Week Ending 10 April

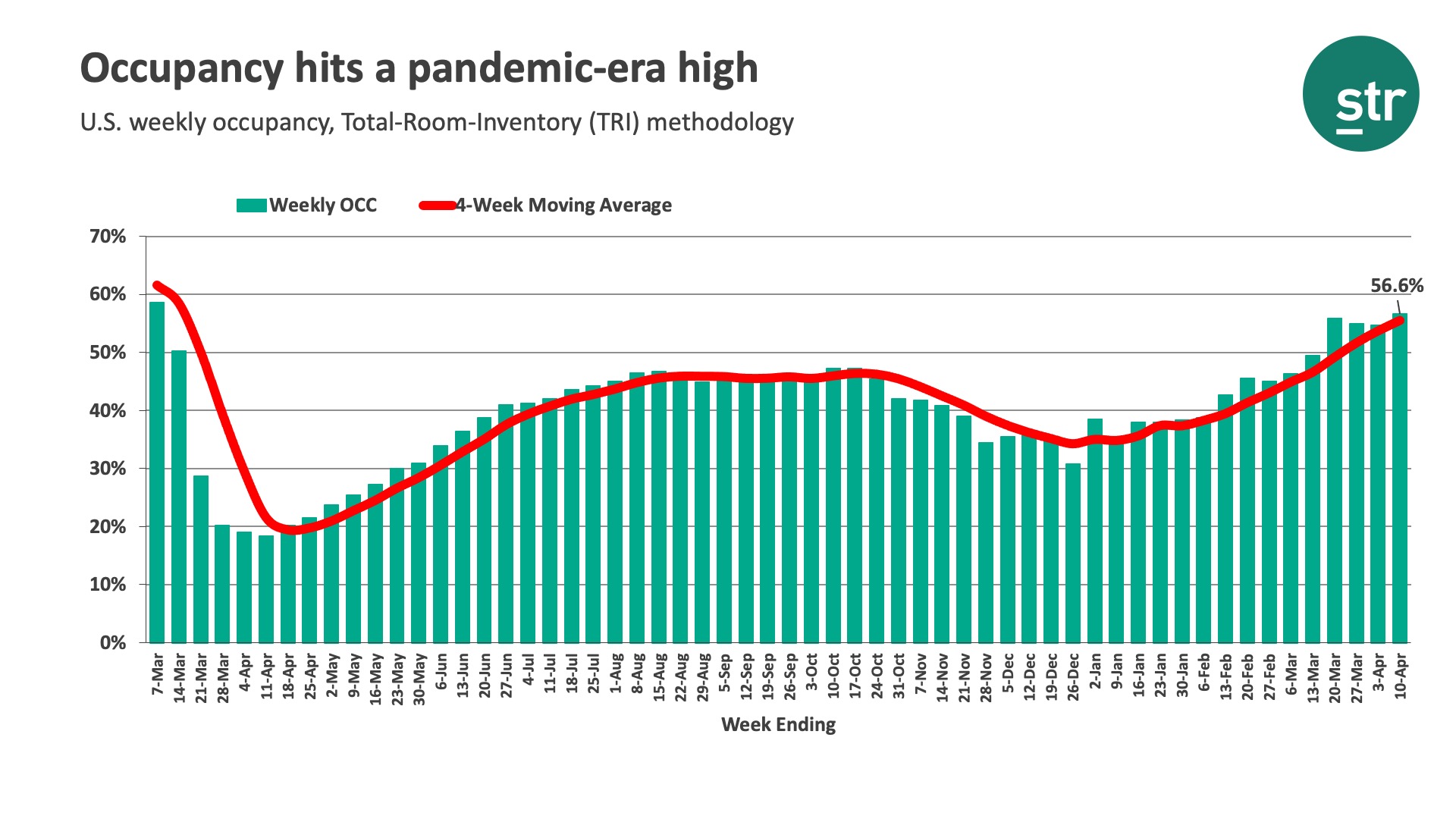

The week of 4-10 April was all about demand. The number of U.S. room nights sold surged to 22 million, which was the most since the start of the pandemic. As a result, occupancy reached 59.7%, also the highest level of the past year. On a total-room-inventory (TRI) basis, which includes temporarily closed hotels because of the pandemic, U.S. occupancy reached 56.6%—yes, that was another pandemic-era high. On average, the industry sold 3.2 million rooms per day during the week. A year ago, daily demand was a third of that.

