In this Placer Bytes, we dive into pharmacy giant CVS and one of the biggest surprises in retail, Floor & Decor.

CVS’s Continues to Show Strength

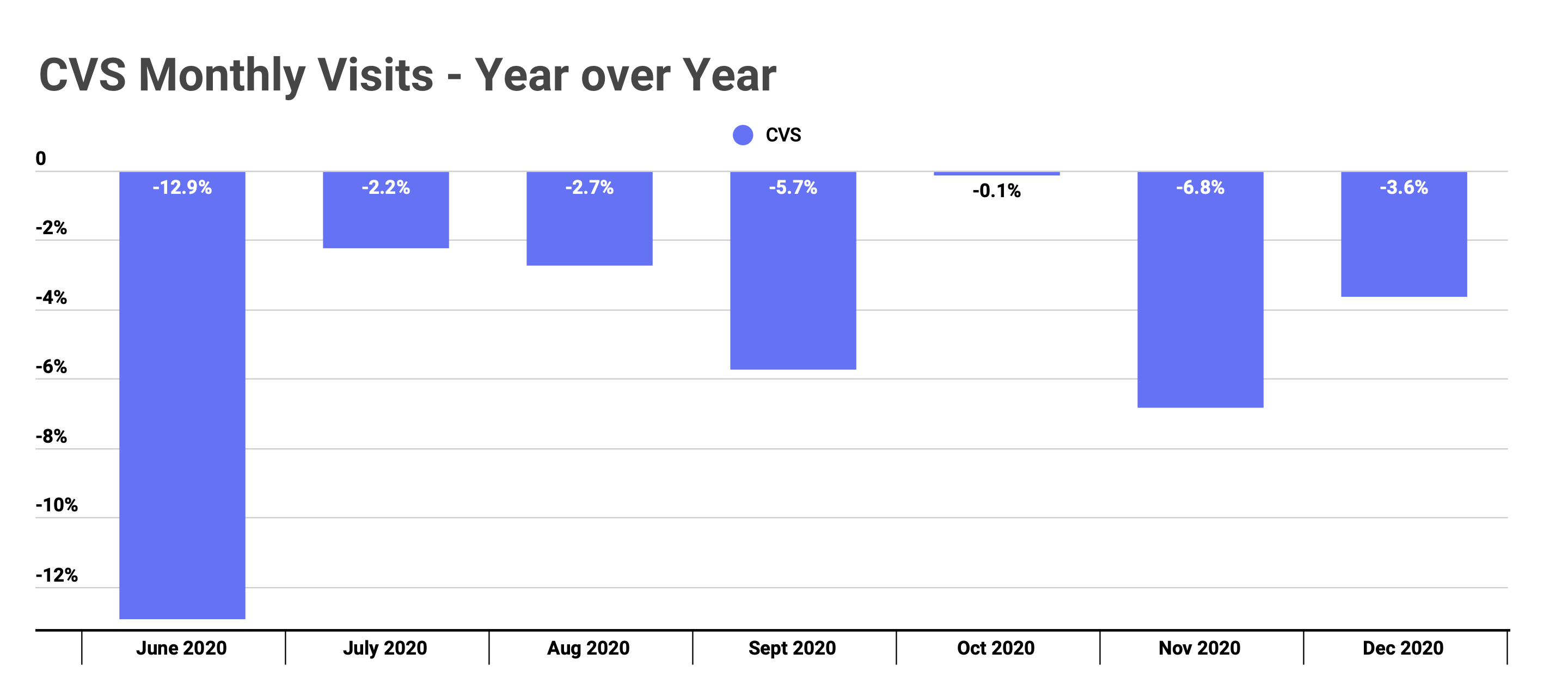

With CVS beginning in-store vaccinations, there is reason to be excited about the brand’s prospects in the coming months. But this is especially true considering the strength it’s already shown. Visits to CVS locations were down just 0.1% in October before a surge in COVID cases drove the visit gap to 6.8% in November. Yet, even with that challenge, visits rebounded in December and were down just 3.6% year over year that month.

