Source: https://secondmeasure.com/datapoints/food-delivery-services-grubhub-uber-eats-doordash-postmates/

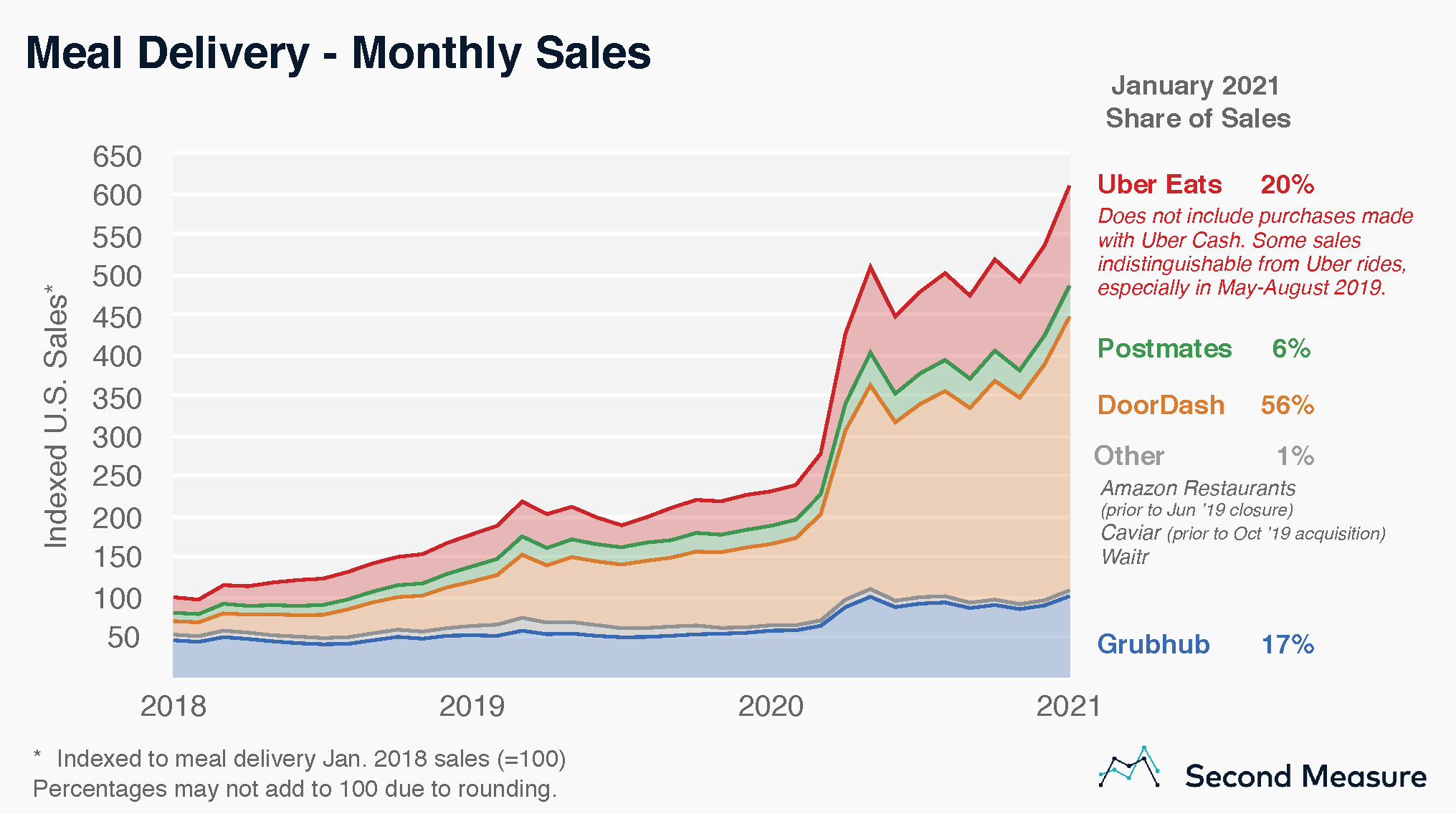

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in January, sales for meal delivery services grew 164 percent year-over-year, collectively.

Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase. In January, 46 percent of U.S. consumers had ever ordered from one of the services in our analysis, up from 36 percent a year ago.

