In this Placer Bytes, we dive into Ulta’s performance, Sephora’s expansion plans, and the continued rise of Citi Trends.

The Ulta Standard

It’s becoming increasingly clear that Ulta resides in a stratosphere reserved for retail’s top players. After delivering a very strong 2020, especially considering the context, the brand had one of the fastest starts to 2021.

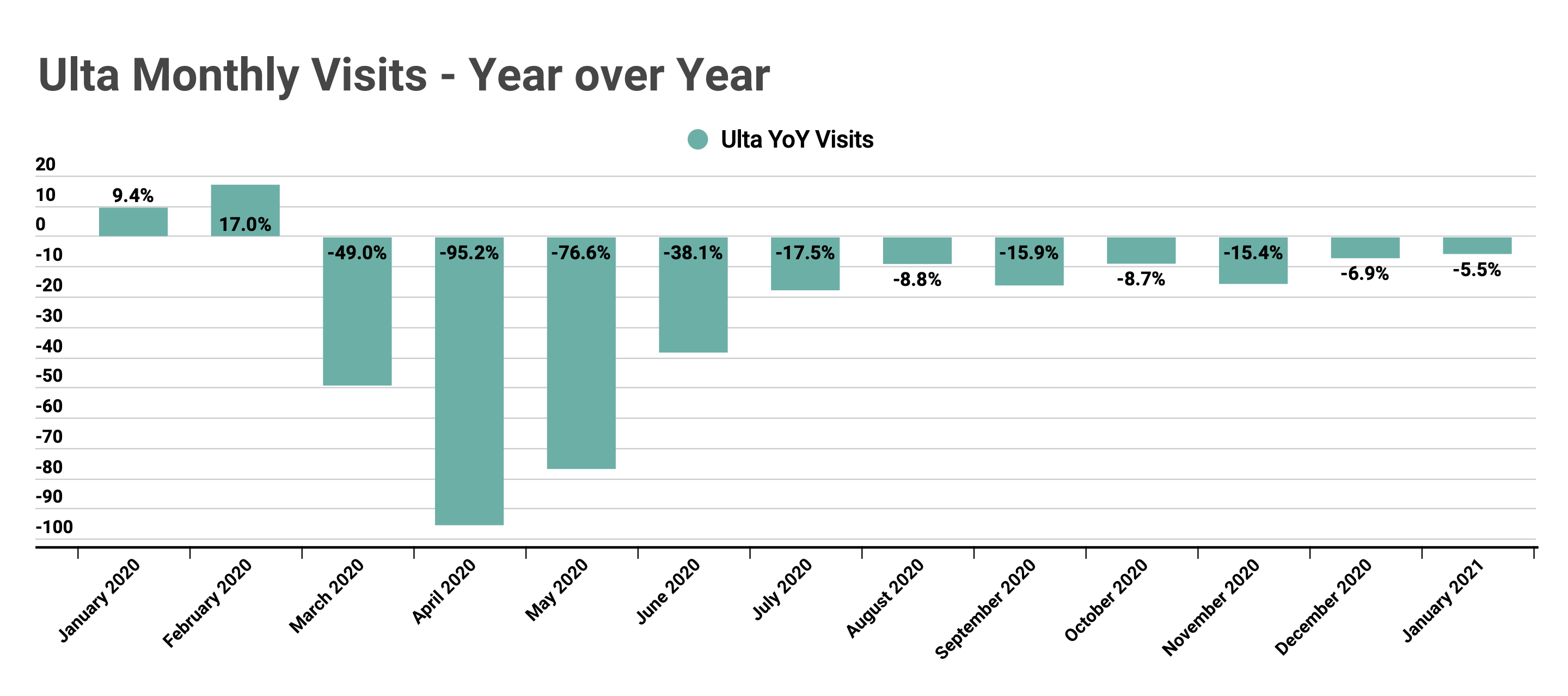

After seeing the year-over-year visit gap increase substantially in November to 15.4% as COVID cases rose and offline retail visits took a hit, the brands offline visits rebounded quickly, Traffic in December was down just 6.9%, the best mark since the start of the pandemic, and by January 2021, visits were down just 5.5%. Critically, the brand’s current strength will likely only increase as its owned retail presence strengthens alongside partnerships with brands like Target. Additionally, Ulta is well-positioned with wider industry trends like an increased focus on health and wellness and the fact that our face continues to take center stage on Zoom, even if pajama bottoms become the new work fashion norm.