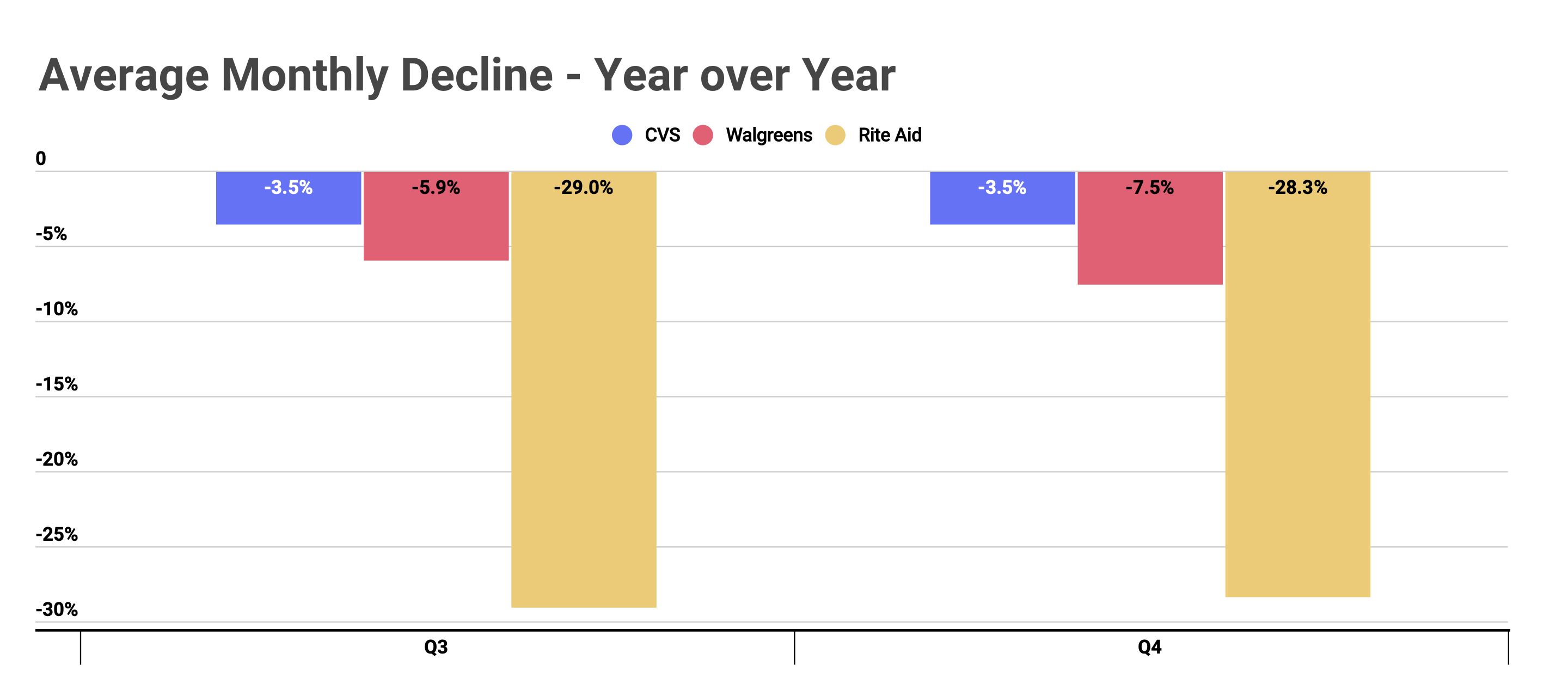

And while the numbers are impressive, when given context from other leading players from the sector, they look all the better. In Q3, CVS saw an average monthly visits gap of 3.5%, while competitors Walgreens and Rite Aid saw gaps of 5.9% and 29.0%. In Q4, CVS saw a continuation of that 3.5% year-over-year gap, even while Walgreens saw its visit gap increase to 7.5%. Critically, this is not because of any weakness on the part of Walgreens who has still seen relative strength compared to the wider retail ecosystem. But it is a huge testament to the ongoing performance of CVS.

