Considering the unique effects of COVID, QSR brands were among the best situated in all of offline retail, but especially the dining sector. A value orientation in a time of economic uncertainty provided a benefit that was bolstered by pre-existing strength in takeaway, drive-thru and delivery. The result was a strong ability to drive strength during the pandemic.

But while in-location visits and certain behaviors were severely affected by the pandemic, a recovery does appear to be en route for the wider dining space.

So what does this mean for QSR?

Returning Visitors

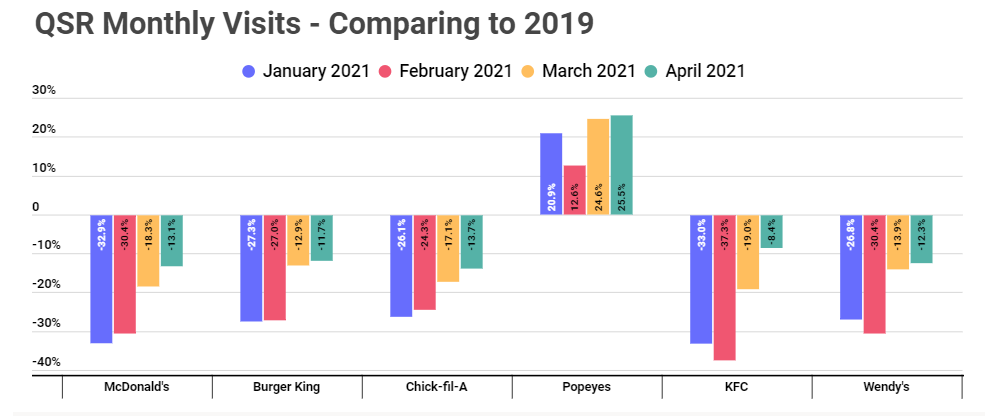

While visits are still far from normal, the brands analyzed are all seeing a clear and marked recovery. Comparing monthly visits to the equivalent months in 2019 shows that all brands measured saw their visit gap shrink to the lowest point in 2021.

The steady increases are a very positive sign that the trend is heading back towards dining normalcy. This should only deepen bullishness around the unique strength of these brands in the coming months. While the ability to leverage multiple channels will be less valuable in a post-COVID environment, it still clearly helps. But perhaps most importantly, the sector enables patrons to combine convenience and value as they attempt to juggle returning routines. This orientation is a massive asset that could help fuel the in-location recovery.

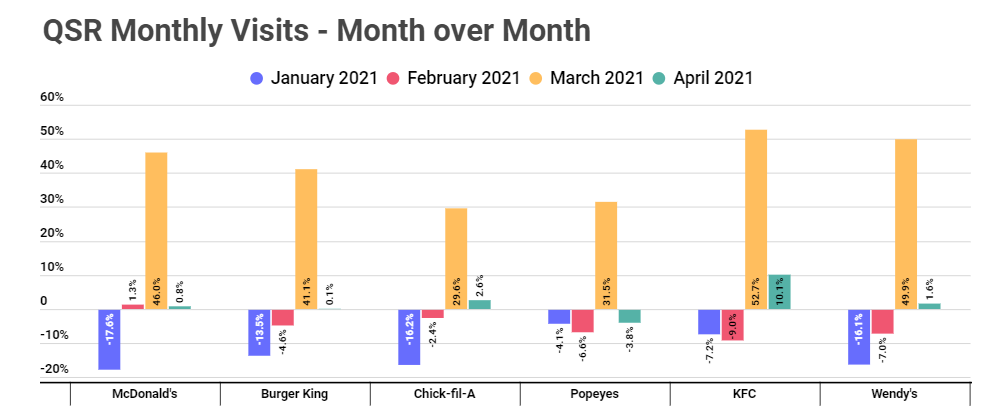

This strength is further emphasized when looking at monthly visits month over month. All the brands measured saw a huge turning point in March, but continued to see increases in April. Should these brands prove capable of sustaining even limited month over month gains, the addition of increasingly open states like California and New York could drive significant and meaningful surges bringing visit normalcy within reach.

The Outlier

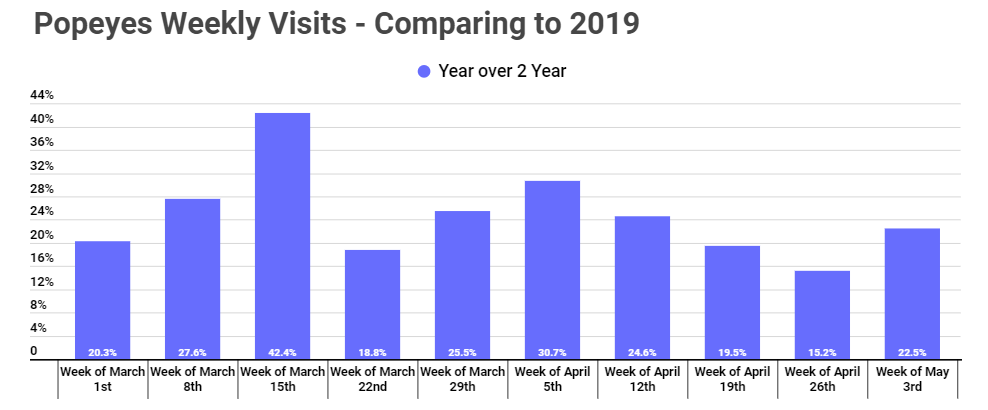

But there is a clear outlier when analyzing the group – Popeyes. Growth for the brand in 2019 centers around the summer 2019 Chicken Sandwich launch, and it’s even more successful fall reboot. Essentially, the 2019 comparison shows just how significant the launch really was. It didn’t just change how the brand performed in the short term, but created a fundamental shift that has allowed it to dramatically outperform previous standards.

Even if the heights of the initial launch are never again reached, the initial surge of chicken sandwich driven visits may be one of the most significant events in the recent history of the company and the wider QSR space.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.