Source: https://www.yodlee.com/data-analytics/new-year-new-stimulus-new-round-investment-and-spending

On December 29, 2020, the Internal Revenue Service (IRS) began to distribute initial direct deposit payments for the second round of stimulus checks to consumers as part of the U.S. response to the COVID-19 pandemic. The IRS sent check payments beginning the following day, on December 30, with an official payment date of January 4. According to the IRS, most recipients would receive payments via direct deposits. The second round of payments were generally $600 for single individuals and $1,200 for married couples filing a joint tax return. Those with qualifying children should have also received $600 for each child.

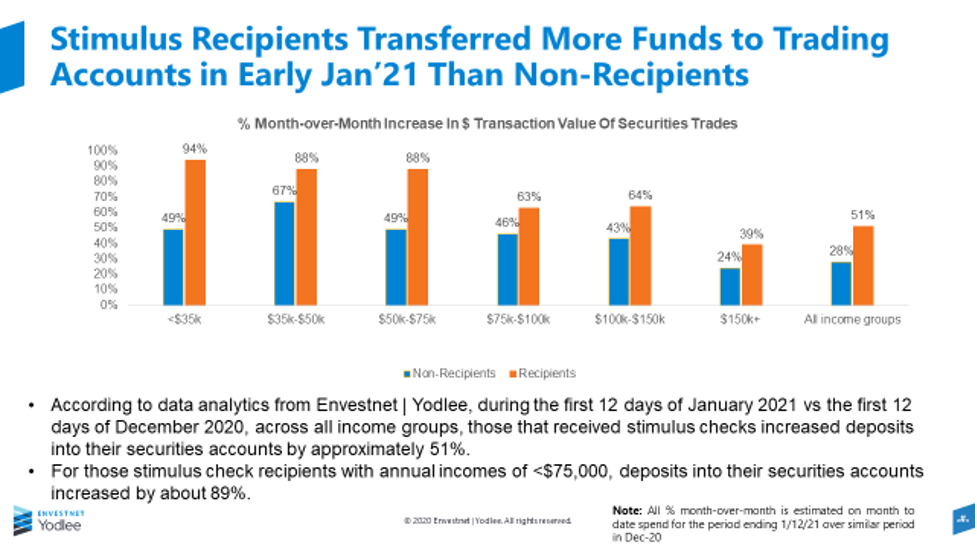

According to Envestnet | Yodlee Income and Spending Trends, there was a 51% increase in deposits into securities accounts for those who received the stimulus check within the first 12 days of January 2021 vs. the first 12 days in December 2020. This was observed across all income groups. For those that did not receive the stimulus, there was also an increase in deposits, but only by 28 percent.

Among those with annual incomes of less than $75,000, that received Stimulus monies, deposits into those securities accounts increased by 89% for the same month-to-month comparison (Janaury 2021 vs. December 2020).

Brokerage platforms were beneficiaries of this surge in money movement, including many first-time user deposits to new securities accounts according to Envestnet | Yodlee’s Income and Spending Trends. A first time user is defined as one who has not transacted with the brokerage platform as far back as 2018. Looking at the data on a month-over-month basis again, for the first 12 days of January 2021, there was a 90% increase in deposits to new securities accounts across all income groups. For the lowest income groups (less than$35,000/annually), that percentage was double compared to those that moved funds into new accounts in December 2020.

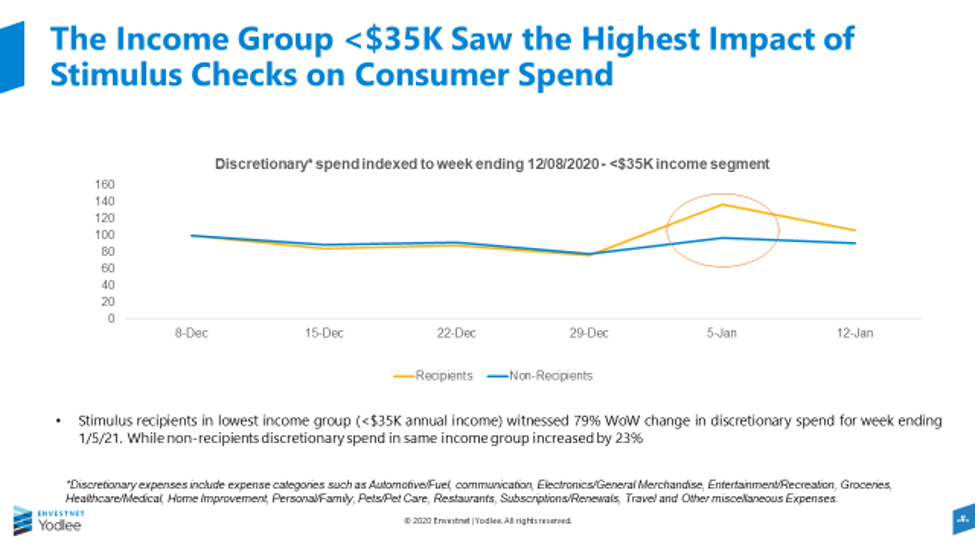

Besides deposits, Envestnet | Yodlee Income and Spending Trends show that those who received stimulus payments also spent their checks on consumer products. As displayed in the chart below, those with incomes of less than $35,000 who received a stimulus check, spent more on consumer products than those that had not yet received the payment.

To learn more about the data behind this article and what Yodlee has to offer, please reach out to Dylan Curtis at Dylan.Curtis@yodlee.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.