While every sector has its doubters, off-price leaders were the focus of a high level of concern during COVID because of their reliance on physical locations. And while the ultimate success of the sector, especially relative to the wider apparel space, was hardly impossible to predict, the performances of top brands in the space were truly impressive.

So where do things stand and how might these leaders progress deeper into 2021?

Strong Performances Overall

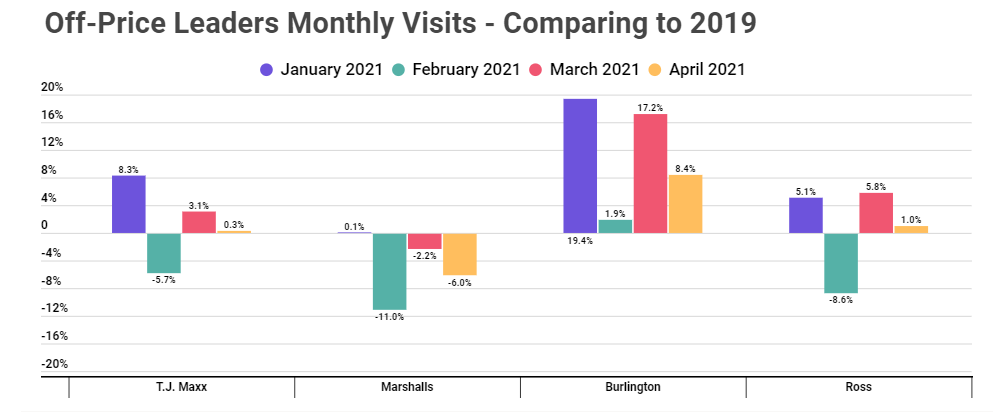

Off-price leaders have seen a tight mix of results so far in 2021, Some brands are still seeing minimal visit declines when compared to 2019, while others have seen consistent growth. Burlington has seen visit growth when compared to 2019 each month in 2021, with March and April showing increases of 17.2% and 8.4% respectively. Ross and T.J. Maxx have seen similarly impressive numbers when compared to 2019 with visits up 5.8% and 1.0% in March and April for Ross and 3.1% and 0.3% in those same months for T.J. Maxx.

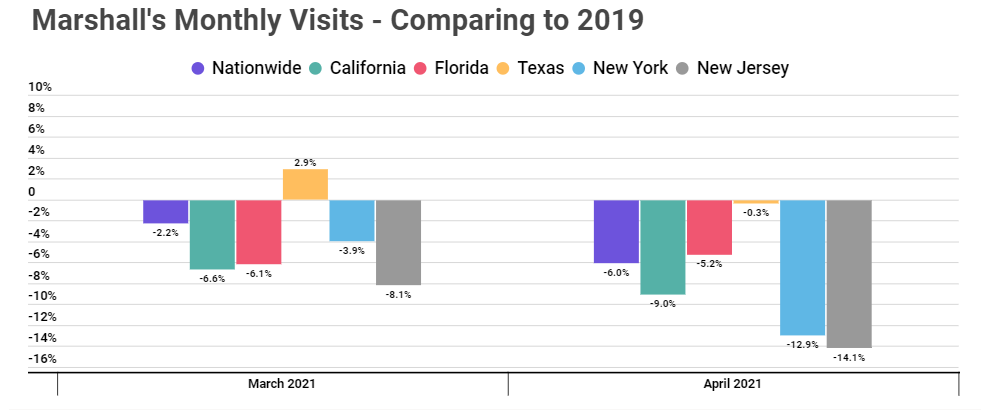

And even Marshalls is being heavily impacted by its own regional distribution of locations. For example, the brand has a large number of branches in the more limited retail environments of New York and New Jersey, impacting the full weight of the recovery.

Context – Comparing to Other Sectors

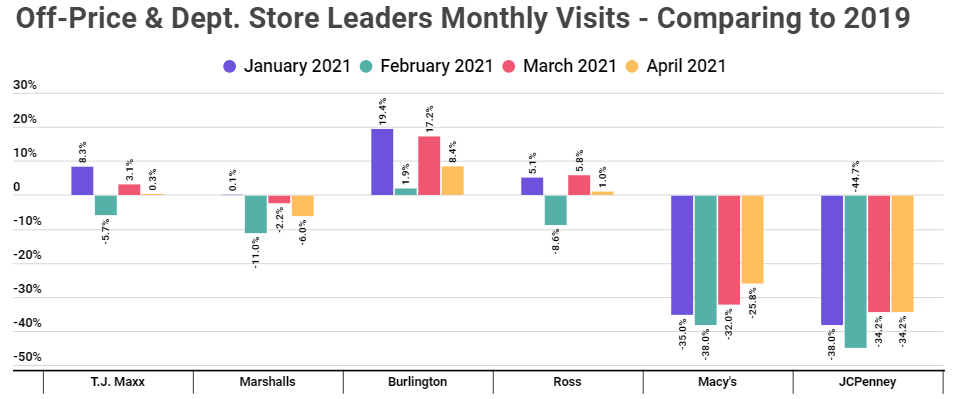

Yet, to properly appreciate the performances of these brands, it demands context from other apparel retailers. Looking at the first four months of 2021 compared to 2019 shows just how strong visit rates for off-price retailers have been when compared to department stores.