These thriving businesses are in the spotlight during the COVID-19 era. In December, DoorDash made its public market debut with one of the biggest IPOs of 2020, while Uber acquired Postmates at the end of November in an attempt to consolidate market share and boost profitability. Uber is also seeking ways to diversify its existing business strategy, such as by launching a U.S. grocery delivery service and acquiring alcohol delivery company Drizly. Meanwhile, DoorDash’s partnership with CVS marks the company’s first foray into grocery delivery.

DoorDash and its subsidiaries earned 56 percent of U.S. consumers’ meal delivery sales in January, while our data indicates Uber Eats came in second place with 20 percent. It’s worth noting that our sales metrics may differ from publicly reported earnings for a number of reasons. First, some Uber Eats transactions are indistinguishable from Uber Rides transactions in Second Measure’s data, and this issue was especially pronounced from May 2019 to mid-August 2019. Additionally, Second Measure’s data does not include Uber Eats’ purchases made using Uber Cash or purchases made by corporate customers, an area where Uber Eats is reportedly making inroads. Our analysis includes aggregated debit and credit card purchases from a panel of millions of anonymized U.S. consumers. Postmates earned 6 percent of the U.S. meal delivery market in January, bringing Uber Eats’ total market share to 26 percent.

Grubhub and its subsidiaries, which include Seamless and Eat24, came in at 17 percent of U.S. meal delivery consumer spending in January. (Purchases made through LevelUp, which Grubhub acquired in late 2018, are not included in our analysis. Neither are college student meal plan purchases made through Grubhub subsidiary Tapingo.)

One of the industry’s smaller services, Waitr, earned 1 percent of national sales. In January 2020, the company announced plans to lay off all drivers in favor of using contractors. The change came weeks after Waitr installed a new CEO as it tried to boost share prices and remain listed on Nasdaq.

