Spending in a Pandemic Across the US, UK, and Germany

With COVID-19 vaccinations just beginning, alongside a further wave of the virus spreading across the globe, Earnest partnered with Fable Data, a European transaction data provider, to assess consumer spending trends across the US, UK, and Germany. We have compared performance across countries and within various sectors since the start of the pandemic, and assessed a ‘current-state-of-affairs’ (Dec ‘20) as consumers exit the holiday season of a global pandemic.

While broader consumer trends across all three geographies appeared similar, the extent of COVID-19 disruptions saw varying degrees of impact across sectors and geographies.

Total Spend – Volatility at lower levels in subsequent lockdowns:

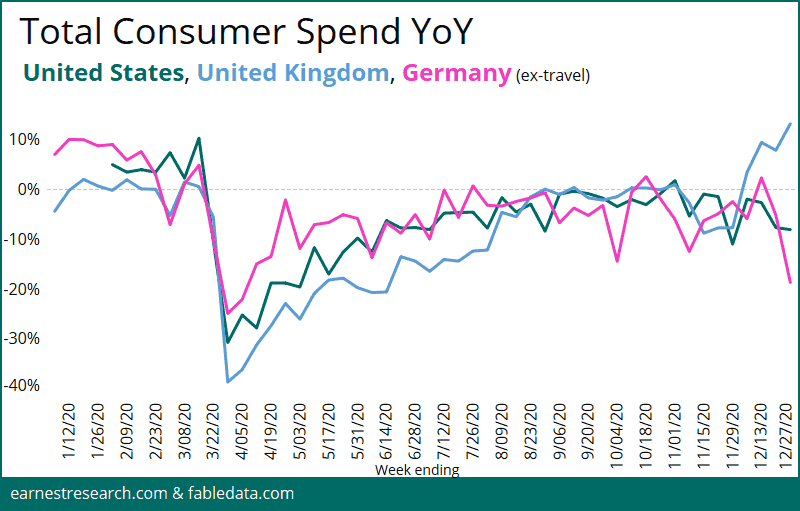

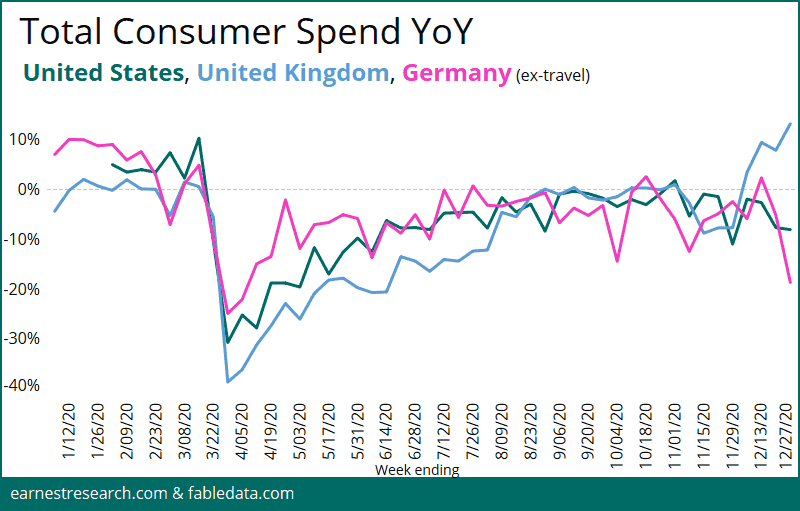

- All three geographies highlighted a gradual climb in 2H20 but still shy of pre-COVID YoY spending levels.

- Subsequent lockdowns and cases surging across geographies has resulted in a re-emergence of volatility in spend, albeit to a much lesser extent than March/April.

- US consumer spending reflected the least volatility compared to the UK and Germany.

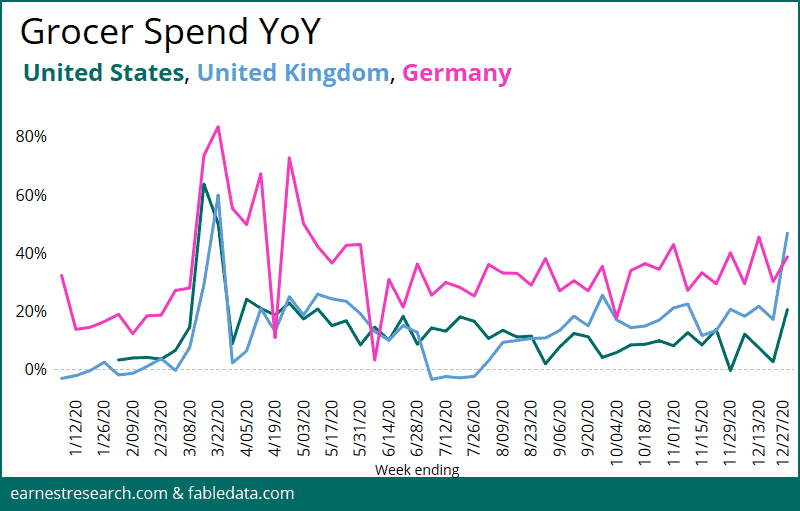

Grocery – Elevated spend through 2020, but no more panic:

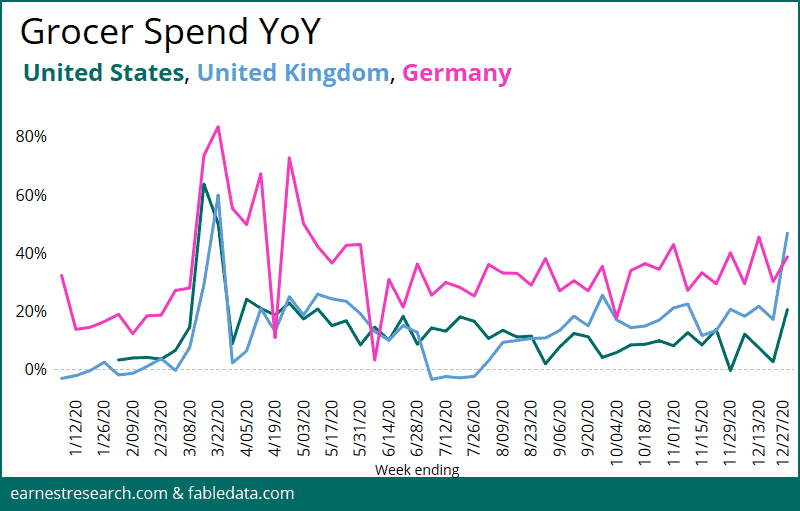

- Spend and basket size surges emerged in all geographies in March 2020, with Grocery spend continuing to be defined by bigger baskets with fewer trips. Renewed UK lockdown restrictions over the holiday period resulted in another material surge in late December.

