Source: https://www.speedtest.net/insights/blog/indias-internet-speeds-improve-but-5g-cant-come-fast-enough/

India has seen strong internet speed increases during a year when internet access has been crucial. 4G expansions are leading to mobile speed improvements, while fiber rollouts are driving jumps in fixed broadband speeds. Today we’re looking closely at how India’s improvements compare to other countries in the South Asian Association for Regional Cooperation (SAARC). We have also paired the internet speed performance of India’s top internet providers with data on consumer sentiment to shed light on how consumers view their operators.

India’s fixed broadband is fast for SAARC countries (and getting faster)

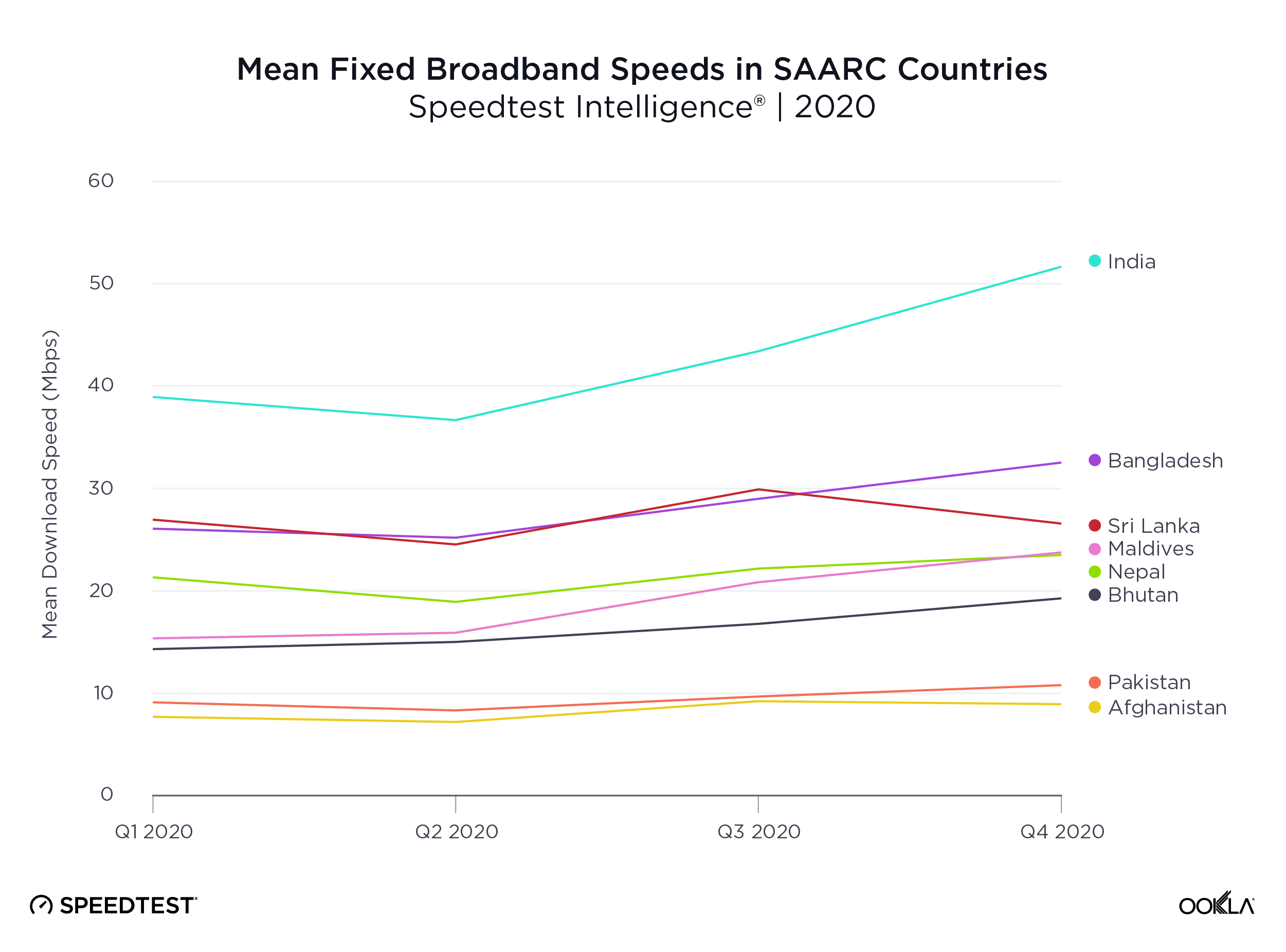

India started 2020 with the fastest mean download speed over fixed broadband among SAARC countries, and strong improvements in India from Q2 2020 onward only widened the gap. India’s government has been instrumental in these improvements with both Digital India and the Smart Cities Mission.

