More than almost any other sector, the restaurant industry suffered one of the hardest COVID-19 hits. Yet, location data provides a hopeful sign of recovery across dining segments, with some, like the QSR and coffee sub-sectors, expected to reach a full recovery faster than others.

Hourly Demand Will Continue to Shift

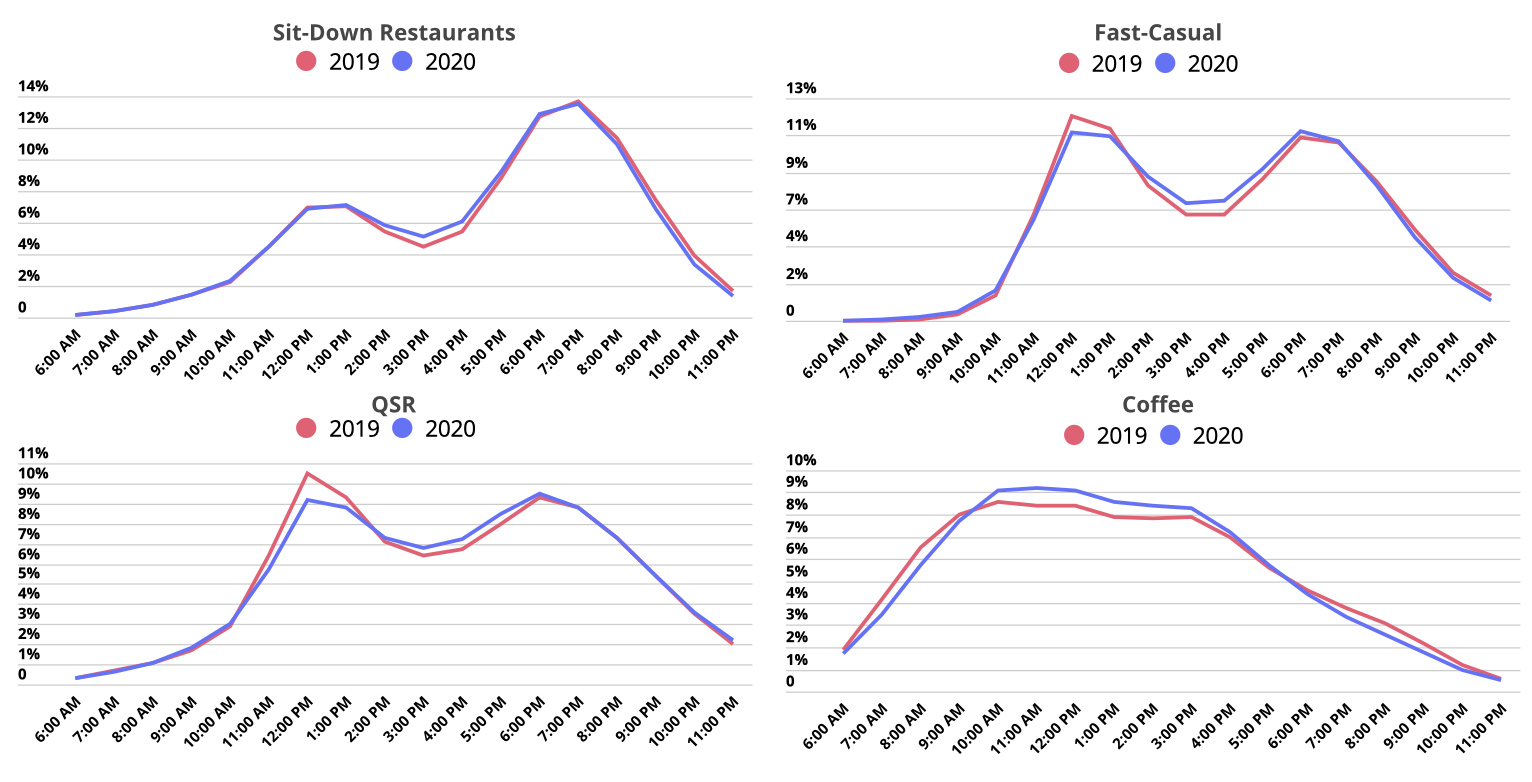

The change that the pandemic brought to the daily schedules of many impacted the various dining segments differently. Those relying more heavily on daily routines, like the coffee and breakfast space, were affected more.

But despite the differences, there was one strong pandemic-related trend experienced by all segments – a significant rise in the overall proportion of mid-day visits. As flexible work became more common, mid-day lunch outings to a local cafe or restaurant – either as a short escape from the work-from-home monotony or as a refreshing place to work for a few hours – became a more valuable asset. Should more extended mid-day stays continue, they could also drive larger transaction sizes.