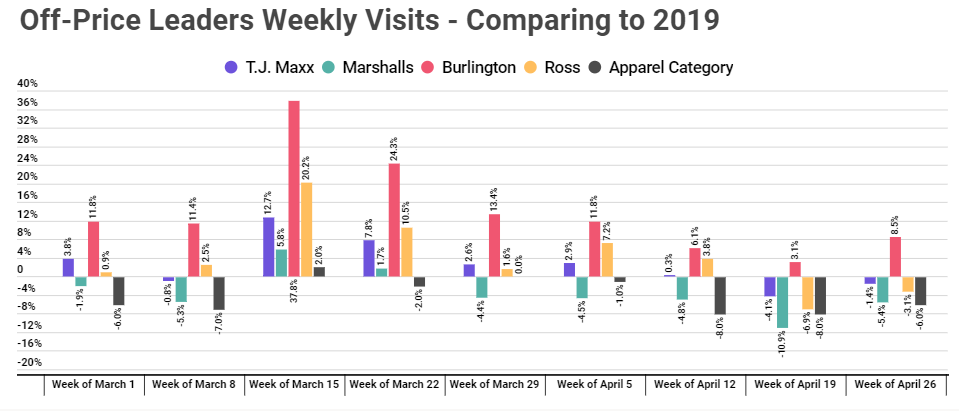

But even comparisons to the apparel category show that the brands analyzed have consistently outperformed the standard set by the wider apparel sector, and there are many reasons why. First, the value orientation is especially powerful in a period of economic uncertainty. While stimulus checks and relative economic strength give off the impression of “money-to-spend” the reality is that many people likely still feel concern about what is coming next. Second, the brands benefit from an offline “treasure-hunt” experience that is a pull in and of itself, especially offline. Finally, these companies benefit from strong brand affiliations increasing the likelihood that when a consumer ventures out, they spend that time in one of these locations.

Looking Ahead

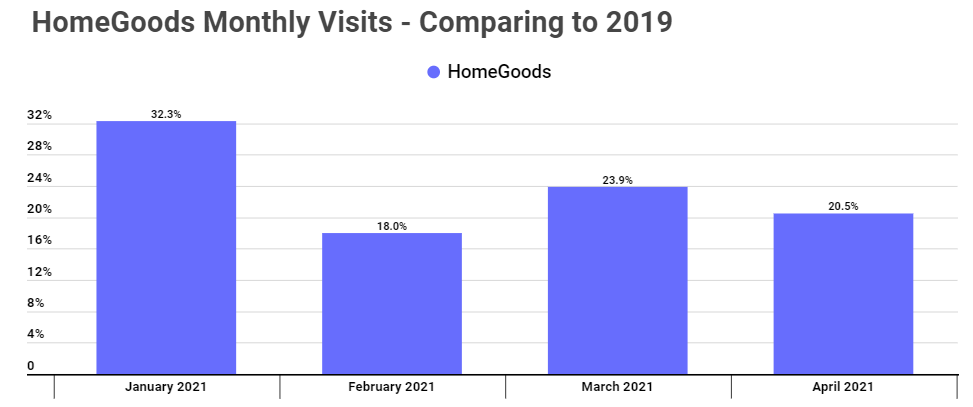

There’s no reason to believe that the strength shown by off-price retailers will dissipate and many reasons to believe that the coming months could be even better for the sector. First, recoveries in California, New York and New Jersey should provide another boost to the sector in the month to come. Second, the alignment with this period of economic uncertainty is only enhanced by the people wanting to move to the suburbs, bringing new audiences out of cities. The combination of pent up demand from an existing customer base, and the first time demand from new-to-suburb shoppers should provide a significant bump. Finally, TJX Companies is not just benefiting from off-price apparel, but a strong play in the home furnishings sector with HomeGoods.

While HomeGoods is the definition of perfect alignment with key 2021 trends, other players have shown the ability to infuse other components beyond apparel into the off-price shopping experience.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.