The fourth quarter was not good for restaurant sales; each month posted worse same-store sales growth than the previous month. By December, same-store sales growth fell to -13.3% year-over-year, the worst month for the industry since July. Same-store traffic growth for the month was -18.6%, also the worst performance in the last five months.

For more industry performance data visit the Restaurant Industry Snapshot: December Ends 2020 with Exasperating Sales Results; Final Week Offers Reasons for Optimism.

There are many factors that contributed to poor restaurant sales in November and December. The rapidly spiking number of COVID-19 cases came with tighter dine-in restrictions in some areas and may have discouraged some potential diners due to health risks. In addition, colder winter weather eliminated some potential for outdoor restaurant dining, favored by many guests who believe patio seating is a safer option.

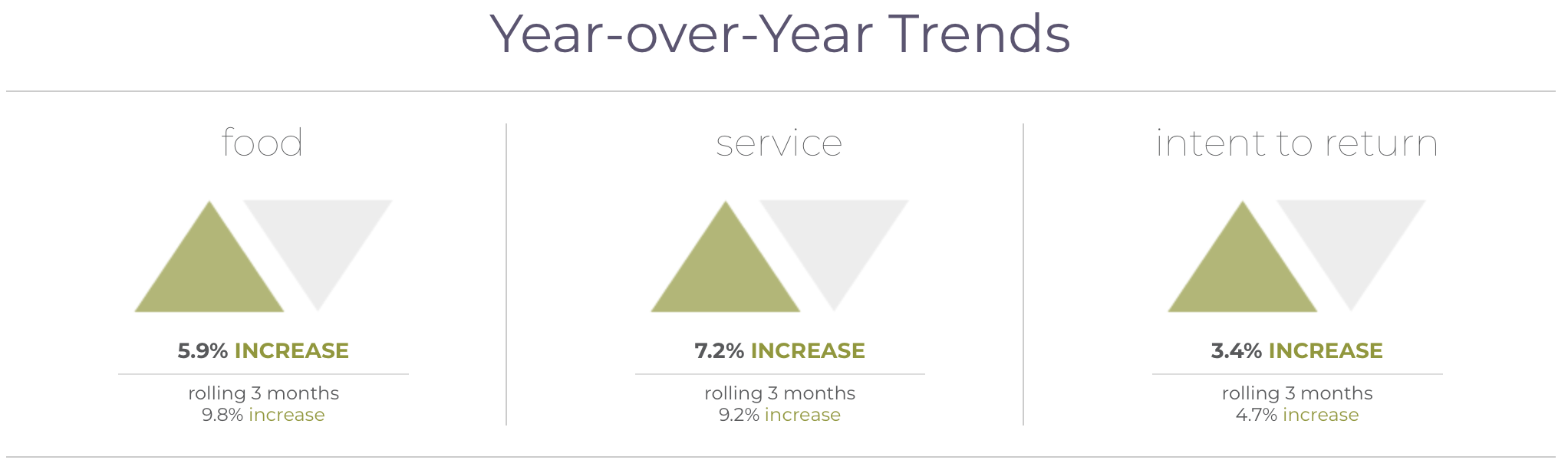

Black Box Guest Intelligence™ suggests that despite the disappointing sales and traffic results, restaurants were successful in meeting their guests’ expectations and raising the guest sentiment for their brands in December.

Ambiance was the attribute with the largest improvement in guest sentiment year over year. As previous data has highlighted, guests are hyper-focused on cleanliness during this pandemic, and it is reflected in their online comments and reviews. In many cases, safety is their primary concern. Meeting or exceeding their expectations for safety is rewarded by positive feedback online.

Sentiment for restaurant service and food improved significantly in December compared to a year ago. For service, net sentiment was the third highest in 2020, only behind September and November which saw the best scores of all for the year.

For food, 50% of all mentions and reviews during the month had positive sentiment. Nonetheless, net sentiment dropped considerably from November scores. As off-premise*** sales growth accelerated again during the month and dine-in sales slowed down, food sentiment suffered as a result. Traditionally, off-premise food sentiment has always been significantly lower than sentiment for dine-in.

