In this Placer Bytes, we dive into the Q4 performance of Walmart and BJ’s Wholesale to see how these brands ended 2020 and kicked off 2021.

Walmart On the Rise Again

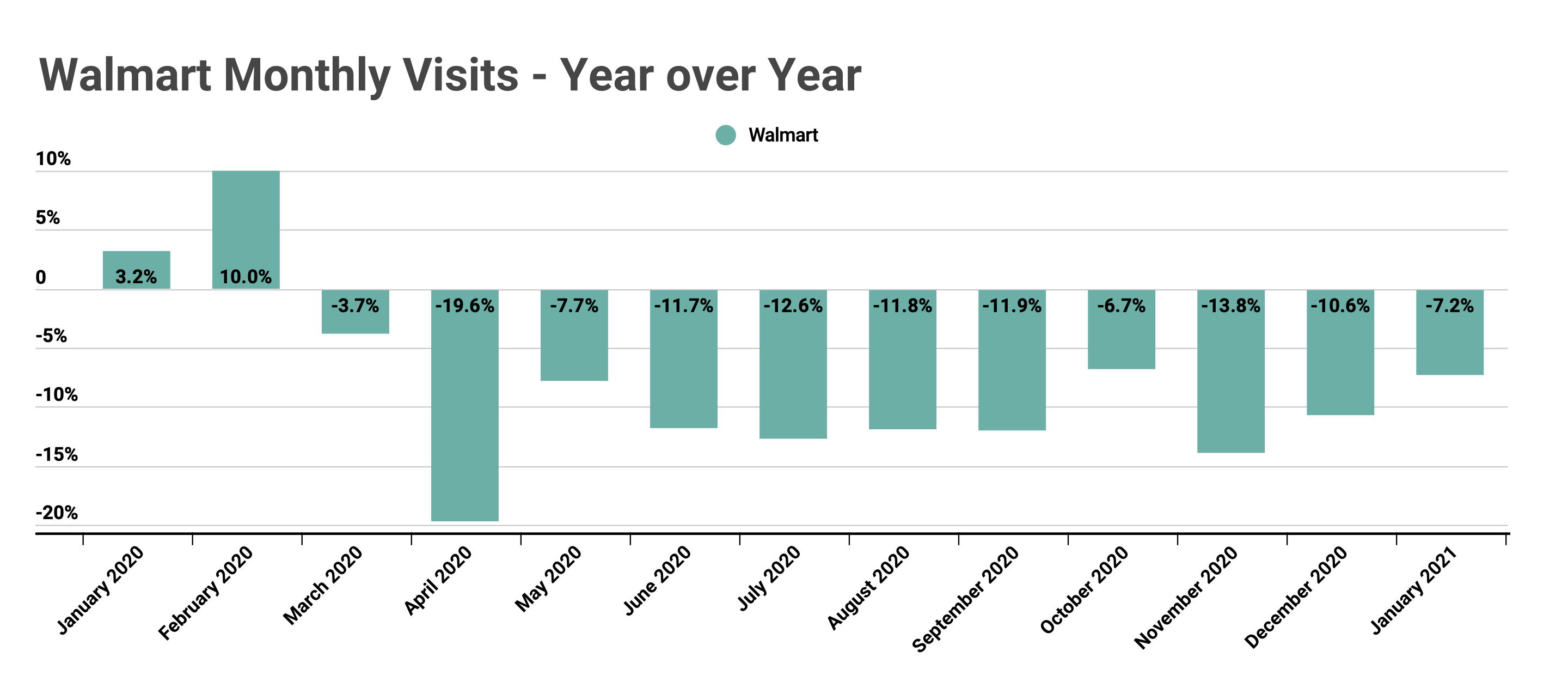

Walmart felt the same offline effects as other retailers in late 2020 as the holiday season was hit hard by a resurgence of COVID cases. The result was a November year-over-year visit gap of 13.8%, the largest since April. But December saw the visit gap shrink to 10.6%, and January saw that drop to just 7.2% year over year – the best since October’s mark of 6.7%. And while this is a success in and of itself, when combined with the mission-driven shopping trend that has boosted basket size, the impact could be even more significant. Should Walmart continue to benefit from digital and BOPIS channels as in-store visits return, the brand could be especially well-positioned for the year to come.

