Grocery was one of the stronger performers throughout the pandemic, and there is real reason to believe that sector could be heading into an extended period of strength. However, the coming year is going to be defined by a high degree of complexity when attempting to measure the performance of top grocery brands.

The Year-over-Year Challenge

Year-over-year analyses are an especially useful tool to account for seasonality and understand brand strength over time. As a simple example, you’re more likely to visit an ice cream store when it’s hot so looking at said parlor in June year over year will tell far more than looking at the same June month compared to the January or March that preceded it. But 2021 is going to be mired in the unique challenge of trying to make sense of certain sectors in a world where year-over-year data could be heavily misleading.

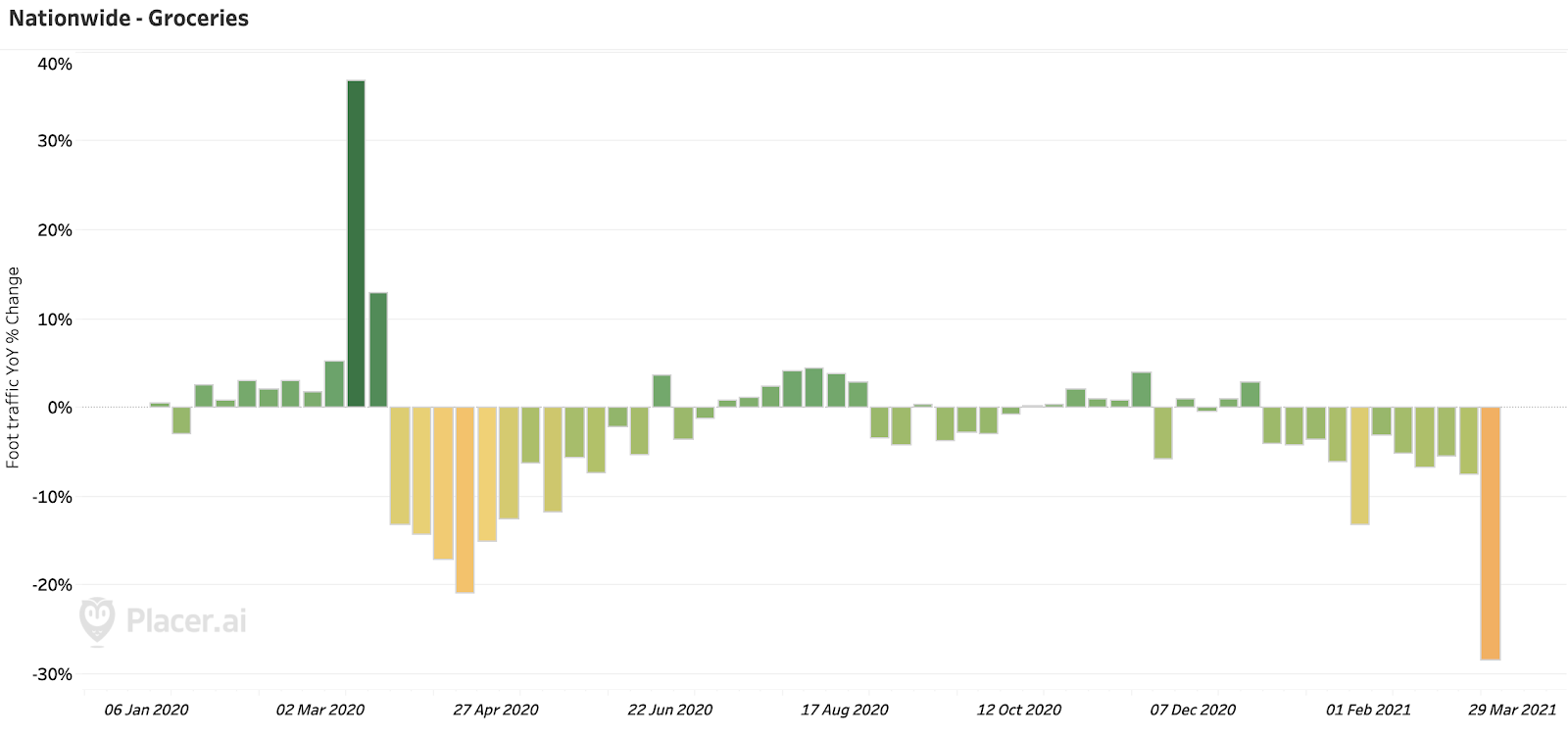

For example, looking at the week beginning March 8th, 2021, shows grocery visits down 28% year over year. This might lead one to believe that the sector’s overall strength found during the pandemic is in the midst of a rapid decline as ‘normalcy’ returns. However, this seems to be very far from the actual case.