Sephora’s Offline Push

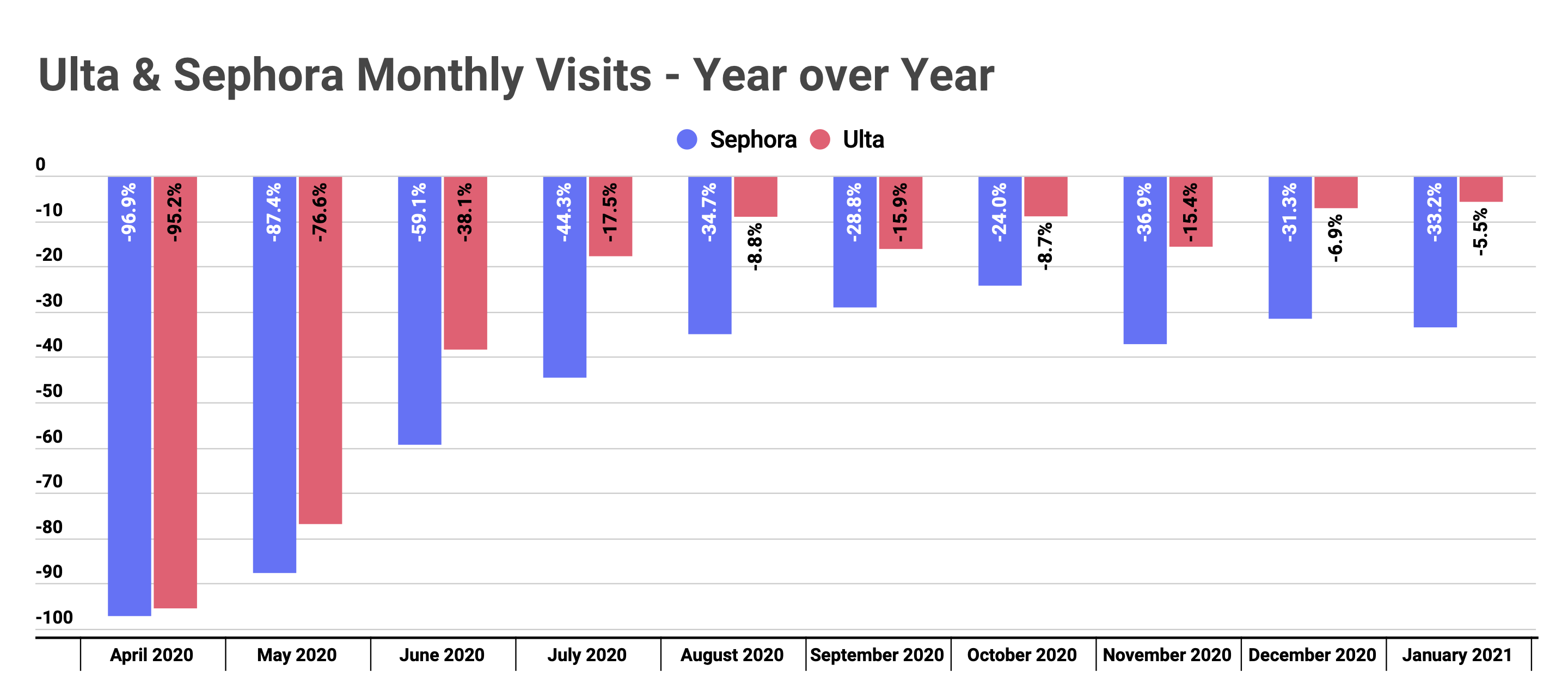

And the Ulta context is critical when attempting to better understand the recent announcement by Sephora that it will be launching 60 free-standing locations. After an earlier announcement of a partnership to bring Sephora into Kohl’s locations, the moves need to be understood within the strengthening of Sephora’s expanded reach.

The brand is clearly looking to diversify its presence, so that its strength in urban and mall environments can be balanced with a more suburban focus as well. This is important as there is clear data to show that people are leaving cities and this audience is relocating to nearby suburban areas. Additionally, Sephora has recognized what more and more brands are realizing – offline locations can be leveraged in more effective ways. Beyond noting its desire to use these locations to boost Buy Online Pick Up In-Store (BOPIS) efforts, they also will look to use the locations to enable advanced reservations to hold products that customers specifically want. This type of innovative approach to offline retail will help ensure that the expansion value is fully realized.