The combination of grocery strength and the economic value supercenters provide align the chain with key retail trends and should be enough to offset any declines in mission-driven shopping. And along with the potential that vaccination centers could offer, early 2021 could drive tremendous success for Walmart Supercenters.

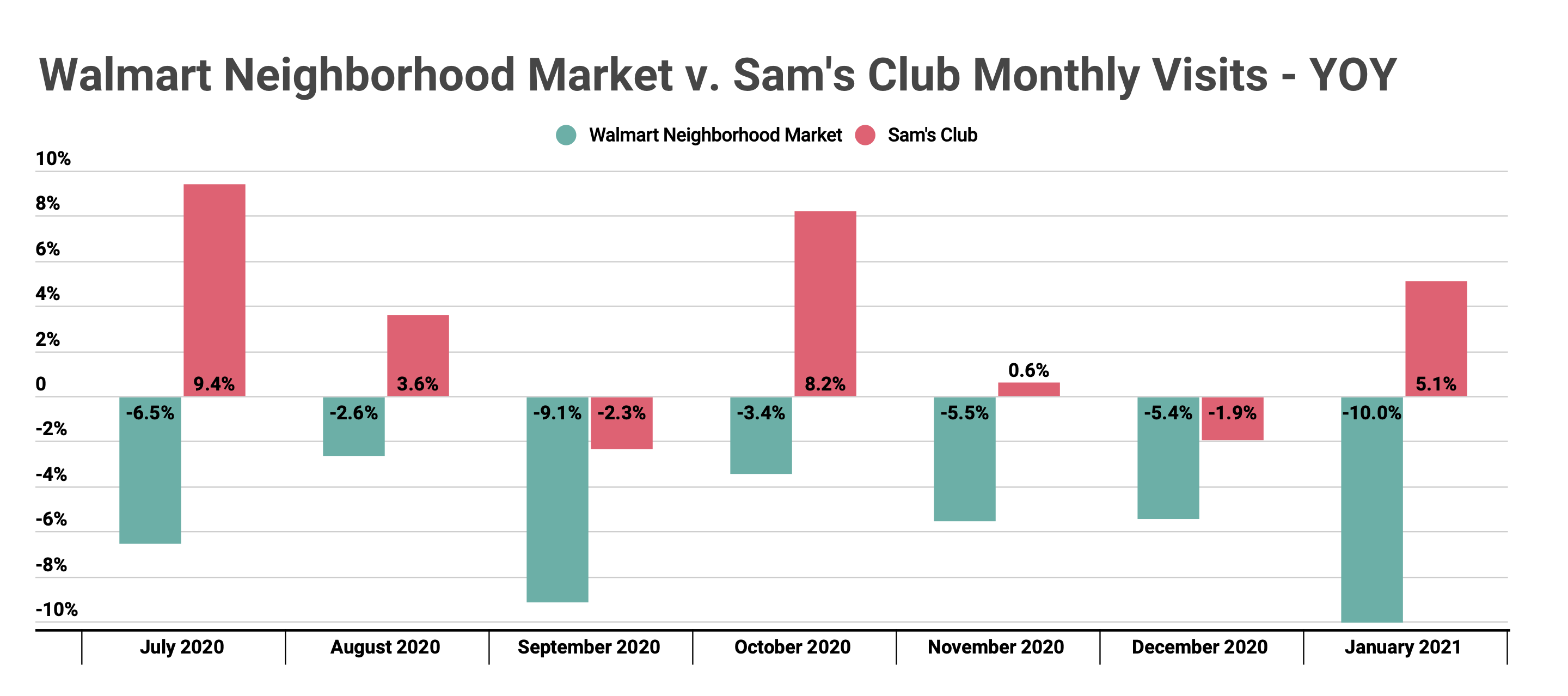

But, supercenters are hardly the only element of the Walmart portfolio. While the Neighborhood Market chain continues to see year-over-year declines, likely as a result of store closures in recent years, Sam’s Club continues to see strength. November visits were up 0.6% year over year before December saw visits down 1.9%. Yet, January already provided a significant boost with visits up 5.1% to kick off the new year. While February will likely see a decline because of fewer overall days than in 2020, the chain is still exceptionally well-positioned. The combination of the wholesale club membership model, the continuation of mission-driven shopping, and the high value these brands provide should create a strong environment for success.

