Source: https://insights.consumer-edge.com/2021/03/has-covid-19-changed-the-channel-on-uk-retail-sales/

In today’s Insight Flash, we take advantage of our newly launched UK channel data for industries and subindustries in our UK Brand Universe to examine how online shopping behavior has changed over the last year. With over 1,400 brands tagged for online and offline spend, it becomes clear that there are significant differences in industry share online versus offline as well as which industries and subindustries have seen the largest growth.

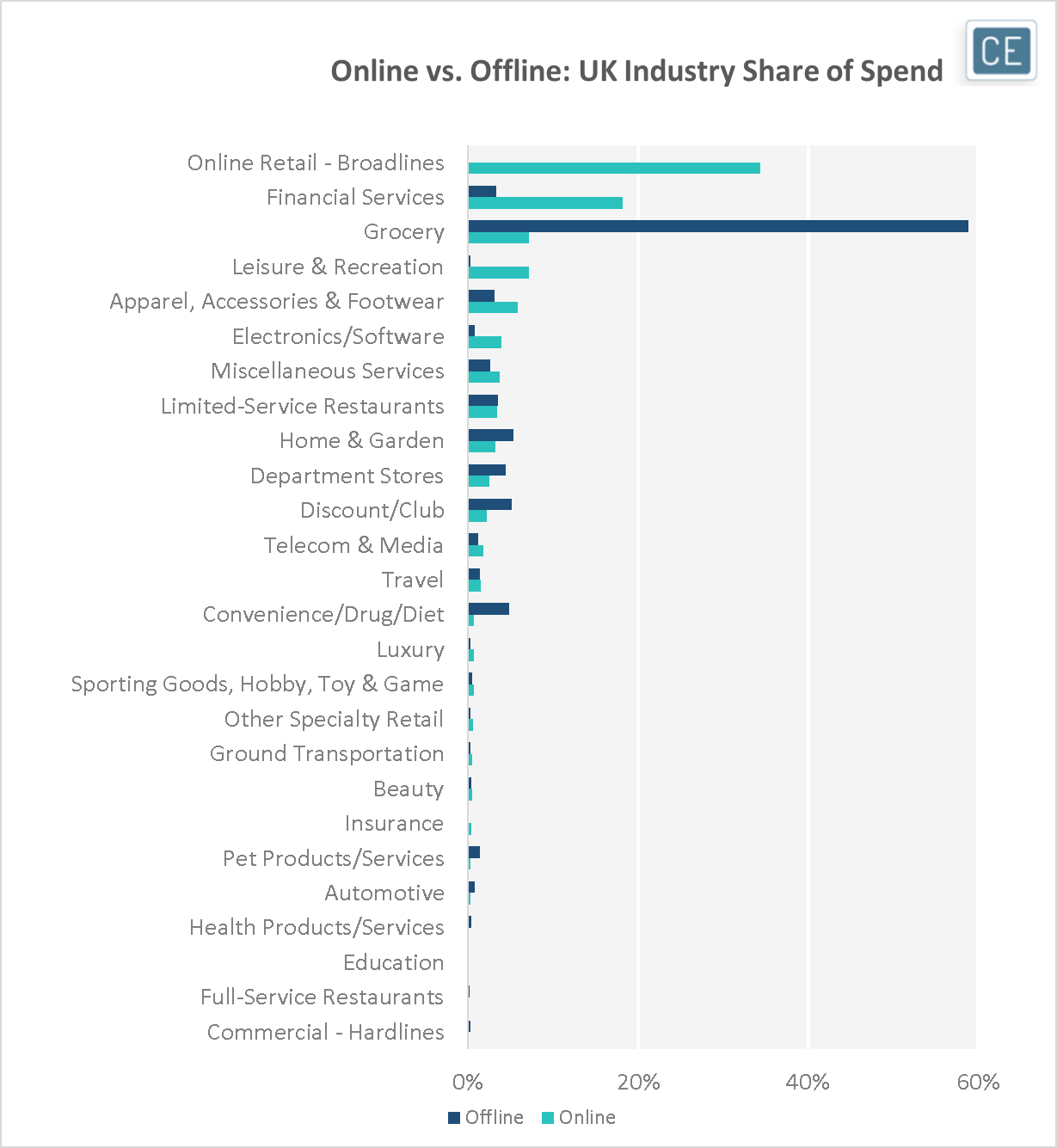

Even from a high-level share perspective, major differences can be seen between how UK residents spent online versus offline in the last year. Online, Broadlines retailers such as Amazon.com dominate with over a third of spend over the last year. Offline, Grocery is even more dominant with almost 60% of offline spend. Interestingly, Grocery is also the third-highest share of spend online (just after financial services), though at only 7%. Offline, Home & Garden and Discount/Club stores are also among the top spend industries with 5% of offline spend each.

