Due to the COVID-19 pandemic, over a year ago a large portion of US schoolchildren were forced to move their studies online as physical schools closed for safety reasons. At the same time, many adults who were sheltering in place and couldn’t entertain themselves out of the house turned to online education to pass the time. How have these trends held up over the last year? And what do they signal about Coursera’s upcoming IPO? In today’s Insight flash, we look at overall subindustry trends, how those differ by demographic, and which companies have done the best job bringing customers back after their first purchase.

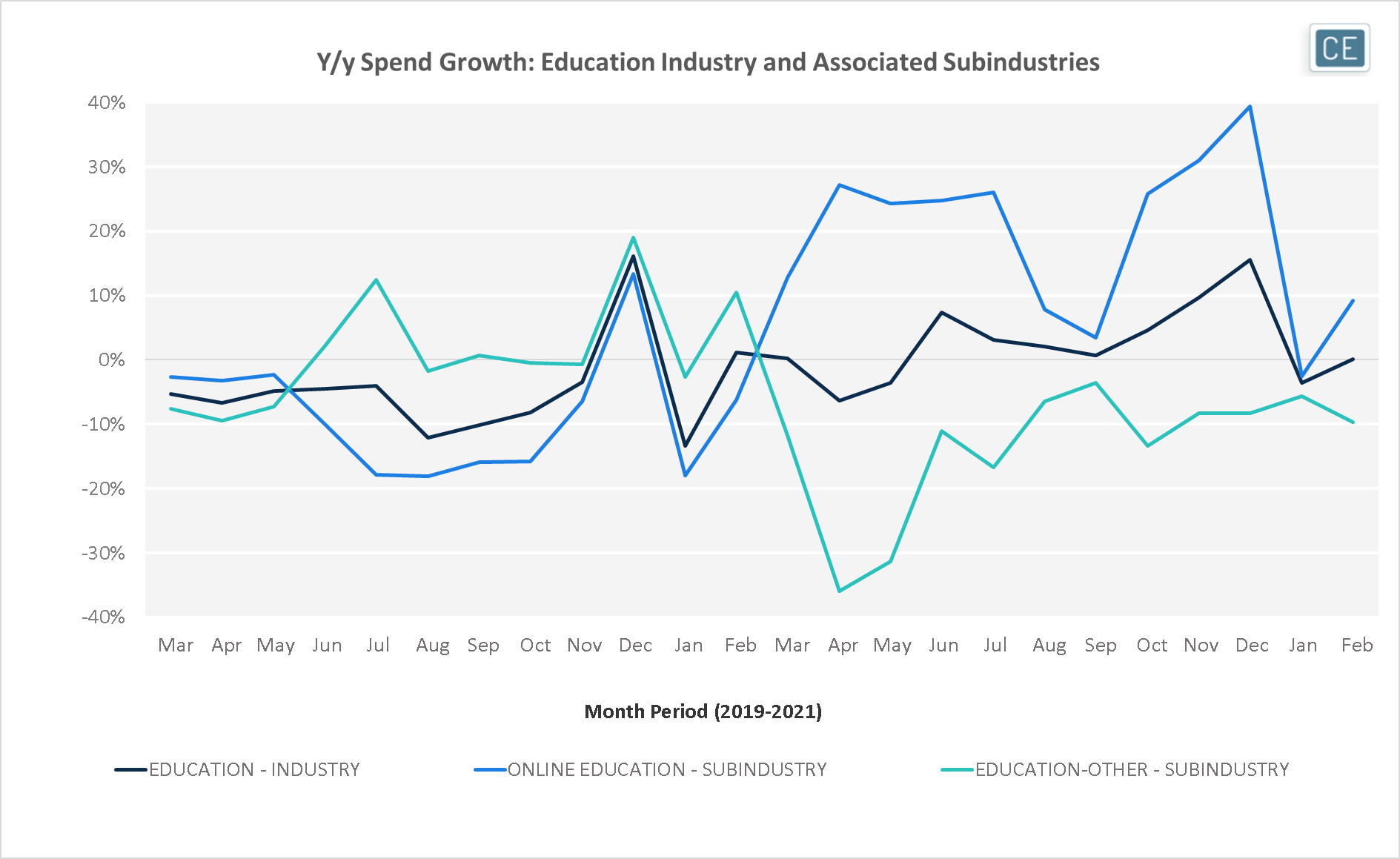