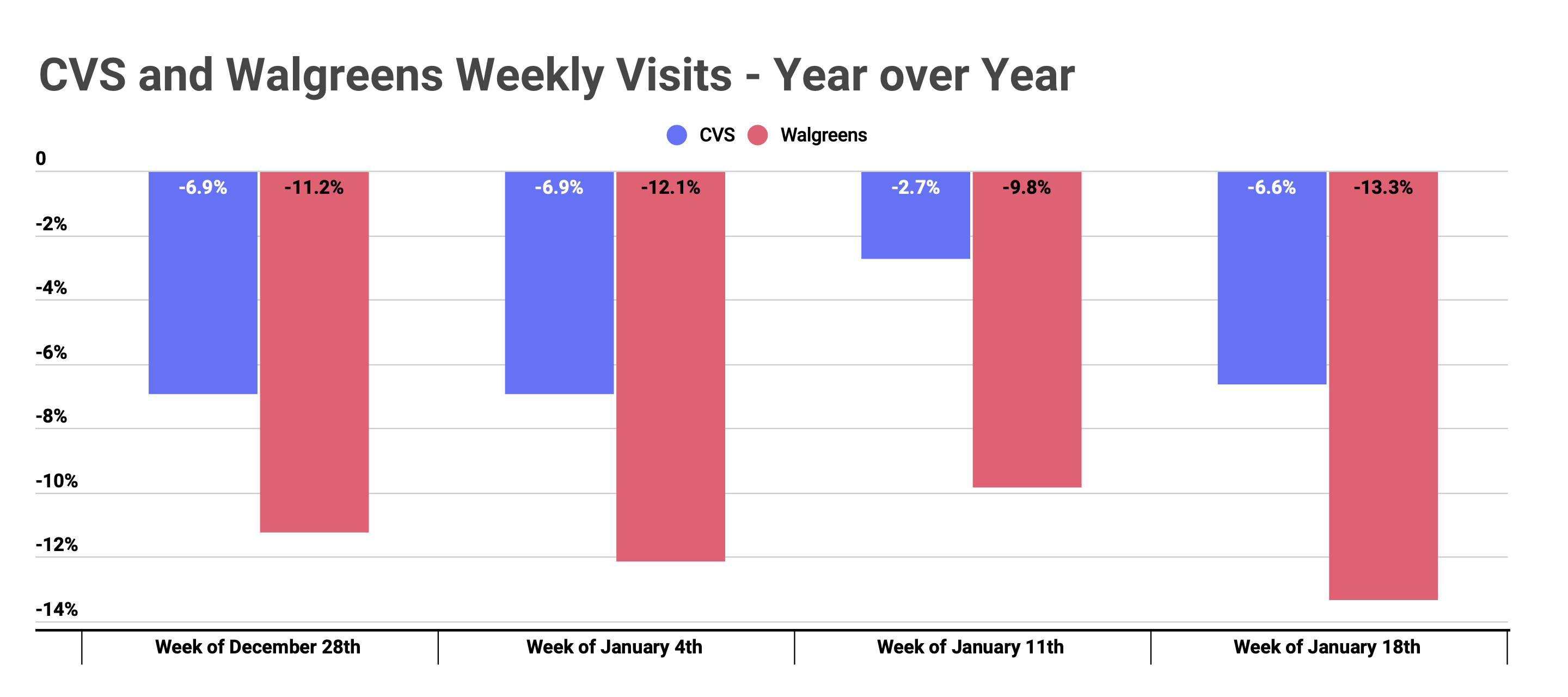

And the same trend continued into 2021 with CVS seeing a visit gap as low as 2.7% the week beginning January 11th. CVS is also a brand that’s uniquely suited to benefit from a large increase in visitors. The brand sells a wide range of items and it’s rare that a customer won’t stumble upon something they need during a visit, even if the initial motivation was not purchase related. This makes CVS one of the most interesting brands to watch in the coming months.