As the impact of COVID begins to dissipate and daily schedules start returning to normal, the time distribution of restaurant visits will likely continue to change. It will become crucial for restaurants to track these changes to optimize their menus and regulate foot traffic.

Fewer are Ordering the Usual

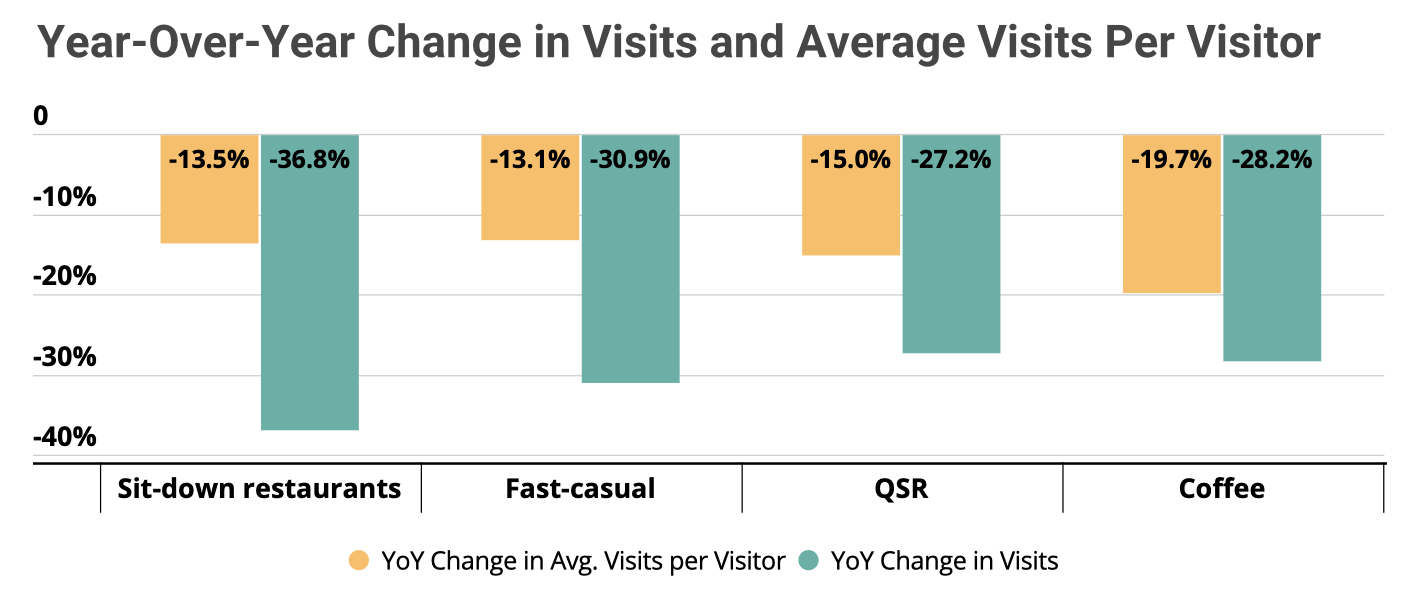

In addition to the sector’s dramatic drop in foot traffic, it also experienced a significant decrease in the average number of visits per visitor. This means that not only were fewer customers visiting, but those who were visiting were doing so less frequently.

Although sit-down restaurants and fast-casual dining saw more significant drops in year-over-year visits than the QSR and coffee segments had, they saw smaller drops in the average number of visits per visitor, retaining a higher percentage of their regular customer base. And this could actually indicate even better times ahead for QSR and coffee segments that are more oriented towards regular customers.

As the recovery proceeds and pandemic-driven competition intensifies between restaurant chains, the ability to hold a significant base of committed regular customers could prove to be more crucial than ever.