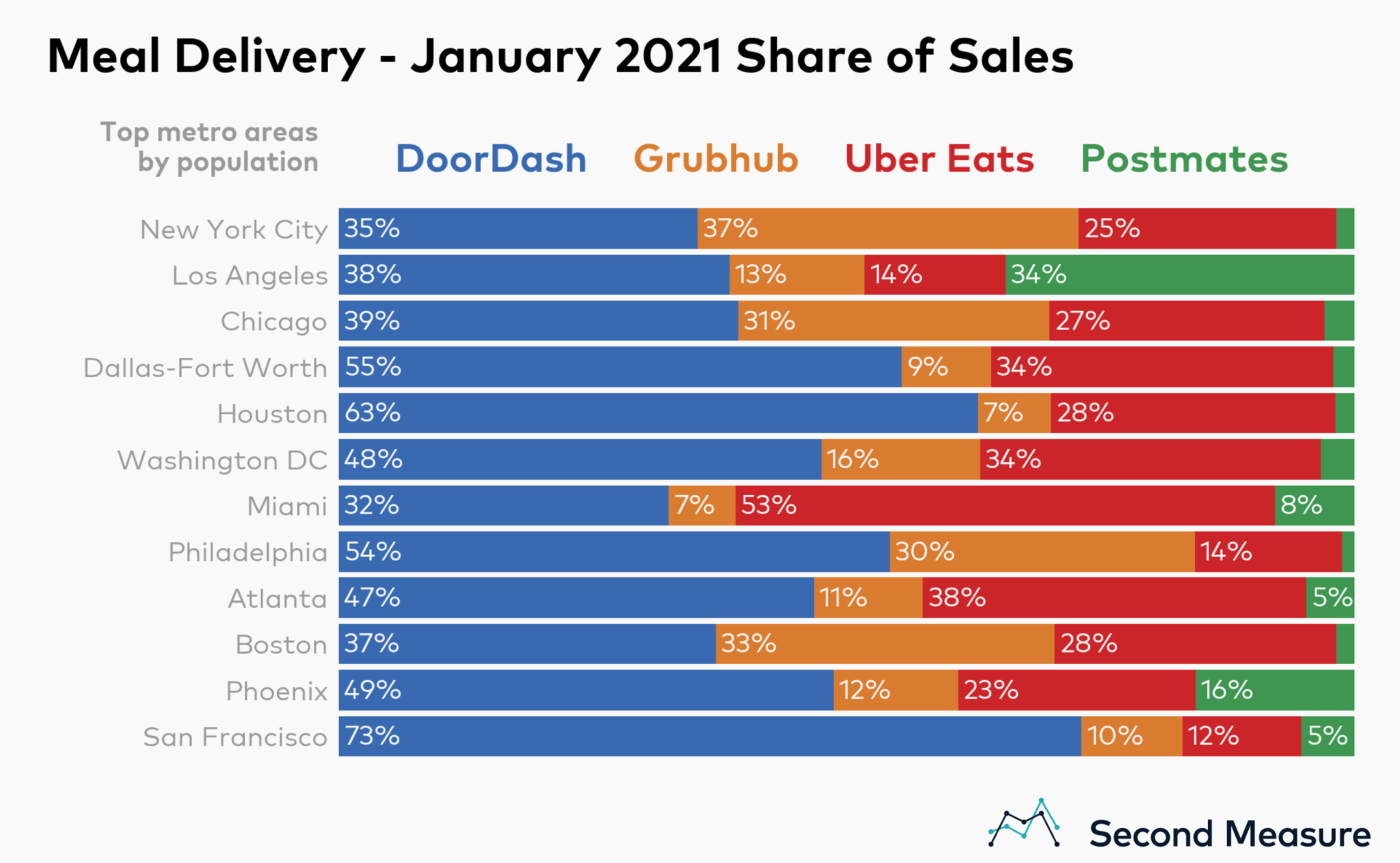

Grubhub and DoorDash control different parts of the country

Food delivery services have strongholds in different metro areas. For example, Grubhub is the most popular service in New York, while Uber Eats is the most popular in Miami. DoorDash rakes in more than half the sales in the two biggest Texas metro areas, Dallas-Fort Worth and Houston, and it’s nearly three-quarters of the market share in its Bay Area home turf.

Subscription meals have appeal

As meal delivery services look for new ways to grow in cities big and small, one emerging answer is subscriptions. Last year, Grubhub announced its answer to Postmates Unlimited (launched in 2016) and DoorDash’s DashPass (launched in 2018). Notably, in December 2019, DoorDash partnered with Chase to give free DashPass memberships to millions of credit card holders. (These free memberships are not included in Second Measure’s data.) Uber is also testing various subscription plans for food, rides, bikes, and scooters.

In January, 20 percent of Postmates customers were subscribers, a proportion that’s grown 6 percent over the past year. DashPass also attracted 21 percent of DoorDash’s customers, not including the promotional memberships they offered Chase users.

Companies vie for restaurant partners

Another very popular growth strategy for meal delivery companies has been forming partnerships with the nation’s top chain restaurants. (Though many services have also been in the news for listing restaurants that do not want partnerships.) Last year, DoorDash officially teamed up with Little Caesars Pizza, a brand that has never previously offered delivery. DoorDash has other deals with Wendy’s, Chick-fil-A, and McDonald’s, the biggest fast food chain in the country, which also offers delivery with Uber Eats.

Starbucks has a contract with Uber Eats, Popeyes with Postmates, and Taco Bell and KFC with Grubhub. Yet, as Uber Eats and Grubhub public filings show, partnerships don’t always lead to revenue. Often, larger partners pay the delivery services lower fees, decreasing their take rates or even causing them to lose money. Conversely, some restaurants that are relying heavily on delivery amidst the COVID-19 pandemic have reported losing money on orders as delivery companies charge high service fees, prompting policy intervention in many cities.

However, the partnerships seem to be driving sales for some of the restaurants. The Cheesecake Factory and Chipotle have publicly credited DoorDash with boosting their revenue. In January, Second Measure data shows 26 percent of The Cheesecake Factory’s sales came through DoorDash (before subtracting DoorDash’s cut or the delivery tip). The delivery service accounted for 13 percent of January sales at Buffalo Wild Wings, and 12 percent at Chipotle.