Floor & Decor Continues to Impress

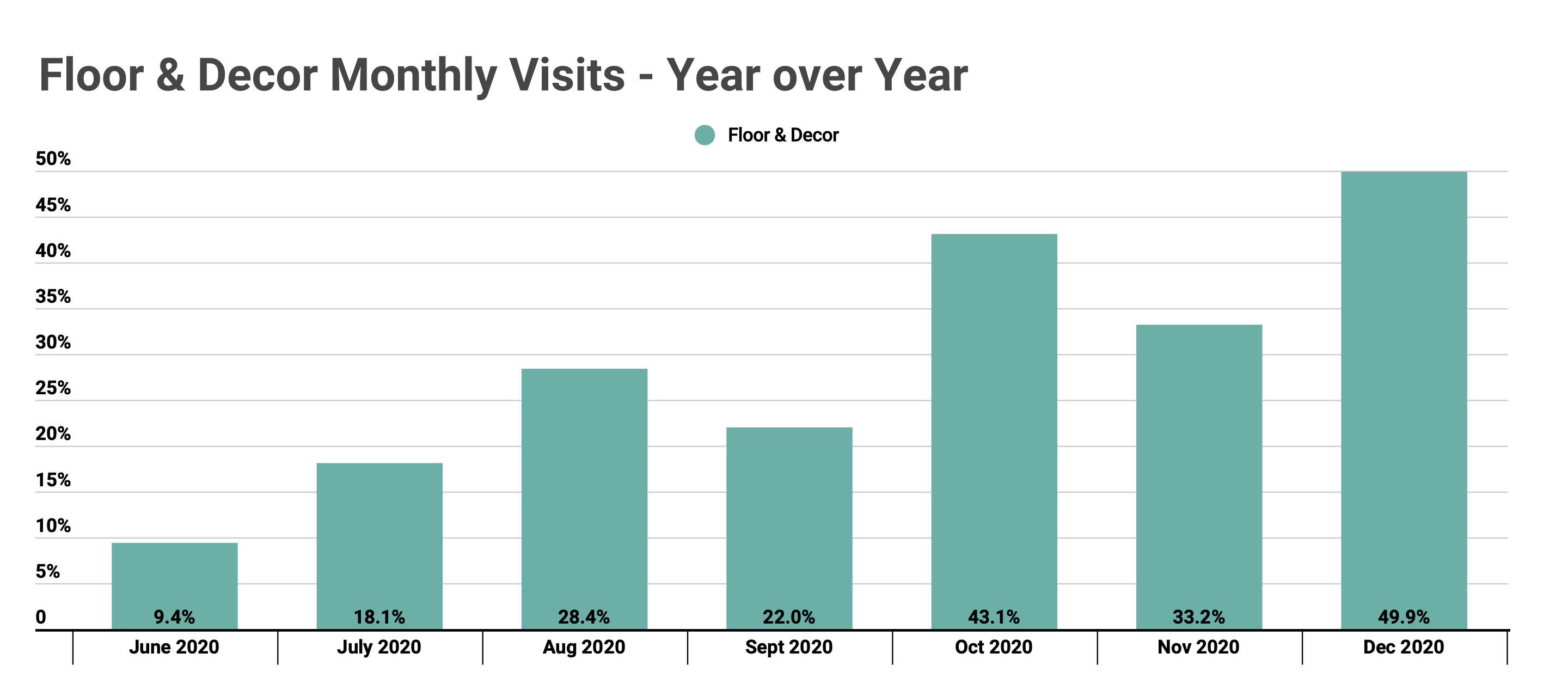

The home improvement sector proved to be among the most resilient in retail throughout the pandemic. And while the sector was filled with winners from leaders like Home Depot and Lowe’s to rising players like Tractor Supply, one brand may take the crown for the biggest surprise. Floor & Decor confirmed that it would be expanding its store fleet in 2021, and for good reason. Visits for the brand have not only been up year over year, but the increase has actually been expanding. In Q4, visits to Floor & Decor locations were up 43.1%, 33.2%, and 49.9% in October, November, and December respectively.

