Hotel food and beverage operations have radically changed in the wake of the pandemic. From breakfast buffets to banquet dinners, service has drastically altered to keep guests safe and as stopgap against weaker demand. Several of the adjustments made due to immediate needs are likely to remain in place for the foreseeable future, according to some F&B authorities.

“The buffet is gone,” said Steven Kamali, CEO of Hospitality House, which provides F&B solutions for the hospitality industry, and has worked with many major brands to fine-tune service and offerings. “Hotels are now thinking about how they can provide service that falls somewhere between a vending machine and a full-service breakfast, and that’s where people are trying to innovate.”

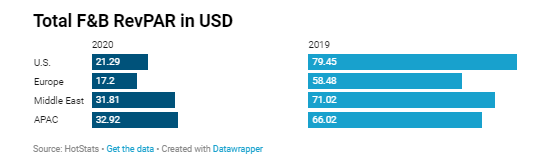

They’d better act fast. In the U.S., total food revenue per available room for full-year 2019 was $55.08, according to HotStats data, while total beverage revenue per available room for that period was $14.25. By comparison, for full-year 2020, those same numbers fell, to $14.61 and $4.37, respectively. Hoteliers have a major opportunity.

And by and large, they’re seizing it. “At many properties—across brands and chain scales—grab-and-go windows are the norm, or they’re soon coming onboard,” said Kamali. Some hotels are serving to-go drinks and still others have created pre-packaged items.

New Chances to Cut Back

All of that presents hoteliers “a new opportunity to sell,” said Kamali. “It’s additive.” Plus, pre-portioned and wrapped-to-go items, versus dishing out food on demand, cuts down on expenses.

“If you order à la carte, it takes time and it’s costly; the hotel has to have a staff member take the order, and people are waiting in the kitchen to make it,” he said. “Instead, pre-packaged items make the kitchen more cost-effective.”

Another cost-cutting measure happening at hotels is the use of “ghost kitchens,” or commercial kitchens creating only delivery orders. In other words, these facilities are restaurants without space for guests.

“I foresee ghost kitchens as a thing of the future and they certainly have a place in the [hotel] industry,” said Adam Crocini, Global Head & VP, Food & Beverage Brands, at Hilton. “We see a lot of success with them.”

For group business now, contact between guests and staff is limited. Buffets, when made available, are laid out on one-sided tables, and food is distributed in covered vessels, such as glasses with lids and bento boxes, according to Marriott International and Hilton.

“Having individual servings and more action stations allows us to offer a wide variety of options, said Petr Raba, VP of Meetings and Events, Global Operations at Marriott. The company also has seen a rise in the “use of non-traditional event spaces, such as outdoor venues,” he added.

Unorthodox Becomes More Common

Hotel guests could see more unconventional dining spaces on property, creating new potential revenue streams for hotels, Kamali said. “Conference rooms or private dining rooms will be made available to smaller groups seeking more intimate environments to dine with people they know, instead of in cluttered dining rooms. This presents a huge opportunity.”

Whatever changes hoteliers have made, they’re likely to be incorporated into standard operating procedure post-pandemic, Crocini said. “When life returns to a more normal state, these new offerings won’t completely go away. They will continue to enhance our overall food and beverage programs, but as part of a much larger and enriching in-person experience.”

To learn more about the data behind this article and what HotStats has to offer, visit www.hotstats.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.