BJ’s Continues to Impress

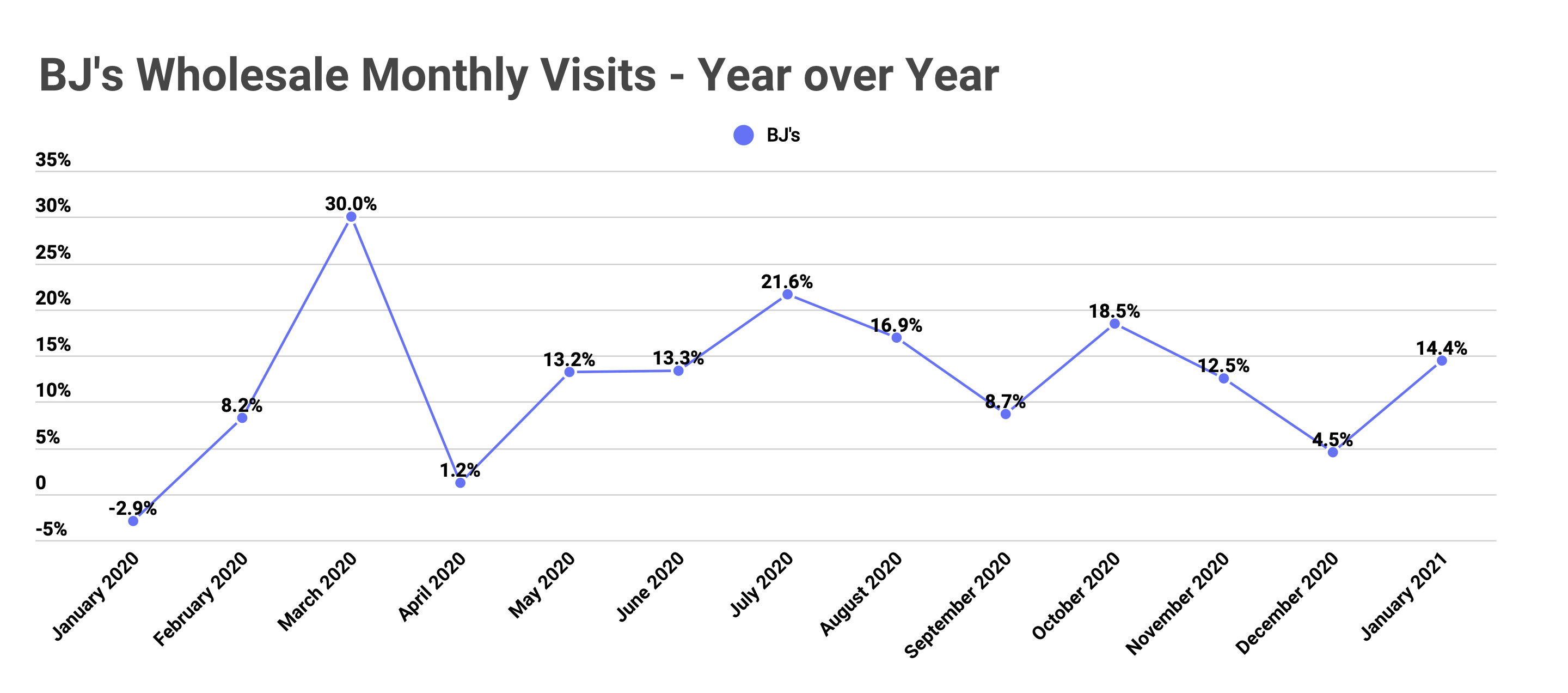

There are few brands that saw the same boost as BJ’s Wholesale during the pandemic. Following a 2019 that was marked by up and down months with inconsistent results, 2020 drove year-over-year growth in every month other than a pre-COVID January. And the brand ended 2020 and kicked off 2021 with similar strength. Visits in November were up 12.5%, and after a December where visit growth was ‘just’ 4.5%, visits surged again in January with traffic up 14.4% year over year.