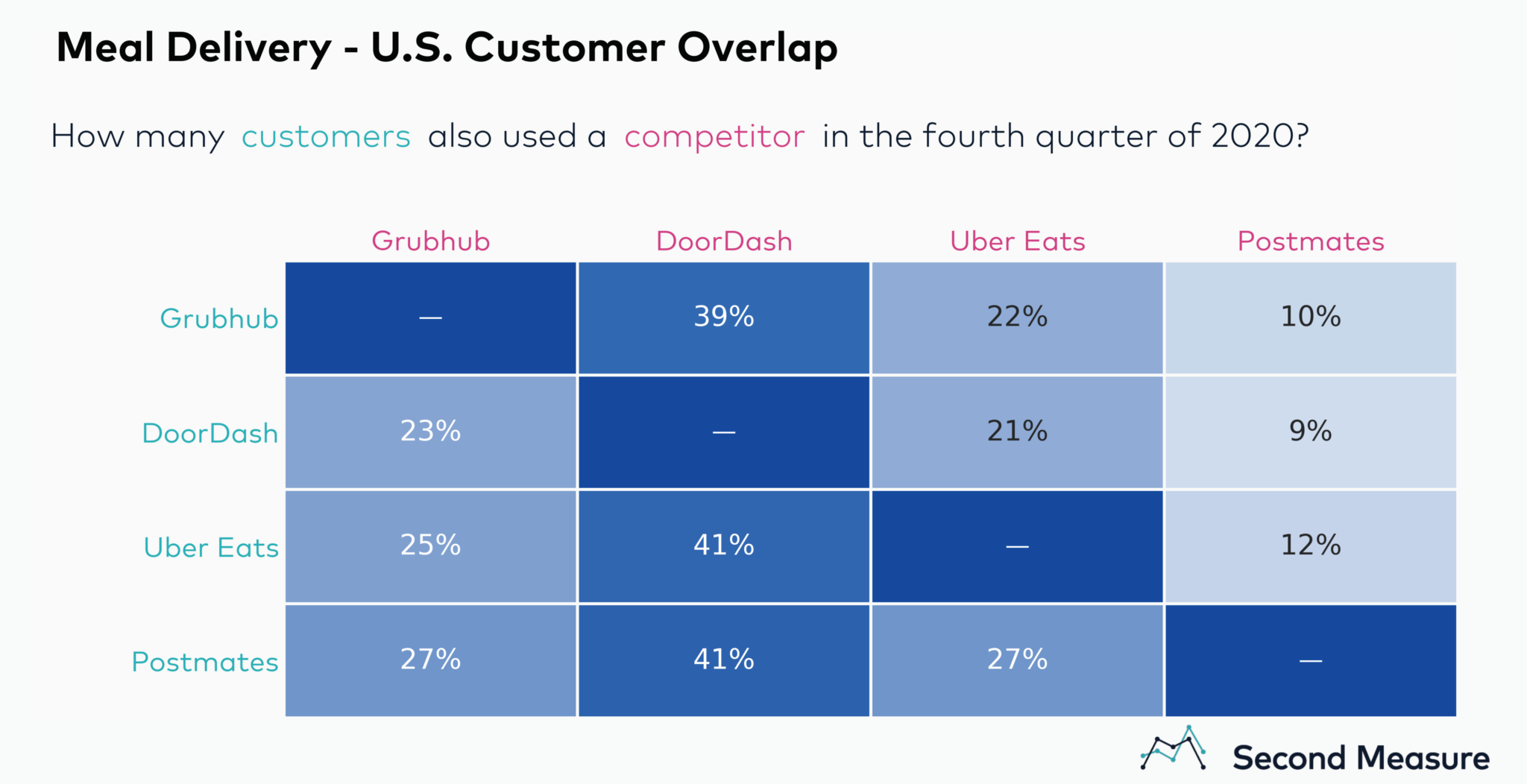

Fewer customers are loyal to a single service

Despite overall industry growth, the battle for customers is getting more intense because fewer of today’s diners are loyal to just one service. (Grubhub’s CEO has cited “promiscuous customers” as a hindrance to his company’s growth.) In the fourth quarter of 2018, 68 percent of Grubhub’s customers didn’t use other meal delivery services. Two years later, it’s fallen to 46 percent, as competing services woo customers with different restaurant offerings and promotional prices.

Postmates has the lowest percentage of exclusive customers (36 percent). DoorDash saw 56 percent of customers use them exclusively in the fourth quarter of 2020, and for Uber Eats, it was 43 percent. All of the services in our analysis have a lower percentage of exclusive customers than they did two years ago.

Not surprisingly, the biggest meal delivery services are also the most likely to share customers. Around 40 percent of each company’s diners also ordered food from top competitor DoorDash in the fourth quarter of 2020.

As more restaurants form exclusive delivery partnerships, more diners are going to have to hop between apps to cover all their favorite takeout spots. The least loyal customers, it seems, will also be the most well fed.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.