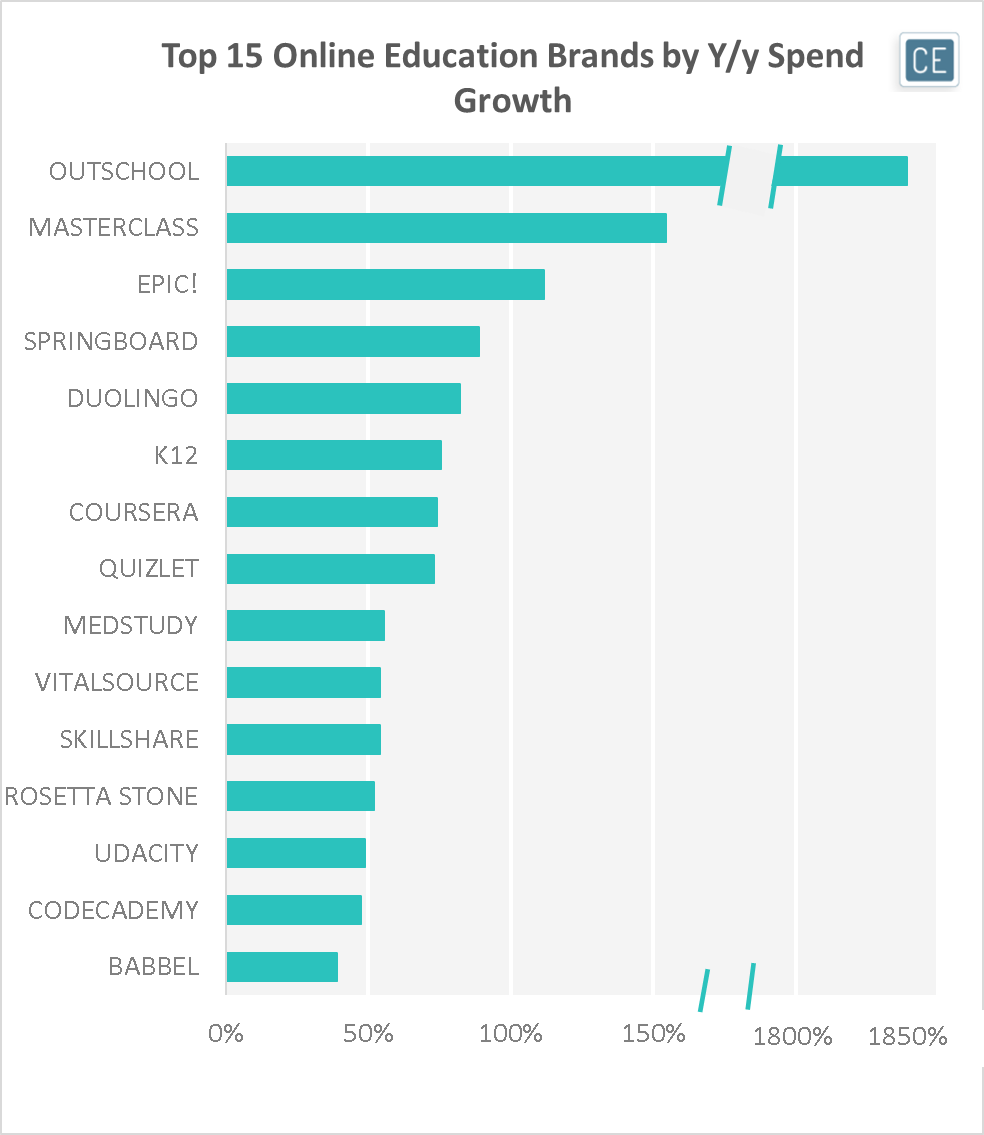

Prospects for Online Education were dour pre-pandemic. In the twelve months prior to March 2020, the subindustry saw negative spend growth in every month besides December, which likely benefitted from the gifting of classes. In March 2020, however, spend jumped 13%, and remained above 20% for the next four months. The strongest growth came from Outschool, MasterClass, and Epic!, which all saw over 100% y/y spend growth in the last year.

Education Spend Growth

Note: 03/01/2020 – 02/28/2021 vs. 03/02/2019 – 02/29/2020; Top 15 brands with at least $75,000 of spend in year ago period