Location, Location, Location

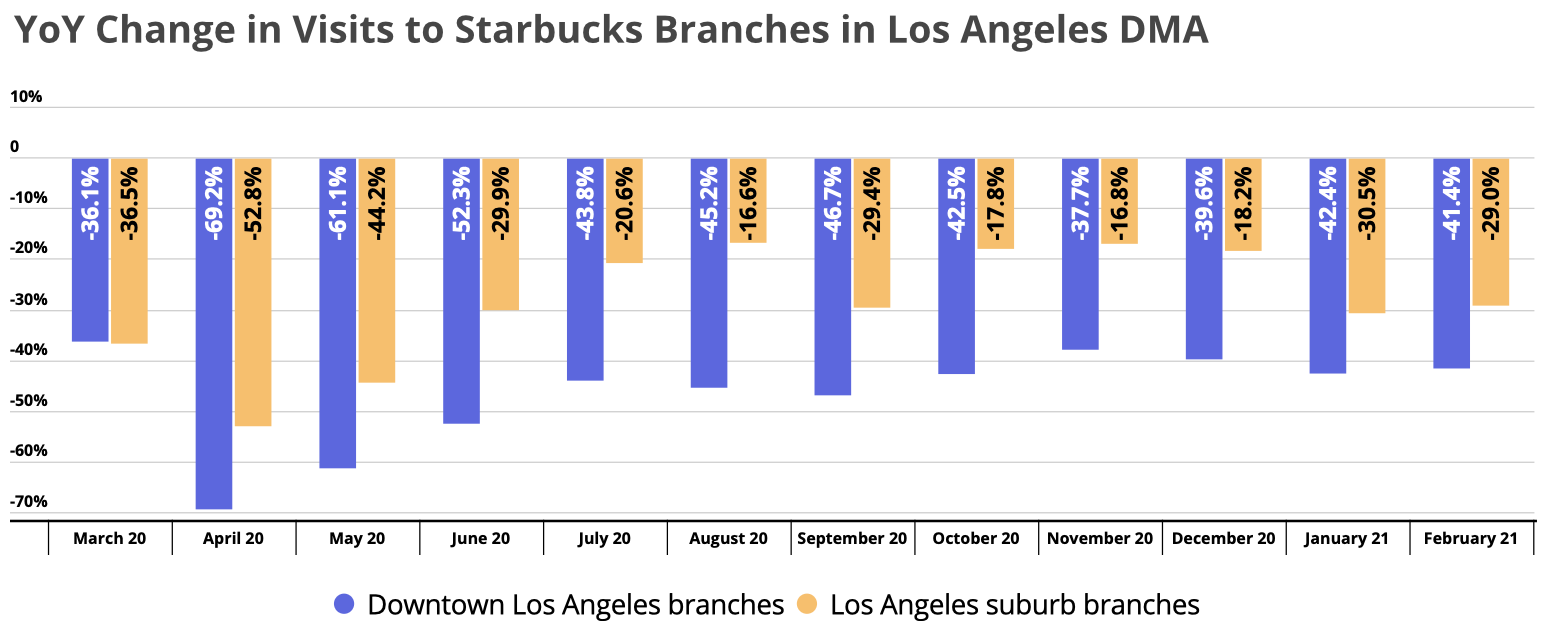

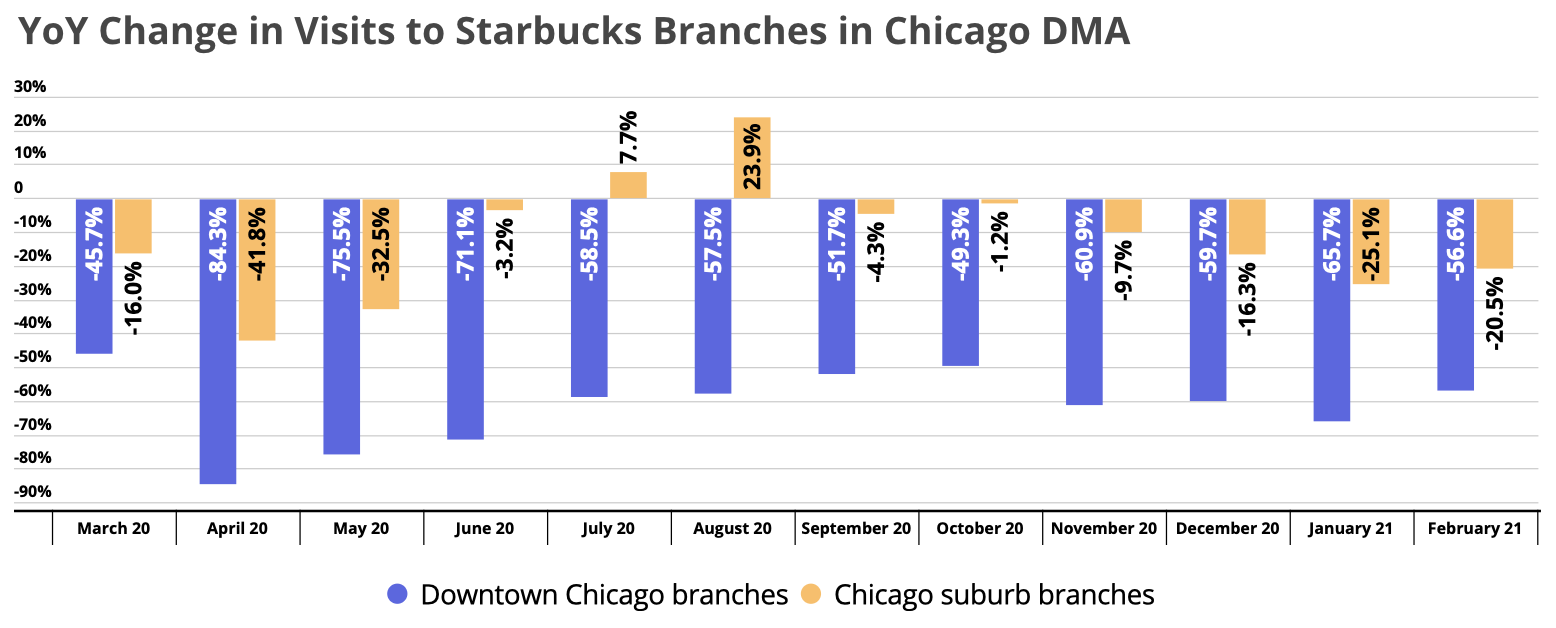

The population shift from heavily populated cities and states to suburbs and lower populated states, along with the transformation of urban work-life to at-home-offices has forced city and suburb restaurants to adapt in different ways. While city-based restaurants need to rethink how to attract visitors by providing experiences that make the trip to the office more enticing, suburban locations could leverage this larger visit potential by upgrading their sit-down component or enhancing customer experience to lengthen visit duration.