Citi Trends

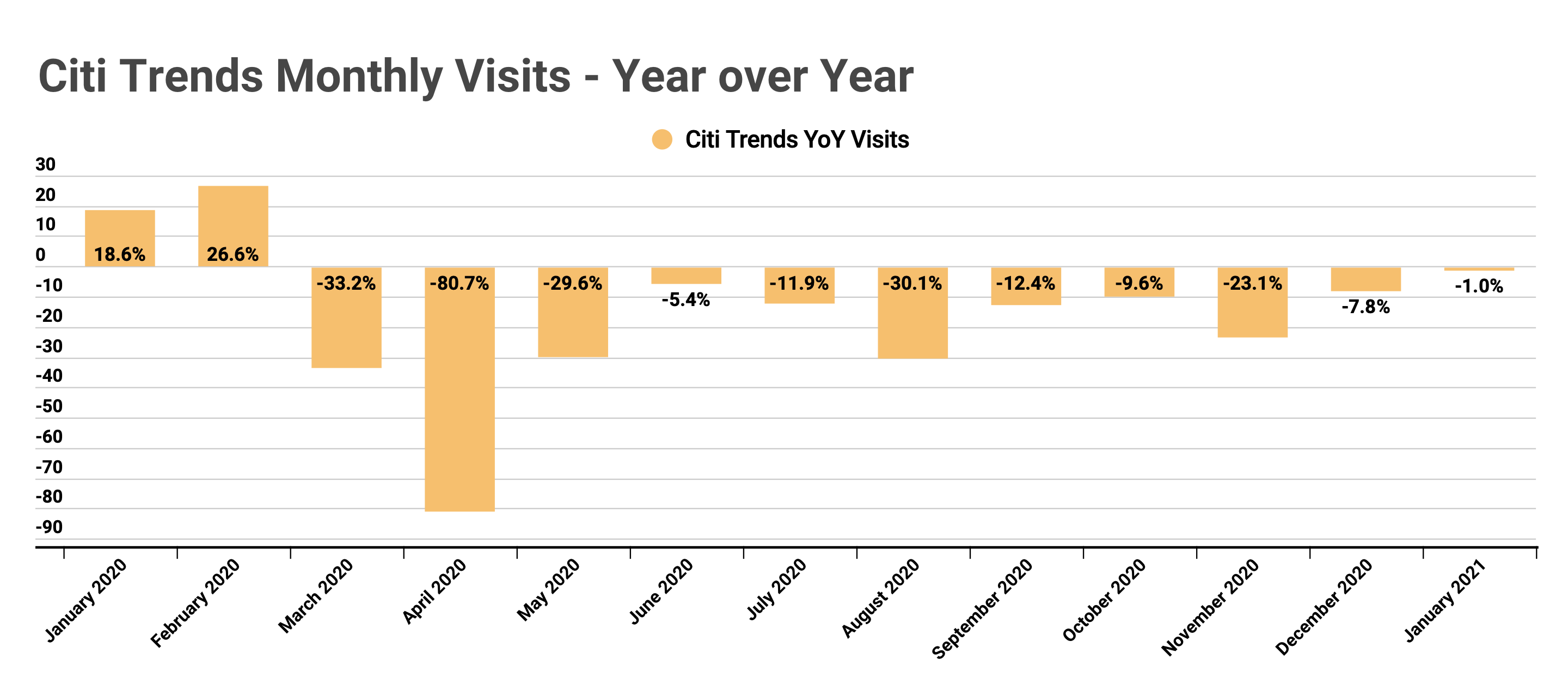

Citi Trends is expanding, and for good reason. The brand followed up a torrid start to 2020, with a strong relative performance throughout the pandemic. While Citi Trends did experience the retail-wide drop in visits in November with the visit gap growing to 23.1%, that changed rapidly. In December visits were down just 7.8% and by January, the year-over-year visit gap was down to just 1.0%. The continued strength of the brand, especially considering its current expansion, should make them among the most exciting apparel retailers to watch.

Will Ulta’s dominance continue? Can Sephora match Ulta’s performance with an aggressive expansion plan? Will Citi Trend continue to impress?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.