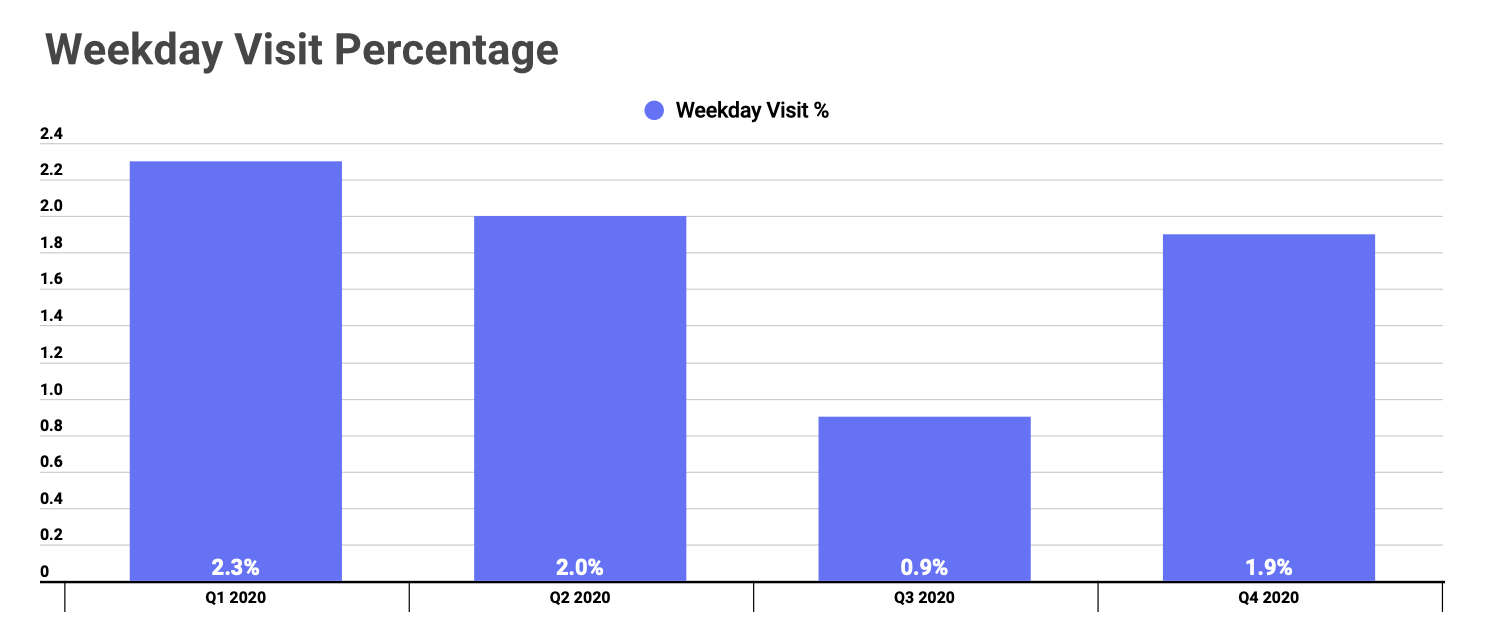

The Weekday Surge

A final trend worth noting is the continued shift in shopping patterns. While Q1’s weekend/weekday split was upended by COVID-prep buying, the shift to weekday visits continued to take place throughout 2020. Q4 2020 saw the proportion of weekday shoppers grow by 1.9%, a significant sign that the shift to a new work/life balance could give this trend some added weight. However, it is also possible that the rise of COVID cases had a direct impact here, making it one of the more interesting trends to track moving forward.

Conclusions

Grocery had a great 2020 – especially when compared to the rest of the retail landscape. But there are signs that 2021 could be equally strong. Growing visit durations and weekday shopping trends indicate a continuation of a pandemic-style environment that drives larger basket sizes. Additionally, the continued specter of economic uncertainty will likely continue to drive visits to the sector deep into the new year. All told, there may not be a sector better positioned for the year to come.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.