A jump in fixed broadband download speed in Bangladesh brought the country to second by the end of the year, while a decline in speeds put Sri Lanka in third place. Afghanistan had the lowest mean download speed over fixed broadband among SAARC countries during 2020.

Despite increases, Indian mobile speeds lag among SAARC countries

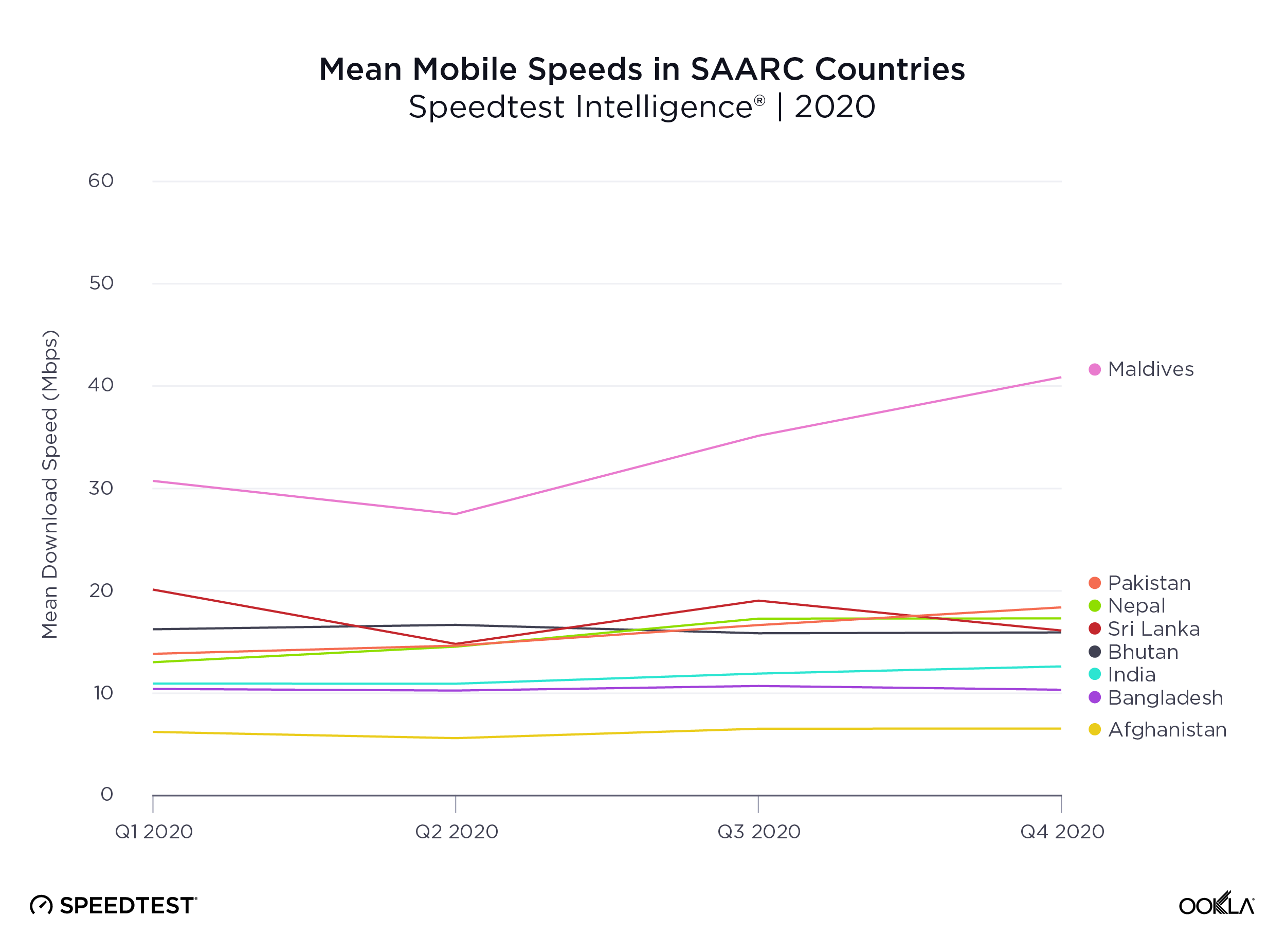

The Maldives, the only SAARC country with active 5G during 2020, was the fastest for mean download speed over mobile throughout 2020. Pakistan, Nepal, Sri Lanka and Bhutan were very closely grouped for second, third, fourth and fifth fastest during Q4 2020. Afghanistan had the slowest mean download speed over mobile among SAARC countries throughout 2020. Bangladesh was second slowest and India third. According to the Ookla 5G Map™, India, Pakistan and Sri Lanka each have at least one location where 5G is available, but only in pre-release.