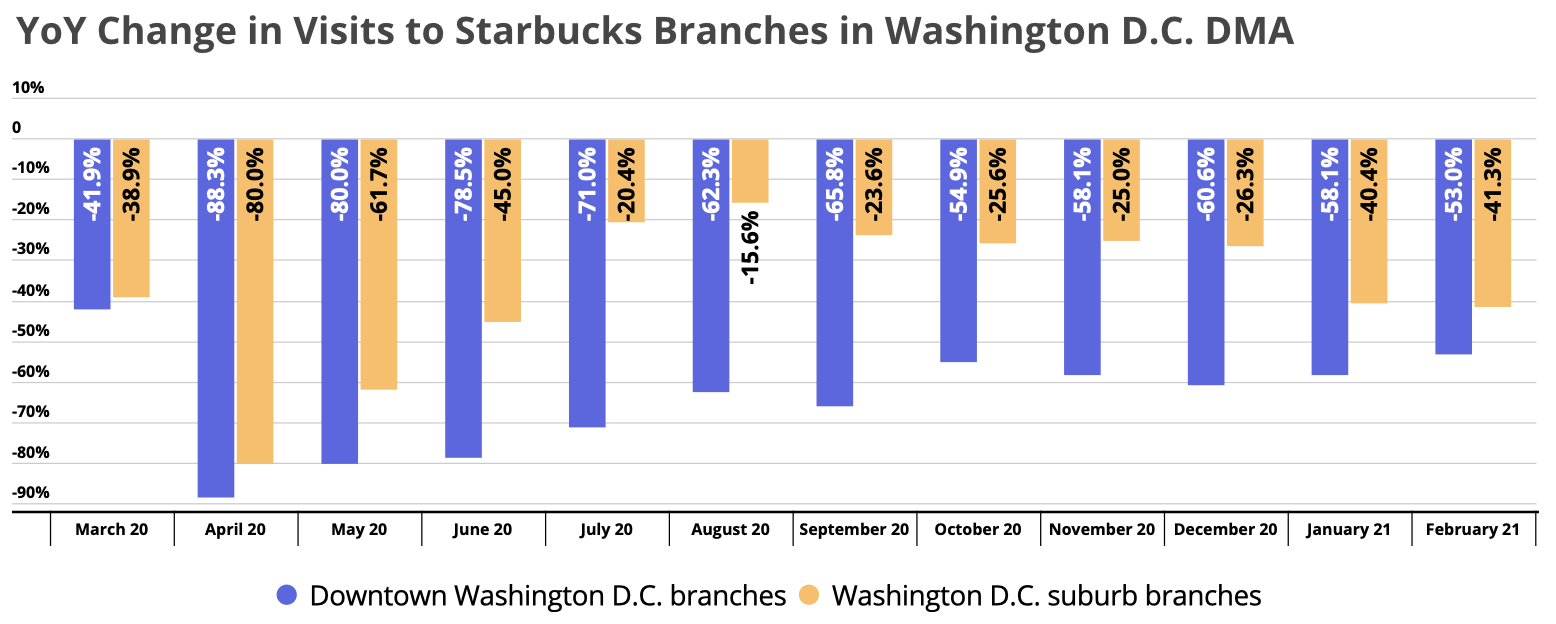

But even with these called-for adaptations, location data has shown a considerable gap in the foot-traffic recovery rate of city- and suburb-based restaurants. A comparison of year-over-year visits of thirty central Starbucks branches across Los Angeles, Chicago, and Washington D.C. with thirty other suburb-based branches around those cities showed that the suburban venues had far outperformed the city locations.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.