More Signals to an Advertising Rebound in Canada

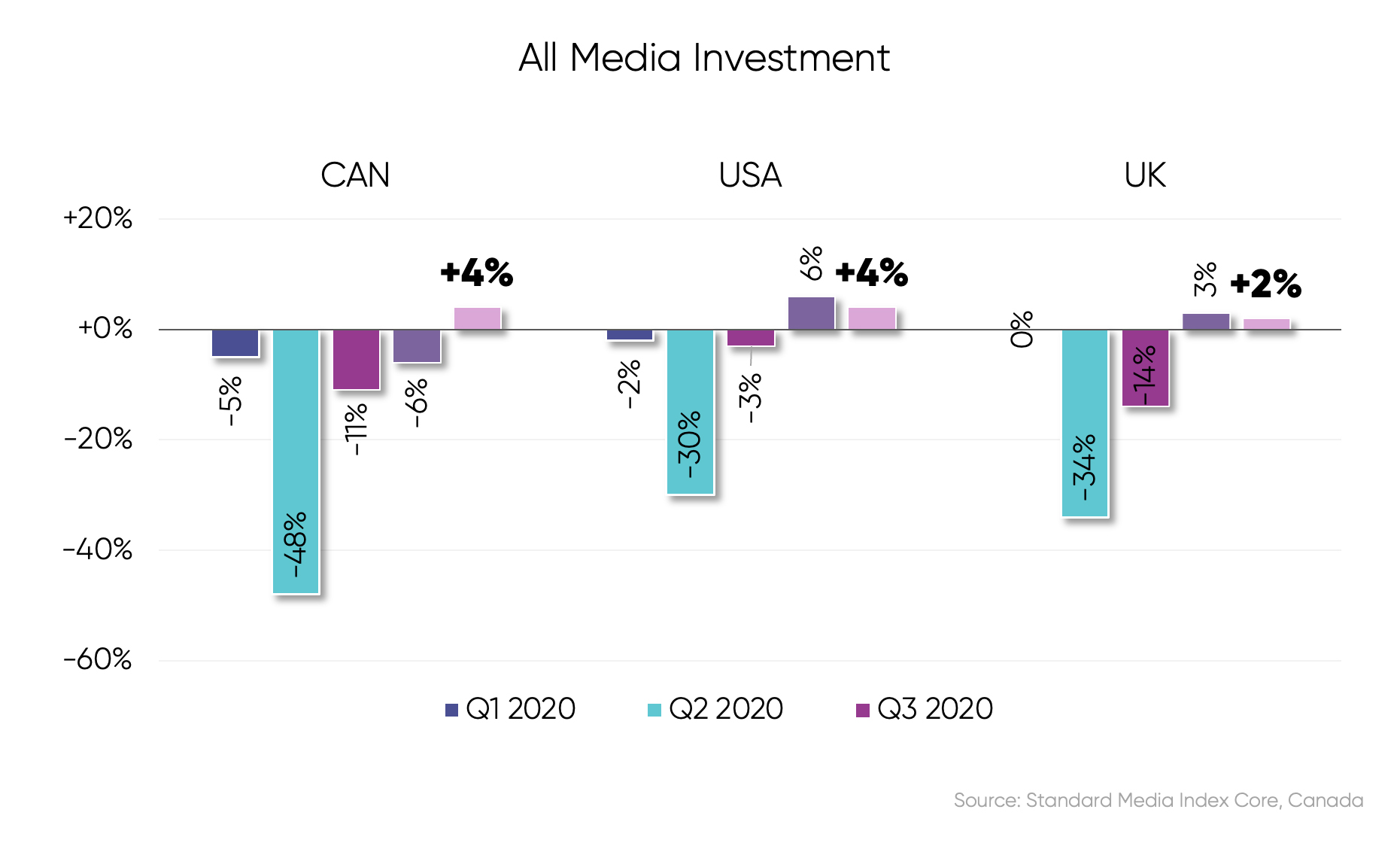

In what has been the hardest-hit and slowest-to-recover ad market, Canada has finally rebound. To understand the effect of the rebound, we leveraged our detailed ad intelligence data sourced from actual spend from the top media agencies in Canada. The data shows that in Q1 2021, national advertising expenditure across all media was up +4% vs Q1 2020 and driven by a strong March month, up +10% vs. March 2021. Comparing to other major markets, ad investment was down -48% YoY Q2 2020 vs. Q2 2019 while US and UK were down -30% and -34%, respectively.

I would be remiss to acknowledge the correlation between ad expenditure and the COVID-19 pandemic as it directly impacts consumer confidence and advertiser confidence. In Canada, March 2021 was seemingly a light at the end of a tunnel with average cases plummeting down to lower levels. A feeling of ‘normal’ had returned for many and this increased confidence aligned with an increase in national advertising expenditure, up over 20% versus March 2020. And to close the case on a rebound in full swing, Q1 2021 was near flat, only down -1% when compared to pre-pandemic levels vs Q1 2019.