- Throughout 2H20, spend was still elevated vs. pre-lockdown levels, but the panic appears to have subsided, likely aided by better supply chain and distribution efficiency.

- Increased disruption across the hospitality sector has seen grocery spend growth in the UK and Germany remain higher than in the US.

Food & Beverage – Accelerated trends towards food delivery & takeaway:

- The strength of Food Delivery spend has remained a consistent theme throughout 2020 across geographies. However, while the US peaked in the summer, the UK and Germany Food Delivery spend growth peaked most recently in December, reflecting continued adoption and alternatives being available in subsequent lockdowns.

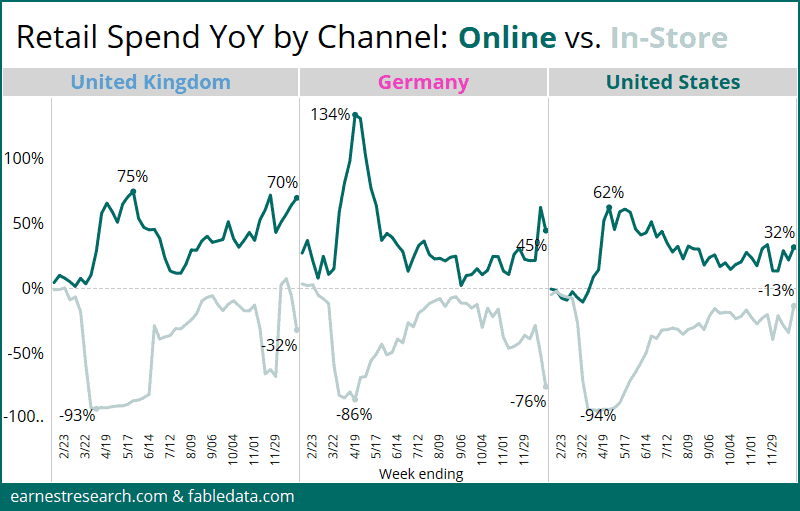

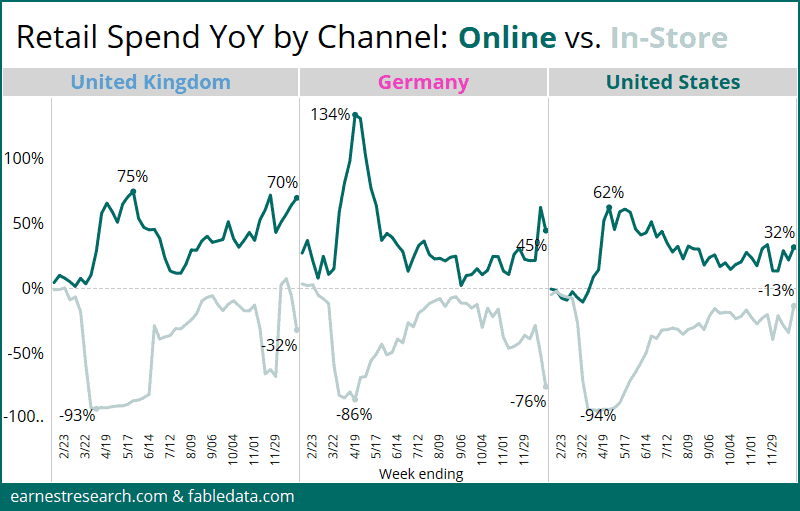

Retail – Online picking up the slack:

- The trend towards e-commerce was country-agnostic, but was slightly more pronounced in the UK and Germany, which have faced more disruptions in terms of physical store closures.

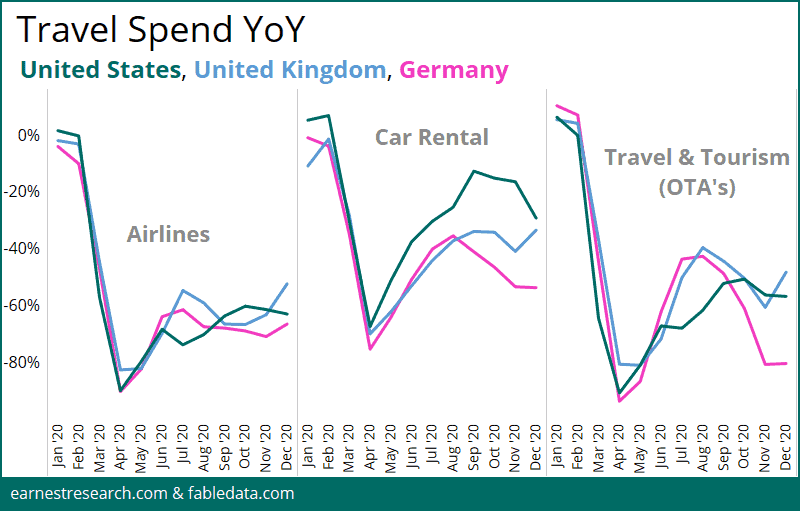

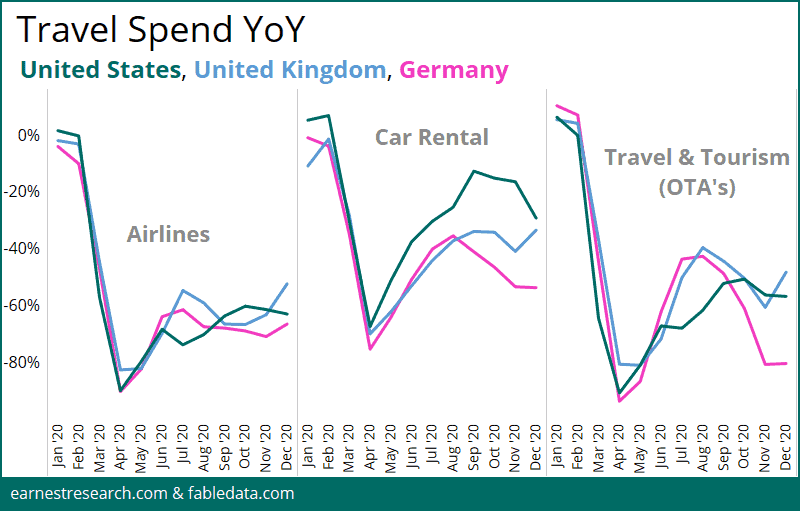

Travel – Spend yet to retrace pre-COVID levels:

- With travel being the most hit from the pandemic across all geographies, greenshoots in domestic travel emerged (e.g. Car Rental, OTAs) over the peak summer months, particularly European OTA spend and US Car Rental spend.