*Full-Service: casual dining, family dining, upscale casual and fine dining **Limited-Service: quick service and fast casual

***Off-Premise: restaurant to-go, delivery and drive-thru where applicable

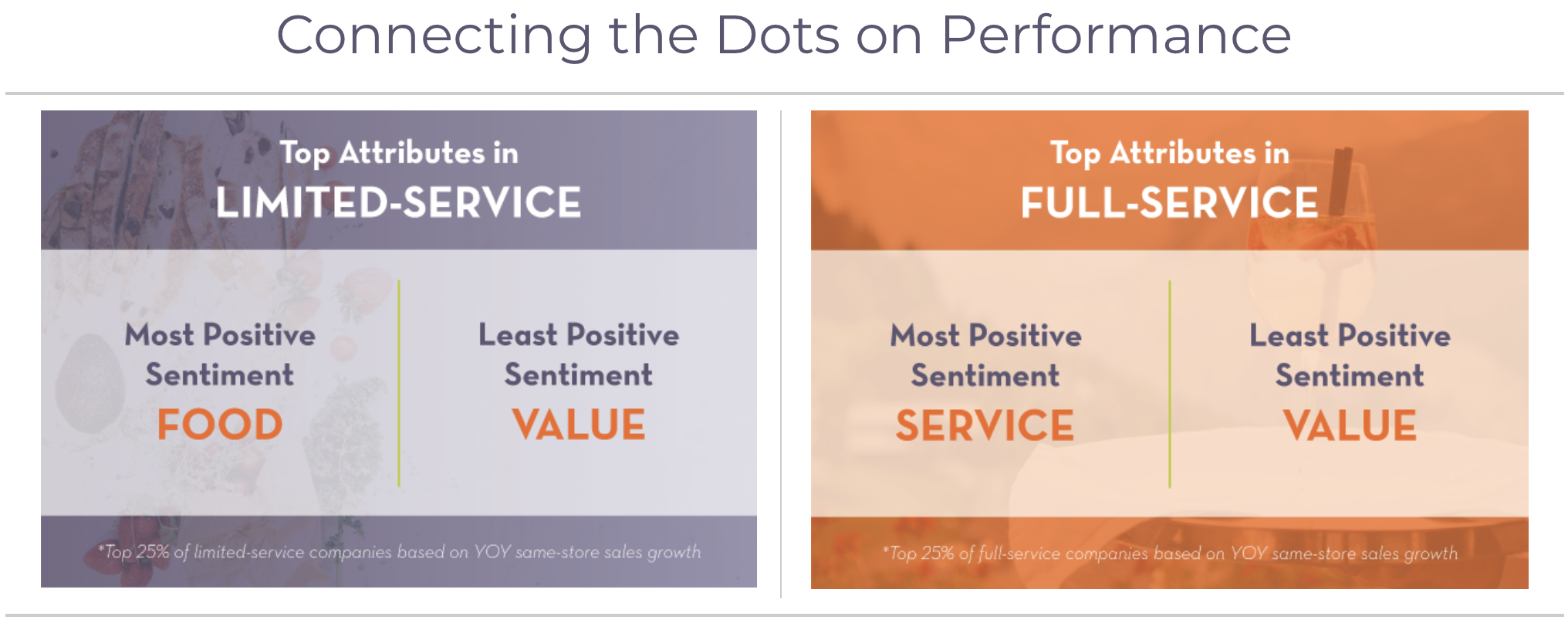

Limited-service continues to achieve much better sales and traffic than full-service but there are some wide ranges in performance at the brand level. Sales growth rates for companies in the top quartile of sales performance were almost 30 percentage points better than those in the bottom quartile. Analyzing guest sentiment by attribute for top performing limited-service companies offers insight into what guests value the most in this environment.

Top performing limited-service brands during the fourth quarter found food rated as their most positive attribute*. With over 80% of all sales in limited-service currently occurring through off-premise channels, one can conclude that food quality is separating the best performers from the rest right now.

Value was the lowest net sentiment for these top performers. Even though the difference in net sentiment between food and value was a surprising 25 percentage points, this does not mean that value is not important in limited-service. Guests of top performing brands would not frequent the restaurant if they did not have an appealing value proposition. But the data is showing that once those guests are there, value is not what they highlight the most as part of their experience.

For full-service restaurants, net sentiment for top performing brands was a lot more consistent across all attributes of the restaurant experience. Here, the attention and importance guests placed on each is a lot more balanced than in limited-service. Only 9 percentage points separated the attribute with the highest and the lowest net sentiment. Value also had the lowest sentiment for full-service. However, value sentiment is much more positive for full-service than for limited-service.

*Attributes tracked by Black Box Guest Intelligence: food, beverage, service, ambiance, value and intent to return.

