When Uber first began trying to grow into smaller markets, some venture capitalists scoffed and didn’t think that its business model was scalable. Years later, the company has certainly proven naysayers wrong. The company has successfully expanded into business lines such as food delivery and just recently alcohol delivery with its purchase of Drizly. It has succeeded in expanding geographically as well, with operations in over 10,000 cities around the world. In parallel with Uber’s success at expansion, CE data has proven successful at capturing the company’s growth across both business lines and geographies. In today’s Insight Flash, we compare how the company’s rides business is performing versus its food delivery business (and potential future alcohol delivery) in the US versus the UK.

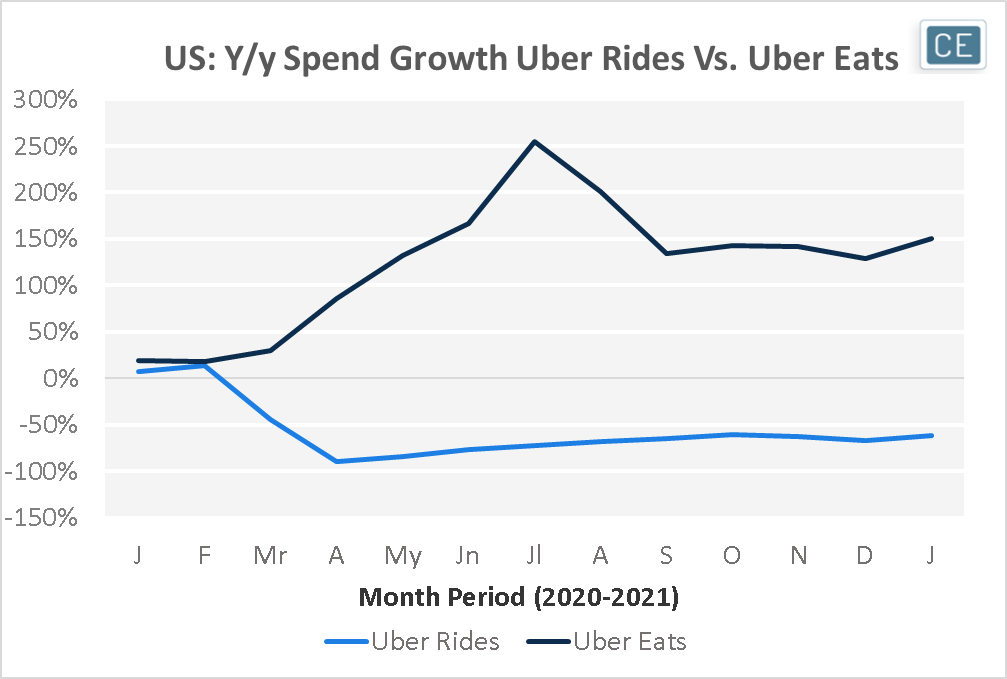

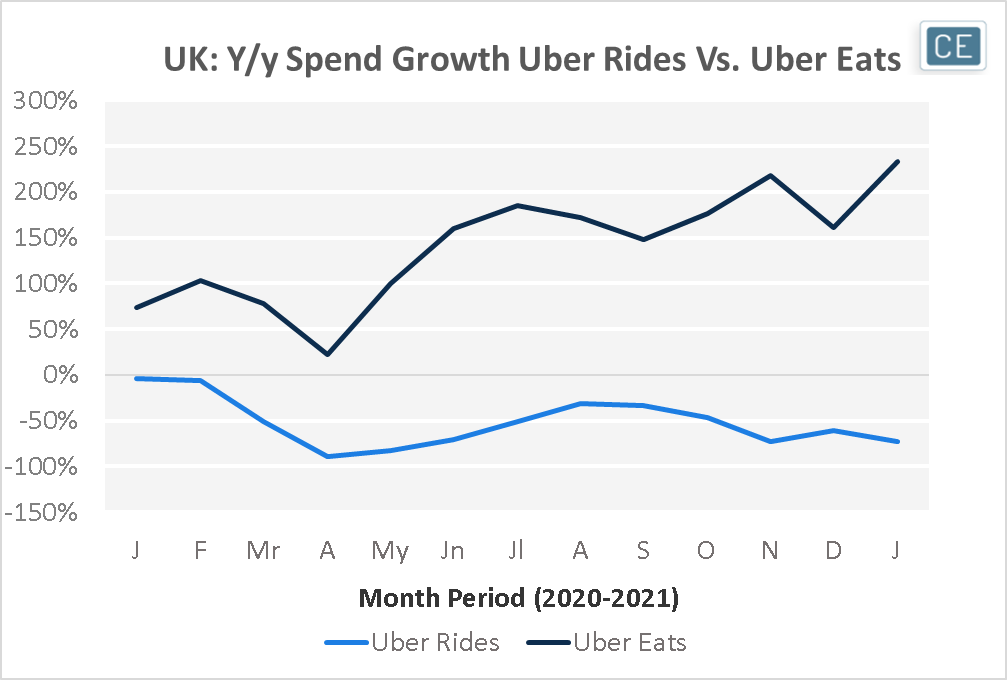

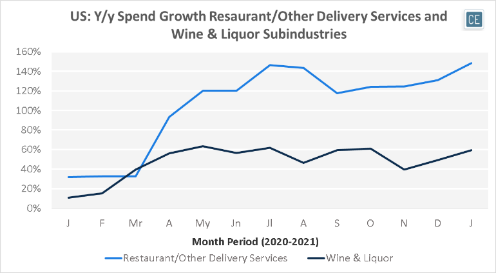

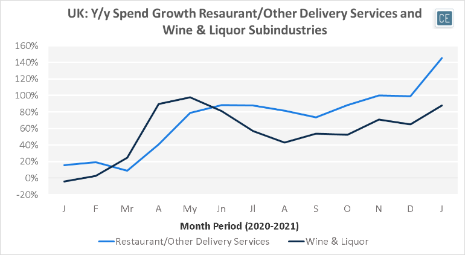

Even pre-pandemic, growth for the Uber Eats business was outpacing the Uber Rides business in both the US and UK. The emergence of COVID-19 in March amplified this difference, with y/y growth in spend on Uber Rides down -90% in both countries in April. Uber Eats sales accelerated very quickly in the US as shoppers sheltered in place and ordered food delivered to their homes, peaking at 255% growth in July before dropping in August and plateuing to ~130-150% growth from September 2020 through January 2021. In contrast, Uber Eats growth saw a slower start to the pandemic and acctually decelerated in April 2020 to only 20% growth. The business soon found its feet, however, and growth has been consistently accelerating in the UK since then, to a peak coming close to that of the US, at over 230% y/y spend growth in January 2021.