The gain in demand was widespread with all but 37 of the 166 STR-defined U.S. markets reporting room demand improvement. The week-to-week increase was led by Texas, where all markets, except McAllen/Brownsville, reported higher room demand. Other states leading the demand surge included South Carolina and North Carolina, where beach resort destinations like Myrtle Beach and Hilton Head continued to post higher demand. In fact, Myrtle Beach saw the largest increase of any market this past week.

Florida continued to see solid growth and had the highest occupancy of any state (77.9%) when looking strictly at open hotels. Using the TRI calculation, occupancy for the state was 73.2%, which was the second highest behind South Carolina, which has very few temporarily closed hotels. Even when considering temp closures, most Florida markets posted a weekly occupancy higher than what was seen in the same week back in 2019. Even Orlando, which has been lagging the state in its performance, saw its TRI occupancy index top 73 for the week. This means that Orlando’s occupancy was one-third less than what it was in 2019. There are still a considerable number of hotels closed in Orlando (15,000+ rooms) that will need to be reabsorbed as the recovery continues. This will impact occupancy for weeks and possibly months to come until large groups and meetings return to the market.

The news continued to get better as 55% of hotels saw weekly occupancy above 60%, the most in more than a year. More importantly, the number of hotels with occupancy below 30% dwindled to only 8% of open hotels.

Weekly ADR slipped a bit but remained above $112 for a second straight week. The slowing in ADR was mostly from hotels in the Top 25 markets, as rate was flat in all other markets combined. All classes of hotels saw the dip in ADR, which was most pronounced in the combined Luxury & Upper Upscale classes.