Jio had the fastest fixed broadband, highest ratings by customers

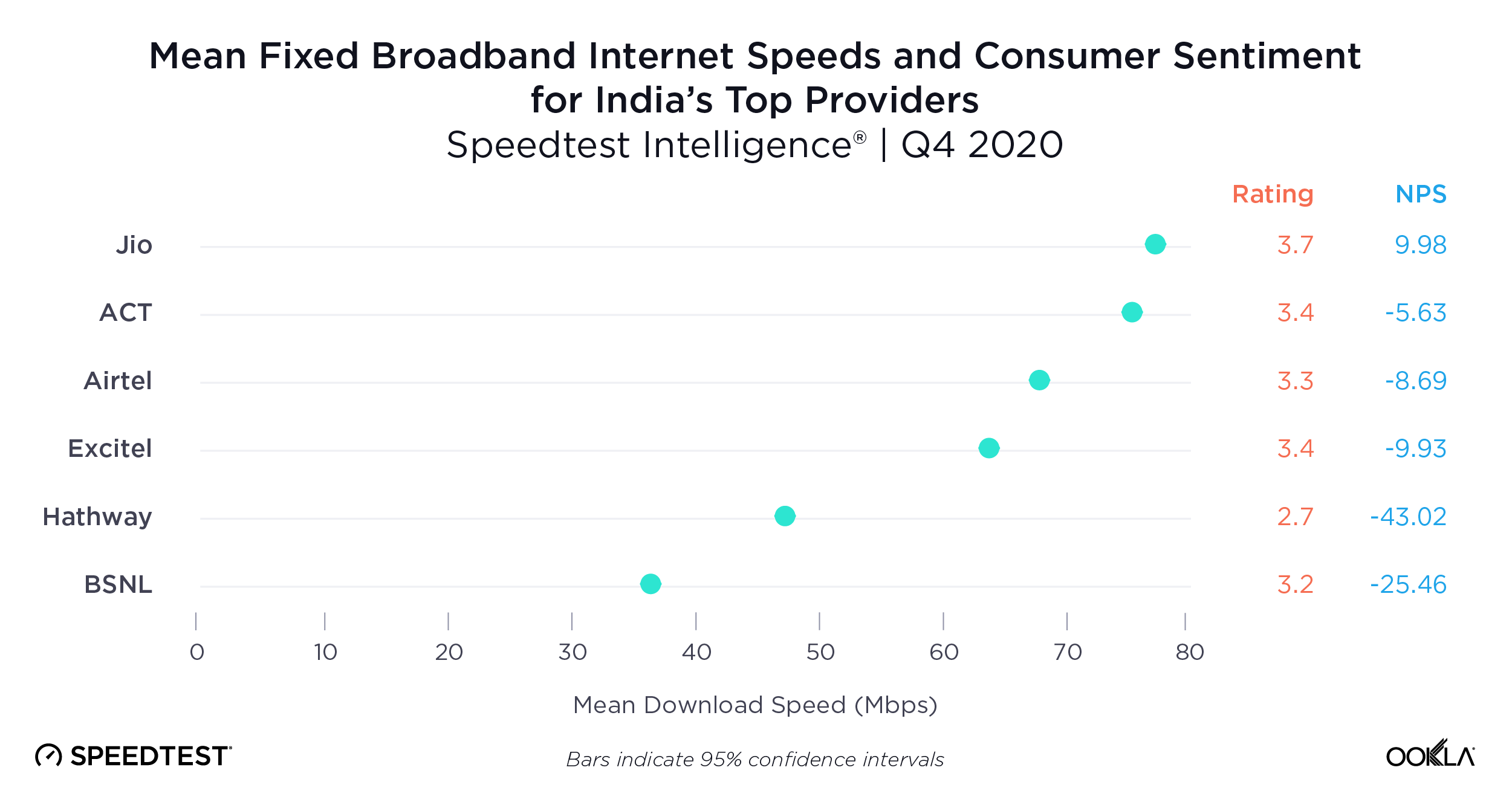

Speedtest® Consumer Sentiment data is gathered from single-question surveys presented to users at the end of a Speedtest. This data set provides rich insights into customer satisfaction over time, as well as competitive benchmarking, by providing data on both customers’ overall satisfaction with their network providers (based on a five-star scale) and Net Promoter Score (NPS). Operators and government regulators across the globe use this data to monitor improvements over time. By comparing Q4 2020 ratings data from India’s top providers with their speeds during the same period, we can explore the relationship between customer satisfaction and network performance.

Jio had the fastest mean download speed over fixed broadband among India’s top providers during Q4 2020. Jio also had the highest rating at 3.7 stars and the only positive NPS. ACT was second for download speed over fixed broadband, Airtel third and Excitel fourth. ACT and Excitel had the same star rating, while ACT had a higher NPS. Airtel had the third highest NPS.

BSNL had the slowest mean download speed over fixed broadband during the same period, although Hathway had the lowest rating and the lowest NPS. Note that the confidence intervals are narrow enough that they are obscured in the above chart and the one below.

Jio along with BSNL and Airtel offers fixed-line broadband service at Pan-India level. ACT, Excitel and Hathway are fixed broadband ISPs which offer services in a few key Indian cities and metros.