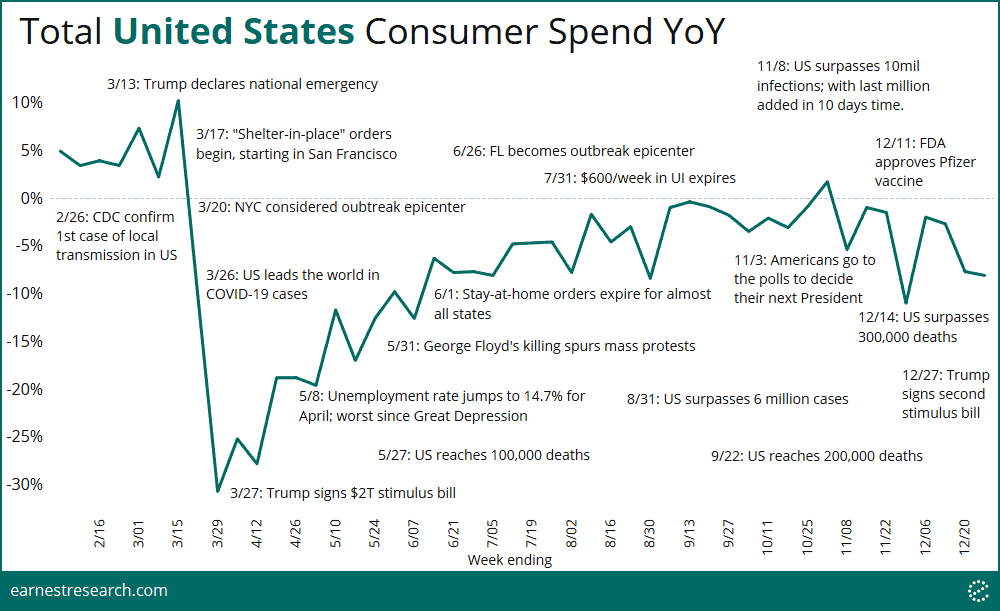

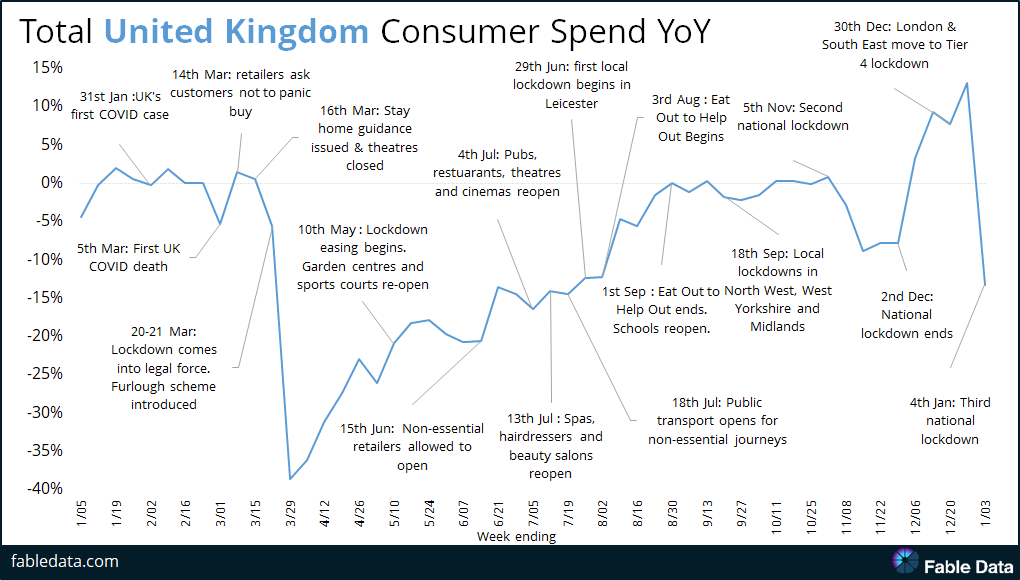

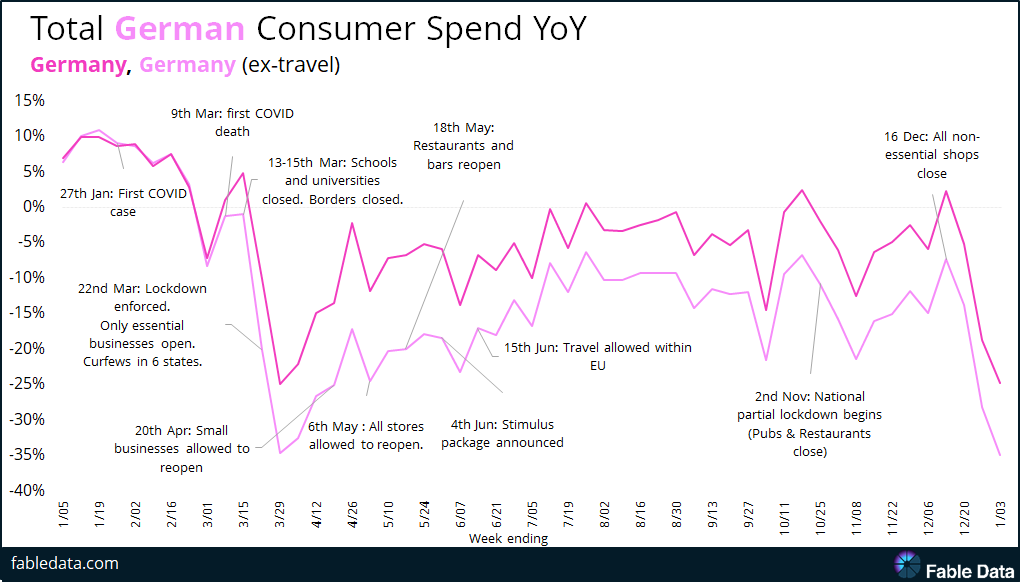

Pandemic-driven behavior across Germany, UK, & US

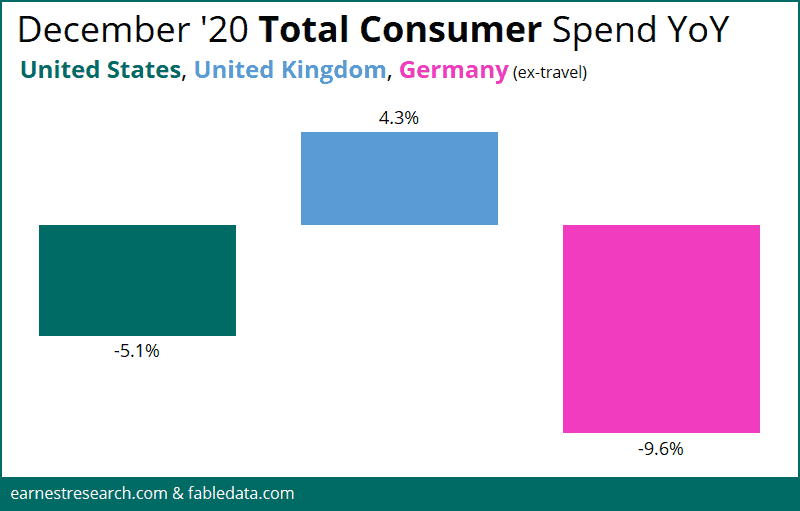

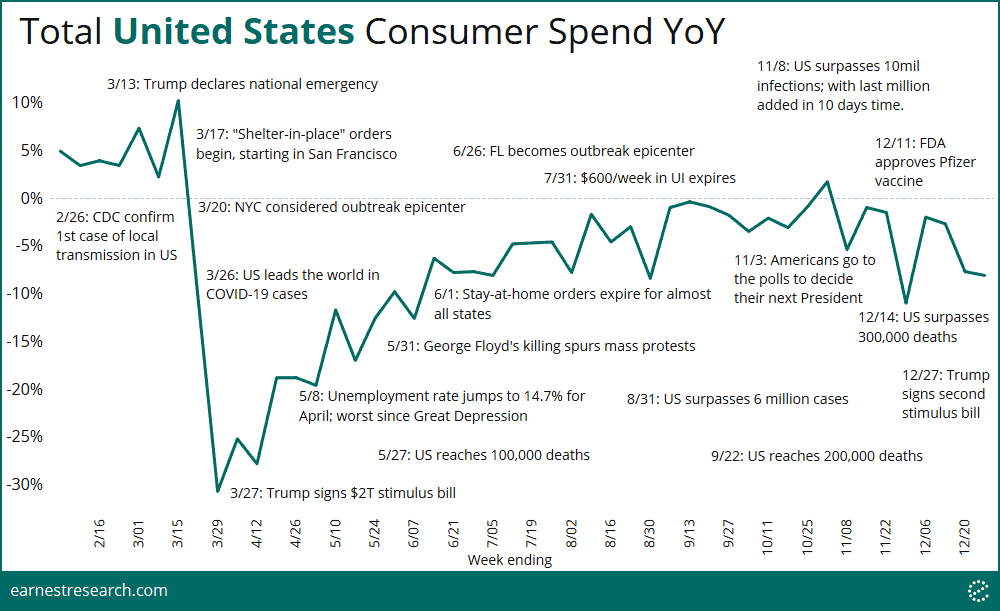

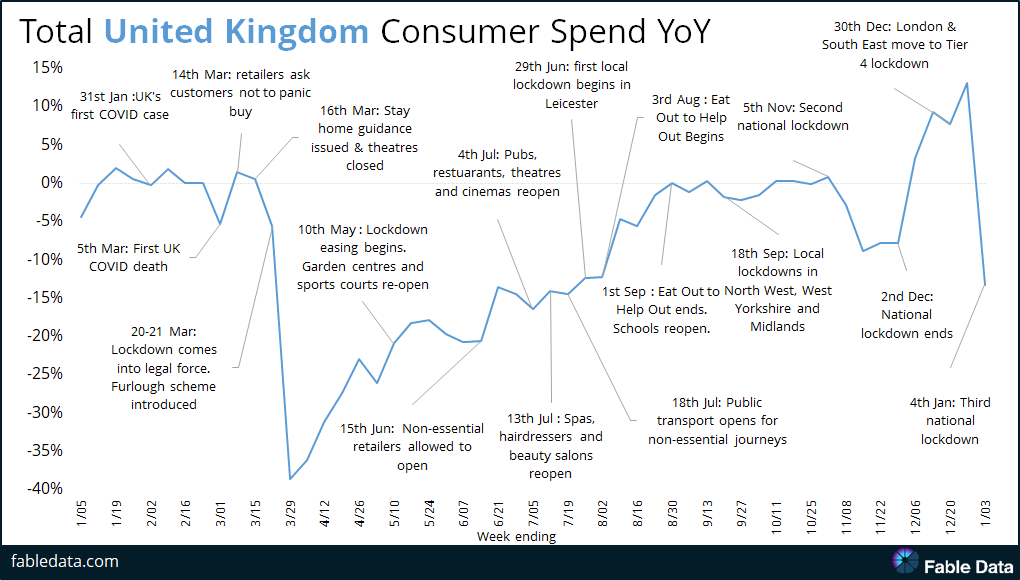

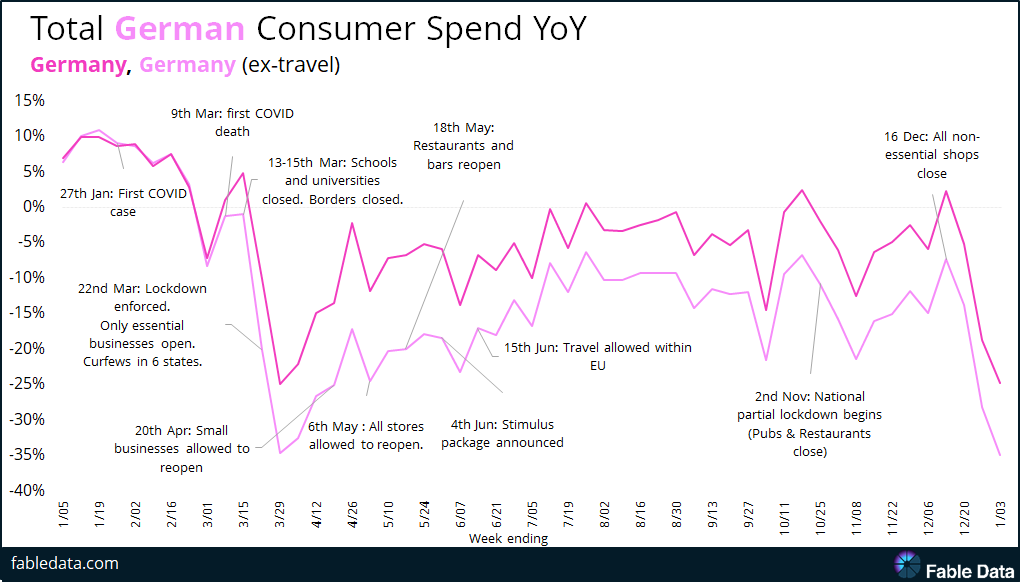

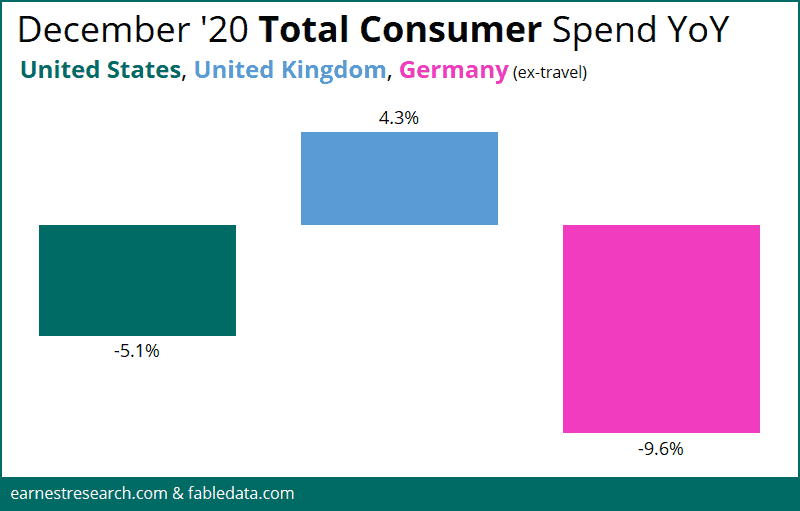

Current State: Still in the midst of a long recovery, aggregate spending has weakened to ~5 to 10% YoY declines across all countries relative to a flat September/October, albeit alongside a recent [temporary] recovery in the UK in December. The UK saw the most pronounced drop in November, impacted by a second national lockdown, which interestingly followed its ability to recover to 2019 levels the fastest from the onset of the pandemic relative to the US and Germany. As second waves of restrictions and COVID cases emerged in all three geographies, spend declines have not mirrored declines seen in the early parts of the pandemic.