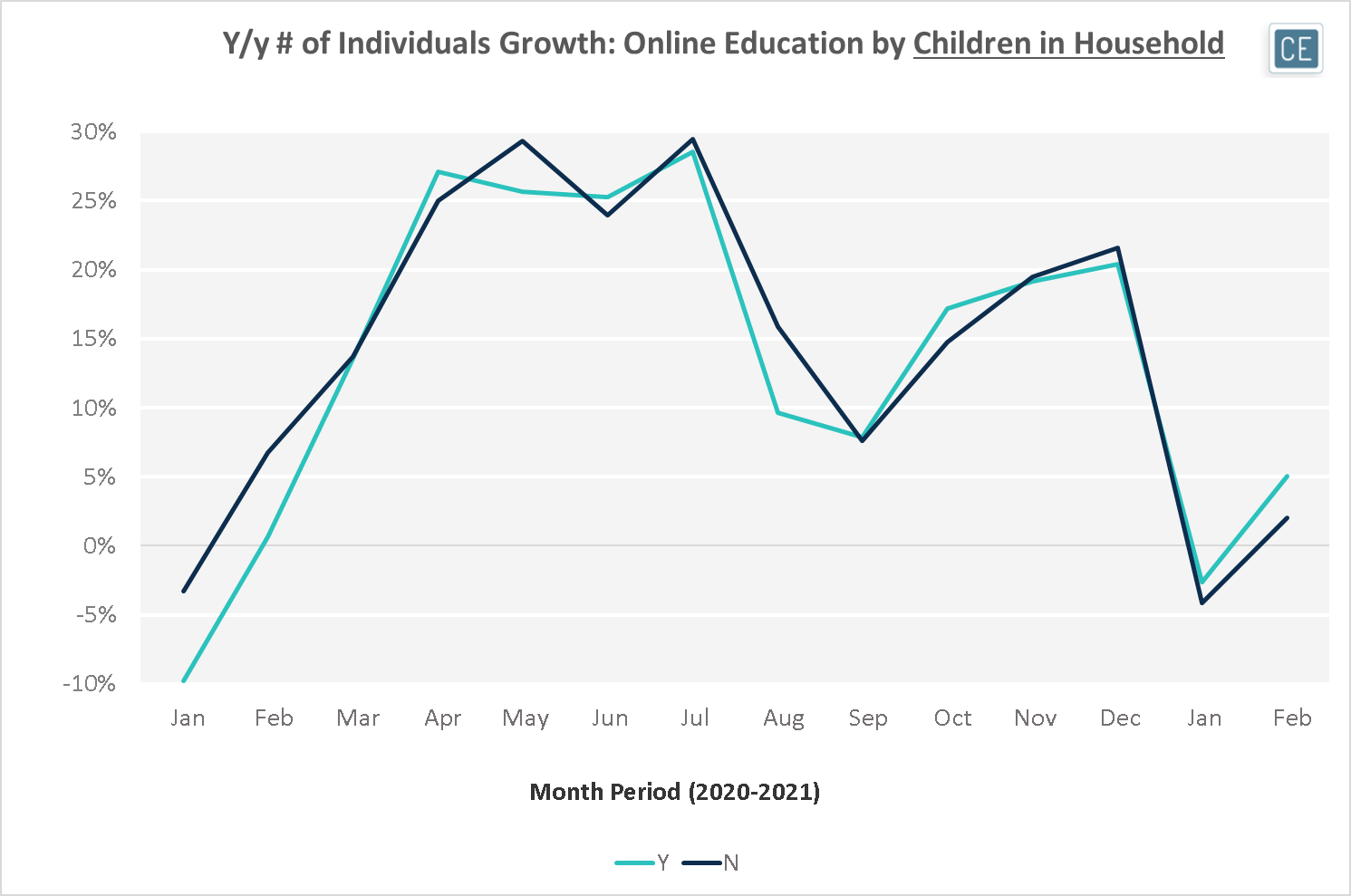

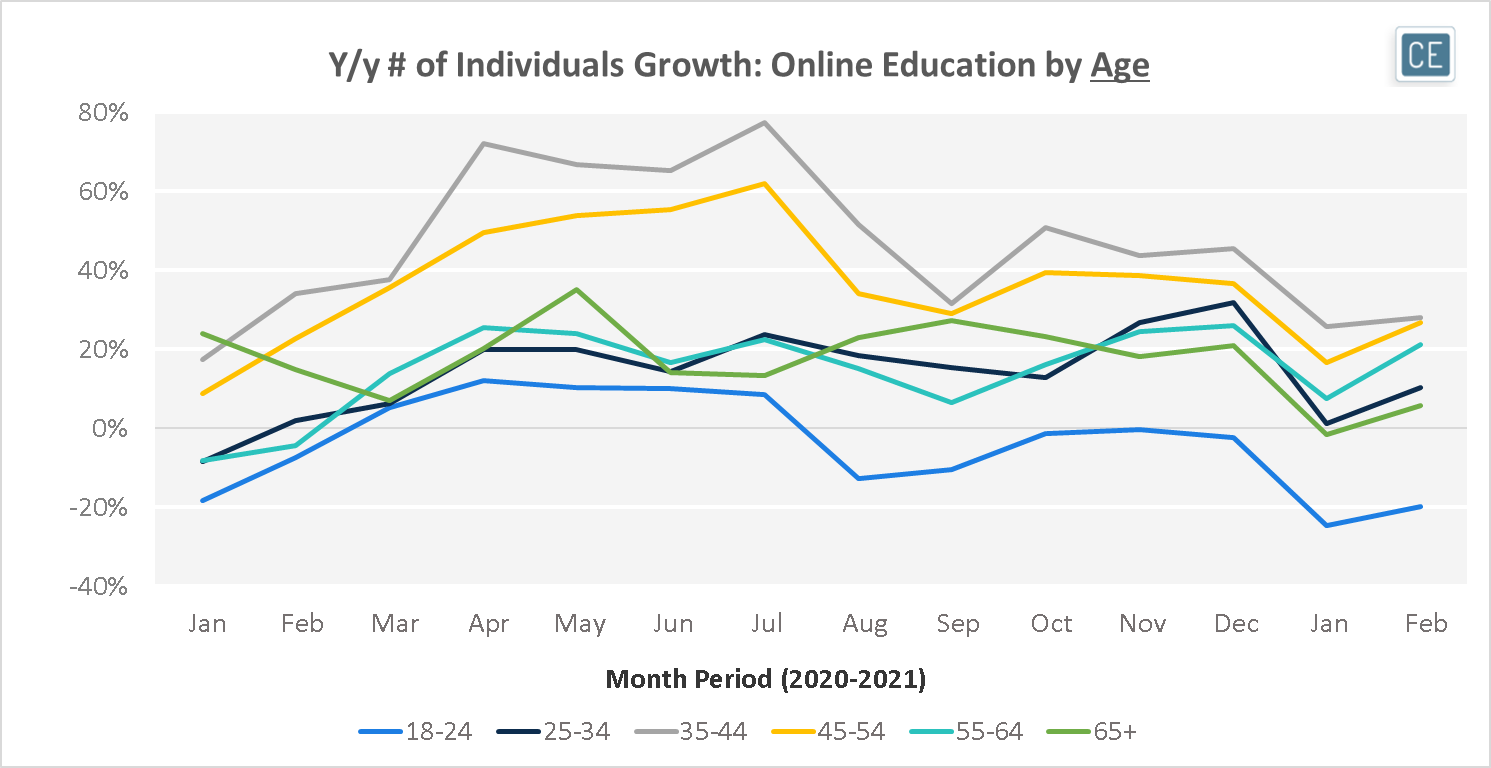

The importance of adult education for these companies is clear when looking at demographic breakdowns. Y/y growth in individuals spending on Online Education has been similar for households with children and households without children for most of the last year, with households without children unsurprisingly showing stronger growth in summer months when school is out. All age groups older than 18-24 year olds showed consistent growth in Online Education participation as well in the last year, with 35-54 year olds growing the fastest.

Online Education Demographics

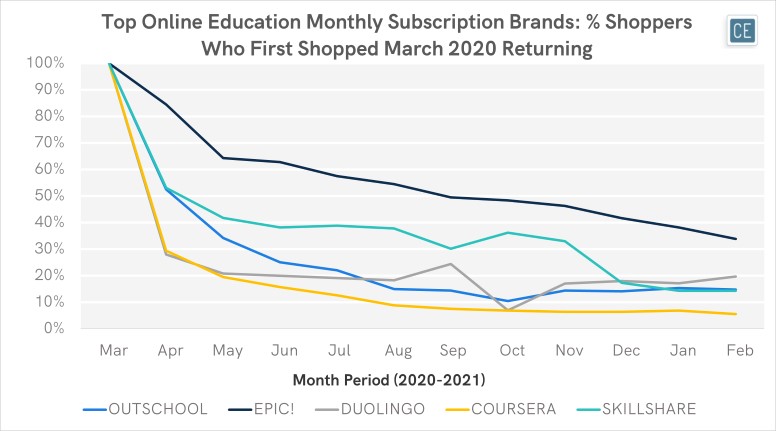

Which Online Education brands are seeing the most success in bringing customers back? Epic! has been leading the charge among the top monthly subscription services, with 84% of March 2020 new customers coming back in April and 64% returning in May. Coursera has been lagging, perhaps due to its high price point. Only 29% of March 2020 new customers returned in April, and only 19% in May. By February 2021 one year later, only 6% of Coursera monthly subscribers who started in March 2020 were still on the platform, versus 14% for Skillshare, 15% for Outschool, 20% for Duolingo, and 34% for Epic!

Repeat Subscriptions

Note: Top five monthly subscription brands, price filters used to isolate monthly vs. annual subscriptions.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.