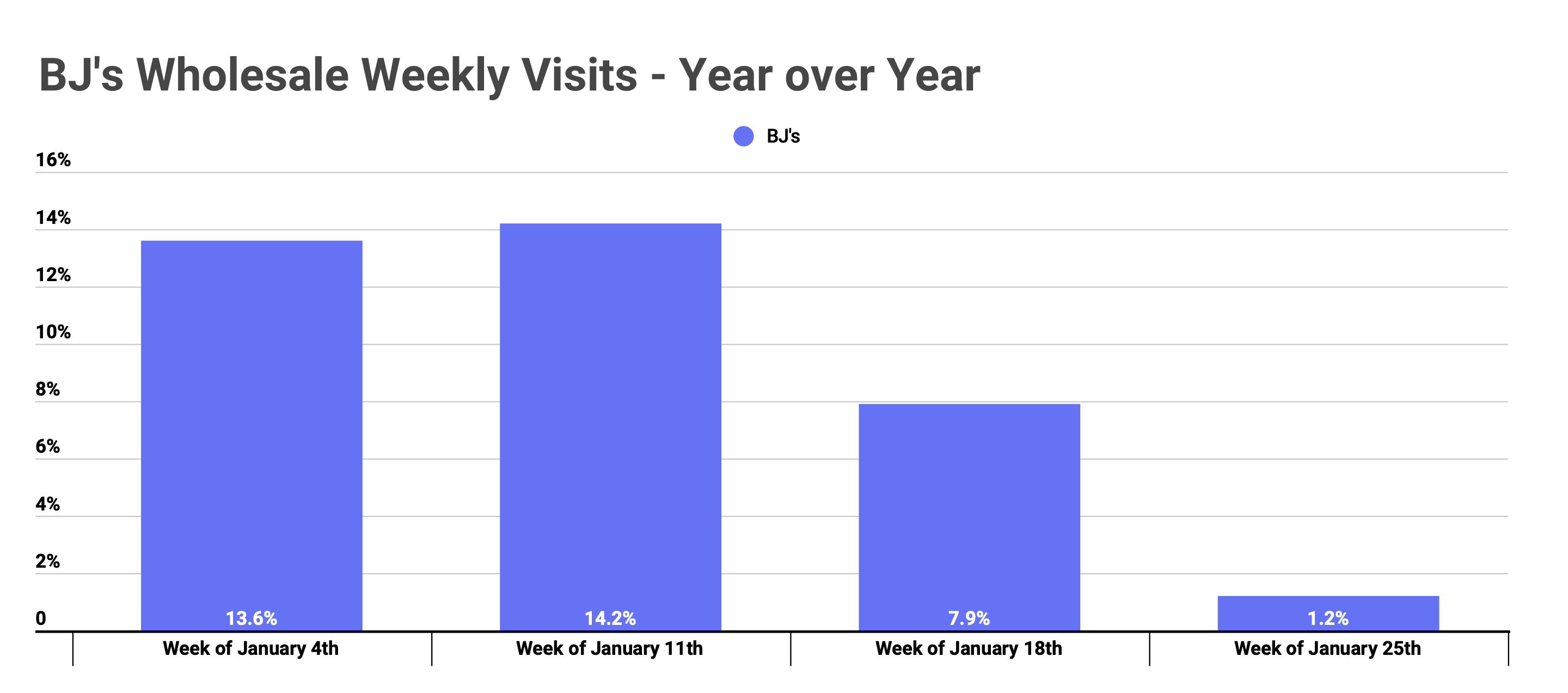

Weekly visits showed that the strength was consistent with all weeks showing year-over-year growth though with the early part of the month seeing the most significant surge. Critically, BJ’s is about to face a very significant test – being measured against 2020’s success for the first time. In this case, even minor year-over-year declines in the coming months would mark a significant step forward for the brand, but increases could signify an even higher ceiling for the company’s recent growth.

Will Walmart hit even higher levels of performance in early 2021? Can BJ’s Wholesale continue to outperform in 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.