*UK spend declined 8% in the two weeks ending 10th Jan 2021

- Pre-lockdown: As the threat of lockdowns emerged in March, stocking up / panic buying was a common theme across all geographies, particularly in the grocery and discount store sectors.

- Initial impacts of lockdown: All three geographies experienced a significant drop in consumer spend in the initial periods of the pandemic (March & April). The drop in spending was most severe in the UK (~40%), possibly reflecting a nationwide approach to lockdown in late March. Both the US and Germany spend reductions reflect a more decentralised approach to lockdown measures (state based).

- Road to recovery: Varying forms of government-led support such as fiscal stimuli were announced in Germany (June), the UK (March), and US (April), which has underpinned a recovery in consumer spending, albeit gradually. German spending (ex-Travel & Tourism) recovered most quickly as restrictions on retail and hospitality eased earlier than in the UK and US.

*UK spend declined 8% in the two weeks ending 10th Jan 2021

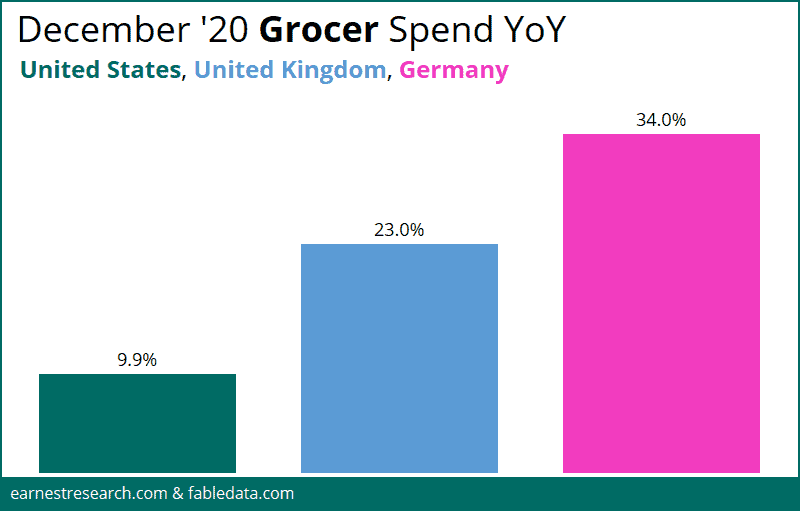

Grocery – Panic subsides in second wave

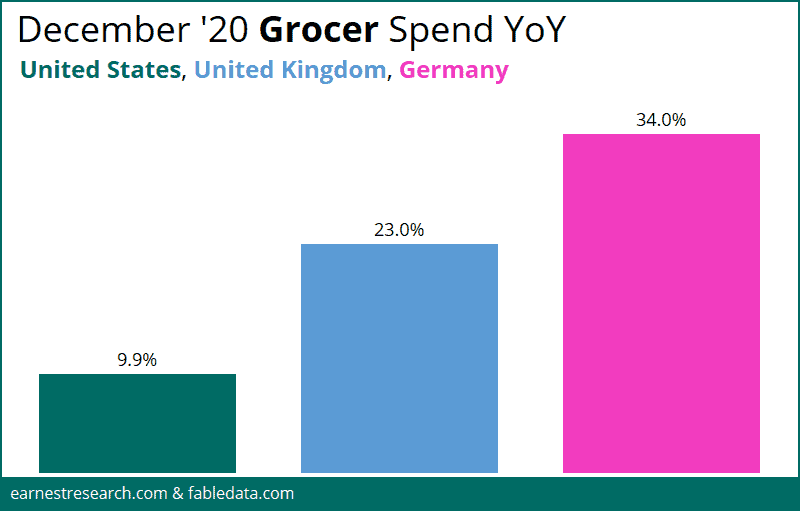

Current State: With renewed lockdown restrictions impacting Pubs and Restaurants over the holiday period, UK grocery spend has surged, along with slight increases in Germany and the US, although not at levels seen during the initial panic buying levels of March and April.

*UK & Germany spend includes Grocery/Bakery/Confectionery

Key takeaways through 2020: The Grocery sector has seen a net underlying benefit in spend through 2020. All countries have continued to see elevated spend relative to pre-pandemic levels, driven by higher basket sizes with fewer trips.