Vi India is fastest for mobile

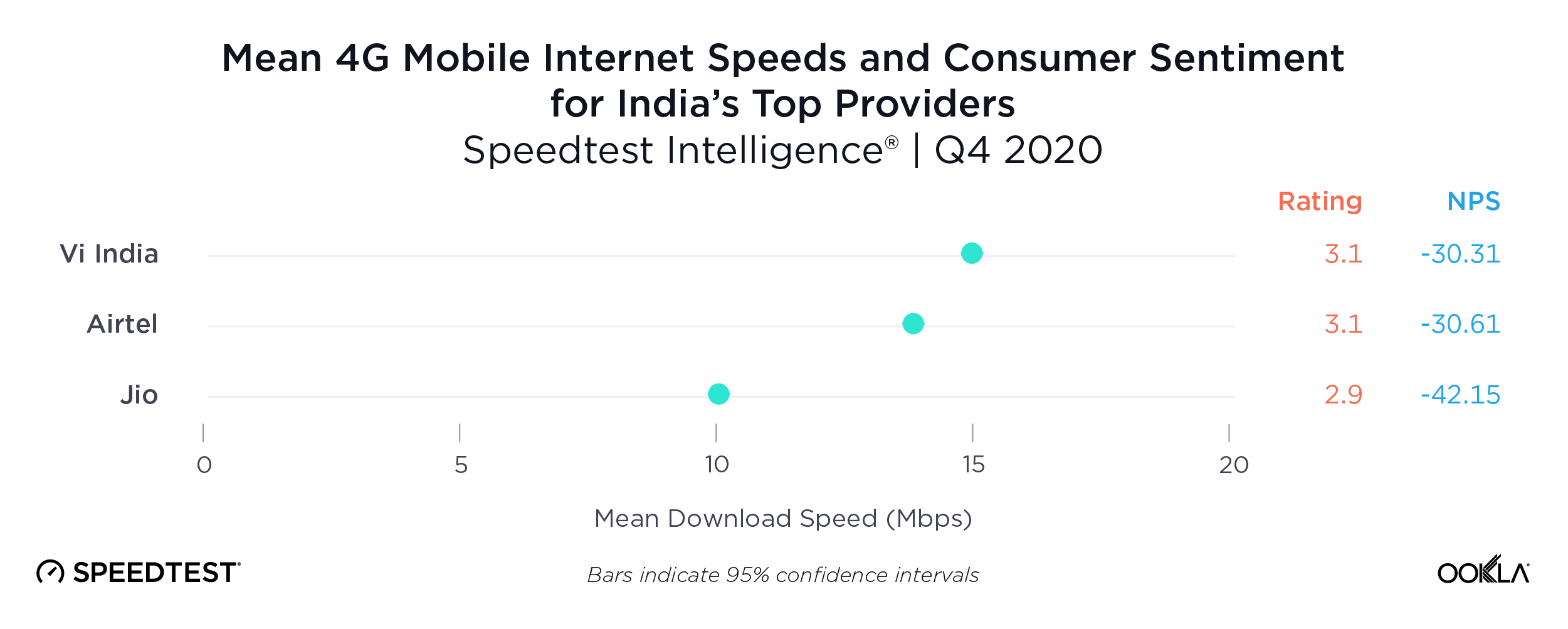

Vi India had the fastest mean mobile download speed during Q4 2020 as it increased its download speed performance lead over Airtel from Q3. This confirms that Vi India is continuing to provide its users with a better network speed experience than its rivals. In Consumer Sentiment ratings, Vi tied with Airtel.

Airtel had the second-fastest mean download speed. Jio came in third place for performance, ratings and NPS. Vi led Airtel and Jio on NPS, but none of the providers’ scores were positive, indicating that customers were not likely to recommend any of the providers.

How Indian operators are approaching 5G

While 5G still isn’t commercialized in India, Airtel’s commercial 5G network is ready to roll out services once spectrum is allocated in late 2021 or early 2022. On January 28, 2021, Airtel successfully conducted a 5G trial in the Hyderabad region using Dynamic Spectrum Sharing (DSS) on a 1800 MHz spectrum band. This demonstration was made possible by the Swedish infrastructure giant Ericsson (which provided the software to its radio infrastructure) and the device manufacturer Oppo (which provided its 5G-capable device powered by Qualcomm’s Snapdragon 865 5G Mobile Platform). Over the past year, Airtel has deployed LTE services using “5G-ready” Altiostar’s virtual open RAN software stack. This indicates that the operator’s 5G strategy may at least partially include O-RAN.

In a recent interview, Vi India’s CEO declared the company is also ready for a 5G rollout, but Vi India will wait for the 5G spectrum auction in the 3.3 GHz - 3.6 GHz band.