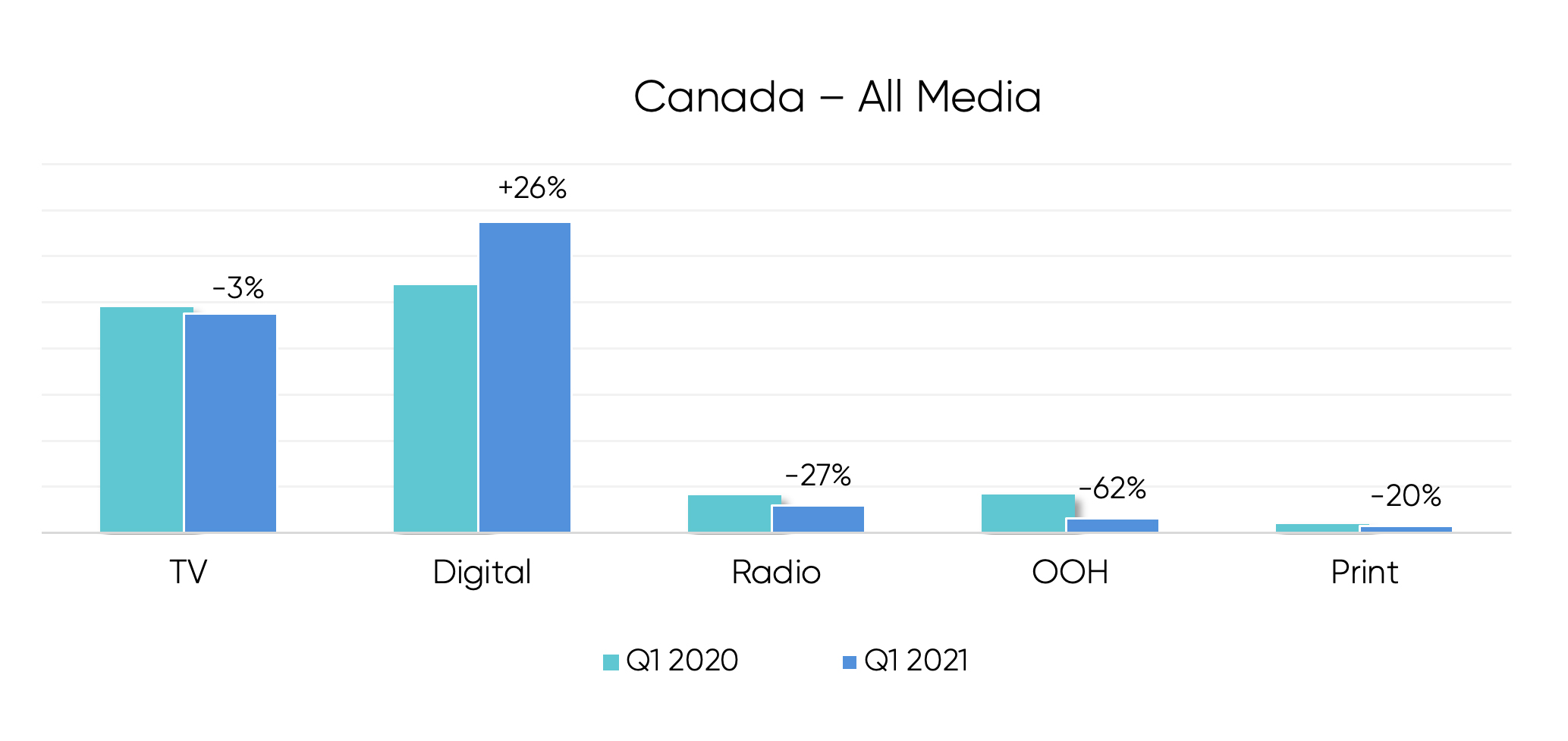

Among all media types, Digital was the only media type to see an increase, up +26% while all offline media down -14% with declines driven by mediums that are often enjoyed outside of the home in Radio and OOH. Digital experienced a dramatic shift, up 10 percentage points in share of all national advertising spend. This came from a share increase of 4 percentage points from Social. Among the leading social media publishers were Pinterest (+186%), Snap (+104%), and TikTok (+544%).

While the ad market is seeing a rebound, there are some industries that are not immune to COVID-19, and that is apparent in their respective advertising categories too. Entertainment & Media and Travel were two product category groups that were down collectively -32% in Q1 2021 vs. Q1 2020. Entertainment & Media, made up of media advertisers and Toys & Games, was down -11% while Airlines, Cruise Lines, and Hotels were among the categories that encompass the Travel category decline of -78%. On the brighter side, there were gains in 10 of the 12 major product category groups in Canada with growth in Technology (+227%) driven by an increase in Software advertising expenditure. Notably, CPG has remained the leading category in share of ad spend and experienced a +53% growth led by Alcoholic Beverages and Household Supplies.

As the Canadian ad market strengthens through 2021, we will start to see a return to normal levels across all categories and SMI will keep the market informed through the near real-time dataset it has been providing to subscribers and Agency partners since the COVID pandemic began.

To learn more about the data behind this article and what SMI has to offer, visit https://www.standardmediaindex.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.