Longer & Shorter Term Context

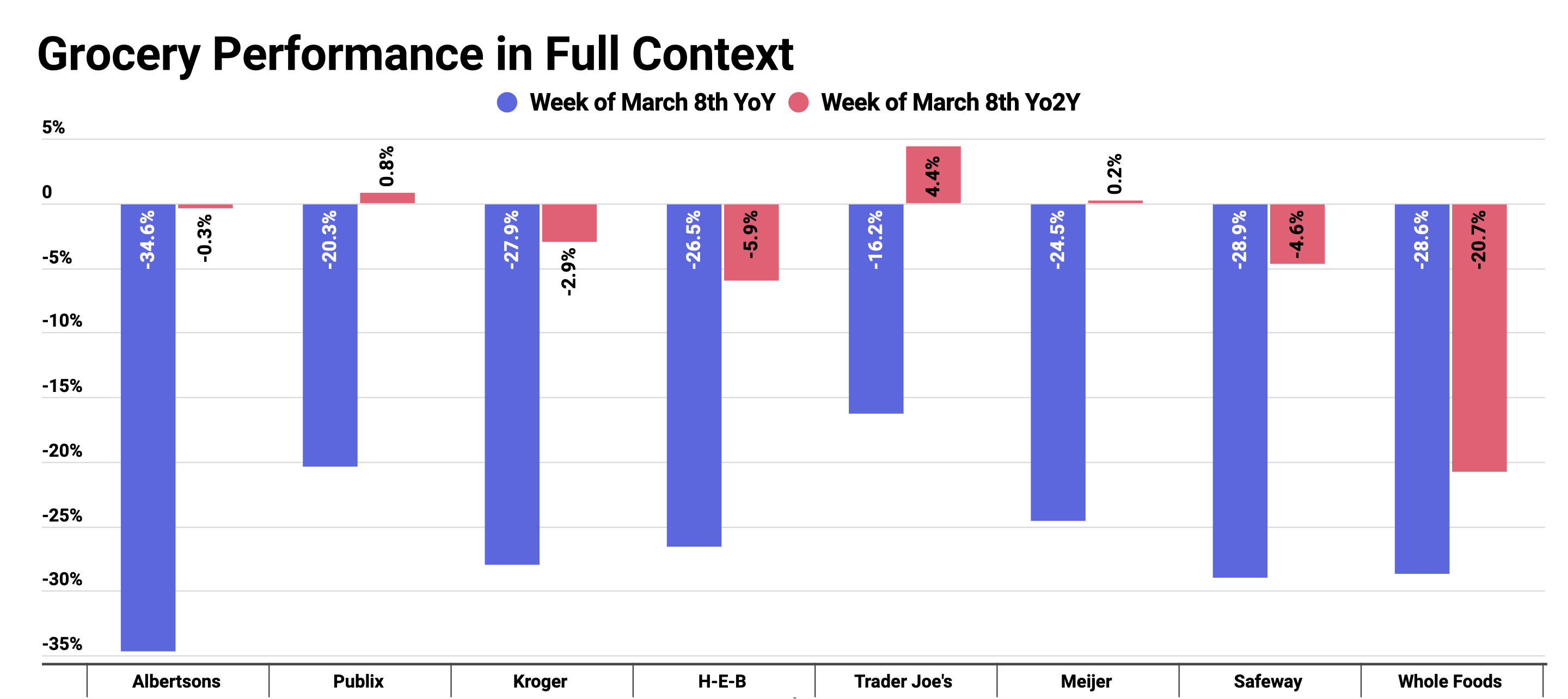

When looking at top brands in the grocery sector the week of March 8th, the same pattern emerges. Visits for leading grocers like Albertsons or Publix – two brands we predicted to have very strong years in 2021 – were down 34.6% and 20.3% respectively – the worst weekly year-over-year mark either brand has seen since our dataset begins in 2017. Yet, when looking at the same brands compared to the equivalent week in 2019, the picture shifts dramatically with Albertsons down just 0.3% and Publix up 0.8%. So, what’s actually happening here?

The large year-over-year declines are being driven by the massive heights that these same grocery brands saw in the early weeks of the pandemic when consumers were afraid of not having enough key items. This panic-driven, stocking-up-oriented shopping drove massive visit growth in the first few weeks of March 2020, leading the relatively strong performances of the same period in 2021 to pale in comparison. And this can lead to significant mistakes.