- Pre / Initial lockdown: Grocery related spend increased ~30 to 80% in the US, UK, and Germany from late March – April, a sharp increase relative to low single digit growth in the US and UK (and high-teens growth in Germany) pre-pandemic.

- Re-opening of sector: With restrictions eased across the broader economies, Grocery related spend has still remained elevated YoY, albeit at more moderate levels (compared to Mar-Apr). Importantly, this is driven by higher basket size with fewer visits, with ticket sizes ~$10 to $20 more than pre-COVID levels

- Secondary lockdowns: As second waves of cases and restrictions emerged once more, Grocery spend spiked a bit, but without clear signs of stocking up or panic buying. Spend and basket sizes in the sector are ~20% higher compared to pre lockdown levels, and interestingly equivalent to the March/April panic, but overall sales are not as high as the pandemic’s onset (except for over the holiday periods in the UK & Germany). This is perhaps a reflection of online grocery supply chains having evolved, effective in-store restocking preventing panic, and an increasing number of alternatives have emerged across the sector (e.g. food delivery).

- Grocery related spend growth rates in the UK and Germany appear higher than in the US, perhaps reflecting the impact of the extent of disruption in the Pubs and Restaurant sectors, which have faced strict lockdown restrictions during March-May, November and December.

*UK & Germany spend includes Grocery/Bakery/Confectionery

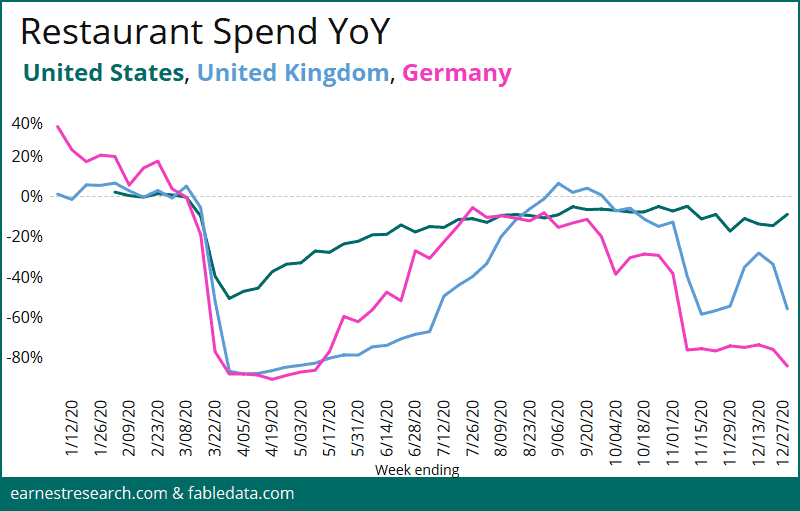

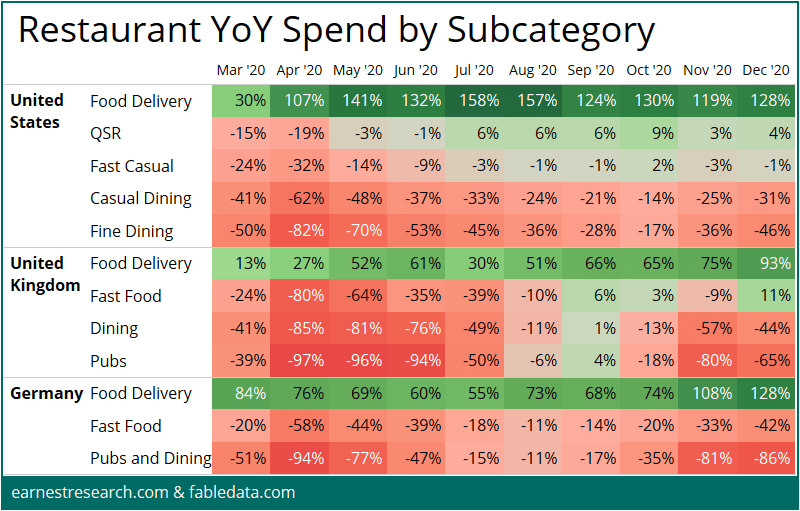

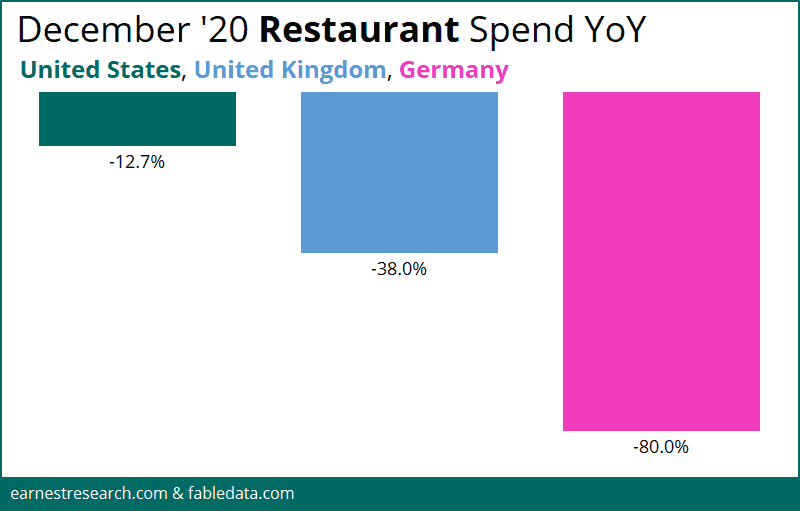

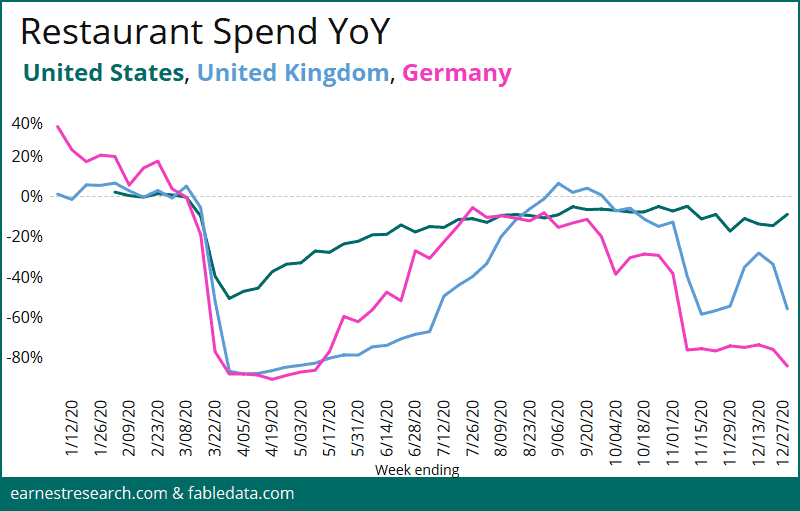

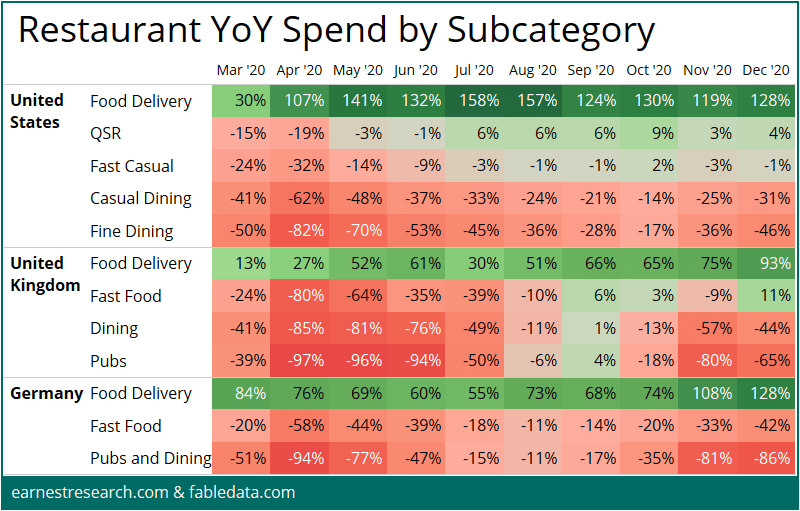

Food Delivery trends provide food for thought

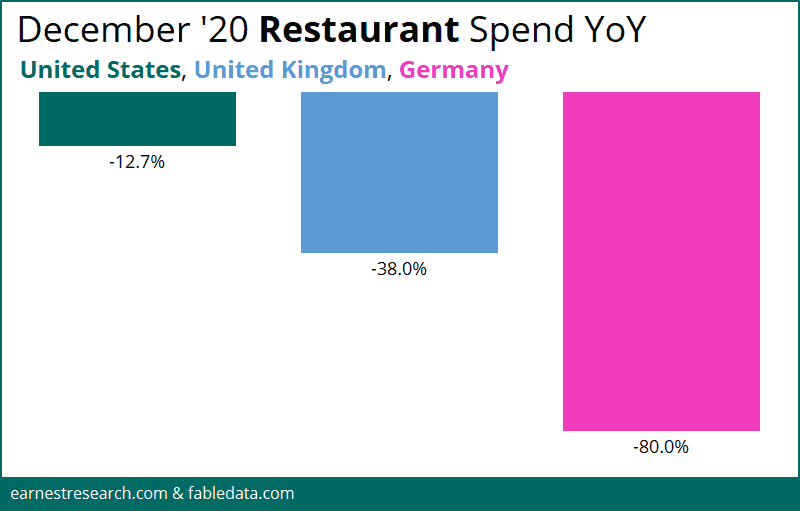

Current State: Secondary lockdowns and subsequent closures of dining venues has seen German dining spend remain suppressed and trend down since November (down ~50% to 70 YoY). A national lockdown in the UK during November once again saw spend decline (~40% YoY), albeit not to the same extent as prior lockdowns (~70% YoY), with spend quickly recovering in early December (to down ~20% YoY) with dining venues partly reopened. The US declined ~13% YoY in December; continuing its slow gradual road to recovery.