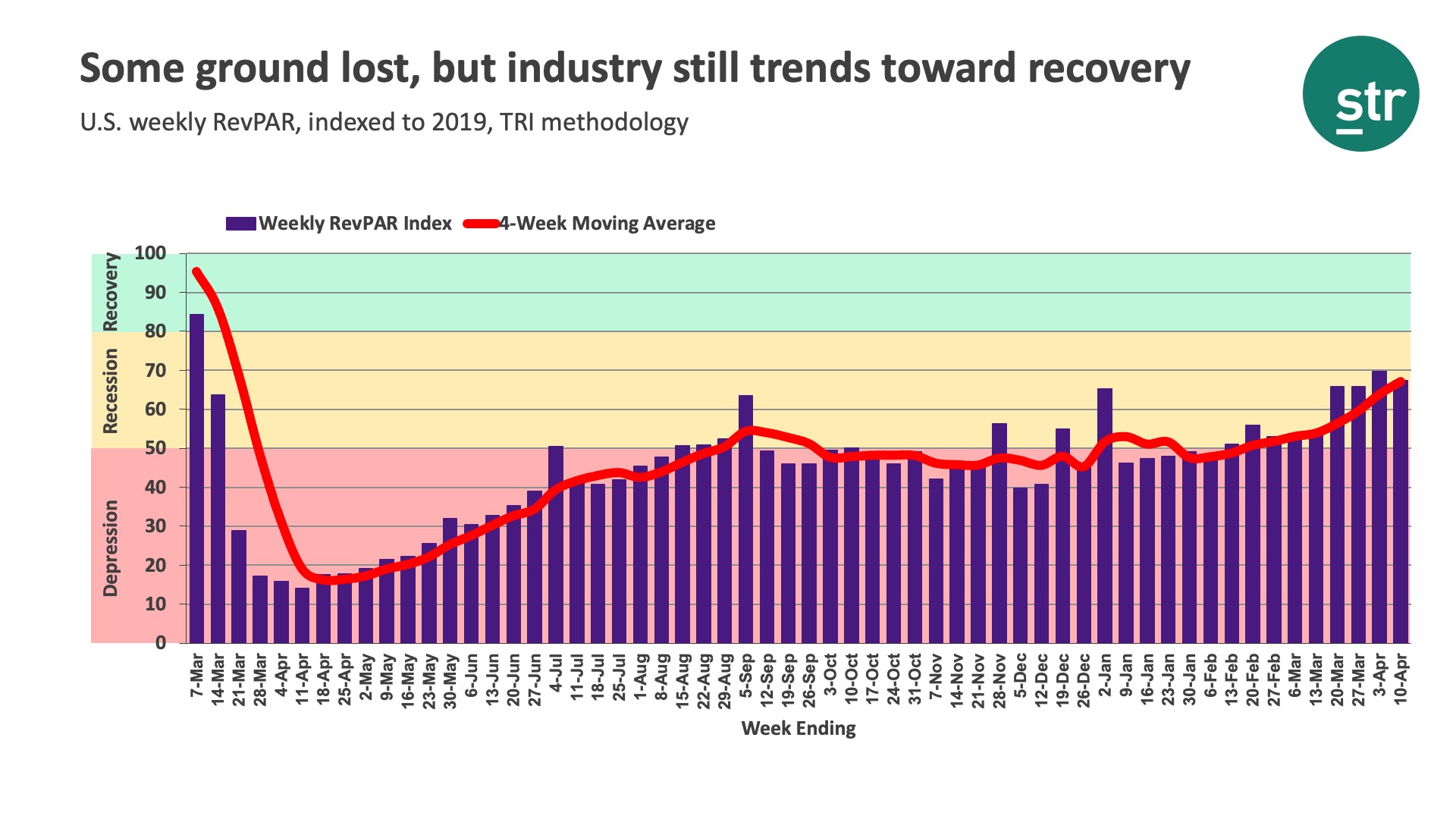

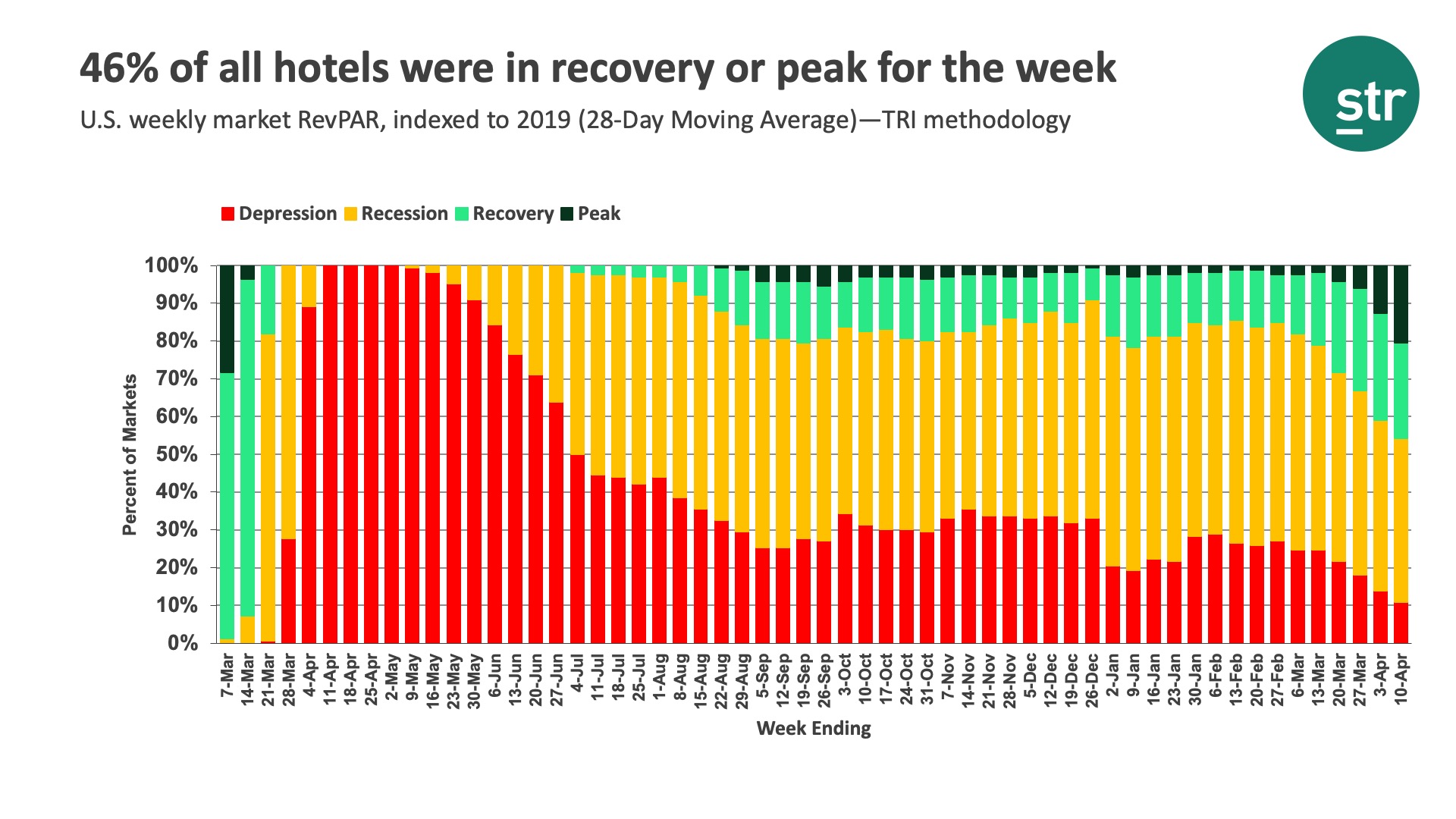

Putting it all together, STR’s Market Recovery Monitor shows a slight decrease versus the previous week, but the industry is still trending toward Recovery. More than 48% of markets were categorized as being in Recovery or Peak this week, the most since the start of the pandemic. When including temporary closures, 46% of markets were in those two categories. Again using that TRI methodology, there are still 18 markets, including San Francisco, New York, Boston and Washington, DC, that are in the Depression category, down from 55 at the end of last year.