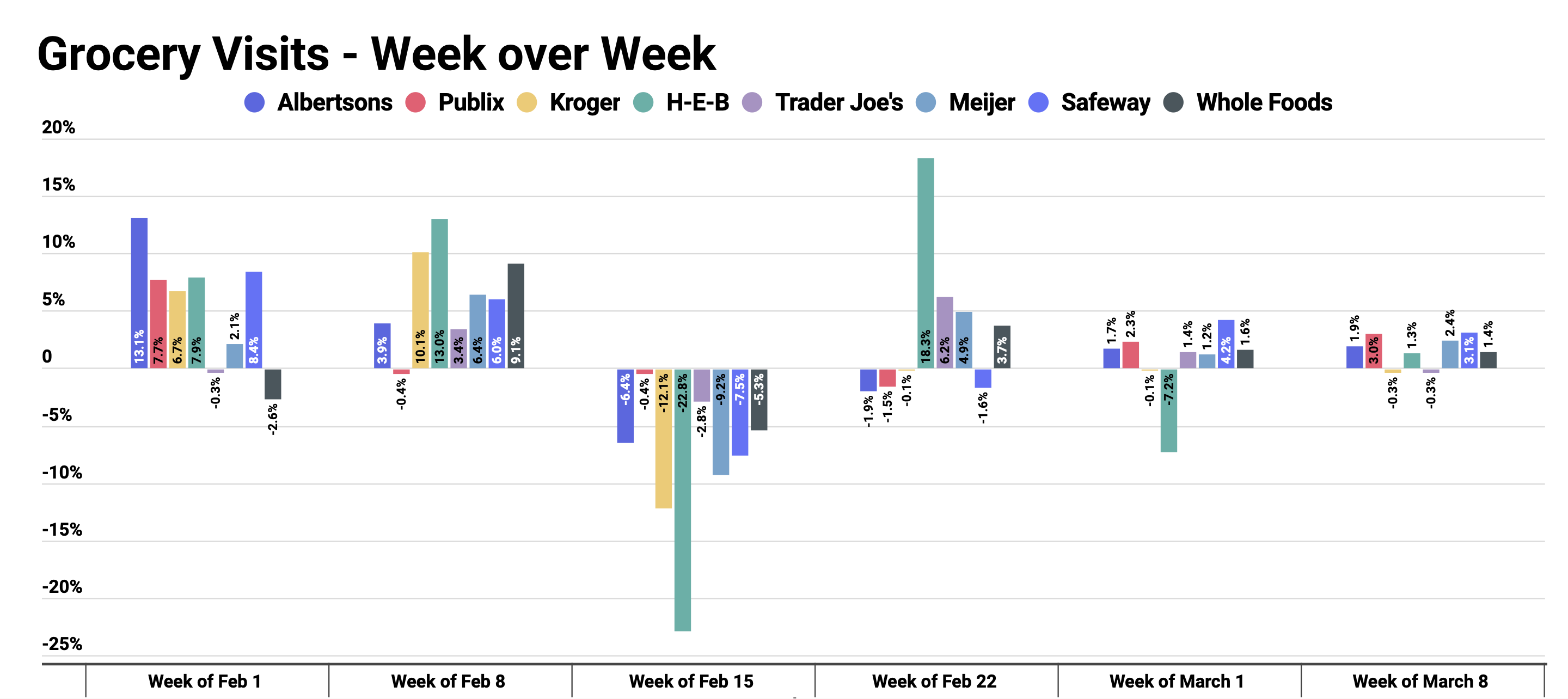

Because not only is grocery not in a weak position, it’s actually gaining momentum even in the shorter term. Looking at week-over-week visits for these same chains shows that most are seeing consistent growth with the primary cause of declines coming from severe inclement weather in late January and early February in specific regions.

So, instead of a picture of decline, one of significant long-term potential appears. Top grocers are actually trending in the right direction and could be heading into a period of unique strength. While COVID’s health effects seem to be dissipating, the economic consequences will last far longer. This should buoy grocery as it provides a cost-conscious alternative to eating out. Additionally, greater flexibility in work from home should allow more people to shop when they want, enabling them to have longer visits driving larger basket sizes. These factors among others should give the grocery sector an extended lift.

Will the grocery sector see a period of extended growth? Which other sectors will require shifts to measurement to account for dramatic pandemic-driven changes?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.