*Restaurants include Dining, Pubs, and Fast Food/QSR. QSR in the US is much heavier weighted relative to the UK and Germany thus inflating growth. Chart excludes Food Delivery/Online Ordering.

Key takeaways in 2020 across the Food & Beverage sector: Dining sector spend has been consistently impacted by changing restrictions across all countries, with some lasting impacts:

- German spend rebounded the quickest after the initial drop in March-May, reflecting easing lockdown restrictions.

- Dining spend has been least impacted in the US, reflecting fewer lockdown restrictions.

- Acceleration towards convenience and online food delivery:

- Growth has been unwavering even when the hospitality sector has reopened.

- Average monthly YoY spend within Food Delivery between April – December 2020 was +58% in the UK, +79% in Germany and +133% in the US.

- Food Delivery in the US peaked in the summer, while in the UK and Germany it peaked most recently in December.

- Traditional restaurant sector has adapted:

- Expanded takeaway and delivery options have seen more muted spend declines. Recent lockdown declines of ~40% are less pronounced than earlier in 2020 (~80-90%).

- Government-led initiatives helped stimulate demand:

- In the UK the “Eat Out to Help Out Scheme” introduced in August was effective in stimulating spend across the sector.

- In the US, Food Delivery was a clear beneficiary of federal stimulus checks and increased weekly UI benefits.

- Fast Food spend has been relatively less impacted than Pubs and Restaurants.

- This is a core reason for the US experiencing less drastic declines. We are again seeing this theme as secondary lockdown measures are introduced.

*Restaurants include Dining, Pubs, and Fast Food/QSR. QSR in the US is much heavier weighted relative to the UK and Germany thus inflating growth. Chart excludes Food Delivery/Online Ordering.