Jio, the telecom branch of Reliance Industries Limited (RIL), has been getting ready to roll out its homegrown O-RAN 5G network. Building an in-house cloud-native 5G core and radio access network from the ground up — while leveraging containerized network functions — will lay the groundwork for the operator to deliver improved security and spectral efficiency. This network approach can also enable new use cases like ultra-reliable low-latency communications (URLLC), network slicing and improved reliability, to name a few. Similar to Rakuten Mobile’s approach, Jio aims to leverage automation and artificial intelligence for network monitoring and optimization, as well as capacity planning. A zero-touch deployment approach promises to deliver rapid cell site provisioning, which opens the door for massive infrastructure scaling.

However, without a sufficient amount of wireless spectrum, LTE and 5G technologies won’t be able to deliver the ultra-fast speeds and low latency promised by the emerging technology. This is why the Indian Department of Communications (DoT) held a spectrum auction on March 1, 2021 to license the spectrum blocks in the 700 MHz and 800 MHz bands. Airtel opted for spectrum in the sub-GHz, mid band and 2300 MHz bands. Vi India did not disclose which spectrum it had purchased and Jio reportedly purchased spectrum in the 800 MHz, 1800 MHz and 2300 MHz bands to renew permits expiring in July. The 700 MHz band did not get any offers.

Mobile and fixed broadband are rapidly improving in India, and we’ll be watching this market for continued performance improvements in the near future. Soon, we’ll also be using data from Speedtest video testing to assess how networks are performing when streaming video. Try video testing on Speedtest for iOS now to see how well your operator supports streaming video.

To learn more about the data behind this article and what Ookla has to offer, visit https://www.ookla.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.