Industry Share

Note: 364 days ending 3/10/2021

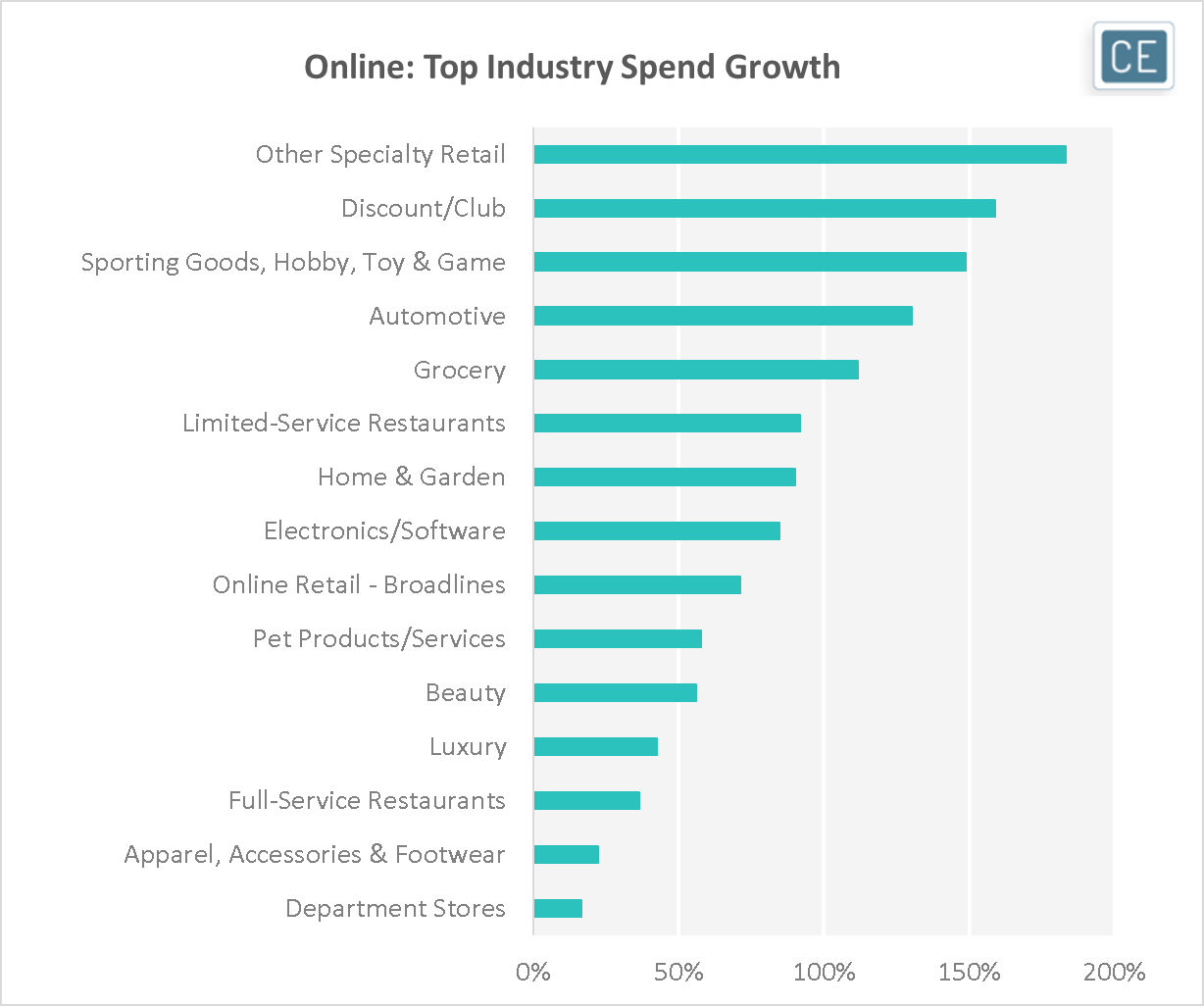

The importance of Discount/Club stores offline may be in jeopardy. They’re showing the second-highest online industry growth of our 26 tracked industries at almost 160% growth y/y. Gifting also is growing in online popularity, with Other Specialty retail growing online 183%. Some hardlines categories like Sporting Goods, Hobby, Toy & Game (149% y/y growth) and Automotive (130% y/y growth) are also seeing rapid increases in online spending.

Online Industry Growth

Note: 364 days ending 3/10/2021 vs. 364 days ending 3/11/2020.

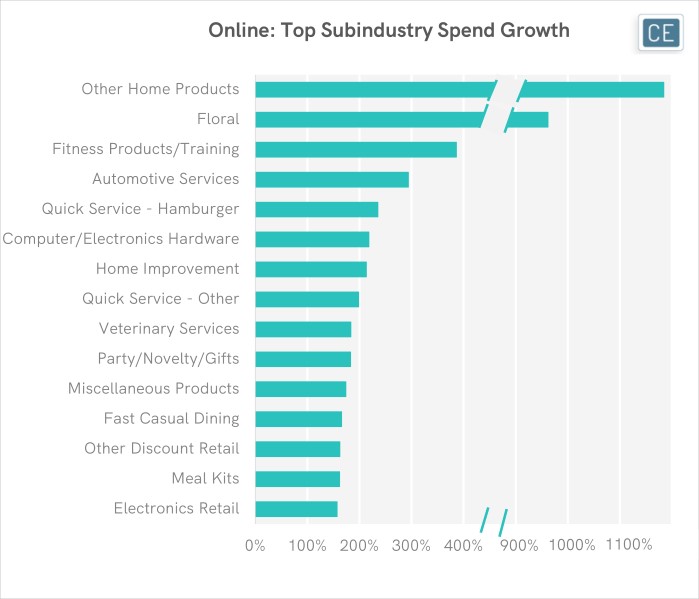

A subindustry view of online growth in the UK over the last year provides additional color. Other Home Products grew the fastest online, with over 1,000% y/y growth. Floral drove the gifting growth with over 950% y/y online growth. Fitness Products/Training also showed strong trends with gyms closed at over 350% growth online y/y. And Automotive Services seemed to be a driver of broader Automotive growth at almost 300% online growth y/y.

Online Subindustry Growth

Note: 364 days ending 3/10/2021 vs. 364 days ending 3/11/2020.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.