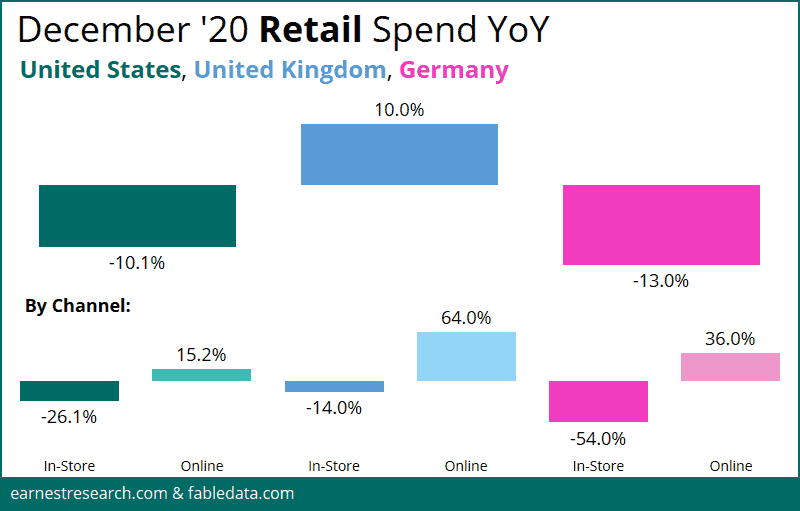

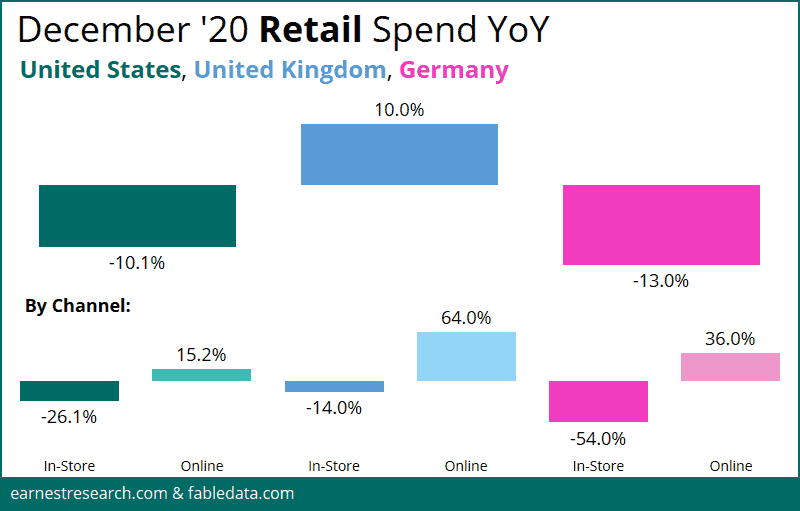

Retail – E-commerce boom

Current State: Despite a strong start to December in which in-store retail returned to YoY growth in the UK, recent lockdown restrictions have once again culminated in a spend decline. A drop in spend is evident in Germany, following the recent closure of non-essential retail stores, and the US has continued to absorb ~10% YoY declines, although the last week of the year saw a slight improvement.

Retail includes Apparel & Department Stores, Health & Beauty, Electronics, and Sporting Goods. US numbers exclude Sporting Goods as they were deemed essential throughout lockdown.

Key takeaways in 2020:

- There is no question e-commerce was and continues to be the lifeline of the hour, and has thus skyrocketed for retail businesses throughout 2020; a theme well pronounced across Germany, the UK, and the US.

- The November/December lockdown-to-opening, back-to-lockdown spiral in the UK carried a highly volatile in-store vs. ecommerce behavior. Most recently we have seen UK YoY e-commerce spend return back to its initial April levels. Germany’s recent non-essential store closures has seen in-store spend drop to near March-April lows, and the US’s steady road to recovery continues to be characterized by ecommerce growth of ~30% YoY alongside in-store declines of ~ 15% YoY.

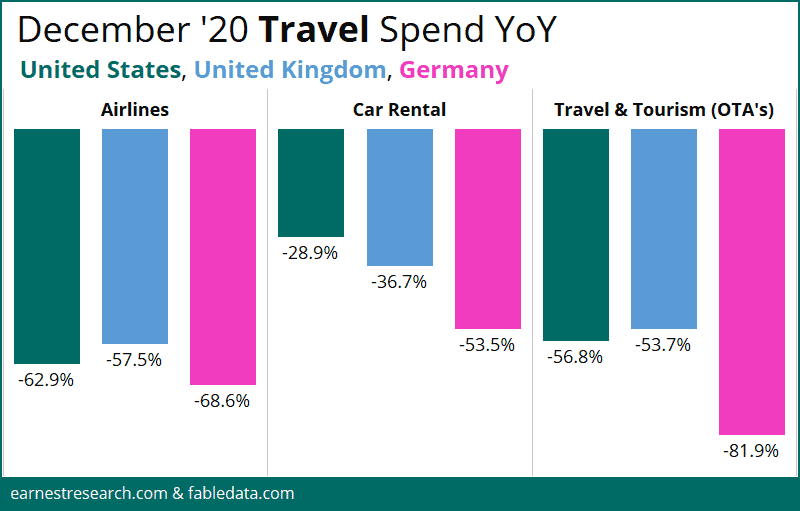

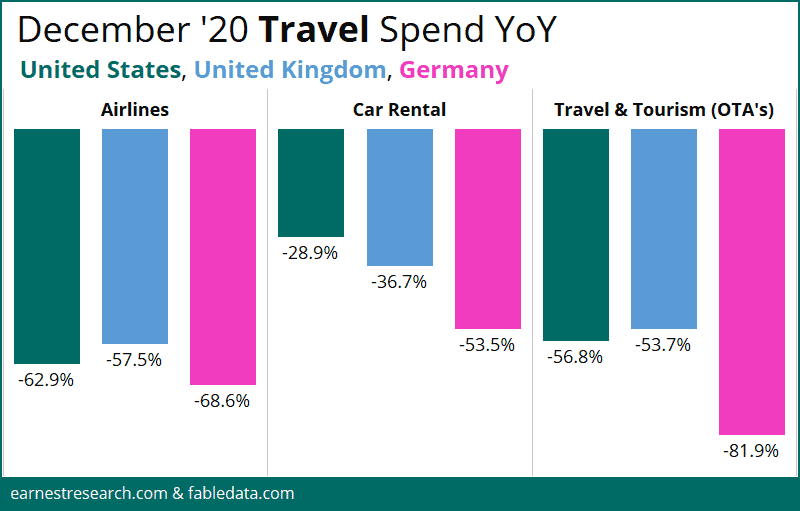

Travel differences – Still waiting for lift-off

Current State: Travel was one of the hardest hit categories through 2020, with spend still yet to recover to pre-COVID levels. Through December-20 spend was most depressed in Germany. Airline spend was down between ~60-70% YoY across all geographies with Germany the hardest hit over the peak holiday period. Car Rental spend was relatively better in the US and online travel agency spend had similar declines across the US and UK at ~55%.

While other sectors have seen a steeper recovery, travel related spend remains subdued and is yet to retrace prior year levels.

- Whilst international travel has been tough, particularly in Europe, greenshoots have emerged in some parts of the domestic travel market. In the months in which travel was less restricted, spend related to Car Rental and domestic Travel & Tourism/OTAs did improve.

- Online OTA’s spend was less impacted in Europe vs the US. This reflects a relaxing of travel restrictions over the peak summer months. US OTA spend has been gradually improving from March-Apr lows.

Appendix

Total Consumer Spending YoY with Annotated COVID Timeline by Country:

To learn more about the data behind this article and what

Earnest Research has to offer,

visit https://www.earnestresearch.com/.