Rides vs. Food Delivery

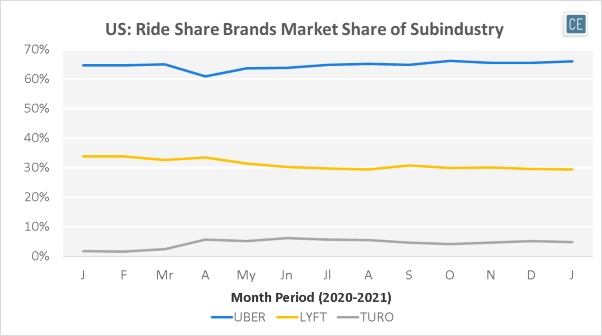

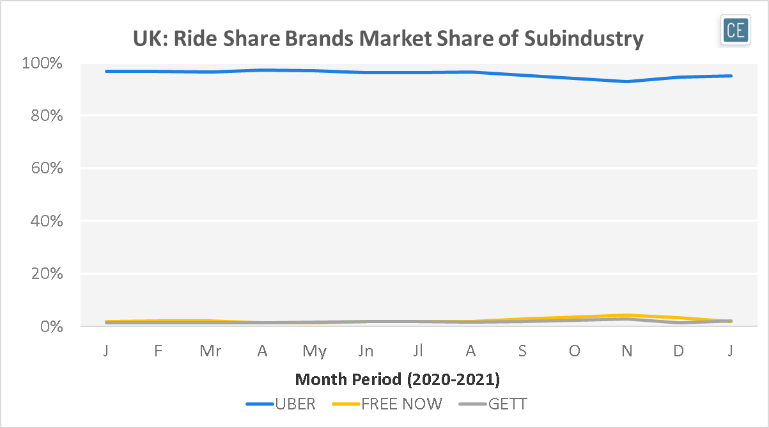

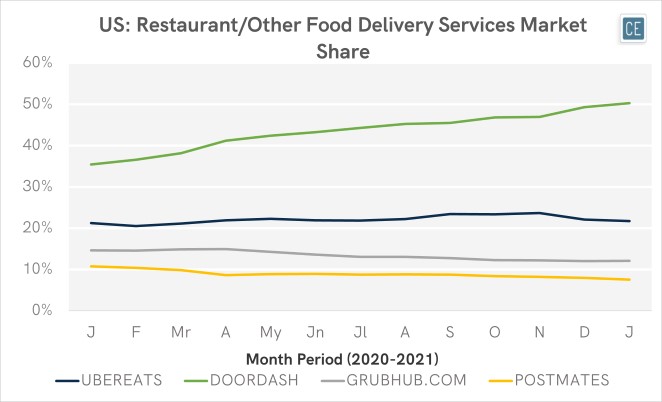

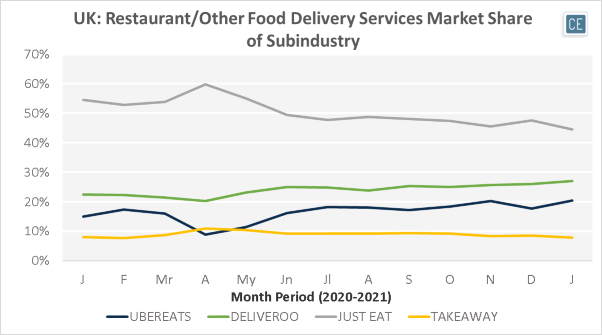

With ride sharing and food delivery both subject to dramatic sectoral trends, market share is an important indicator of performance across geographies. Uber rides is the clear market leader in both countries, with consistent ~65% market share in the US and ~95% share in the UK among tracked brands. The food delivery business has been less dominant. In the US its share has been holding steady around 20-25%, while in the UK its share has increased from 15% in January 2020 to 20% in January 2021.

Market Share

Note: Spend share; subindustry includes tracked brands only

In either country, the move into alcohol delivery could deliver additional upside. Wine & Liquor spend in the US has grown at least 40% y/y in every month since March, reaching as high as 60% for several of those months. Uber’s recently announced acquisition of Drizly could give it a toe into that attractive market. If the company were to expand similarly in the UK, prospects could be even better. UK Wine & Liquor spend growth outpaced food delivery growth in March through May of last year, and continues to show growth much closer to attractive food delivery rates.

Alcohol Delivery Growth

Note: Spend share; subindustry includes tracked brands only

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.