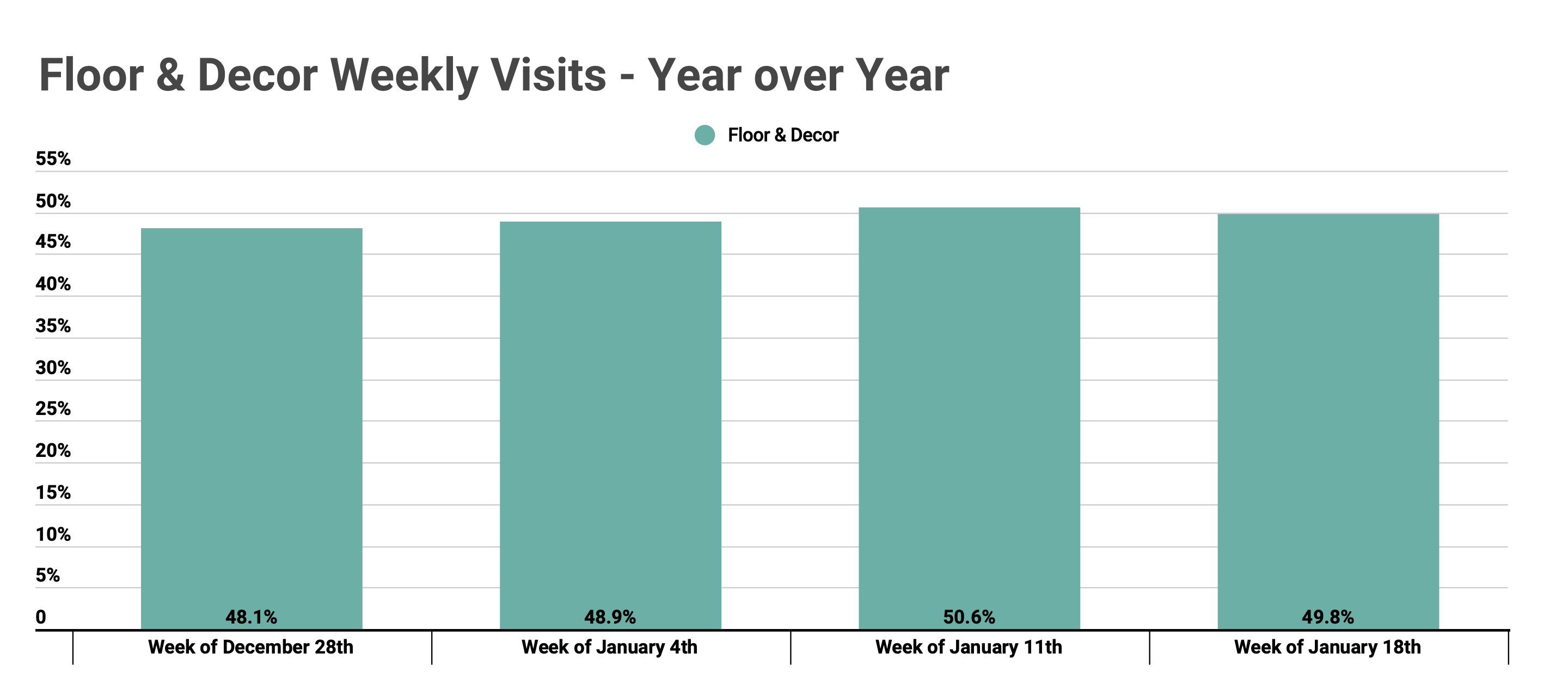

And that pace hasn’t slowed down in 2021 with the weeks beginning December 28th, January 4th, January 11th, and January 18th all up over 45% year over year. These are dramatic jumps that indicate a brand that’s ready to significantly outperform. Add the fact that it’s operating in a wider sector enjoying a huge surge, there are many reasons to be excited about Floor & Decor’s offline potential.

Will CVS and Floor & Decor further set themselves apart as retail leaders in 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.