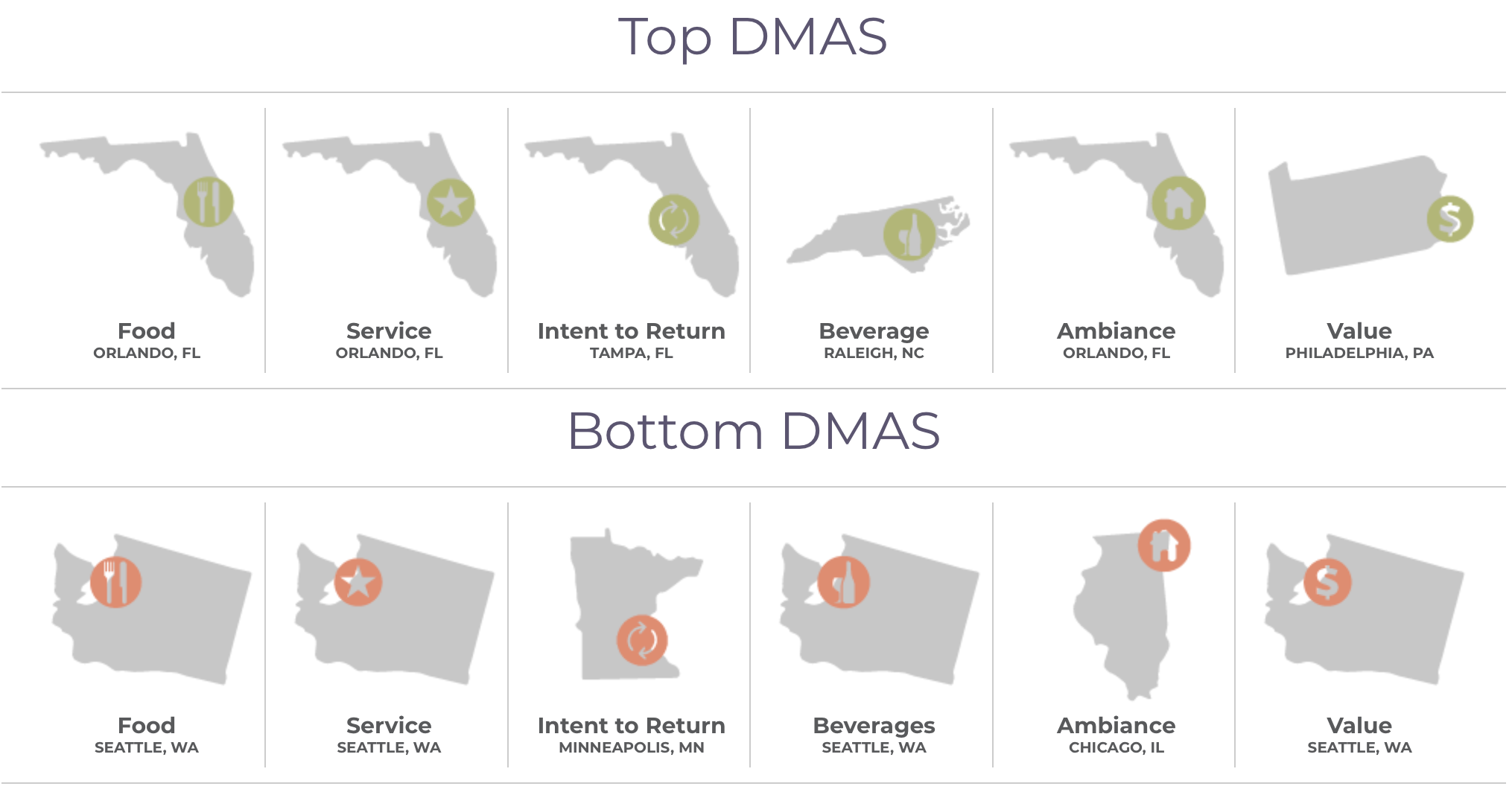

Guest sentiment remained consistent across most designated market areas. Metropolitan areas in Florida topped the rankings for the most positive sentiment in the country. The Orlando market once again hosted the most positive restaurant guests when it came to rating restaurant food, service and ambiance. Restaurant guests in Tampa-St. Petersburg were the most positive based on intent to return.

The latest data also revealed what aspects of the restaurant experience are most impacted by the effects of the pandemic. In December, a clear connection emerged between restaurant food and service net sentiment and sales performance. Markets with the biggest drops in sales experienced much lower guest sentiment around food and service. The opposite is true for markets that retained restaurant sales dollars at a better rate.

Among the 25 largest DMAs, the worst performing markets still had same-store sale losses approaching 50% year-over-year. In this environment, there is little doubt that the virus is the main driver behind this sales downturn. Food sentiment for those same underperforming markets was 16 points lower than DMAs with the best sales results. For service scores, the difference was 17 points.

To learn more about the data behind this article and what Black Box Intelligence has to offer, visit blackboxintelligence.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.