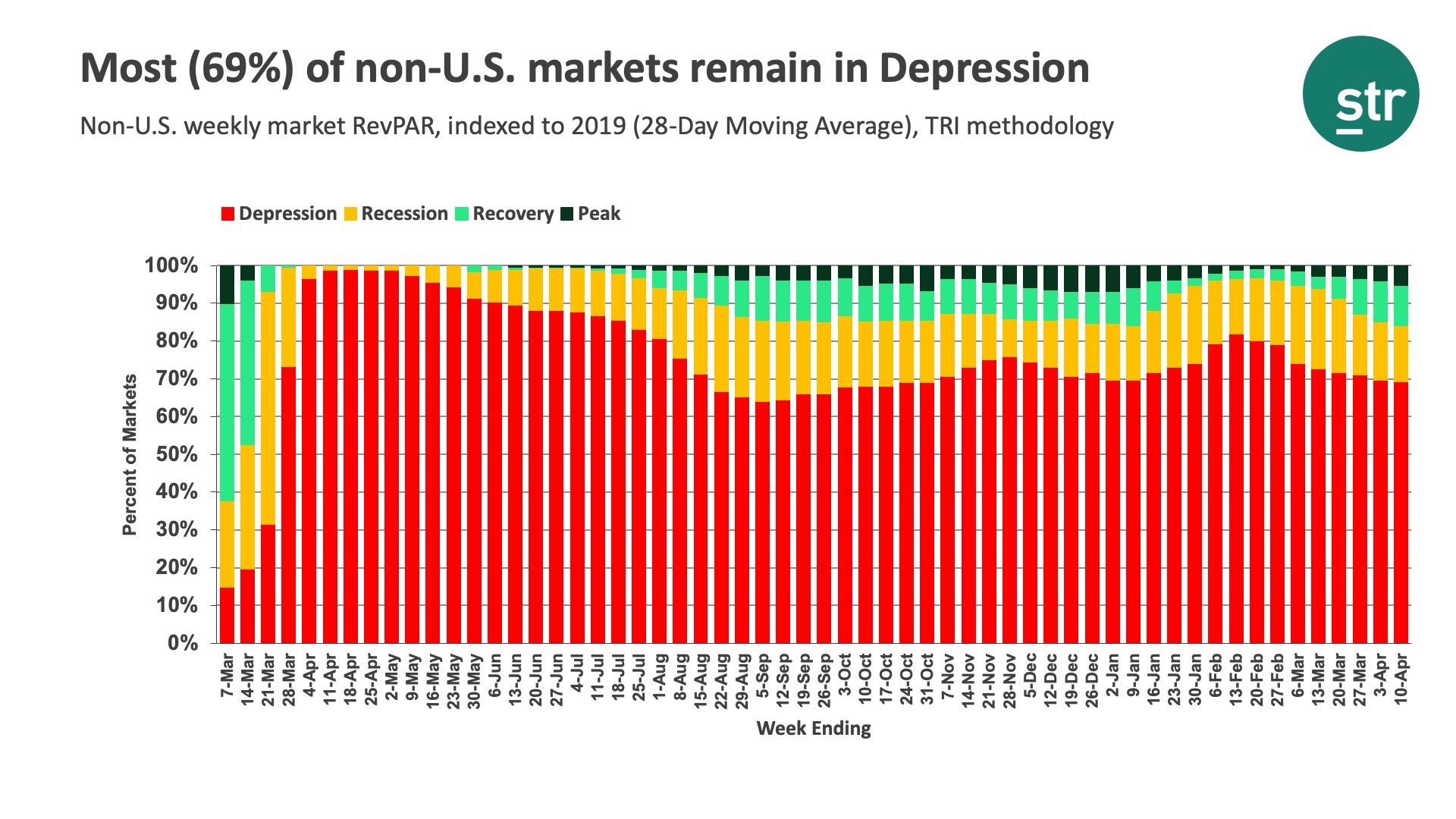

Outside the U.S., the recovery has yet to take hold as 69% of the 349 STR-defined markets with sufficient data remain in the Depression category. We once again use TRI methodology given that so many hotels remain closed, and travel is restricted. There are some bright spots with markets in UAE, Singapore and Qatar seeing occupancy above 60% for the week.

While we are overjoyed to see U.S. demand and occupancy growing and reaching new pandemic-era highs, we must keep in mind that there are 580 hotels with 154,000 rooms still temporarily closed. Expect ebbs and flows in performance, particularly in big markets like New York, Orlando, Chicago, Washington, DC, and others, as more hotels reopen. While we have yet to see it, there could also be a slowing in demand ahead of the summer travel season. But let’s take stock that our industry is on the rebound.

About the MRM

When the U.S. hotel industry reached the one-year anniversary of the earliest COVID-19 impact, year-over-year percentage changes became less actionable when analyzing performance recovery. Thus, STR introduced a weekly Market Recovery Monitor that categorizes each STR-defined market based on an indexed comparison with the same time periods in 2019. An index is simply a ratio that divides current performance by the benchmark (2019 data).

For example, during the week ending 6 March 2021, U.S. RevPAR was $48.13. In the comparable week from 2019, RevPAR was $87.75. This produces an index of 54.8 ($48.13/$87.75*100), meaning RevPAR was slightly more than half of what it was in 2019.

We use an index to place each market in one of four categories: depression (index <50), recession (index between 50 and 79.9), recovery (index between 80 and 99.9), and peak (index >=100). Additionally, we highlight other top market performances that contribute to higher levels of recovery across the U.S.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.